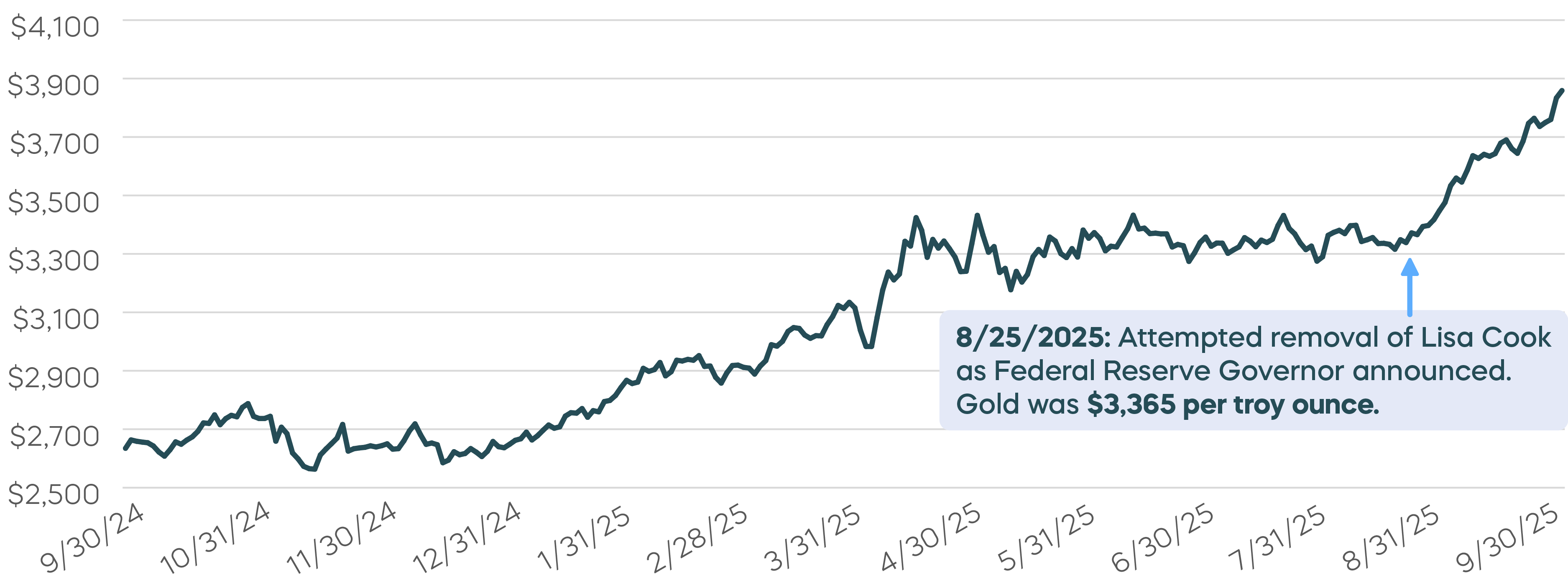

Gold has climbed steadily higher over the past year. And the August attempt to fire Fed governor Lisa Cook seemed to catalyze what has since been a steep price rally. Now, with the significant uncertainties from a government shutdown poised to further boost gold prices, can anything tarnish gold’s rally?

The Gold Rally | Gold Spot Price

Source: Bloomberg, 9/30/24-9/30/25. Index returns are for illustrative purposes only and do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest directly in an index. Past performance does not guarantee future results.

Concerns about a government shutdown and Fed independence certainly haven’t been the only potential drivers for gold’s rise. The U.S. budget deficit also remains a favorite data point for gold bulls, with the Congressional Budget Office projecting a $1.9 trillion deficit for fiscal year 2025.

Inflation, too, has been stubborn. Just how sticky it remains is apparent in the reaction of longer-term interest rates to the Federal Reserve’s recent cut. The Federal Funds rate dropped by 25 bps on September 17, and as of September 30, the U.S. 10-Year Treasury Yield has risen 12 bps (Source: Bloomberg). This muted response is indicative of the bond market’s ongoing inflation concerns—another favorite data point among gold’s fans.

There are tailwinds for gold outside of the U.S as well, largely related to fiscal and political woes among major economies. Japan, for example, now has the world’s largest debt relative to GDP (IMF). France’s government has collapsed, again. Argentina might need yet another bailout. The list goes on, and offers additional support to the current gold rally.

Still, gold’s rise is not without risk. The U.S. dollar saw a mid-month rally in September (Source: Bloomberg, 9/30), and gold—as a perceived safe haven—has historically been negatively correlated with the dollar. If the dollar shakes off current weakness, it could tarnish the gold story.