Relentless headlines about the Magnificent 7 might suggest that equity market leadership is dominated by a fixed group of tech giants. But history tells a different story: market leadership is never static. Today’s leaders may not be tomorrow’s top performers. How can investors keep up?

Instead of strategies focused on a fixed group of companies like the Magnificent 7 (or the FAANGs before that), consider the Nasdaq-100 Mega Index, which follows a dynamic approach targeting the performance of the top 45% of Nasdaq-100 companies by weight.[1] The index adapts over time to provide concentrated exposure to Nasdaq’s top companies today, and as they change in the future.

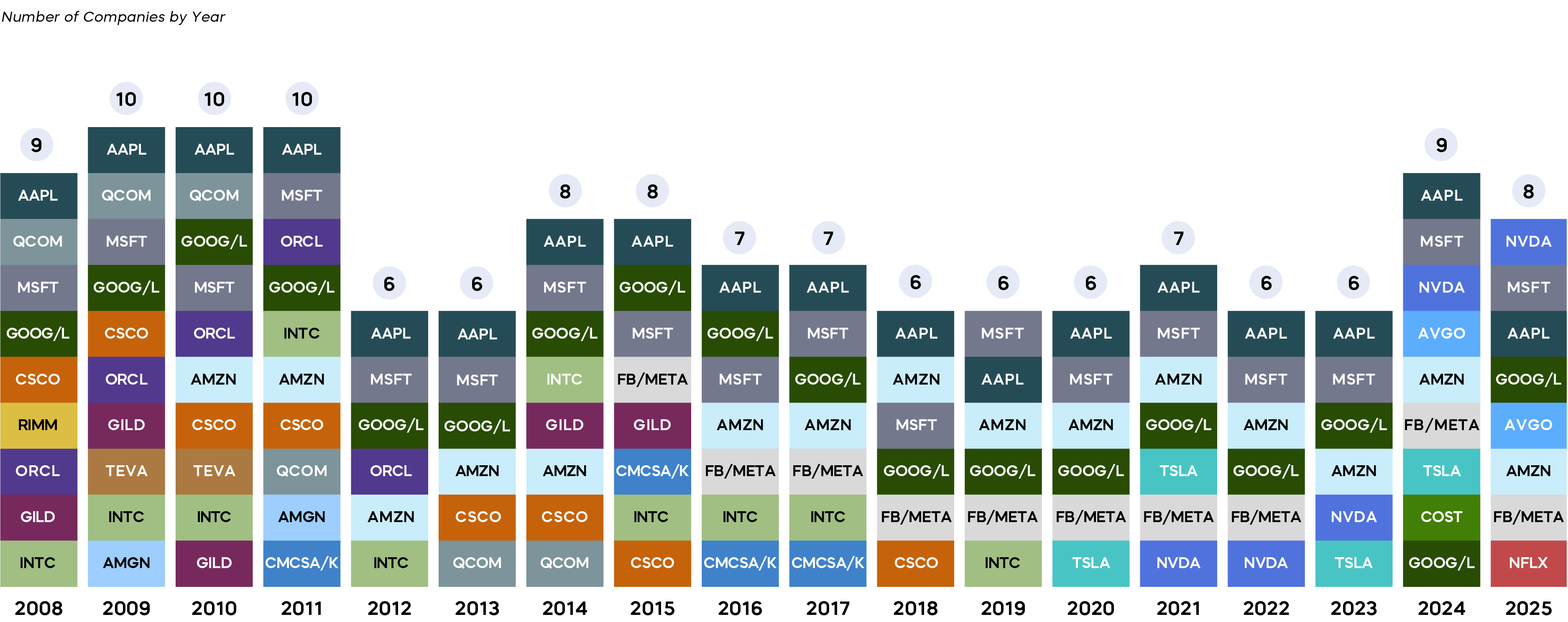

There are, of course, Nasdaq companies with impressive staying power like Apple, Microsoft, Google, and Amazon.[2] But from an investment standpoint, strategies that target only a fixed list of individual stocks may be too focused on yesterday’s winners at the cost of ignoring their sometimes rapidly advancing successors. Consider NVIDIA—its swift ascent to the top of the Nasdaq, two years before “Magnificent Seven” was coined, reflects how new leadership can reshape markets.

To capture market leadership as it evolves, investors targeting the Nasdaq-100 Mega Index could be uniquely positioned to capture and profit from such changes.

Hypothetical Nasdaq-100 Mega Index Companies by Year Over Time Click image to enlarge

Click image to enlarge

Source: Nasdaq, as of 9/22/25. Hypothetical percentage weights are from the first day following the September index rebalancing of each year. Holdings weights for FB/META, GOOG/GOOGL, and CMCSA/CMCSAK were combined. Indexes are unmanaged, and one cannot invest directly in an index. Past performance does not guarantee future results.

Tickers are sorted from top to bottom, with the top ticker representing the largest constituent by weight as of each respective date.

The Nasdaq-100 Mega Index

Concentrated Exposure

Includes the largest companies in the Nasdaq-100, representing approximately the top 45% cumulative weight—currently eight companies.

Captures Shifts in Market Leadership

The index’s dynamic strategy allows for its constituent names, number of holdings, and industry exposures to align with ever-evolving market leadership.

Market Cap Weighted

Applies a market cap-weighted approach that naturally emphasizes the most impactful companies.

The Takeaway

Explore ETFs that offer leveraged or inverse exposure to the performance of the Nasdaq-100 Mega Index.

[1] The Nasdaq-100 Mega Index is designed to target the performance of approximately the top 45% cumulative weight of the Nasdaq-100 Index.

[2] Source: ProShares. Company weights in the Nasdaq-100 Mega Index as of 9/30/25 are: NVIDIA 20.01%, Microsoft 17.00%, Apple 16.68%, Broadcom 11.33%, Amazon 10.34%, Meta Class A 7.03%, Alphabet-Class A 6.24%, Alphabet Class C 5.84%, and Netflix 5.53%.