Powered by a Daily Covered Call Innovation

Investors have flocked to covered call strategies over the past few years to create portfolios capable of generating attractive income while maintaining the potential to earn equity market returns. Traditional covered call strategies, however, have largely missed this mark and left investors disappointed. Now, a new covered call innovation that uses daily options offers a potentially more effective solution in the small-cap space.

Traditional covered call strategies—those using monthly call options—typically require investors to accept a costly trade-off between high income potential and the strategy’s long-term total returns.

For small caps, that trade-off can be particularly costly. A recent innovation—daily options—offers a solution designed to help investors participate more in upward price movements and capture potential returns that monthly small-cap strategies can miss.

Versus traditional strategies, a small cap covered call strategy that uses daily options provides investors the opportunity to seek high income, target equity market performance over the long term, and capture returns traditional strategies may sacrifice.

The Covered Call Conundrum—Especially Costly for Small Caps?

Small-cap stocks would seem an attractive arena to deploy a covered call strategy for precisely the same reasons you would include small caps in any asset allocation—growth potential and diversification benefits. But it only really makes sense if that small cap covered call strategy can produce not only income, but also the return potential of which small caps are capable.

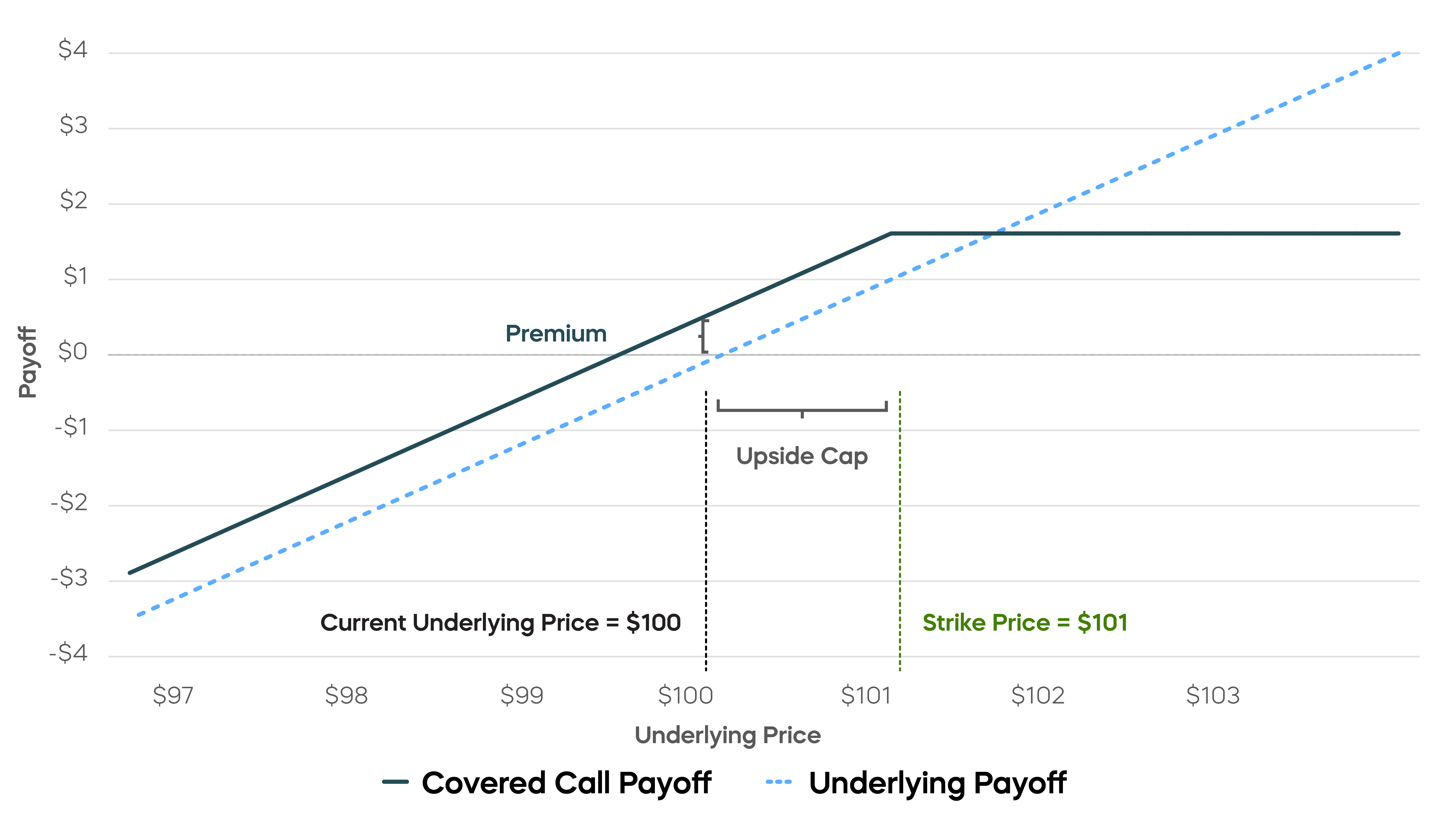

In a classic covered call strategy, an investor accepts a ceiling or cap on the appreciation of an investment—for example, a stock market index—in return for income from the sale of a call option. If the index rises above the strike price of the call option, the option is “in the money,” meaning the seller of the call option owes a payment, or “payout,” to the buyer equal to the difference between the price of the index and the option’s strike price. The option payout is “covered” by the gains on the stock index, so the covered call strategy does not lose money if the price of the index rises above the option’s strike price; the strategy simply places a cap on performance. This creates an inherent trade-off: The investor receives income from selling calls but sacrifices total return potential by capping the upside.

Covered Calls Place a Cap on Upside Payoffs

Chart is for illustrative purposes only.

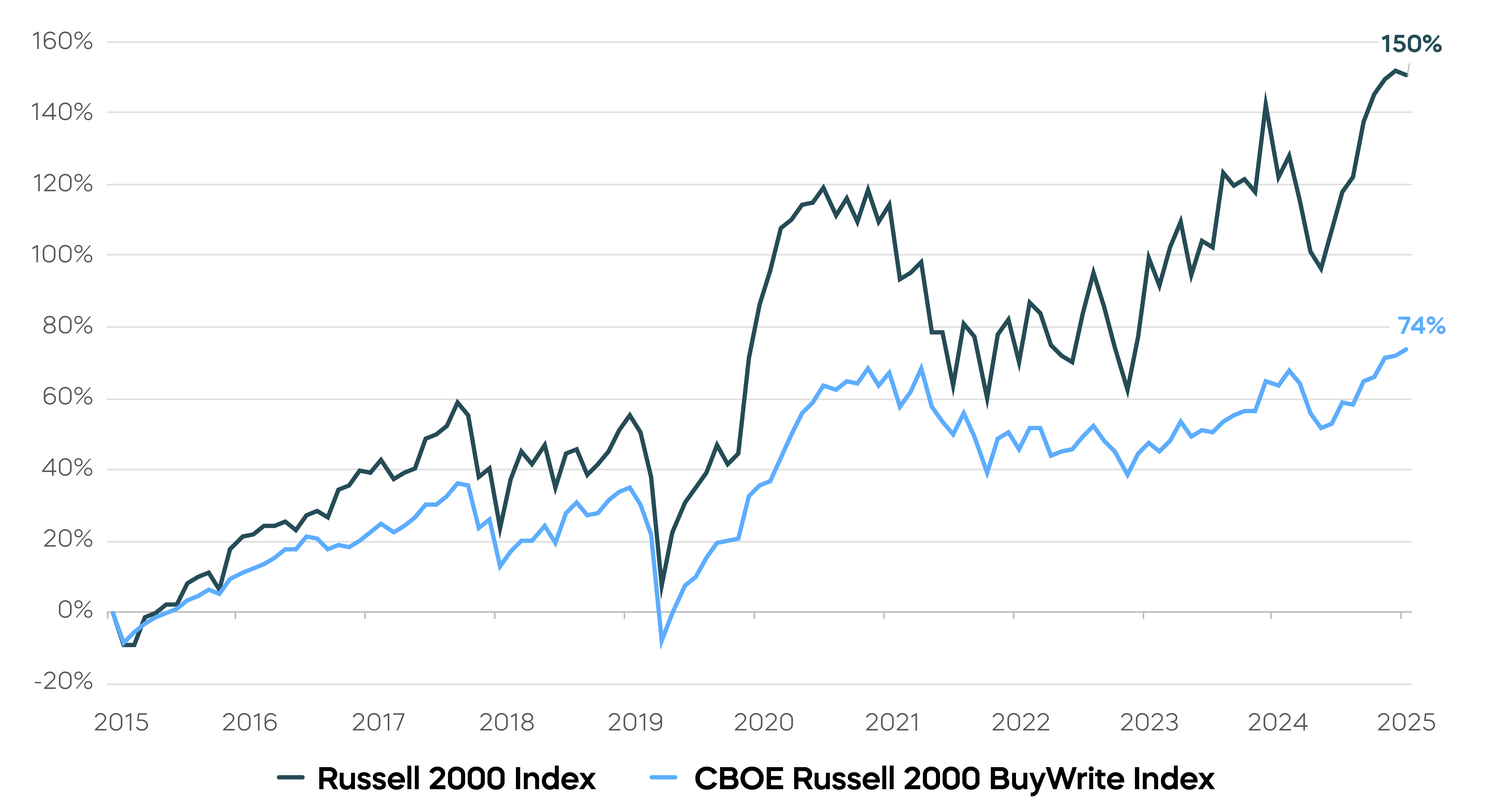

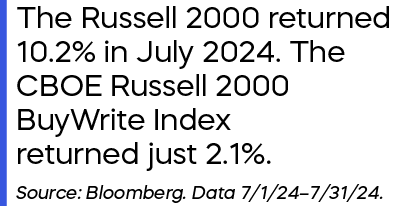

In the case of small-cap stocks, the income/return tradeoff in a traditional monthly covered call strategy can be particularly costly. Let’s compare the performance of the Russell 2000 Index and the CBOE Russell 2000 BuyWrite Index over the past ten years.

Russell 2000 Monthly Covered Call Strategies Have Underperformed by Over 70%

Source: Bloomberg. Data from 9/30/15 to 12/31/25. Index returns are for illustrative purposes only and do not represent actual fund performance. Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

If we dig deeper, the story for traditional monthly small cap covered call strategies seems even more challenging. Looking back at the covered call payoff diagram that we showed earlier, we see that the greater the positive returns of the underlying stocks, the greater the potential upside sacrifice. The greater the loss, on the other hand, the greater the potential downside. Because small-cap stocks tend to be more volatile, a traditional monthly strategy may capture less of the good and more of the bad.

|

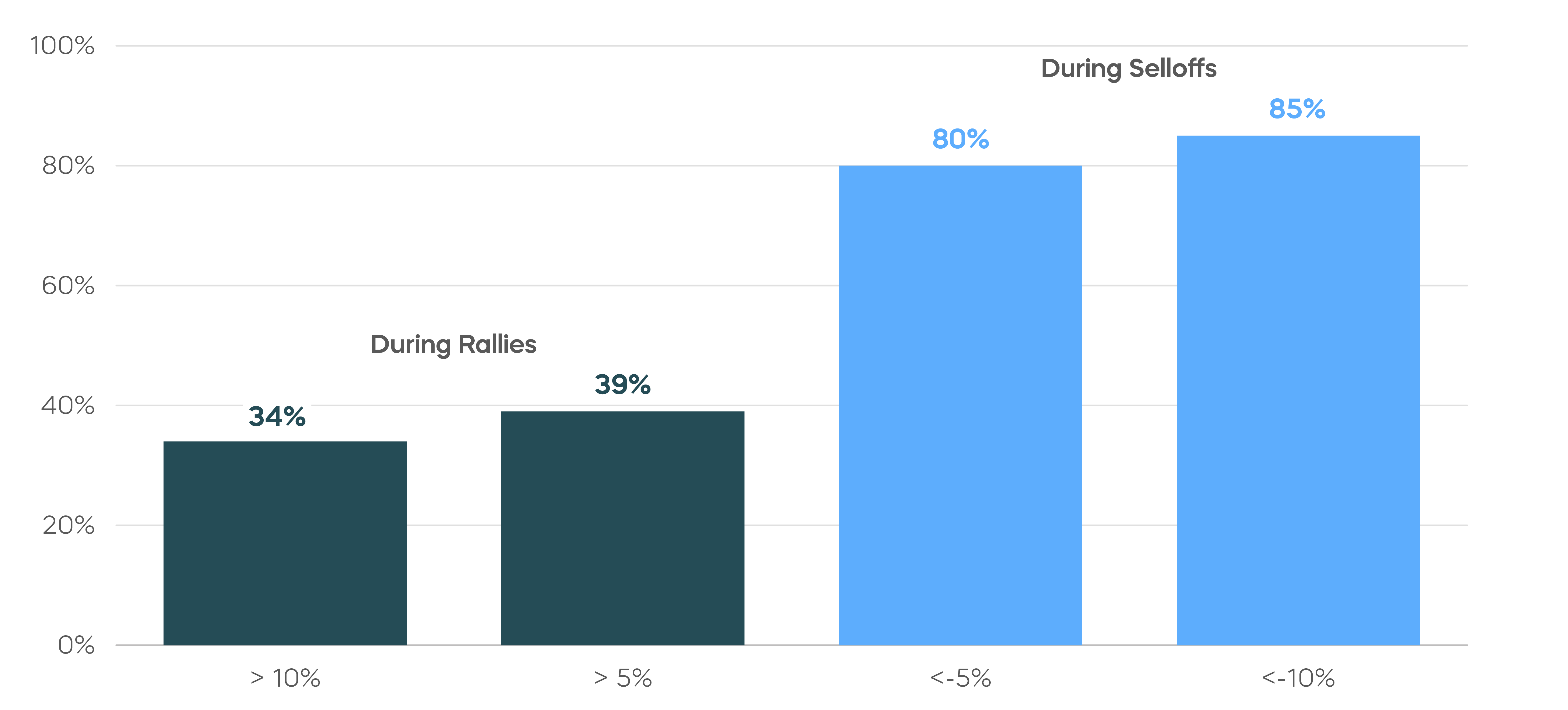

Reviewing historical participation during small-cap rallies and selloffs, the chart below demonstrates that in months when the Russell 2000 rose more than 10%, the BuyWrite index participated in only a little over one-third of the gains. But when the Russell 2000 lost more than 10%, the BuyWrite index captured 85% of that downside. Considering the general volatility of small caps, it seems clear that traditional covered call strategies face challenges in the small-cap space. |

Participation of Monthly Small Cap Covered Call Strategies in Rallies and Selloffs

Russell 2000 Index Performance (monthly)

Source: Bloomberg. Comparison of the upside and downside capture of the Russell 2000 Index vs. the CBOE Russell 2000 BuyWrite Index from 6/18/04 to 12/31/25. Index returns are for illustrative purposes only and do not reflect any management fees, transaction costs, or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results. “Upside capture” measures the performance of a fund or index relative to a benchmark when that benchmark has risen. “Downside capture” measures relative performance during periods when the benchmark has declined.

Cracking the Conundrum for Small Caps: Daily Options May Improve the Income/Return Tradeoff

By selling daily options, a move that resets the cap each day, A covered call strategy that uses daily options seeks to overcome the tradeoff between high income and potential long-term market returns. Using daily call options enables the strategy to participate in potential market gains, up to the strike price, each day that it occurs. Additionally, selling call options each day helps to maintain a desirable balance between premiums and payouts.

If we apply a covered call approach that uses daily options to small caps, the strategy has the potential to appeal to investors and behave in much the same way small caps always have—by providing returns and diversification benefits—but with the added potential income of a covered call strategy.

A Look at Large Cap Covered Call Performance Powered by Daily Options

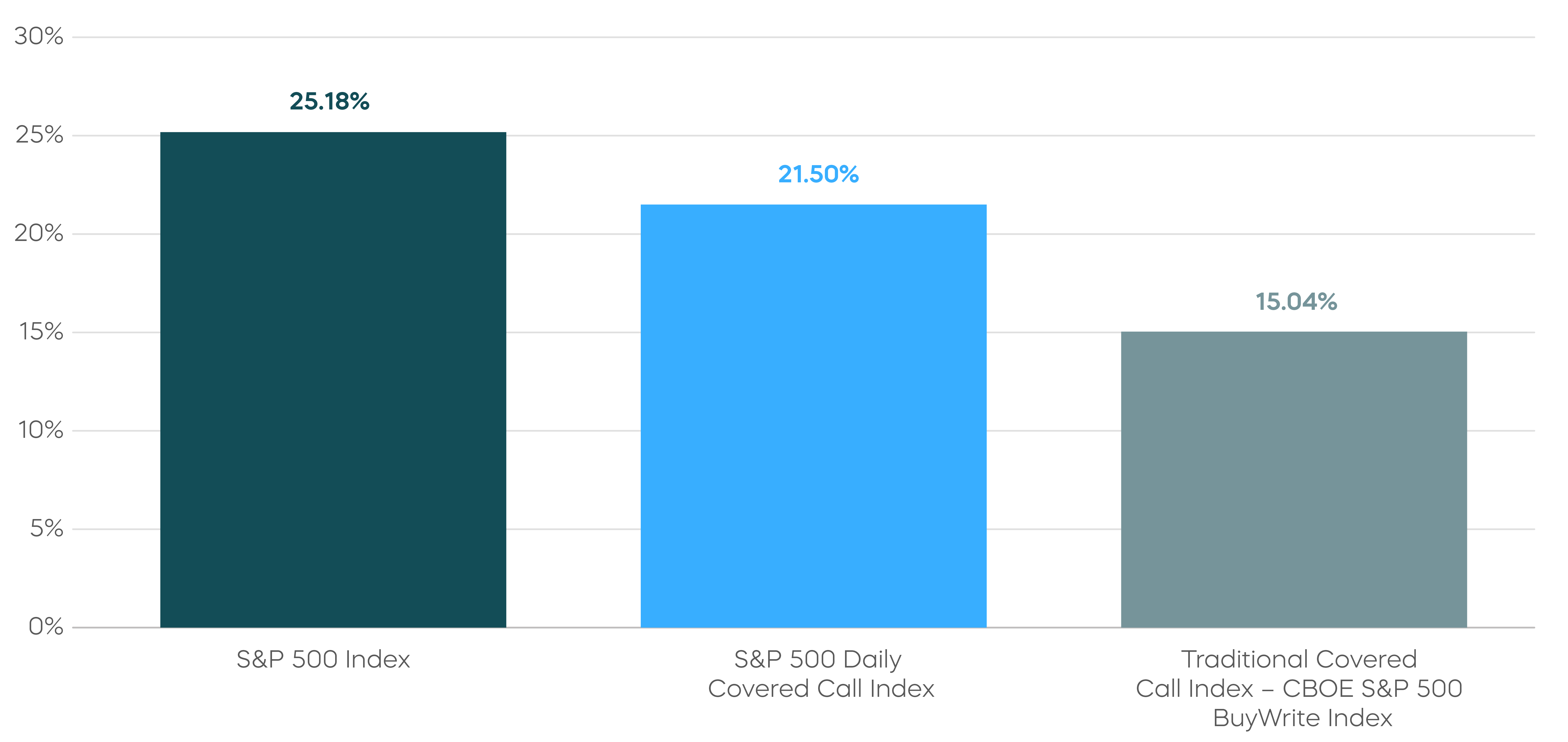

Covered call strategies that utilize daily options are a recent innovation. As we consider the potential for a Russell 2000-based, small cap covered call strategy that uses daily options, it might be helpful to consider the covered call strategy using daily options with the longest performance history. The large cap S&P 500 Daily Covered Call Index recently celebrated its first birthday, and has so far demonstrated its potential to capture returns more effectively than its traditional monthly call option strategy counterpart.

S&P 500 Covered Call Strategy Powered by Daily Options Has Shown Promise Since Inception

Source: Bloomberg. Data from 10/5/23 to 12/31/25. Index returns are for illustrative purposes only and do not reflect any management fees, transaction costs, or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results. ISPY’s total returns: Year to date through 12/31/25 – NAV 13.02%, Market Price 13.11%; Since Inception on 12/18/2023 – NAV 17.34%, Market Price 17.41%. ISPY gains exposure to the sale of daily call options using swap agreements and does not trade options. The fund has very limited performance history, which should not be taken as an indication of future performance.

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Shares are bought and sold at market price (not NAV) and are not individually redeemed from the fund. Market price returns are based upon the midpoint of the bid/ask spread at 4:00 p.m. ET (when NAV is normally determined for most funds). Your brokerage commissions will reduce returns. Current performance may be lower or higher than the performance quoted. For standardized returns and performance data current to the most recent month end, visit ProShares.com.

Learn More

ISPY

S&P 500 High Income ETF

ProShares S&P 500 High Income ETF seeks investment results, before fees and expenses, that track the performance of the S&P 500 Daily Covered Call Index.

IQQQ

Nasdaq-100 High Income ETF

ProShares Nasdaq-100 High Income ETF seeks investment results, before fees and expenses, that track the performance of the Nasdaq-100 Daily Covered Call Index.

ITWO

Russell 2000 High Income ETF

ProShares Russell 2000 High Income ETF seeks investment results, before fees and expenses, that track the performance of the Cboe Russell 2000 Daily Covered Call Index.