The considerable political and humanitarian implications of the capture of Venezuela’s Nicolas Maduro will undoubtedly prove significant. Financial markets seem, at least initially, unperturbed. Global equities have so far reacted to the weekend’s news with a modest rally, and both interest rates and oil prices have moved only slightly.

The considerable political and humanitarian implications of the capture of Venezuela’s Nicolas Maduro will undoubtedly prove significant. Financial markets seem, at least initially, unperturbed. Global equities have so far reacted to the weekend’s news with a modest rally, and both interest rates and oil prices have moved only slightly.

Among the key reasons: years of economic decline have diminished Venezuela’s role in global trade and in the oil market. In the late 1970s Venezuela produced roughly 7% of the world’s oil. Today, it’s less than 1%, according to Reuters. Its share of global GDP is about 0.1%, a stark decline from nearly 1% in 1980, per Statista.

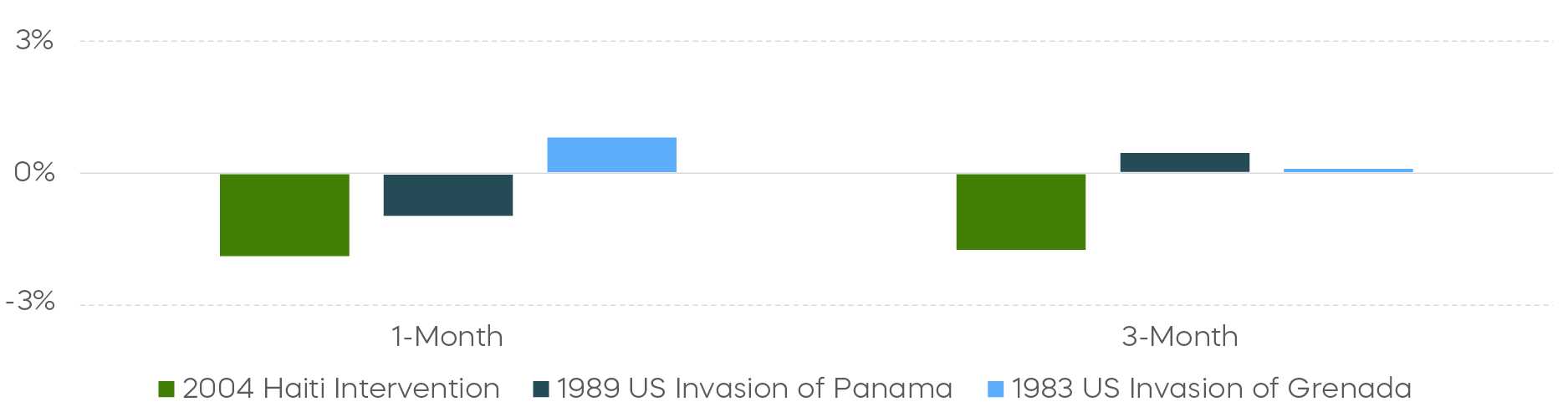

This immediate market response aligns with historical precedent. Previous geopolitical interventions—including the 2004 intervention in Haiti, the 1989 invasion of Panama, and the 1983 invasion of Grenada—elicited similarly muted reactions.

1-Month and 3-Month S&P 500 Returns After U.S. Intervention Events

Source: Bloomberg, data as of 1/5/26. Index returns are for illustrative purposes only and do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest directly in an index. Past performance does not guarantee future results.

Perhaps the only notable exception to the current collective shoulder shrug to the events in Venezuela is the dramatic rally in Venezuelan sovereign bonds. For those who didn’t manage to catch that trade, consider shifting your attention back to the business cycle and corporate earnings.