With renewed conflict in the Middle East, attention naturally turns to oil prices and the potential impact on the U.S. and global economy. In 1973, an OAPEC embargo nearly quadrupled the price of oil and was a significant contributor to the economic malaise of the 1970s. Again, at the end of that decade, the Iranian revolution nearly tripled the price of oil. Fast forward to today: oil prices rose following the Russian invasion of Ukraine, but fell during the intervening years despite that ongoing war and rising tensions in the Middle East. One key component of lower prices: The U.S. has been the world’s largest producer of oil for the last six years, according to Reuters.

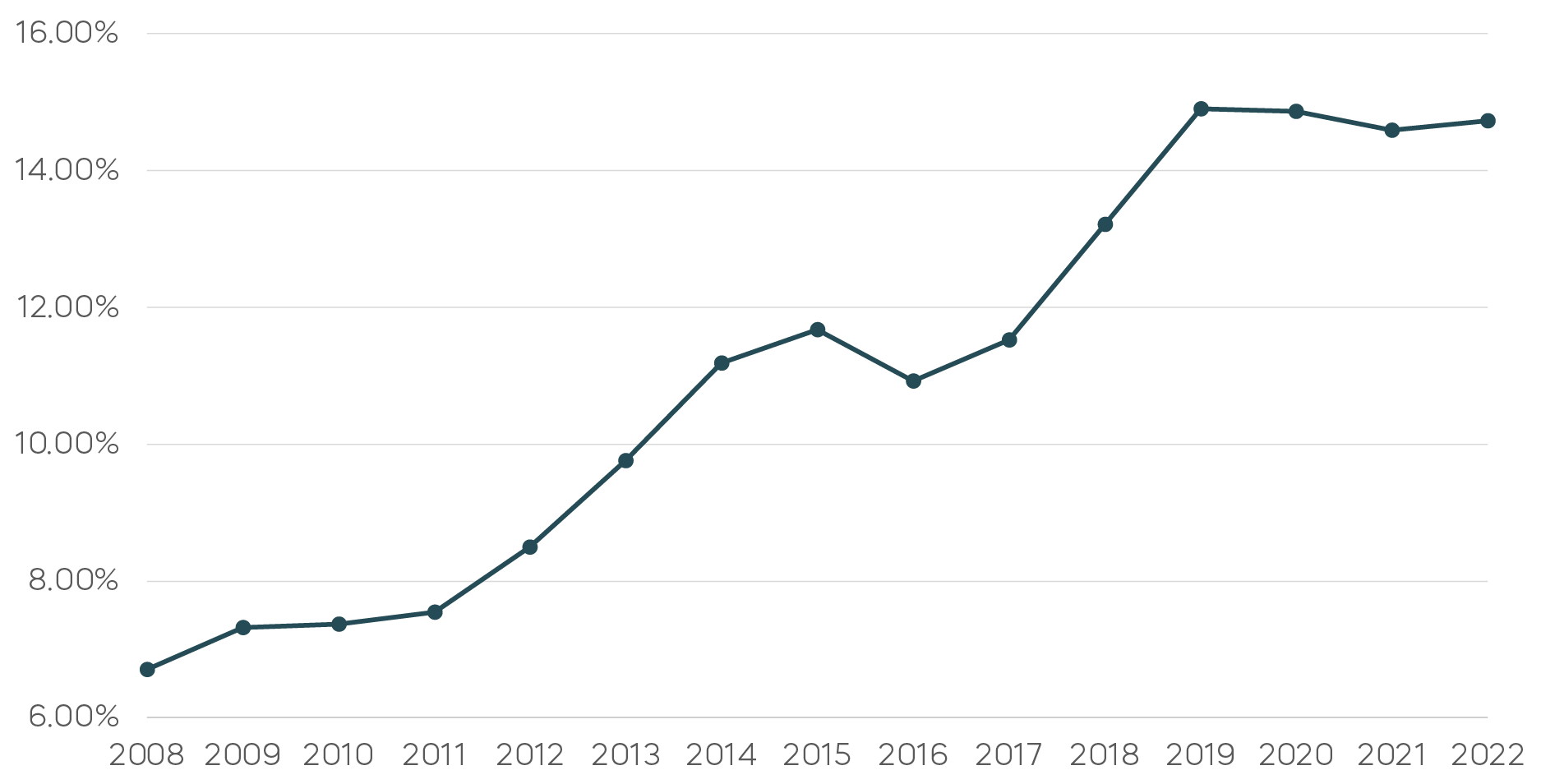

U.S. Share of Global Crude Oil Production

Source: Statista. Data 2008-2022

There is, of course, a risk the conflict between Israel and Iran will expand, but the economic impact of a confined conflict is less likely to significantly impact oil prices than it would have a generation or two ago.

This is not intended to be investment advice. Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results.

Any forward-looking statements herein are based on expectations of ProShare Advisors LLC at this time. Whether or not actual results and developments will conform to ProShare Advisors LLC’s expectations and predictions, however, is subject to a number of risks and uncertainties, including general economic, market and business conditions; changes in laws or regulations or other actions made by governmental authorities or regulatory bodies; and other world economic and political developments. ProShare Advisors LLC undertakes no duty to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.