How Can Investors Take Advantage?

People love their four-legged friends, and consumer behavior around pet ownership has changed over time. Increasingly, people feel like their pets are part of the family and happily pay for premium pet products and healthcare. Investors should not overlook the potential in pet care, as the opportunity may be bigger than most realize.

Three things that investors should know about the pet care business:

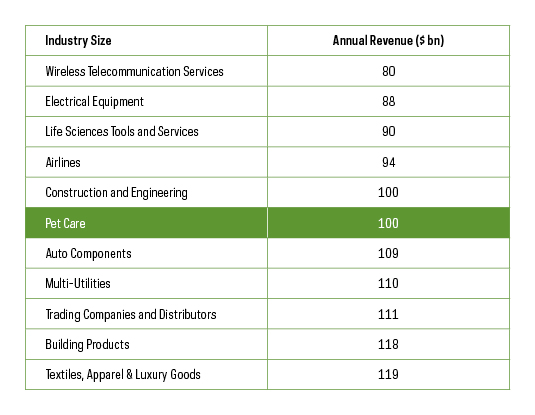

1). Pet care’s annual revenue is larger than many other well-known and established industries

2). U.S. consumer spending on pets has grown faster than many other market segments

3). Growth in sales per share is one of the most rapid across several themes

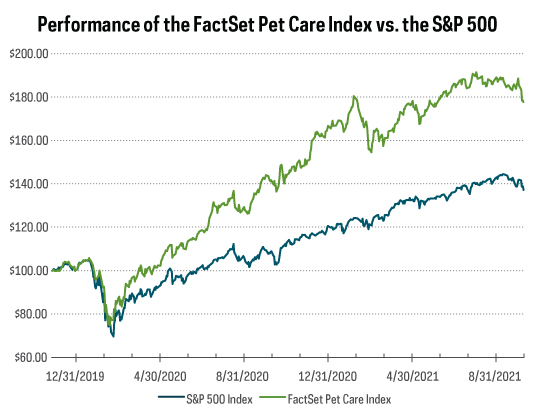

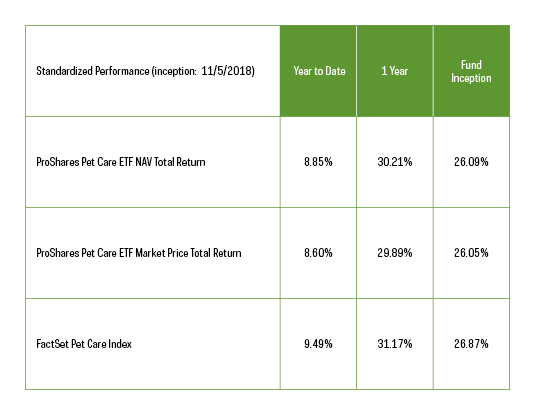

As measured by the FactSet Pet Care Index, the pet care industry has outperformed the S&P 500 by 37% since the inception of the ProShares Pet Care ETF (PAWZ) on November 5, 2018.1 This may sound surprising, but pet care is big business, and the industry has yielded a rapidly growing opportunity.

The Pet Care Industry Is Big Business

The U.S. pet care industry generates $100 billion in annual operating revenue. Versus established GICS industries, pet care ranks higher than wireless telecom services at $80 billion and airlines at $94 billion in annual operating revenue. The industries that rank just below and above pet care are ubiquitous. According to Pew Research, 97% of Americans have cellular phones, but the U.S. pet care industry generates more revenue than the wireless telecom industry.2 Pet care falls just a little below the entire U.S. textile, apparel and luxury goods industry (i.e., U.S. clothing manufacturers, including companies like Nike and Hanesbrands).

GICS Industries Ranked by Size vs. Pet Care

Source: Bloomberg GICS Industry-Level Revenue, Fiscal Year 2020

There are a number of notable characteristics associated with this revenue stream. The industry is broadly made up of two segments: general pet care and pet health. General pet care can include items like food and litter, while pet health can include therapies and preventative medications. Both segments have defensive features associated with recurring revenue streams, much like the consumer staples or healthcare sectors. Further, pet health does not face some of the regulatory hurdles associated with the broader healthcare sector that can increase costs and slow innovation.3

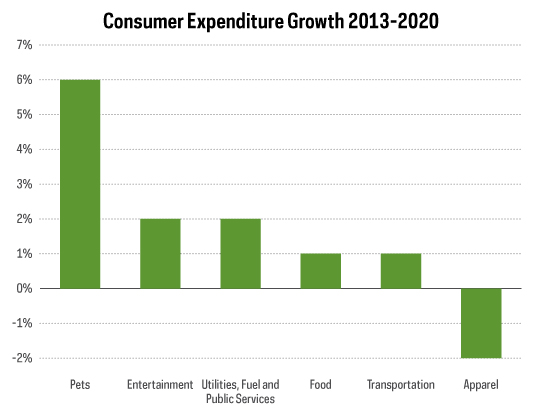

Consumer Behavior Stimulated Growth

Data on consumer spending from the Bureau of Labor and Statistics gives a micro-level view of the growth in pet care based on household expenditures. Spending on pet care has accelerated faster than most other discretionary categories, such as entertainment, transportation and apparel. With 67% of U.S. households owning pets in 2020, there are more households with pets than children.4 Beyond the trend of increasing pet ownership, consumer behavior is also changing. A Morgan Stanley survey found that 70% of pet owners consider their pets to be part of the family, and 72% indicated that their finances would not trigger a change in their pet food spending habits.5 This offers one likely explanation for the increase in spending on pet healthcare and premium pet products.

Source: Consumer Expenditure Surveys, U.S. Bureau of Labor Statistics, September 2021

Rapid Growth in Pet Care Market

Recurring revenue streams, for example in areas like consumer staples, offer investors a degree of stability, but that may be accompanied by slower growth. Trailing 12-month sales per share for the companies of the S&P 500 Consumer Staples Index were just over 8%, as of September 23, 2021, compared to the FactSet Pet Care Index at over 37%.6 Across more than 19 thematic indexes,7 the companies in the FactSet Pet Care Index delivered the fastest sales per-share growth of the first half of 2021, compared to the same period in 2020, and beat out high-growth themes like cloud computing, genomic medicine and social media.

Source: Bloomberg, as of 9/30/21

Then there are the businesses focused on pet insurance, such as Trupanion, which can help alleviate pet owners’ concerns about the costs of keeping their pets healthy. While Trupanion has seen impressive revenue growth of 31% year-over-year for the third quarter, the company believes the United States is still in the early lifecycle of adopting pet insurance. Penetration rates are currently close to 2%, versus projected penetration rates of 25% over the long-term, according to the company’s most recent investor presentation.7

Source: Bloomberg, as of 9/30/21

As of 09/30/2021, PAWZ’s operating expenses are 0.50%.

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost.

Current performance may be lower or higher than the performance quoted. Standardized returns and performance data current to the most recent month end may be obtained by visiting ProShares.com. Index performance is for illustrative purposes only and does not represent fund performance.

Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest in an index. Past performance is not a guarantee of future results.

The pet care industry spans veterinary pharmaceuticals, diagnostics, product distributors and services, manufacturers of pet food and pet supplies, and pet supply retailers. Each of these subindustries is responding to the demands of pet owners with continued innovation that’s led to notable growth. Here in the United States, the pet care industry has grown steadily over the past several decades, even during the Great Recession. Meanwhile, a similar boom has been building internationally. The global pet care industry is expected to grow from $232 billion in 2020 to as much as $350 billion by 2027.8

1Bloomberg, as of 9/30/2021

2https://www.pewresearch.org/internet/fact-sheet/mobile/

3https://www.bls.gov/cex/tables/calendar-year/mean/cu-all-multi-year-2013-2020.pdf

4https://www.statista.com/statistics/198086/us-household-penetration-rates-for-pet-owning-since-2007/

5Morgan Stanley Research Report- Pet Care, March 2021

6Bloomberg

7For discussion of thematic fundamental and market performance: Cloud Computing is defined as companies in the ISE Cloud Computing Index; Software is defined as companies in the Bloomberg Americas Software Index; Internet of Things is defined as companies in the Indxx Global Internet of Things Index; Machine Learning/AI is defined as companies in the ROBO Global Artificial Intelligence Index; Industrial Automation is defined as companies in the ROBO Global Robotics and Automation Index; Cybersecurity is defined as companies in the Nasdaq CTA Cybersecurity Index; Remote Interaction Software is defined as companies in the Solactive Remote Work Index; Digital Payments is defined as companies in the Ecofin Global Digital Payments Infrastructure Index; Biotechnology is defined as companies in the Nasdaq Biotechnology Index; Genomic Medicine is defined as companies in the NYSE FactSet Global Genomics and Immuno Biopharma Index; E-Commerce is defined as companies in the ProShares Online Retail Index; Gaming and E-Sports is defined as companies in the Solactive Video Games & Esports Index; Social Media is defined as companies in the Solactive Social Media Index; Sustainable Food is defined as companies in the Foxberry Tematica Research Sustainable Future of Food Index; Pet Care is defined as companies in the FactSet Pet Care Index; Autonomous Driving is defined as companies in the NYSE FactSet Global Autonomous Driving and Electric Vehicle Index; Alternative Energy is defined as companies in the S&P Kensho Clean Power Index; 3-D Printing is defined as companies in the Total 3D-Printing Index; Defense & Aerospace is defined as companies in the BI North America Defense Prime Index; Infrastructure is defined as companies in the Dow Jones Brookfield Global Infrastructure Composite Index; FinTech is defined as companies in the Indxx Global Fintech Thematic Index; Water is defined as companies in the NASDAQ OMX US Water Index; Space is defined as companies in the S&P Kensho Final Frontiers Index; Defense Contractors is defined as companies in the BI North American Defense Prime Index; and Luxury is defined as companies in the S&P Global Luxury Index.

How Investors Can Access the Pet Care Industry

PAWZ is the first ETF that allows investors to capitalize on people’s passion for their pets. PAWZ gives investors the opportunity to gain broad exposure to public companies in the global pet care industry—companies that stand to potentially benefit from the proliferation of pet ownership and the emerging trends affecting how we care for our pets. PAWZ tracks the FactSet Pet Care Index.

IMPORTANT INFORMATION

Any forward-looking statements herein are based on expectations of ProShare Advisors LLC at this time.

Investing is currently subject to additional risks and uncertainties related to COVID-19, including general economic, market and business conditions; changes in laws or regulations or other actions made by governmental authorities or regulatory bodies; and world economic and political developments.

Investing involves risk, including the possible loss of principal. This ProShares ETF is subject to certain risks, including the risk that the fund may not track the performance of the index and that the fund’s market price may fluctuate, which may decrease performance. Please see their summary and full prospectuses for a more complete description of risks. There is no guarantee any ProShares ETF will achieve its investment objective.

The fund is subject to the risks faced by companies in the pet care industry. Although the pet care industry has historically seen steady growth and has been resilient to economic downturns, these trends may not continue or may reverse. Consumer tastes and preferences are difficult to forecast. Changing consumer preferences could have a negative impact on the revenue streams of companies in the pet care industry. Many companies in the pet care industry are small, independent producers and retailers.

Investments in smaller companies typically exhibit higher volatility. Small- and mid-cap companies may have limited product lines or resources, may be dependent upon a particular market niche and may have greater fluctuations in price than the stocks of larger companies. Small- and mid-cap companies may lack the financial and personnel resources to handle economic or industry-wide setbacks and, as a result, such setbacks could have a greater effect on small- and mid-cap security prices.

Carefully consider the investment objectives, risks, charges and expenses of ProShares before investing. This and other information can be found in their summary and full prospectuses. Read them carefully before investing.

The "FactSet Pet Care Index" and "FactSet" are trademarks of FactSet Research Systems Inc. and have been licensed for use by ProShares. ProShares have not been passed on by these entities or their affiliates as to their legality or suitability. ProShares based on the FactSet Pet Care Index are not sponsored, endorsed, sold, or promoted by FactSet Research Systems Inc., and it makes no representation regarding the advisability of investing in ProShares. THIS ENTITY AND ITS AFFILIATES MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO PROSHARES. FactSet Research Systems Inc. does not guarantee the accuracy and/or the completeness of the FactSet Pet Care Index or any data included therein, and FactSet Research Systems Inc. shall have no liability for any errors, omissions, or interruptions therein.

Learn More

PAWZ

Pet Care ETF

PAWZ is the first and only ETF focused on the expanding pet care industry and companies positioned to benefit from the popularity of pet ownership.