Key Observations

- In the past, investors pursuing a growth and income strategy were often forced to settle for funds with high fees and uneven performance.

- Today, index-based ETFs offer potentially more attractive opportunities for investors seeking growth and high levels of income (that can grow over time).

- ProShares Nasdaq-100 High Income ETF (IQQQ) and ProShares S&P Technology Dividend Aristocrats ETF (TDV) offer convenient, technology-focused strategies to balance growth and income, particularly an income stream that can grow over time.

The Past and Present of Growth and Income

Growth and income funds have a dual mandate to target both capital appreciation and current income, typically generated through dividends or interest payments. They have long been popular among investors with moderate, though not excessive, appetites for risk. Once the exclusive domain of mutual funds, they were prone to high fees and performance that didn’t always stack up to their peers.

Today, however, index-based ETFs offer a more modern and potentially more attractive opportunity for investors seeking capital appreciation and high levels of income. The ProShares Nasdaq-100 High Income ETF (IQQQ), and ProShares S&P Technology Dividend Aristocrats ETF (TDV) are two such funds. By combining these two major-index strategies, investors can target both technology-oriented growth and a high level of current income—importantly in the case of TDV, an income stream that has itself grown substantially over time.

A Nasdaq-100 Covered Call Strategy to Target Income and Growth

Covered call strategies are an increasingly popular option for investors seeking to match equity market upside with high levels of income. While S&P 500-based covered call strategies have been the most popular, Nasdaq-100 strategies may offer investors the potential for even higher levels of income and total return.

The technology-heavy Nasdaq-100 has outperformed the S&P 500 over the past 10 years, returning 502% vs. 290%, respectively.[1] Also, Nasdaq-based stocks are interesting from an income perspective, as they are generally more volatile than S&P 500 stocks. That increased volatility generally translates to higher options premiums, which covered call strategies can harvest and distribute as higher yield.

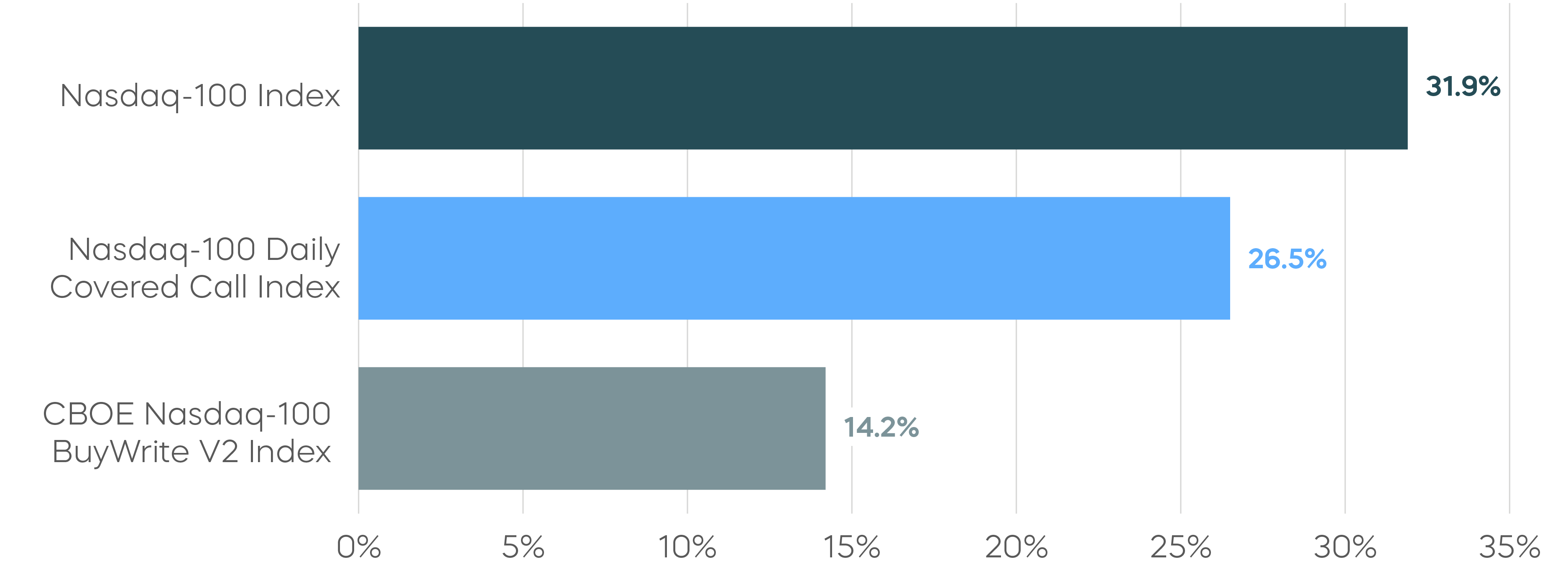

But there is a catch: Traditional covered call strategies use options that expire monthly. That means they frequently sacrifice significant total returns in their quest for high levels of income. The Cboe Nasdaq-100 BuyWrite V2 Index serves as a good proxy for traditional monthly covered call strategies. Since its inception in 2015, it has averaged only an 8.9% annualized total return versus the Nasdaq-100’s 18.6%.[2] Why invest in a growth and income strategy that sacrifices a large portion of its growth?

ProShares Nasdaq-100 High Income ETF (IQQQ) offers something different. It employs a daily options strategy tracking the Nasdaq-100 Daily Covered Call Index that enables investors to seek both high levels of income and target a greater percentage of the returns of the Nasdaq-100 over time. Since its inception, IQQQ’s index has captured 83% of Nasdaq-100’s total returns. IQQQ’s 12-month distribution rate was 11.7% as of 8/31/25 (Source: Bloomberg).

Total Return Since IQQQ’s Index Inception—3/11/24 to 8/31/25

Source: Bloomberg, data as of 8/31/2025. Index returns are for illustrative purposes only and do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest directly in an index. Past performance does not guarantee future results.

IQQQ performance as of 6/30/25: One-year 11.67% (NAV) | 11.65% (Market Price); Since inception on 3/18/24: 15.94% (NAV) | 16.07% (Market Price).

The Trailing 12-Month Distribution Rate represents the sum of IQQQ's distributions for the last 12 months, expressed as a percentage of the NAV, as of 12/31/24, via Morningstar. Distributions include return of capital which may be taxable or non-taxable. The characterization as return of capital does not impact whether the distribution is taxable. See 19a-1 notice for estimated percentage of return of capital. Distributions will reduce the NAV by the amount of the distribution. Future distributions may differ significantly from the latest distribution and are not guaranteed. Actual sources of the distributions may vary at the end of the year and will be provided in a Form 1099-DIV.

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Shares are bought and sold at market price (not NAV) and are not individually redeemed from the fund. Market price returns are based upon the midpoint of the bid/ask spread at 4:00 p.m. ET (when NAV is normally determined for most funds). Your brokerage commissions will reduce returns. Current performance may be lower or higher than the performance quoted. For standardized returns and performance data current to the most recent month end, see the Performance page.

Target High Quality S&P Technology Dividend Aristocrats for Income Growth

Technology stocks have been the market’s growth engine for nearly two decades, and they show no signs of slowing down. According to FactSet, the information technology sector delivered 15% year-over-year revenue growth in Q2 2025—the highest of any S&P 500 sector. Earnings growth was even better at 21.3%. The sector’s 25.4% net profit margin was also the highest of any sector.

In short, tech has produced prodigious profits and free cash flows. In recent years, that impressive performance has increasingly translated into our second strategic benefit: rapidly growing dividends.

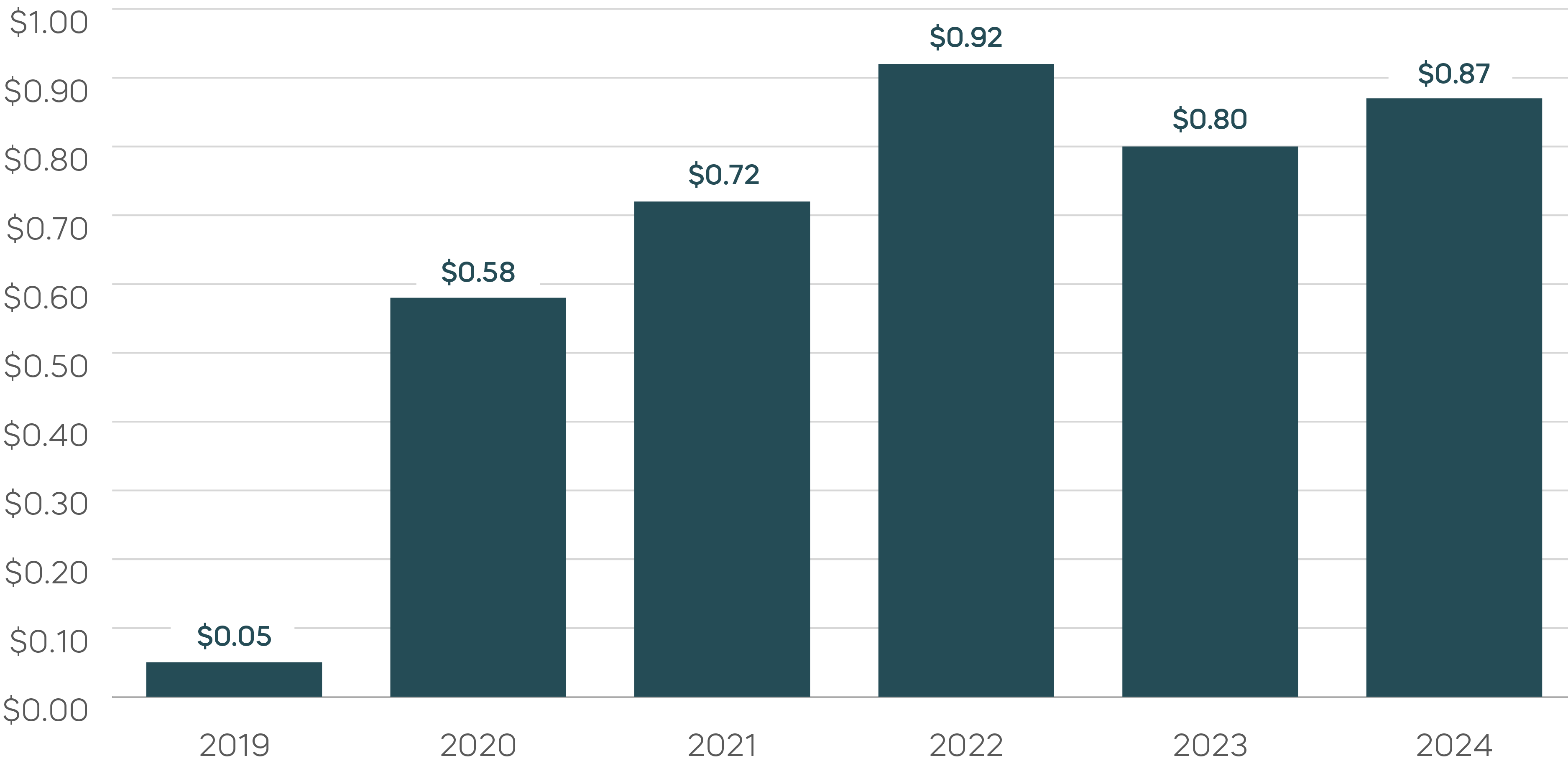

The Dividend Aristocrats represents some of the market’s most iconic dividend growth stocks. Companies that continuously grow their dividends show hallmarks of quality, like stable earnings, strong histories of profit and growth, and solid fundamentals. The S&P Technology Dividend Aristocrats Index requires its members to have grown their dividends for at least seven consecutive years, and only the ProShares S&P Technology Dividend Aristocrats ETF (TDV) tracks this exclusive index. Since its inception in 2019, TDV has steadily grown its distributions (income) at a compound annual growth rate of 10.7%.

TDV Has Delivered Attractive Per Share Income Growth Over Time

Source: ProShares, data from 11/5/19 to 12/31/24. Past performance does not guarantee future results.

TDV performance as of 6/30/25: One-year 12.83% (NAV) | 12.80% (Market Price); Three-year 17.35% (NAV) | 17.31% (Market Price); Five-year 16.22% (NAV) | 16.23% (Market Price); Since inception on 11/5/19: 15.33% (NAV) | 15.33% (Market Price).

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Shares are bought and sold at market price (not NAV) and are not individually redeemed from the fund. Market price returns are based upon the midpoint of the bid/ask spread at 4:00 p.m. ET (when NAV is normally determined for most funds). Your brokerage commissions will reduce returns. Current performance may be lower or higher than the performance quoted. For standardized returns and performance data current to the most recent month end, see the Performance page.

The Takeaway

Investors understand the return potential present in tech-focused investments. Modern income strategies have evolved to meet their needs. Beyond the underperforming and expensive actively managed mutual funds of the past, index-based ETFs like IQQQ and TDV offer meaningful access to technology-oriented stocks and provide the potential for capital appreciation. IQQQ also seeks high levels of income, while TDV’s names have grown their dividends over time.

[1] Source: Bloomberg, data from 8/31/15 to 8/31/25.

[2] Source: Bloomberg, data from 6/22/15 to 8/31/25.

Learn More

IQQQ

Nasdaq-100 High Income ETF

ProShares Nasdaq-100 High Income ETF seeks investment results, before fees and expenses, that track the performance of the Nasdaq-100 Daily Covered Call Index.

TDV

S&P Technology Dividend Aristocrats ETF

ProShares S&P Technology Dividend Aristocrats ETF seeks investment results, before fees and expenses, that track the performance of the S&P® Technology Dividend Aristocrats® Index.