How Social Media Is Shaping the Pet Care Industry

For those of us who frequent social media platforms, it’s hard to deny the impact they have on our lives. And some social media users have greater impact than others. The term “influencer” refers to social media accounts with large numbers of followers that have the ability to impact consumer behavior. Social media’s impact expands beyond just “influencers,” ranging from targeted advertising that seems to know exactly what we’re thinking, to posts from our friends that can spark joy or envy.

Types of posts that seem to be popping up more frequently are ones picturing pets, particularly newly adopted four-legged friends. Some pet owners even make separate accounts devoted to their new family members. Instagram accounts with names such as @jiffpom and @nala_cat have reached clear influencer status, amassing 10 million and 4.3 million followers, respectively.1

Earlier this year, The Wall Street Journal debated whether or not pet Instagram accounts are defensible, posing the question: “Should pets have Instagram accounts?”2 We won’t attempt to settle that debate here, but it is clear that social media has influenced the trends boosting the pet care industry. These include both the growth in pet ownership and the humanization of pets.

The Pet Loving Generation

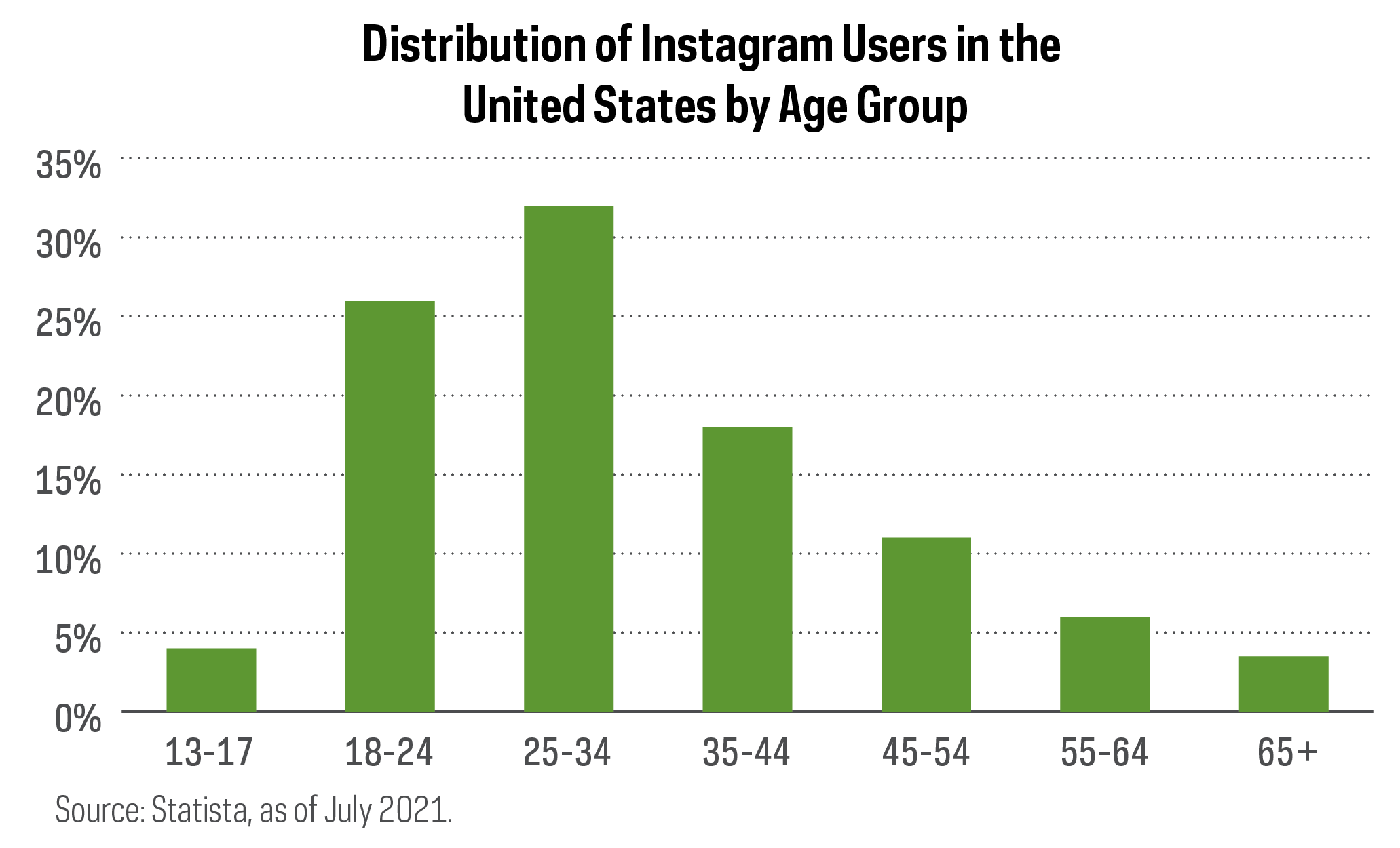

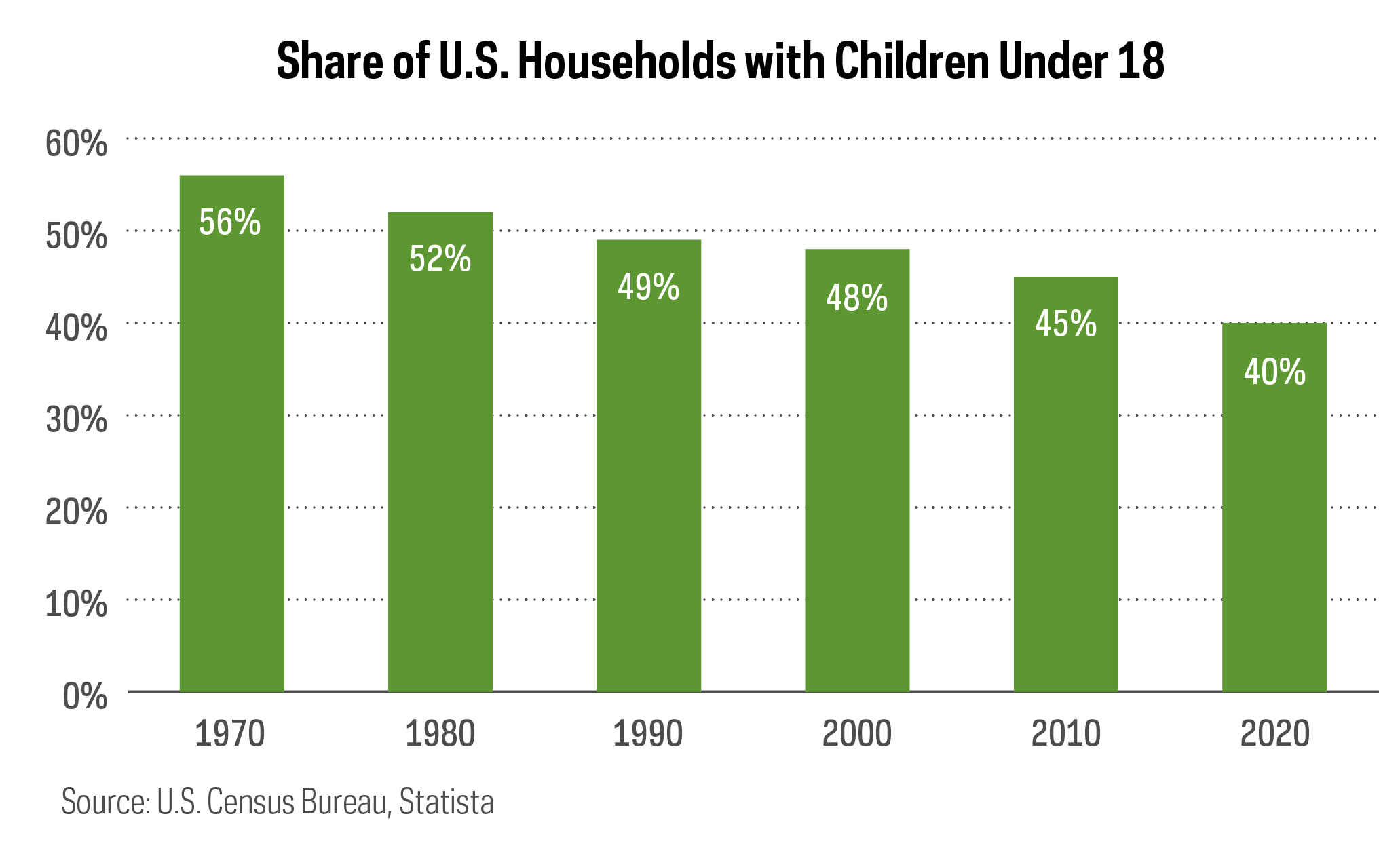

GenZ and millennials are the largest users of Instagram, and these demographics have proven critical to the bottom line for pet care companies.3 The share of U.S. households with children under the age of 18 has been steadily decreasing for the last several decades, and the role of pets in the family is evolving. Businesses focused on pet care, such as veterinary pharmaceutical company Zoetis, are taking note. During the Jeffries Virtual Pet Summit, Zoetis’ representative Glenn David noted that GenZ and millennials are increasing the adoption of pets, and that these cohorts tend to spend more on their pets than baby boomers.4

The influence of increased pet adoption isn’t just limited to the United States. E-commerce pet supply retailer Zooplus recently noted that a similar trend is happening in Europe. For example, the number of new dog registrations in Germany increased by 25% year-over-year in June of 2020.5

Innovation in the Industry

With companies recognizing the heightened importance consumers are placing on pet care, innovation is coming front and center with respect to both product offerings and business models. Organizations like BARK are aiming to support the life-long relationships their customers build with their pets, delivering personalization at scale, while also focusing on subscription-based models. This business model is convenient for pet parents, while also benefitting pet care businesses by delivering recurring revenue streams. Chewy, one of the largest players in the e-commerce pet care space, indicated that its Autoship subscription program—which provides automatic ordering, payment and delivery of products to customers—accounted for 70% of net sales as of the most recent quarter.

Companies within the pet health category are focusing on the increased standard of care for pets, researching and developing both veterinary diagnostics and pharmaceutical products. IDEXX Laboratories estimates that the total addressable market in the diagnostics space to be approximately $37 billion as of 2020, with long-term revenue growth potential driven by positive health care demand trends.6

Then there are the businesses focused on pet insurance, such as Trupanion, which can help alleviate pet owners’ concerns about the costs of keeping their pets healthy. While Trupanion has seen impressive revenue growth of 31% year-over-year for the third quarter, the company believes the United States is still in the early lifecycle of adopting pet insurance. Penetration rates are currently close to 2%, versus projected penetration rates of 25% over the long-term, according to the company’s most recent investor presentation.7

Why Invest in the Pet Care Industry?

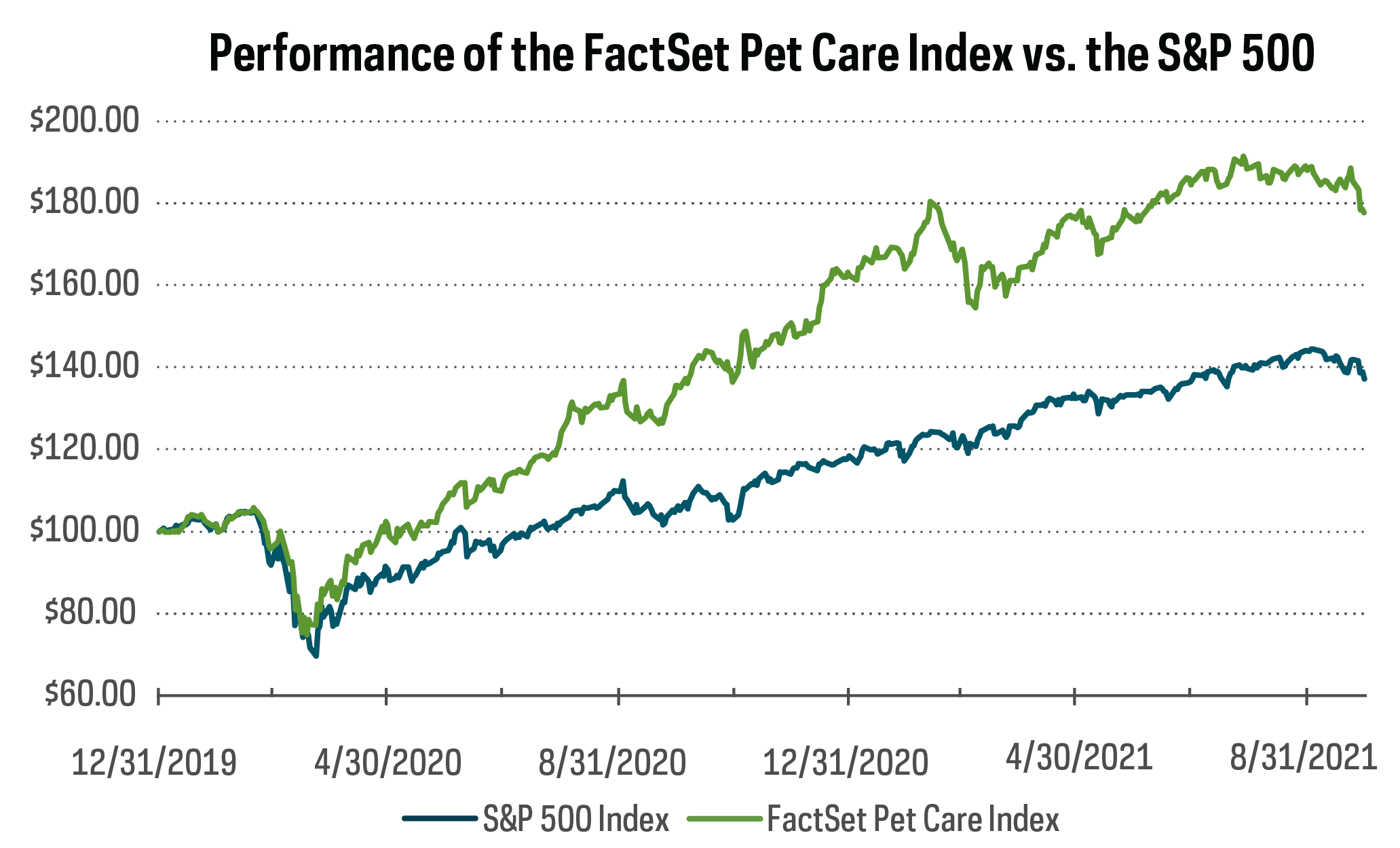

The pet care industry has had strong historical performance and investing in it could present a significant opportunity. As measured by the FactSet Pet Care Index, the pet care industry has outperformed the S&P 500 by a cumulative 40.56% since the end of 2019.

Source: Bloomberg, data as of 9/30/2021

| Year to Date | 1 Year | Fund Inception | |

| ProShares Pet Care ETF NAV Total Return | 8.85% | 30.21% | 26.09% |

| ProShares Pet Care ETF Market Price Total Return | 8.60% | 29.89% | 26.05% |

| FactSet Pet Care Index | 9.49% | 31.17% | 26.87% |

As of 09/30/2021, PAWZ’s operating expenses are 0.50%.

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost.

Current performance may be lower or higher than the performance quoted. Standardized returns and performance data current to the most recent month end may be obtained by visiting ProShares.com. Index performance is for illustrative purposes only and does not represent fund performance.

Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest in an index. Past performance is not a guarantee of future results.

The pet care industry spans veterinary pharmaceuticals, diagnostics, product distributors and services, manufacturers of pet food and pet supplies, and pet supply retailers. Each of these subindustries is responding to the demands of pet owners with continued innovation that’s led to notable growth. Here in the United States, the pet care industry has grown steadily over the past several decades, even during the Great Recession. Meanwhile, a similar boom has been building internationally. The global pet care industry is expected to grow from $232 billion in 2020 to as much as $350 billion by 2027.8

1 As of September 2021.

2 https://www.wsj.com/articles/are-pet-instagram-accounts-defensible-11615322595

3 https://www.packagedfacts.com/Millennials-Gen-Pet-Consumers-Dogs-Cats-Pets-11268949/

5 https://investors.zooplus.com/wp-content/uploads/2021/08/zooplus_H1-Bericht-2021_EN.pdf

6 https://www.idexx.com/files/2021-08-12-investor-day.pdf

8 Source: Global Market Insights, February 2021.

How Investors Can Access the Pet Care Industry

PAWZ is the first ETF that allows investors to capitalize on people’s passions for their pets. PAWZ gives investors the opportunity to gain broad exposure to public companies in the global pet care industry—companies that stand to potentially benefit from the proliferation of pet ownership and the emerging trends affecting how we care for our pets. PAWZ tracks the FactSet Pet Care Index.

| Top 10 Company Holdings | |

| Zoetis Inc. | 9.78% |

| IDEXX Laboratories Inc. | 9.52% |

| Dechra Pharmaceuticals plc | 9.03% |

| Chewy Inc. | 7.81% |

| Freshpet Inc. | 7.79% |

| Merck & Co. Inc. | 4.80% |

| Nestle SA | 4.53% |

| Zooplus AG | 4.42% |

| Petco Health & Wellness Co Inc. | 4.14% |

All data is as of 9/30/2021. Constituents are subject to change. Sum of weightings may not equal 100% due to rounding; weightings may fluctuate between monthly rebalances. For a complete list of daily fund holdings, visit ProShares.com.

IMPORTANT INFORMATION

This is not intended to be investment advice. There is no guarantee forecasts will be met. Indexes are unmanaged and one cannot invest in an index.

Any forward-looking statements herein are based on expectations of ProShare Advisors LLC at this time. ProShare Advisors LLC undertakes no duty to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Investing is currently subject to additional risks and uncertainties related to COVID-19, including general economic, market and business conditions; changes in laws or regulations or other actions made by governmental authorities or regulatory bodies; and world economic and political developments.

Investing involves risk, including the possible loss of principal. This ProShares ETF is non-diversified and entails certain risks, including imperfect benchmark correlation and market price variance, that may decrease performance. Please see their summary and full prospectuses for a more complete description of risks. There is no guarantee any ProShares ETF will achieve its investment objective.

The fund is subject to the risks faced by companies in the pet care industry. Although the pet care industry has historically seen steady growth and has been resilient to economic downturns, these trends may not continue or may reverse. Consumer tastes and preferences are difficult to forecast. Changing consumer preferences could have a negative impact on the revenue streams of companies in the pet care industry. Many companies in the pet care industry are small, independent producers and retailers.

Investments in smaller companies typically exhibit higher volatility. Small- and mid-cap companies may have limited product lines or resources, may be dependent upon a particular market niche and may have greater fluctuations in price than the stocks of larger companies. Small- and mid-cap companies may lack the financial and personnel resources to handle economic or industry-wide setbacks and, as a result, such setbacks could have a greater effect on small- and mid-cap security prices.

Carefully consider the investment objectives, risks, charges and expenses of ProShares before investing. This and other information can be found in their summary and full prospectuses. Read them carefully before investing.

The "FactSet Pet Care Index" and "FactSet" are trademarks of FactSet Research Systems Inc. and have been licensed for use by ProShares. ProShares have not been passed on by these entities or their affiliates as to their legality or suitability. ProShares based on the FactSet Pet Care Index are not sponsored, endorsed, sold or promoted by FactSet Research Systems Inc., and it makes no representation regarding the advisability of investing in ProShares. THIS ENTITY AND ITS AFFILIATES MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO PROSHARES. FactSet Research Systems Inc. does not guarantee the accuracy and/or the completeness of the FactSet Pet Care Index or any data included therein, and FactSet Research Systems Inc. shall have no liability for any errors, omissions or interruptions therein.

Learn More

PAWZ

Pet Care ETF

PAWZ is the first and only ETF focused on the expanding pet care industry and companies positioned to benefit from the popularity of pet ownership.