An Overview of Rising Rate Strategies

Interest rates play a critical role in fixed income returns. When rates rise, bond prices fall. Conversely, when rates fall, bond prices rise. Navigating a shifting climate requires planning. There are a variety of strategies available, which we'll explore here.

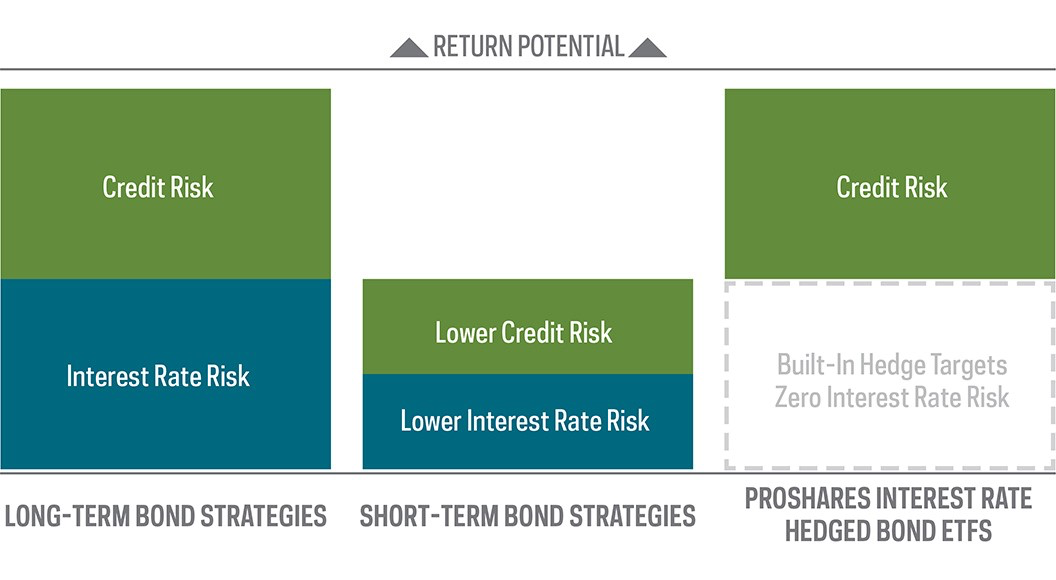

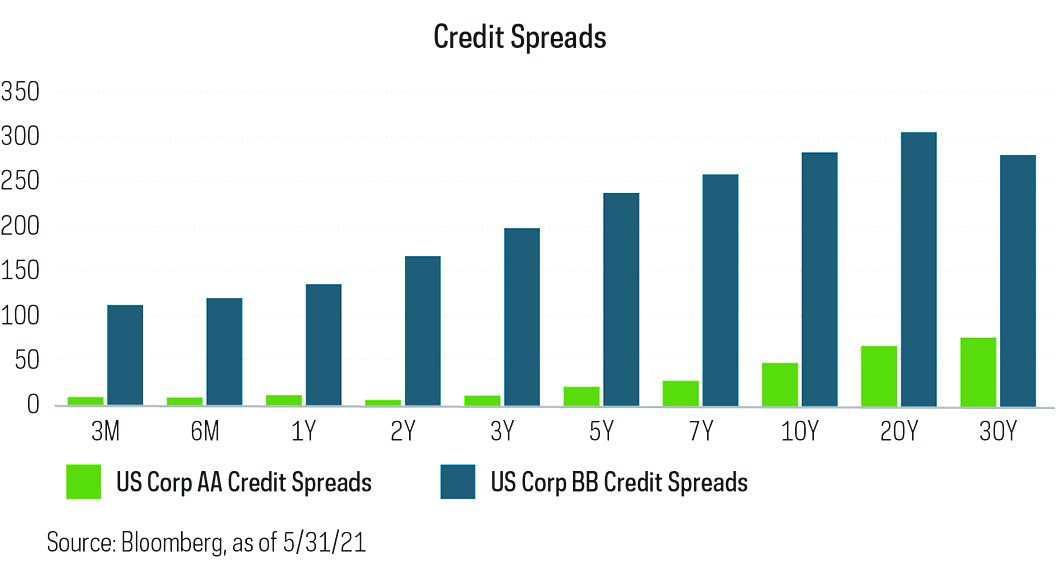

When the economy improves, it can have two contradictory effects on bond returns. As we mentioned above, rising interest rates reduce bond prices, putting a drag on fixed income returns. But there’s another, positive effect. Because companies often thrive in a booming economy, investors don’t demand as much of a premium for investing in corporate bonds when growth accelerates. Credit spreads—that is, the difference in the interest rates between corporate bonds and Treasuries—can shrink. Back to simple bond math: Shrinking credit spreads push corporate bond prices up. As a result, investors concerned about rising interest rates might consider a strategy that seeks to eliminate interest rate risk—the risk of loss from a change in interest rates—during rising rates while still potentially benefitting from improving credit spreads.

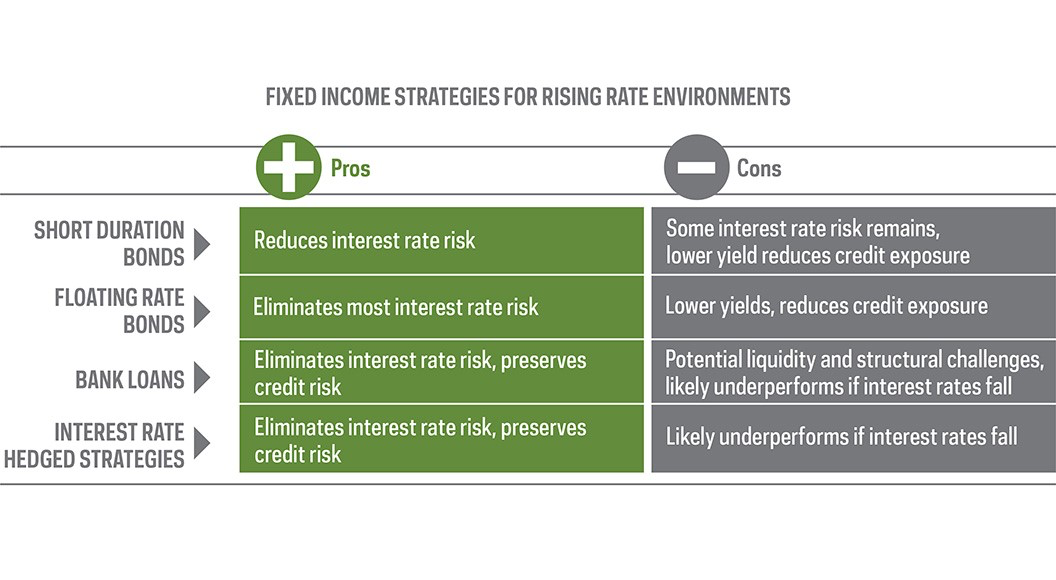

That runs counter to the common assumption that short-duration, floating-rate and bank-loan strategies provide the best protection in a rising rate environment. These strategies do reduce interest rate risk, but they also clamp down on credit risk. Credit risk represents the creditworthiness of the lender and is the risk of loss resulting from the borrower not meeting the obligations of the loan, and exposure to it potentially increases overall return. They may help dampen the negative effects of rising rates but at the cost of blunting the benefit of tightening credit spreads.

Interest rate hedged bond strategies are structured to virtually eliminate interest rate risk while retaining a full exposure to credit risk. It’s a combination that may be well-suited to a rising interest rate environment.

What You Should Know When Choosing a Strategy

Four Rising Rate Strategies to Consider

Below are four bond strategies many investors consider for mitigating risk during rising interest rate environments. We will explore what each strategy offers.

- Short-Term Bond Strategy

-

For bond investors who believe interest rates are rising, the most obvious choice is to reduce the duration of their bond portfolios. Duration measures the sensitivity of the price of a bond to changes in interest rates. A bond with a duration of 10 could lose approximately 10% of its value if its interest rate rises 1%.

-

Treasury bonds only have interest rate risk. Because they’re backed by the U.S. government, there’s no credit risk. Shorter-duration Treasury bonds have less interest rate risk than long-duration Treasuries, but they often have lower yields as well.

-

Corporate bonds generally have higher yields than Treasuries, a credit spread reflecting their additional risk. As a result, corporate bond prices are affected by two kinds of rate changes: first, any changes in the interest rates on U.S. Treasuries, and second, any change in the credit spread (again, the difference between corporate and Treasury rates).

-

Short-duration corporate bonds are affected less by both kinds of risk, but reducing both risks simultaneously may not be the best strategy. That’s because sometimes these two factors move in opposite directions. For instance, interest rates may rise because the economy is improving while at the same time, credit spreads are tightening.

-

Floating-Rate Bond Strategies

-

Floating-rate corporate bonds have interest payments that increase when Treasury rates rise. As a result, investors in these securities have almost no exposure to changes in Treasury rates. In addition, because floating-rate securities generally have short maturities, changes in credit spreads have limited (but not zero) impact on their value. Just like short-duration corporate bonds, these securities reduce exposure to interest rates and credit spreads simultaneously. The combination of minimal interest rate exposure and reduced credit exposure can limit an investor’s potential returns from floating-rate bonds.

- Bank Loan Strategies

-

Bank loans are high-yield offerings with floating coupon payments tied to short-term interest rates. Because they often have longer maturities than floating-rate securities, they are exposed to significantly more risk from changing credit spreads than short-term investments. Bank loans do offer some opportunity to reduce interest rate exposure while maintaining credit risk exposure. However, there are several important considerations investors should keep in mind when evaluating bank loans and bank loan strategies.

-

The first is liquidity. Bank loans can’t be bought and sold as quickly as high-yield bonds. Most bond trades settle within two days, while settlement for bank loans can take up to 20 days. This can affect liquidity and depress yields in bank loan funds.

-

Call provisions are another issue. Bank loans can be “called at par,” which means the issuer may be able to pay back the loan at face value. That limits the potential for price appreciation for investors. Any time a loan trades above par, it is likely to be called and will then have to be reinvested at lower rates. Some high-yield bond funds exclude callable bonds for this reason.

-

And finally, the bank loan coupon payments don’t always “float,” or rise with rates as expected. For instance, if a loan has a floor, which puts a limit on how low a coupon payment can go, rates may need to rise substantially before the coupon increases. In addition, issuers can change reference rates, or the benchmark rates, for short-term loans. For example, an issuer may change the benchmark rate from the three-month London Interbank Offered Rate (LIBOR) to the one-month LIBOR (both common benchmarks based on what banks charge each other for short-term interbank loans). In this situation, bank loan coupons may not float as expected if the three-month LIBOR rises faster than the one-month rate.

-

- Interest Rate Hedged Bond Strategies

-

Interest rate hedged bond strategies typically invest in portfolios of investment grade or high-yield bonds and include built-in hedges to alleviate the impact of rising Treasury rates. Since the hedges are specifically targeted at rising Treasury rates, the strategies retain the full exposure to credit risk as a primary source of return.

-

Managing Bond Risk While Seeking to Maximize Return Potential

For illustrative purposes only.

For illustrative purposes only.

The other potential advantage to interest rate hedged bond strategies is the fact that credit spreads are typically wider for longer maturities and durations. We previously noted that the Treasury yield curve is typically upwardly sloping—that is, a 30-year Treasury bond typically has a higher yield than a 10-year Treasury bond, which will in turn have a higher yield than a two- or one-year Treasury note. Corporate credit curves work in the same way, but they are usually steeper so that the longer a bond’s duration, the bigger its spread will be over Treasuries. Interest rate hedged strategies allow investors to benefit fully from changing credit spreads while specifically targeting Treasury rate risk and may also capture additional yield from wider credit spreads than would short-duration approaches, even if credit spreads stay the same.

Credit Term Premiums for Investment Grade and High-Yield Bond Spreads

Two Interest Rate Hedged Bond ETFs to Consider:

Accelerating economic growth makes fixed income investment challenging, as investors must navigate the sometimes conflicting headwinds of higher rates and shrinking credit spreads. ProShares offers two interest rate hedged bond ETFs that help investors reduce interest rate risk while retaining exposure to the return potential of credit.

For investors focused on higher grade fixed-income investments, ProShares Investment Grade—Interest Rate Hedged ETF (IGHG) is an investment grade corporate bond ETF with a built-in hedge that targets a duration of zero to eliminate interest rate risk.

For investors interested in the higher return potential of non-investment-grade bonds, ProShares High Yield—Interest Rate Hedged ETF (HYHG) is a high-yield corporate bond ETF with a built-in hedge that targets a duration of zero to eliminate interest rate risk.

These two funds offer an alternative to rising rate strategies like floating rate bonds and bank loan funds.

Disclosures

Investment comparisons are for illustrative purposes only and not meant to be all-inclusive.

Investing involves risk, including the possible loss of principal. These ProShares ETFs entail certain risks, which include the use of derivatives (futures contracts), imperfect benchmark correlation, leverage and market price variance, all of which can increase volatility and decrease performance. Bonds will generally decrease in value as interest rates rise. High yield bonds may involve greater levels of credit, liquidity and valuation risk than higher-rated instruments. High yield bonds are more volatile than investment grade securities, and they involve a greater risk of loss (including loss of principal) from missed payments, defaults or downgrades because of their speculative nature. Narrowly focused investments typically exhibit higher volatility. Please see summary and full prospectuses for a more complete description of risks. There is no guarantee any ProShares ETF will achieve its investment objective.

Carefully consider the investment objectives, risks, charges and expenses of ProShares before investing. This and other information can be found in their summary and full prospectuses. Read them carefully before investing.

“FTSE” is a trademark and service mark of FTSE Inc. or its affiliates, is used and registered throughout the world, and has been licensed for use by ProShares. ProShares ETFs based on the "FTSE High Yield (Treasury Rate-Hedged) Index” and the "FTSE Investment Grade (Treasury Rate-Hedged) Index” are not sponsored, endorsed, sold, or promoted by FTSE Index LLC (“FTSE Index”) or its affiliates (collectively, “FTSE”), and they make no representation regarding the advisability of investing in ProShares ETFs. FTSE INDEX MAKES NO EXPRESS OR IMPLIED WARRANTIES OF ANY KIND, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. In no event shall FTSE be liable for any direct, indirect, special or consequential damages in connection with any use of the “FTSE High Yield (Treasury Rate-Hedged) Index” and "FTSE Investment Grade (Treasury Rate-Hedged) Index.”

HYHG and IGHG do not attempt to mitigate factors other than rising Treasury interest rates that impact the price and yield of corporate bonds, such as changes to the market's perceived underlying credit risk of the corporate entity. HYHG and IGHG seek to hedge high yield bonds and investment grade bonds, respectively, against the negative impact of rising rates by taking short positions in Treasury futures. The short positions are not intended to mitigate credit risk or other factors influencing the price of the bonds, which may have a greater impact than rising or falling interest rates. These positions lose value as Treasury prices increase. Investors may be better off in a long-only high yield or investment grade investment than investing in HYHG or IGHG when interest rates remain unchanged or fall, as hedging may limit potential gains or increase losses. No hedge is perfect. Because the duration hedge is reset on a monthly basis, interest rate risk can develop intra-month, and there is no guarantee the short positions will completely eliminate interest rate risk. Furthermore, while HYHG and IGHG seek to achieve an effective duration of zero, the hedges cannot fully account for changes in the shape of the Treasury interest rate (yield) curve. HYHG and IGHG may be more volatile than a long-only investment in high yield or investment grade bonds. Performance of HYHG and IGHG could be particularly poor if high yield or investment grade credit deteriorates at the same time that Treasury interest rates fall. High yield bonds are more volatile than investment grade securities, and they involve a greater risk of loss (including loss of principal) from missed payments, defaults or downgrades because of their speculative nature. There is no guarantee the funds will have positive returns.