Bank loan strategies place the burden of minimizing the impacts of rising rates on debt holders onto the bond issuers. Consider hedging the interest rate risk of fixed coupon bonds.

There Are Challenges with Bank Loan Strategies

Much has been written about the challenges facing investors in bank loan strategies, also known as leveraged loan or senior loan strategies.

-

Bank loans are not as liquid as regular high yield bonds.

-

They often have call provisions that can limit potential price appreciation.

-

They can have interest-rate floors, which might delay an increase in coupon payments as rates rise.

In a period when interest rates are rising quickly—and substantially—there is another key challenge.

A silver lining for many companies when interest rates and inflation are rising is that their fixed-rate debt burden is reduced. It’s a bit like one’s home mortgage becoming a smaller burden over time.

There is no such silver lining for companies’ floating-rate debt. As interest rates rise, they must pay more in debt service. It’s true that rising interest rates typically coincide with sufficient economic growth to support solid performance of corporate credit. However, the benefit may still tilt towards fixed-rate debt.

Why to Consider an Interest Rate Hedging Strategy

As an investor in corporate debt, instead of relying on a floating-rate structure that may place financial stress on the issuing company, you may want to consider hedging the interest rate risk of fixed coupon bonds.

To achieve that, you can purchase fixed-rate bonds, which benefit from the improving credit conditions more than floating-rate bonds (i.e., lower defaults, upgrades and tightening spreads). Then, you can pair those bonds with a short position in Treasurys to help offset the effects of rising rates.

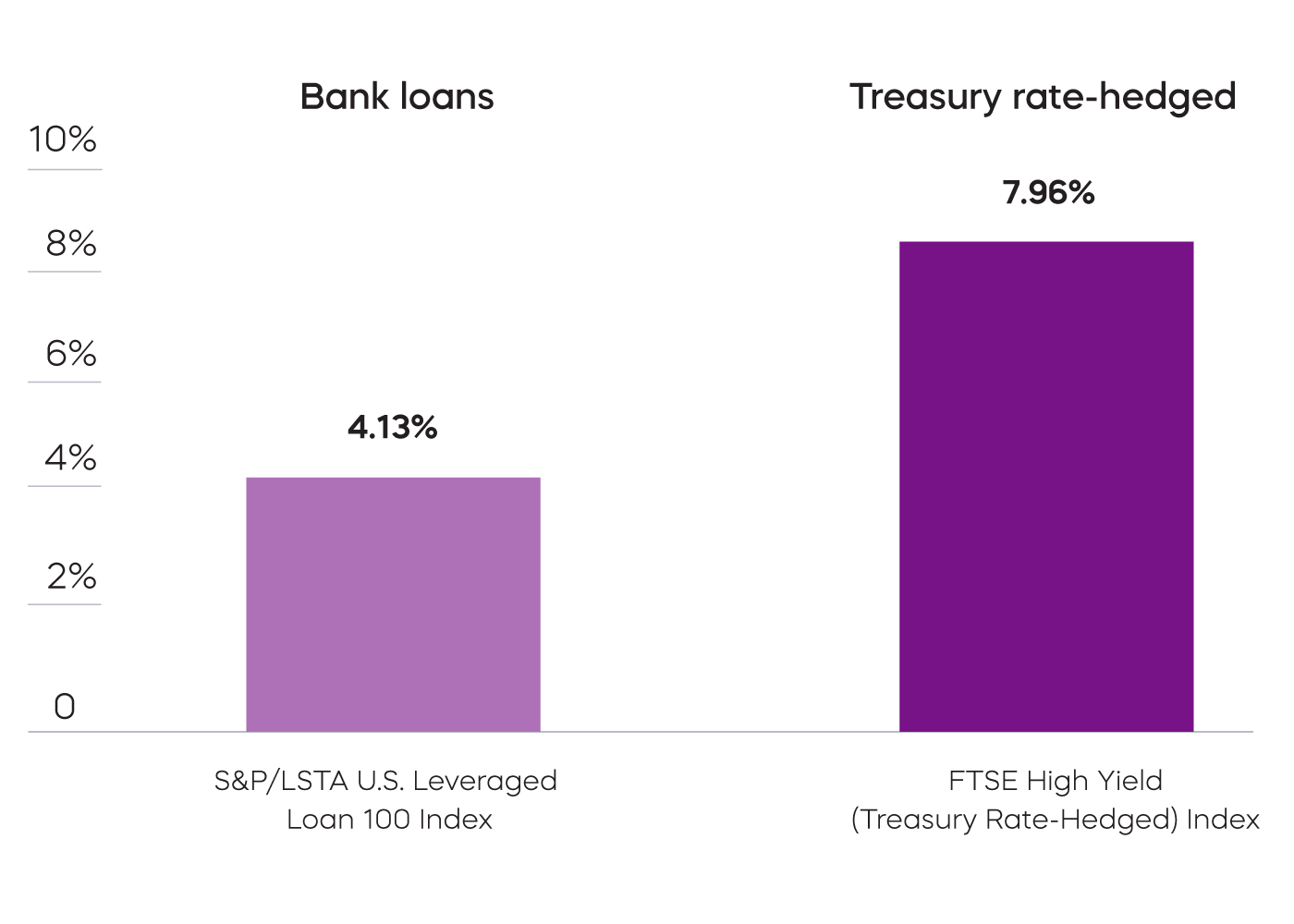

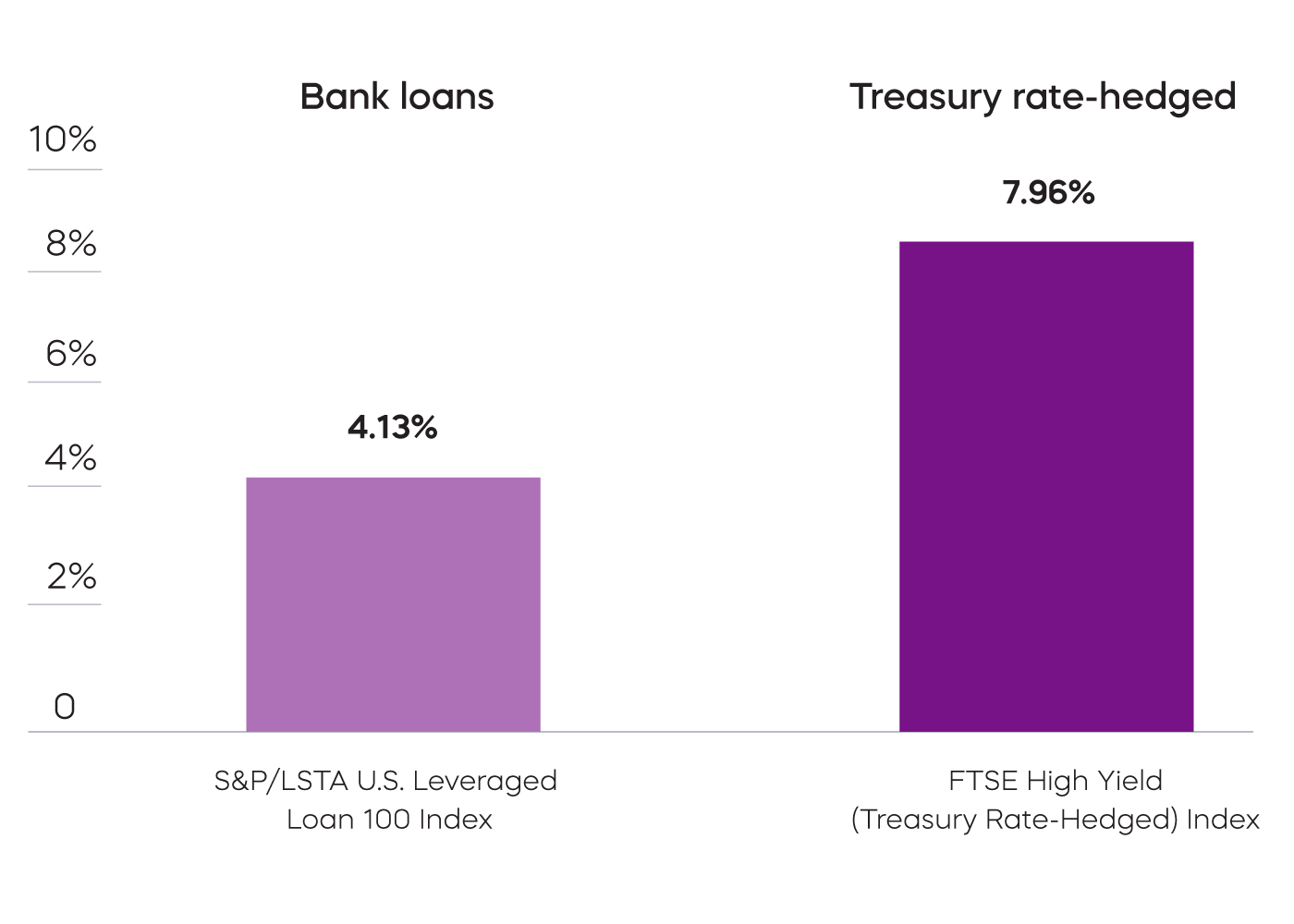

History shows the potential benefit of this approach. The FTSE High Yield (Treasury Rate-Hedged) Index, which is composed of “regular” high-yield bonds combined with short positions in U.S. Treasurys, has delivered nearly double the return of the S&P/LSTA Leverage Loan 100 Index in periods of rising rates.

Interest Rate Hedging versus Bank Loan Strategies

Returns, on average, during periods of rising rates, 5/23/13‒3/31/22

Source: Bloomberg. Starting date reflects available data since the launch of HYHG, which tracks the FTSE High Yield (Treasury Rate-Hedged) Index. Average returns are annualized, based on periods when changes in quarterly 10-Year Treasury yield are positive. Rising rate periods are any calendar quarter where the 10-Year Treasury yield increased, which are Q4 2013, Q3 2014, Q2 2015, Q4 2015, Q3 2016, Q4 2016, Q3 2017, Q4 2017, Q1 2018, Q2 2018, Q3 2018, Q4 2019, Q4 2020, Q1 2021, Q3 2021, Q4 2021 and Q1 2022. The S&P LSTA U.S. Leveraged Loan 100 Index is designed to reflect the performance of the largest facilities in the leveraged loan market and is a widely used benchmark for bank loan funds. Index returns are for illustrative purposes only and do not represent fund performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest in an index. Past performance does not guarantee future results.

Click

here for fund performance.

The Takeaway

Bank loan ETFs may help you reduce interest rate risk, but they also face potentially significant challenges you need to understand. You may want to consider an interest rate hedged, high-yield bond ETF like ProShares High Yield—Interest Rate Hedged (HYHG) instead, if it meets your investment objectives.