Tax-loss harvesting—a process of selling investments with losses to offset capital gains elsewhere—can be a valuable strategy for investors to reduce their potential tax liabilities. A tax swap is a specific strategy utilized in taxable accounts that involves selling a losing investment and buying an investment with similar, but not identical, investment characteristics. By doing this, a capital loss is realized that can be used to offset capital gains realized from other investments, potentially reducing the taxes an investor owes.

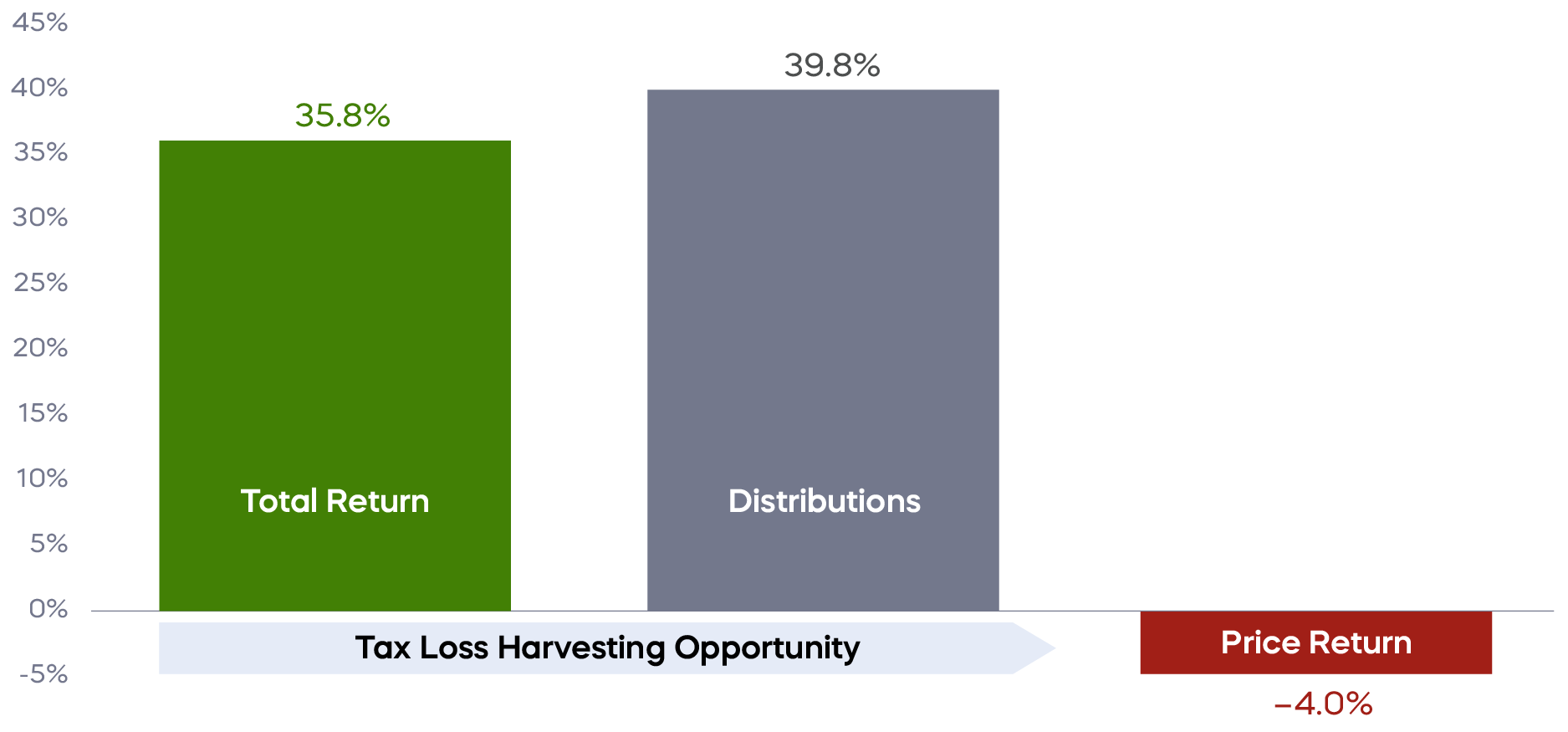

A unique and often overlooked tax-loss selling strategy is even possible when certain investments have experienced positive total returns. For example, some covered call ETFs have made taxable distributions that are greater than their total return, resulting in a negative price return—and a potential tax-loss harvesting opportunity for investors.

Negative Price Returns for Covered Call ETFs May Create an Opportunity for Tax-Loss Harvesting

Source: Morningstar, Bloomberg, ProShares calculations. Based on covered call ETFs with a minimum of four years of price performance history in the Morningstar Derivatives Income Category. Total returns assume reinvestment based on market price; distribution is the implied difference between total return and price return. Net assets as of 10/3/24. The return period is 9/30/21–9/30/25. Total returns assume reinvestment based on market price. Distribution is the implied difference between total return and price return. Distributions are assumed to be taxable.

If your covered call ETF’s share price is below its cost basis (illustrated above), consider harvesting a tax loss and repositioning your equity income allocation with a ProShares High Income ETF.

By utilizing a next-generation daily covered call strategy, ProShares’ suite of innovative High Income strategies can potentially improve the tradeoff between income and total returns, and provide the opportunity to:

- Seek high levels of income

- Target the returns of the S&P 500, Nasdaq-100, or Russell 2000 over the long-term

- Potentially capture the returns that monthly covered call strategies may sacrifice

Learn More

ISPY

S&P 500 High Income ETF

ProShares S&P 500 High Income ETF seeks investment results, before fees and expenses, that track the performance of the S&P 500 Daily Covered Call Index.

IQQQ

Nasdaq-100 High Income ETF

ProShares Nasdaq-100 High Income ETF seeks investment results, before fees and expenses, that track the performance of the Nasdaq-100 Daily Covered Call Index.

ITWO

Russell 2000 High Income ETF

ProShares Russell 2000 High Income ETF seeks investment results, before fees and expenses, that track the performance of the Cboe Russell 2000 Daily Covered Call Index.