Key Observations

How can investors power through today’s equity market uncertainty, elevated inflation and low real yields? The answer may lie with infrastructure.

- When uncertainty threatens equity and fixed income markets at the same time, investors may want to consider diversifying with a pure-play infrastructure strategy.

- Pure-play infrastructure companies historically have had resilient business models with stable margins and attractive cash flows that can potentially offer investors attractive yield and the benefit from growth over time.

Owners and operators of essential infrastructure assets like cell towers, pipelines, and water systems—so-called “pure play” infrastructure companies—offer several notable features for investors. Based on a unique combination of investment characteristics, pure play infrastructure companies have typically boasted resilient business models, attractive levels of yield, and consistent margins. That is a powerful trifecta amid current market conditions.

Fight Inflation Fears with Infrastructure

Volatile U.S. trade policy was already commanding investor attention, even before markets reacted to initial tariff announcements in April. But since then, the back-and-forth nature of tariff and trade agreements has made it exceptionally difficult for a host of industries to assess and react to possible outcomes. It seems likely, however, that tariffs will settle materially above pre-election levels, leaving companies to navigate elevated input costs and consumers to contend with higher prices. Savvy investors are preparing their investment portfolios for the potential fallout by incorporating strategies capable of performing well during extended periods of elevated inflation.

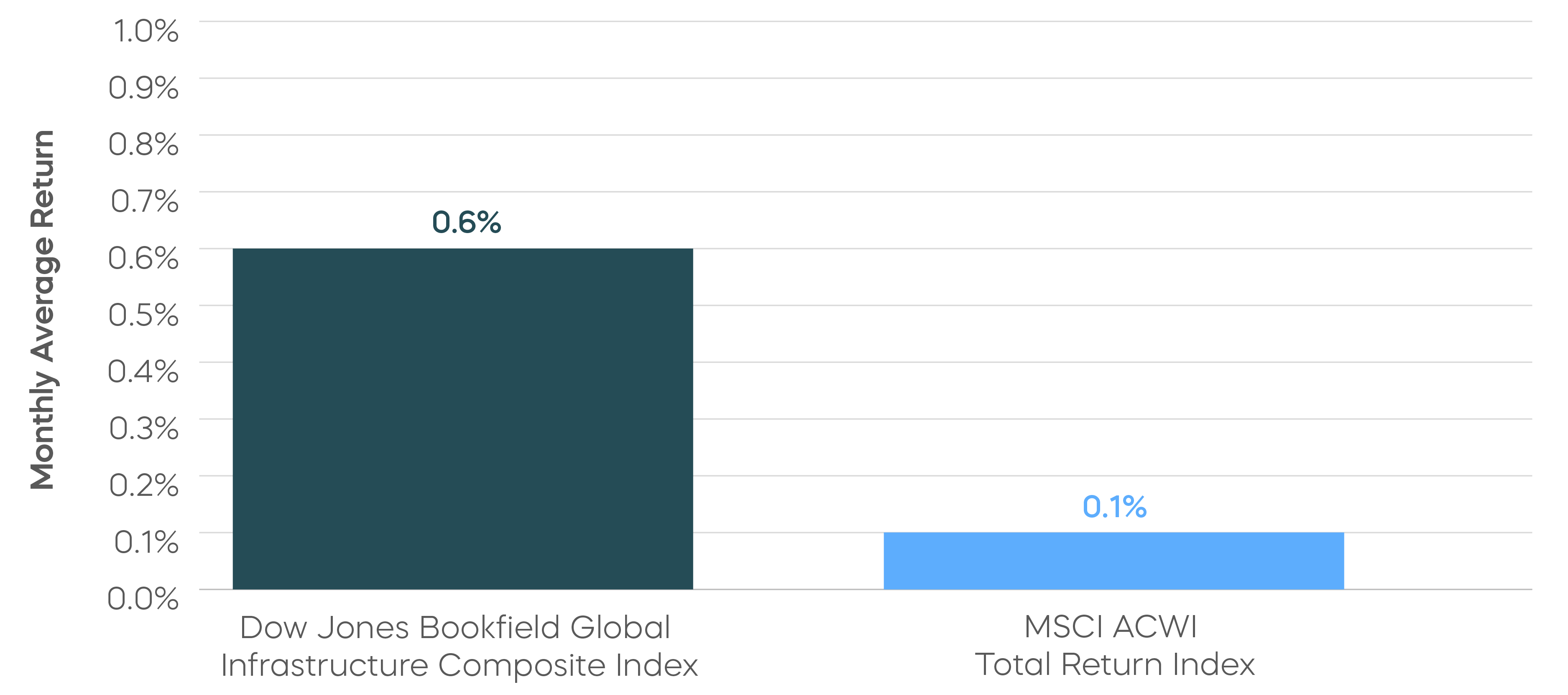

During periods of higher inflation dating back to 2008, pure-play owners and operators of infrastructure consistently outperformed global stocks. Specifically, when year-over-year inflation exceeded 2.25% (25 basis points above the Fed’s target rate), the Dow Jones Brookfield Global Infrastructure Composite Index outperformed the MSCI ACWI Total Return Index by 0.5% on a monthly basis, or approximately 6% annualized.

Pure-Play Infrastructure Companies Outperformed in Periods of High Inflation (>2.25%)

Source: Bloomberg. Data as of 6/30/25. MSCI ACWI Index is a global equity index designed to represent performance of the full opportunity set of large- and mid-cap stocks across developed and emerging markets. Index information does not reflect any management fees, transaction costs, or expenses. Indexes are unmanaged, and one cannot directly invest in an index. Past performance does not guarantee future results.

Using Infrastructure to Target Yield

Rising interest rates have put pressure on bond returns since 2021. More recently, U.S. Treasuries sold off alongside equities following the April 2nd tariff announcements, leaving income focused investors searching for alternative sources of yield. And increasing fiscal deficits and concerns over the sustainability of rising U.S. deficits may continue to pressure longer-term yields.

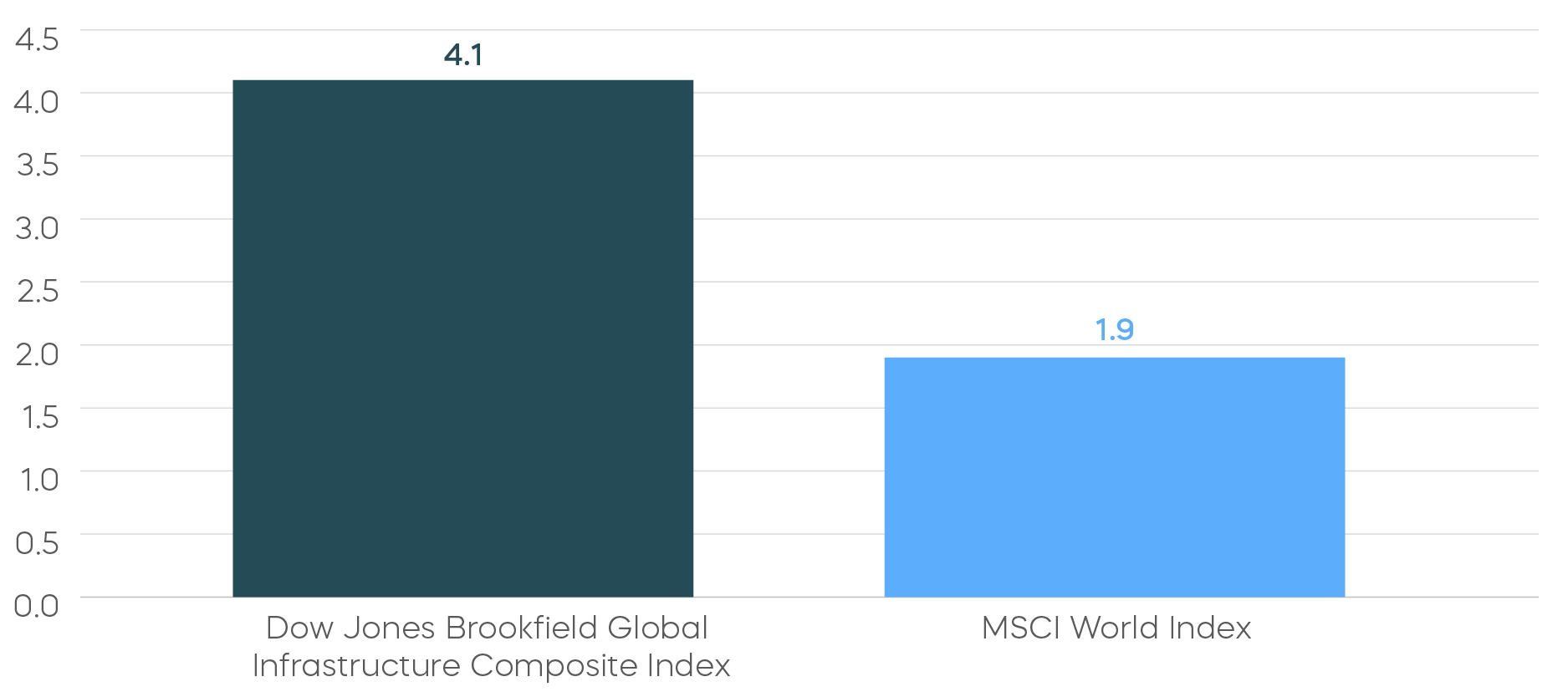

Pure-play infrastructure owners and operators have typically offered attractive levels of yield, while also providing potential for capital appreciation. Since its inception in 2008, the Dow Jones Brookfield Global Infrastructure Composite Index has consistently provided greater yield than global stocks as measured by the MSCI All Country World Index.

Pure-Play Infrastructure Strategies Have Delivered Attractive Yield

Source: Bloomberg. Data as of 6/30/25. Index returns are for illustrative purposes only and do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest directly in an index. Past performance does not guarantee future results.

Consistent Performance Amidst Uncertainty

Economic uncertainty remains high as markets contend with ongoing trade tensions, geopolitical unrest, and growing concerns over the expanding federal budget deficit. According to the latest World Economic Outlook from the International Monetary Fund, the impacts from these headwinds are being felt not just here in the U.S. Even global economic growth is at risk.

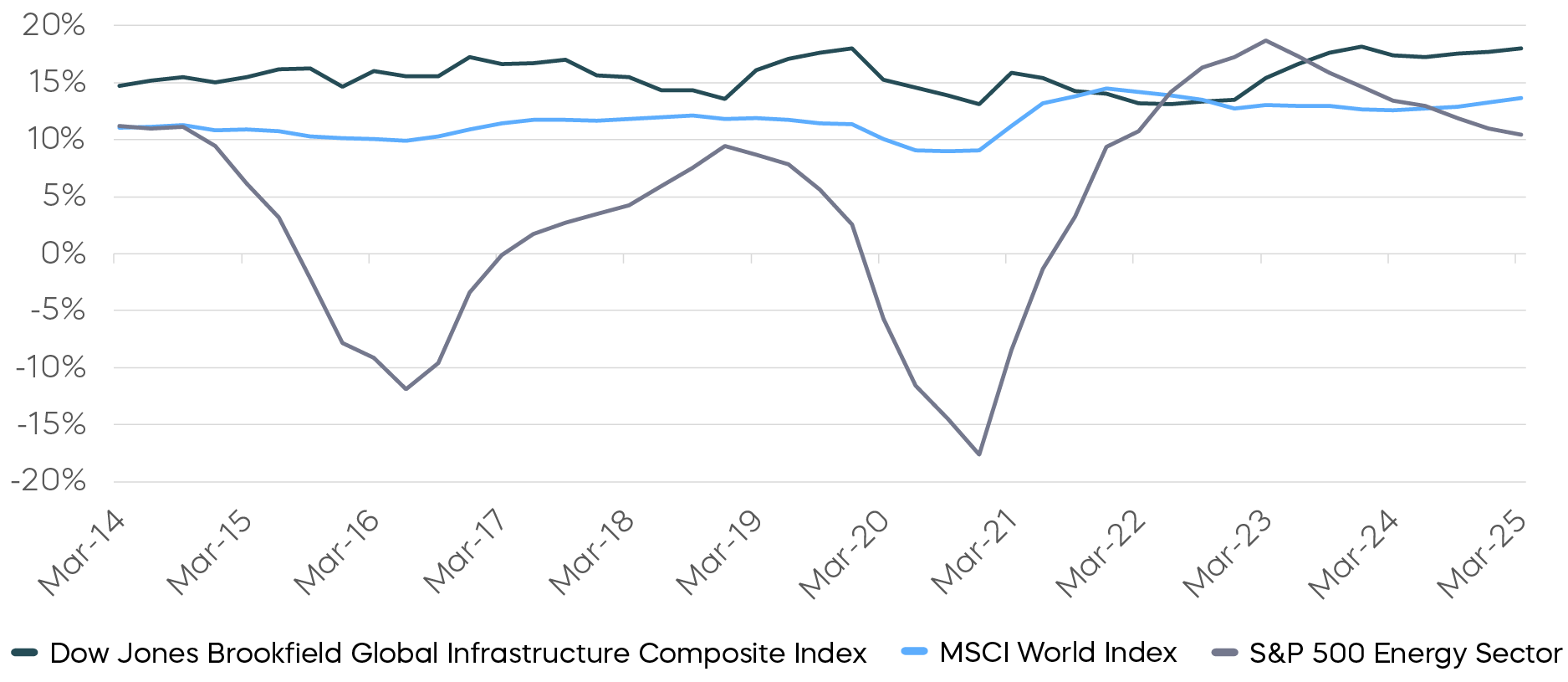

Investors seeking shelter from these potential storms should examine the consistent and stable performance of infrastructure companies over time. Pure-Play Infrastructure businesses typically own quasi-monopolistic assets with high barriers to entry. Accordingly, these assets often operate under long-term agreements that have delivered stable cash flows, and operating margins compared to the MSCI ACWI Index, and the S&P 500 Energy Index.

Consistent and Strong Operating Margins

Source: Bloomberg. Data as of 6/30/25. Index information does not reflect any management fees, transaction costs, or expenses. Indexes are unmanaged, and one cannot directly invest in an index. Past performance does not guarantee future results.

TOLZ: The Only Pure-Play Infrastructure ETF

ProShares DJ Brookfield Global Infrastructure ETF (TOLZ) is the only ETF to invest exclusively in pure-play infrastructure, giving investors access to the asset class’s potential for stable, attractive cash flows, high yield, and benefits from global growth.

TOLZ follows the Dow Jones Brookfield Global Infrastructure Composite Index, which consists of developed and emerging markets companies whose primary business is the ownership and operation of infrastructure assets, companies that derive more than 70% of their cash flows from infrastructure lines of business.