Federal Reserve Chairman Jerome Powell caught everyone's attention when he cast doubt on a December rate cut. It’s easy to see why. Standard Fed logic is simple: 2, 3, 4. If inflation is at the Fed's ultimate target of 2%, the Fed Funds rate should land at 3%, with a 10-year Treasury yield of 4%. That isn’t today’s reality. Inflation, now around 3%, implies a Fed Funds rate—specifically a “neutral” rate, neither loose nor restrictive—of around 4%. Now that the Fed Funds rate is there, this week’s cut is perhaps the last of the easy decisions for policymakers. Any future reduction may require more progress on reining in inflation.

Bonds complicate the picture further. Why did 10-year Treasury yields rise when the Fed cut this time? Let’s return to the logic of 2, 3, 4. A 4% 10-Year Treasury Yield already prices in inflation ultimately getting to 2%. If inflation does move from 3% to 2%, the Fed can cut further, but the 10-Year Treasury yield is likely to hang tough around 4%. If inflation gets stuck around 3%, the 10-year yield could in fact drift up—which helps explain its modest rise in reaction to Powell’s apparent doubts about a smooth path to 2% inflation.

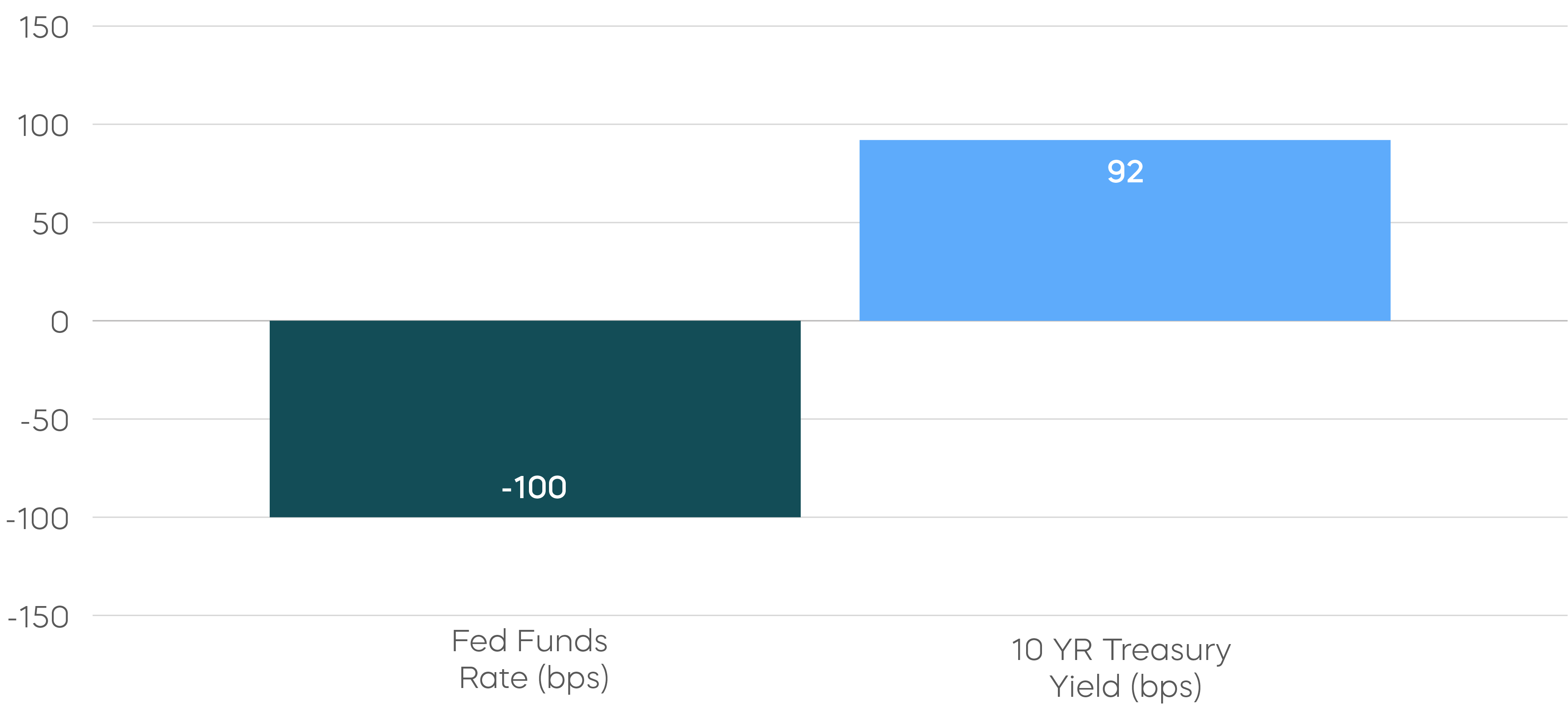

The Fed Funds and the 10-Year Treasury Yield Can (and Do) Move in Opposite Directions

Change in Fed Funds and 10-Year Treasury Yields, 9/17/2024-12/19/2024

Source: Bloomberg

Zoom out a bit and the end of Quantitative Tightening matters, too. Don’t forget: the Fed Funds rate and the 10-Year Treasury yield can (and do) move in opposite directions, and if that concept seems foreign, blame QE and QT. Quantitative Easing allowed the Fed to push down longer-term interest rates to augment cuts in the Fed Funds rate. Quantitative Tightening pushed longer-term interest rates higher while the Fed was raising rates. Now, Quantitative Tightening is coming to an end. A Fed engaged in neither QE nor QT means longer-term Treasury yields are determined by market forces—principally longer-term inflation expectations. One need only look to last year to see how a liberated 10-year Treasury yield can move opposite the Fed Funds rate (see chart).

Chair Powell did, however, emphasize that inflation does seem headed in the right direction, particularly if tariffs have only a transitory impact. And the Fed deserves some credit: if one could have foreseen where today’s economy, inflation, and markets would end up in the wake of the massive disruptions from post-Covid inflation, this certainly qualifies as a pretty darn good soft landing.