Surprisingly, oil prices are receding after U.S. strikes on Iranian nuclear facilities over the weekend. While prices have risen over 20% since the beginning of June, accelerating mid-month following the start of Israeli military actions, oil still trades lower than it did at the start of 2024. This seemingly muted reaction is consistent with our recent note highlighting the meaningful impact of the rise in U.S. oil production as a key mitigating factor for overall price volatility. Of course, risks still remain, particularly if anything impedes shipping in the Strait of Hormuz. But conflict in the region is not a simple one-way ticket up for oil.

At the same time, equity markets seem to be shrugging off the current Middle East conflict, with the S&P 500 kicking off the week in the green. While that might seem surprising, it’s happened before: The S&P 500 held up fine during the first and second Gulf Wars. And those were not “one-and-done” conflicts.

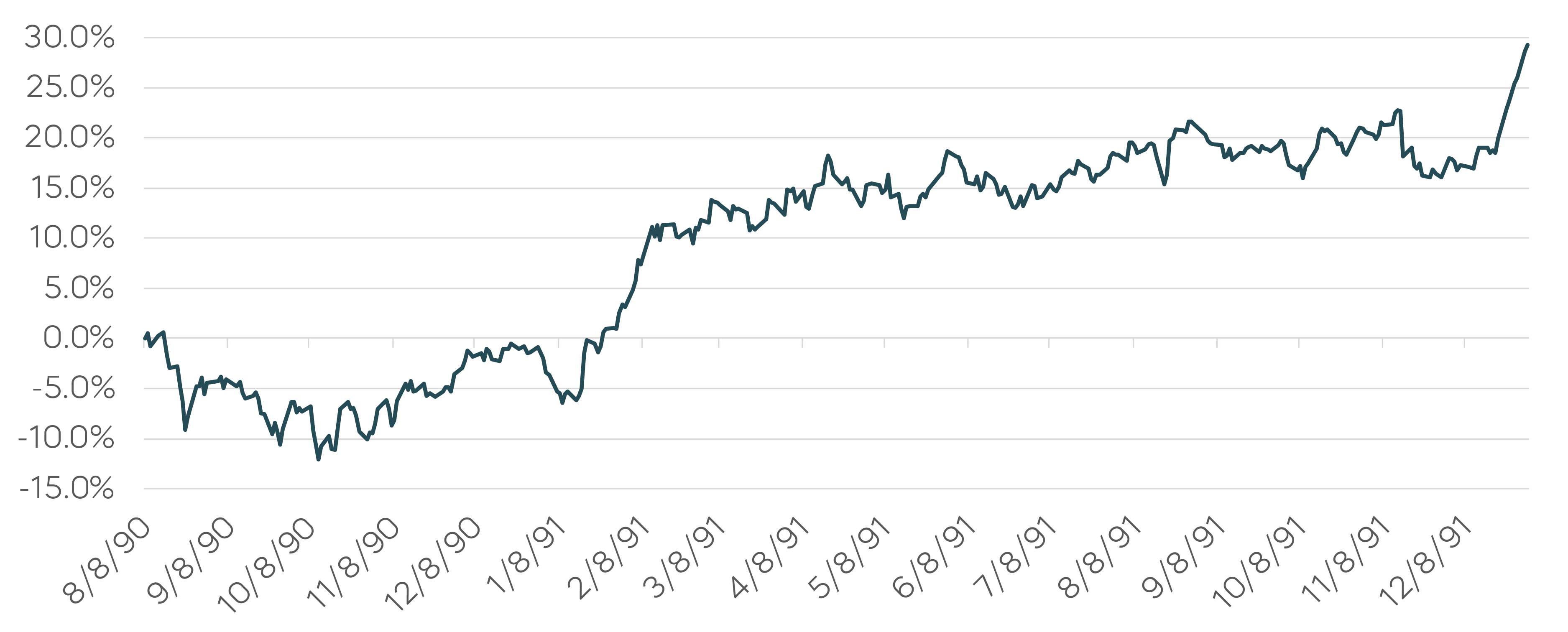

After the start of the first Gulf War, the S&P 500 recovered its initial losses in just a few months, and by the end of 1991 had increased by over 29% from the launch of Operation Desert Shield in August of 1990.

Stocks rose during the first Gulf War ...

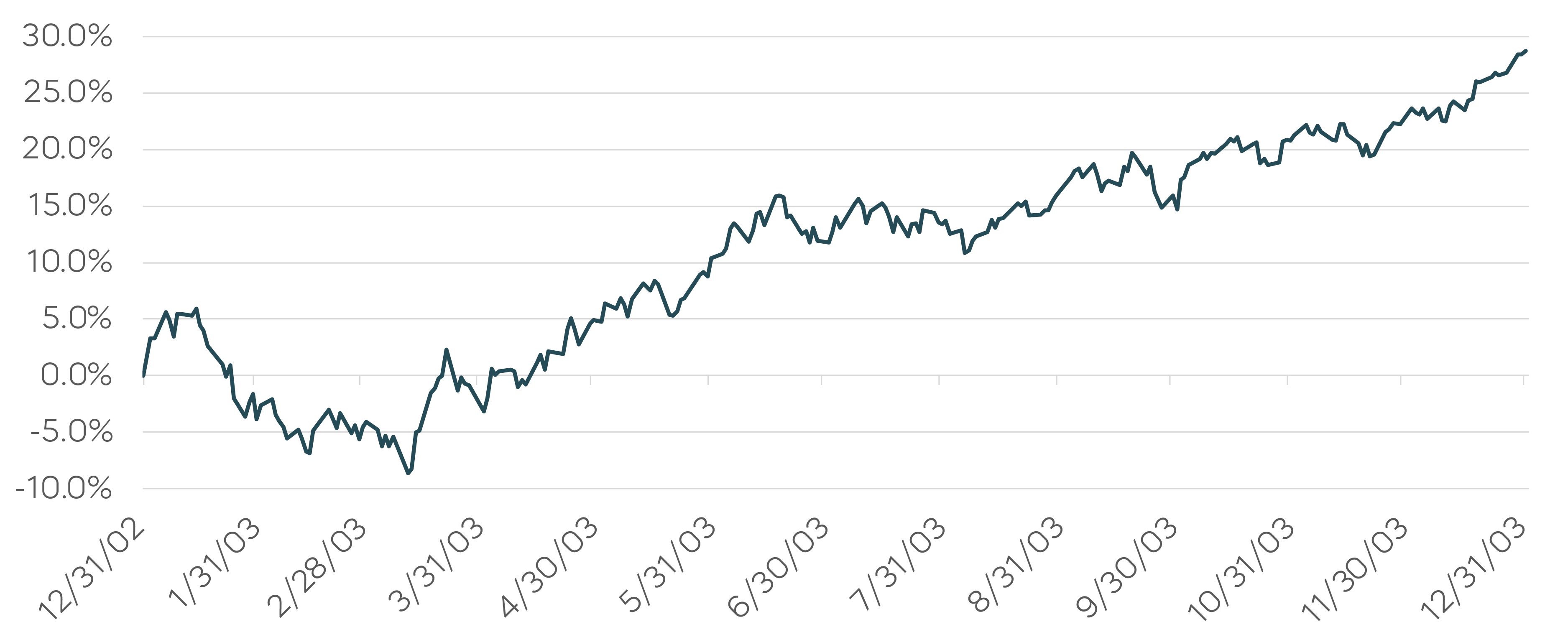

The S&P 500 had fallen modestly prior to the beginning of the second Gulf War in 2003, but its recovery began even before the U.S. invasion on March 20, and ended the year up roughly 29%.

... and during the second.

Military conflicts, stop-start truces, and related geopolitical tension always bring uncertainty to equity markets, but not necessarily declines.

This is not intended to be investment advice. Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results.

Any forward-looking statements herein are based on expectations of ProShare Advisors LLC at this time. Whether or not actual results and developments will conform to ProShare Advisors LLC’s expectations and predictions, however, is subject to a number of risks and uncertainties, including general economic, market and business conditions; changes in laws or regulations or other actions made by governmental authorities or regulatory bodies; and other world economic and political developments. ProShare Advisors LLC undertakes no duty to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.