Key Observations:

-

Pure-play infrastructure has continued to demonstrate resilient performance and may offer a compelling investment opportunity during a period of inflation and ongoing economic uncertainty.

-

Infrastructure owners and operators typically possess a unique combination of desirable investment characteristics, including historically stable growth and long-term cash flows. These qualities have generally made them less cyclical and capable of producing attractive levels of yield.

-

Infrastructure owner/operator American Tower, a company that has grown its revenues, cash flows and dividends at attractive rates, is highlighted in this report.

Infrastructure May Provide a Refuge from Volatility

A combination of persistent inflation, rising interest rates and geopolitical instability has dampened markets in 2025. Where can investors look for refuge amid the uncertainty? Pure-play infrastructure companies—whose primary business is the ownership and operation of essential real infrastructure assets like pipelines, cell towers and water systems—may provide an answer. They offer a unique combination of investment characteristics that has historically made them well suited to withstand uncertain times.

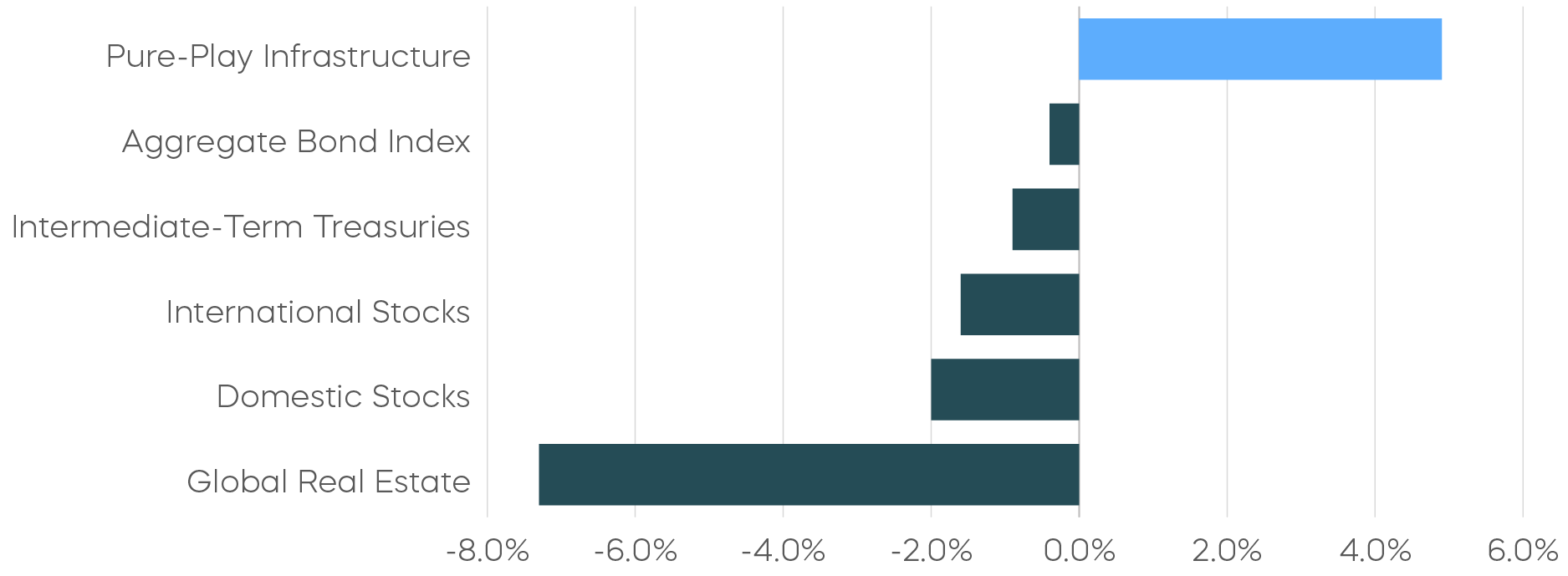

Recent stock market volatility has been especially painful for investors because even typical diversifiers like bonds and real estate have suffered losses. There have been few places to hide. One segment of the market that has performed well of late is infrastructure owners and operators. The Dow Jones Brookfield Global Infrastructure Composite Index measures the performance of companies that are owners and operators of pure-play infrastructure assets.

Pure-Play Infrastructure Companies Performed Well Recently

Resilient Performance in Difficult Markets

Opportunity For Attractive Yield

What has driven infrastructure’s performance in difficult markets? Infrastructure owners and operators possess a unique combination of growth and defensive qualities that have helped them weather the recent economic headwinds. The need for investment in global infrastructure has been well documented. U.S. infrastructure continues to benefit from the hundreds of billions of dollars appropriated by the Infrastructure Investment and Jobs Act (2021), the Inflation Reduction Act (2022), and other public-private initiatives.

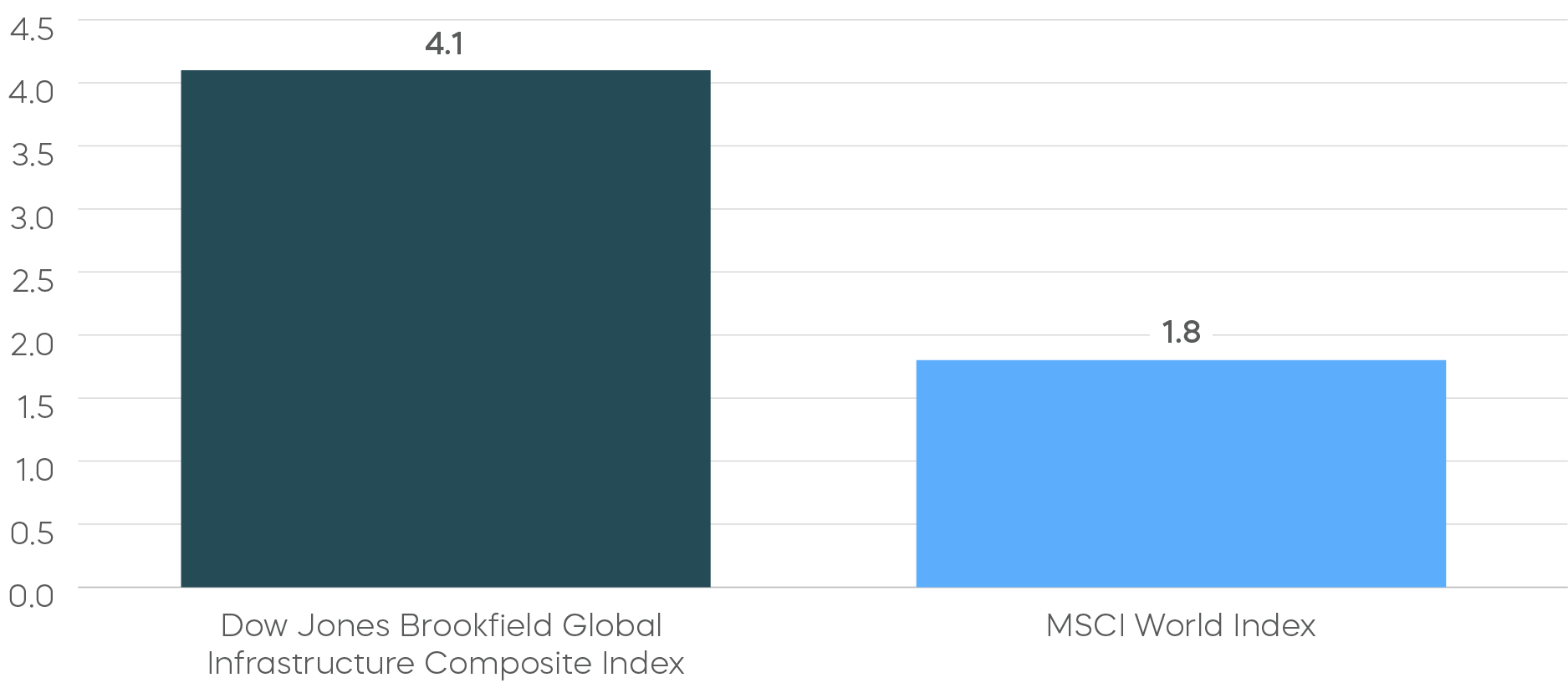

Because infrastructure assets are usually essential and large scale, they often have limited competition, and consumer demand for their services is less elastic, making their business models less cyclical in nature. Even if we do enter a recession, people typically will still pay to heat their homes, turn on the lights and use their cell phones. Additionally, with inflation remaining elevated, owners and operators of infrastructure can often raise revenues in a manner that is consistent with inflation. These qualities have historically enabled infrastructure companies to generate stable cash flows, which has translated to high levels of yield for their shareholders.

Consistently Higher Historical Yields

12 Month Yield

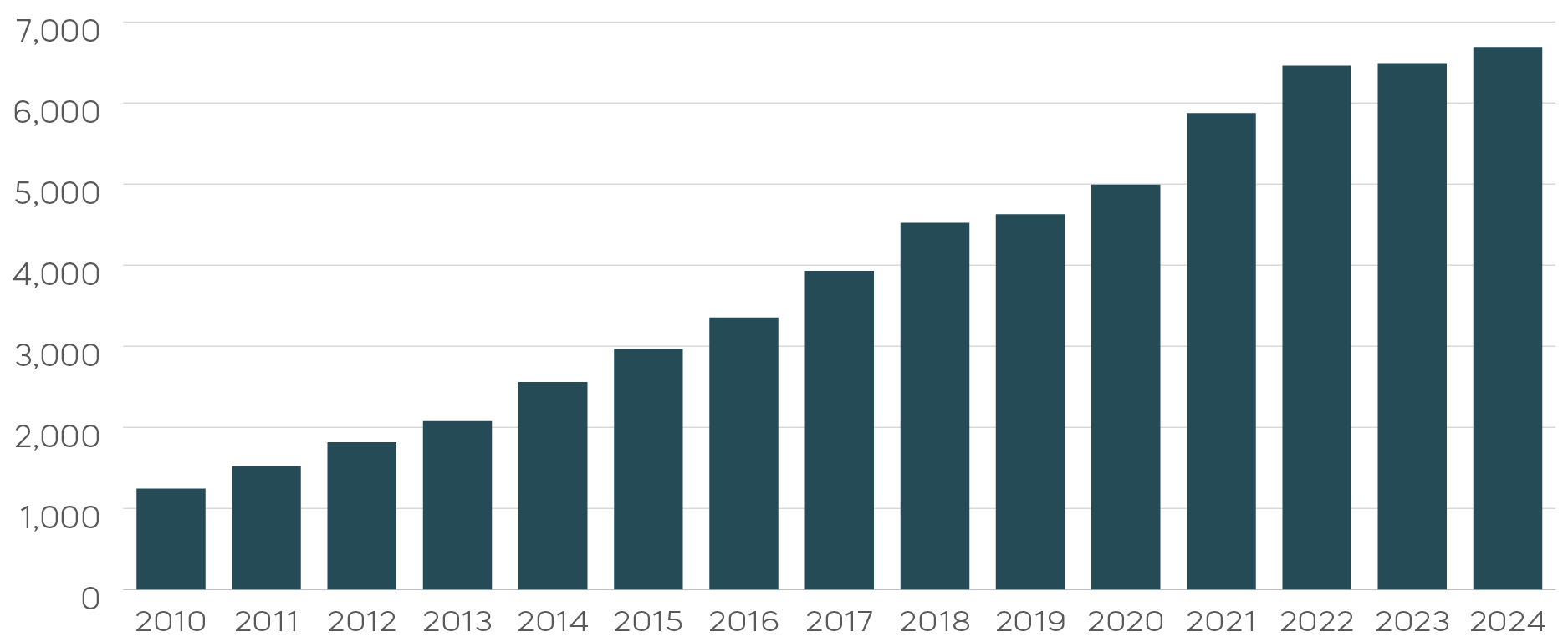

American Tower: Consistent Growth with Pricing Power

A pure-play infrastructure company that exemplifies the types of characteristics we’ve discussed is American Tower Corporation (NYSE: AMT). AMT is a global leader in wireless communication that provides the infrastructure needed to enable a connected world. When you see a cell phone tower, there’s a good chance it is owned by AMT, the nation’s largest operator. As the world has become more connected, wireless data usage has exploded. Technologies like 5G and AI potentially ensure an attractive runway of growth for years to come. AMT’s business model consists of leases with wireless carriers that are typically non-cancellable, extend for several years, and provide annual lease-price escalators. These attributes have helped AMT deliver double-digit growth of cash flows and profits over the previous 10 years. Since it started paying a dividend in 2012, AMT has grown its dividend each year at a compound rate of over 17%, what we believe to be an unmistakable sign of quality.

AMT Has a Long-Term, Consistent Growth & Profitability Profile

Earnings Before Interest, Taxes, Depreciation & Amortization ($ in Millions)

TOLZ: The Only Pure-Play Infrastructure ETF

ProShares DJ Brookfield Global Infrastructure ETF (TOLZ) is the only ETF to invest exclusively in pure-play infrastructure, giving investors access to the asset class’s stable, attractive cash flows, high yield, and potential to benefit from global growth.

TOLZ follows the Dow Jones Brookfield Global Infrastructure Composite Index. This index consists of developed and emerging markets companies that qualify as pure-play infrastructure companies, whose primary business is the ownership and operation of infrastructure assets, and that derive more than 70% of their cash flows from infrastructure lines of business.

As of 4/30/25, TOLZ included a 5.27% allocation to AMT. Holdings are subject to change.

Click here for fund performance. Indexes are unmanaged, and one cannot directly invest in an index. Past performance does not guarantee future results.

Learn More

Learn More

TOLZ

DJ Brookfield Global Infrastructure ETF

TOLZ focuses exclusively on pure-play companies—the owners and operators of infrastructure assets such as toll roads, airports and cell towers.