Optimism for Stocks, Concern for Bonds, and a Look at Digital Assets

Key Observations

Defenseless Bonds

Just about every market segment was in the green last year, except for bonds. We may be in for a repeat. Why? Because fixed-coupon bonds are generally defenseless in the face of inflation and rising interest rates, while stocks—which can grow earnings and dividends—remain the quintessential inflation hedge.

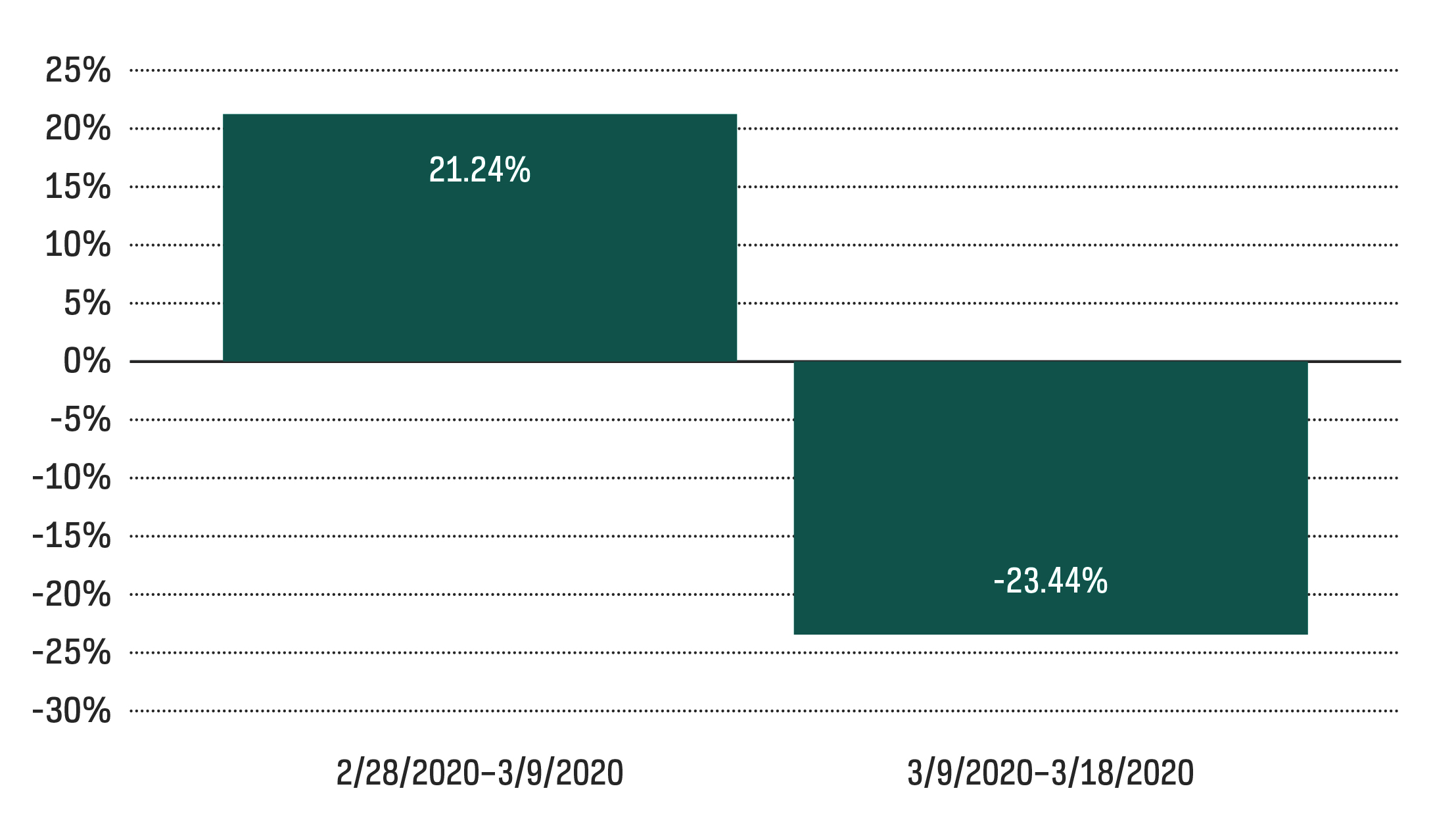

Let’s start with those defenseless bonds. Omicron is surging, and tensions with Russia are rising. Won’t bonds help if something goes wrong? Bonds did help at the beginning of the pandemic. Zero-coupon government bonds—the longest-duration and most interestrate-sensitive bonds—returned over 20% in the beginning of March 2020 as interest rates plummeted at the onset of the pandemic.

Chart of the Month

Zero-Coupon Bond Performance

Source: Bloomberg (ICE BofA US Treasury Principal STRIPS Index).

Those same zero-coupon bonds immediately gave back all those gains and more as interest rates snapped back. And zero-coupon bonds fell in value in 2021, as longer-term rates ended the year higher, even with omicron’s emergence. Yes, omicron could take a turn for the worse. Or a geopolitical flare-up could emerge, perhaps providing a brief window for bonds to shine. But the odds are that interest rates are likely to rise further in 2022, and bonds may fall in value. Why? One word: tapering.

The only reason longer-term interest rates are this low is because the Federal Reserve has been buying bonds and suppressing longer-term rates. Many bond investors have been throwing around the term “tightening” (perhaps cavalierly) to refer to both tapering—the end of the Fed’s bond buying, aka quantitative easing—and increases in the fed funds rate. The danger in conflating the two is drawing the conclusion that tightening will slow the economy, slow future growth, reduce inflation, and thus bring down longer-term interest rates. However, even if the economy slows, future growth slows, and inflation retreats, tapering will likely allow longer-term interest rates to “normalize” (i.e., rise). The long-term real yield on the 10-year Treasury is 2%. If the Fed successfully brings inflation down to its target of 2%, that still suggests a “normal” yield of 4% in a world without quantitative easing. Getting even halfway there would deliver quite a blow to bonds.

Optimism for Stocks

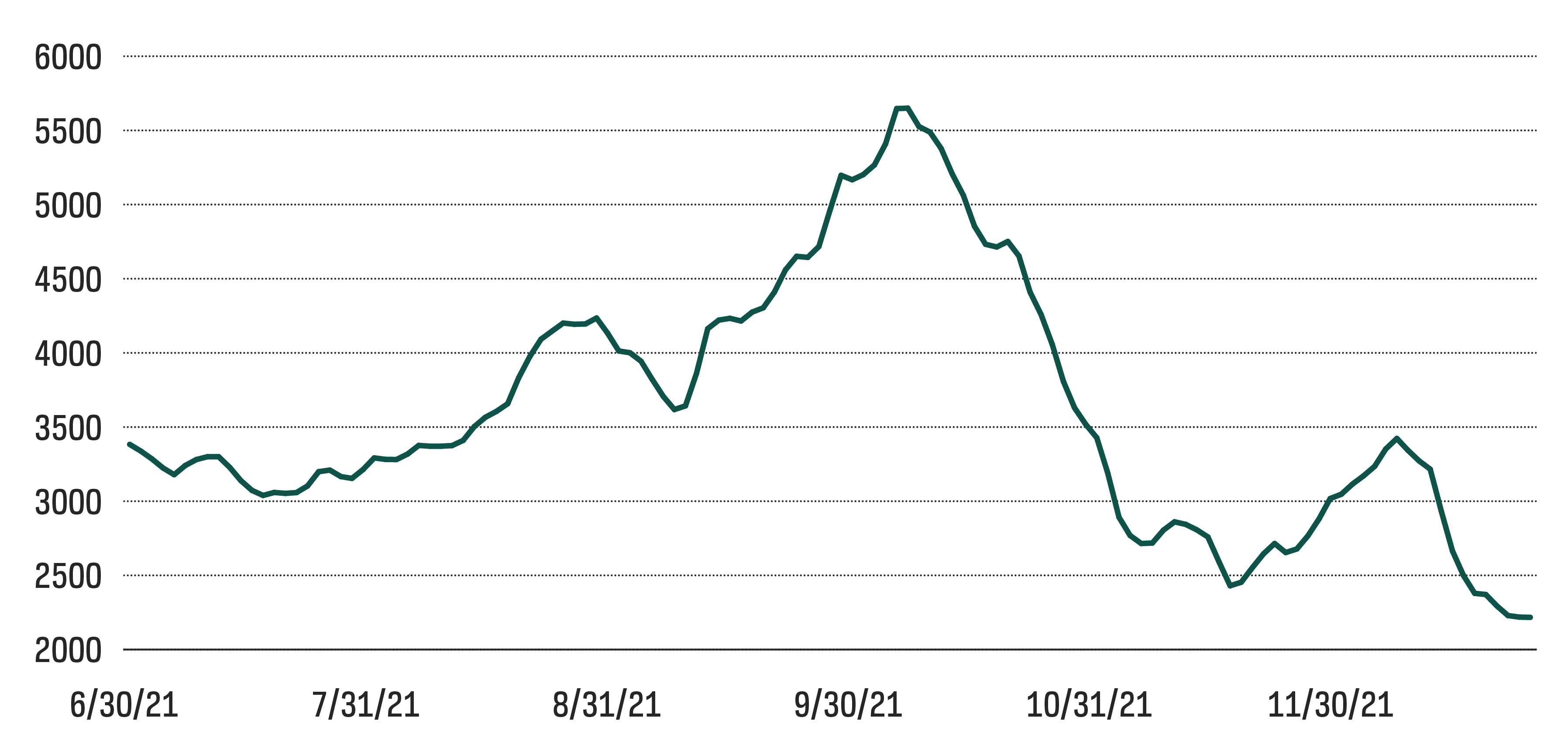

So where does optimism around stocks come from? Aren’t those latest inflation readings of 5%, 6%, and 7% a huge headwind? Part of the optimism comes from an assumption that inflation will retreat at least somewhat. Another source of optimism comes from the Baltic Dry Index.

Baltic Dry Index

Source: Bloomberg.

The Baltic Dry Index provides a benchmark for the price of moving major raw materials by sea. It rose dramatically in the summer and early fall, which is a key measure and manifestation of the global supply chain woes, but it has fallen by roughly 60% from its peak even after a brief omicron-driven rebound. It now sits just a bit above its nearly 40-year average. And this just in: The prices-paid measure included in the December ISM Manufacturing report fell to the lowest level in more than a year. It’s an indication that while inflation may remain mildly elevated at 3% or so, the levels seen in the fall may have been—forgive the use of the term—transitory.

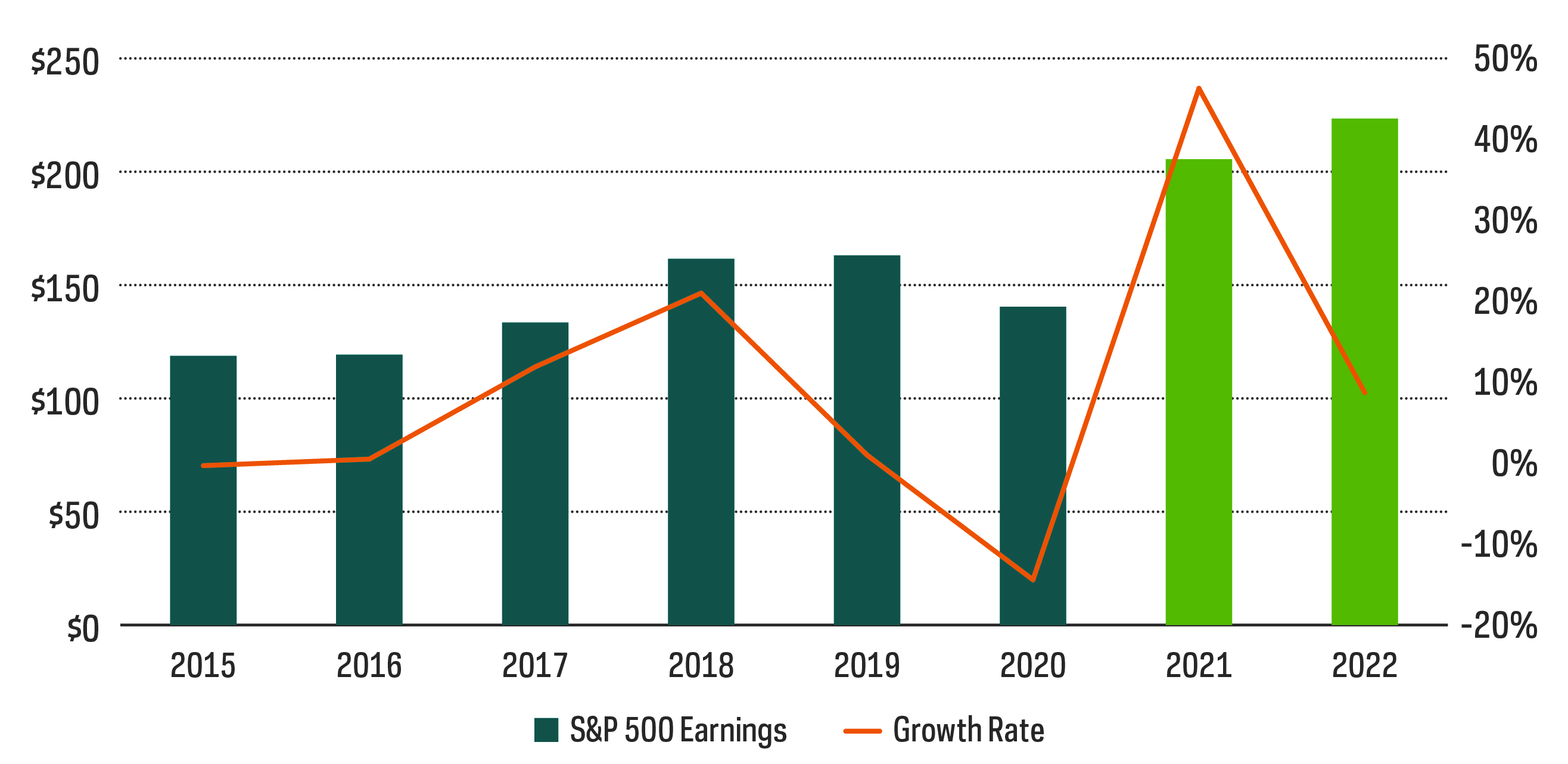

Is that good enough for stocks? Likely, yes. S&P 500 earnings for 2021 are on track to grow nearly 50% over 2020 and, perhaps more importantly, 20% over 2019’s pre-pandemic levels. Consensus estimates project roughly 10% earnings growth in 2022. That should be enough to drive solid stock returns even with a little inflation and a bit of rising interest rates.

Importantly, it’s growth that drives this resilience. Faced with rising interest rates, many investors mistakenly approach stocks like bonds. They seek to shorten the duration of their stock portfolios just like they would shorten the duration of their bond portfolios. Shortening the duration of a stock portfolio means choosing stocks whose earnings and dividends are front-loaded: high-dividend yields and low price-to-earning (P/E) ratios. This approach is likely too clever by half. The “duration” of any stock is just not short enough to matter. In fact, high-dividend strategies have historically underperformed when interest rates rise, as investors begin to be able to satisfy more of their income needs with bonds. Of course, price and yields matter. But growth, particularly consistent growth of dividends and earnings, is likely to have heightened importance in 2022.

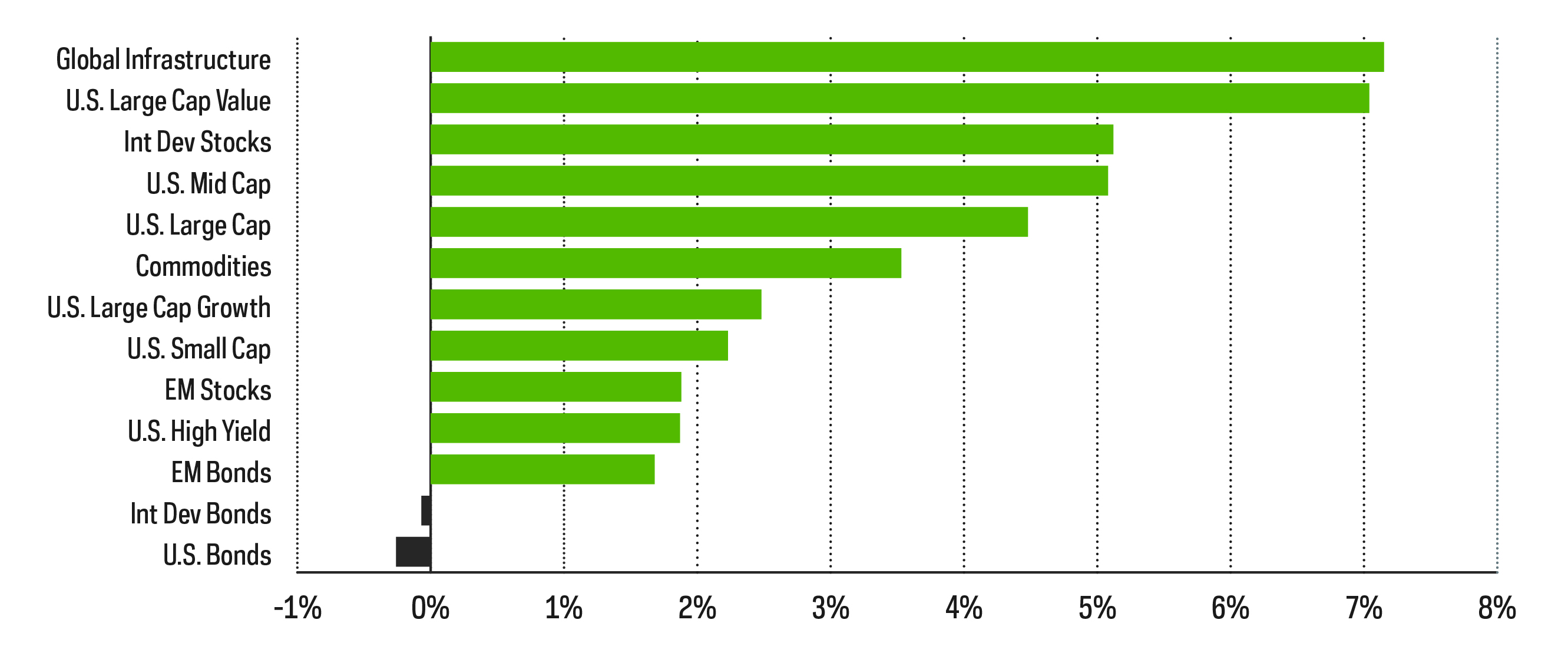

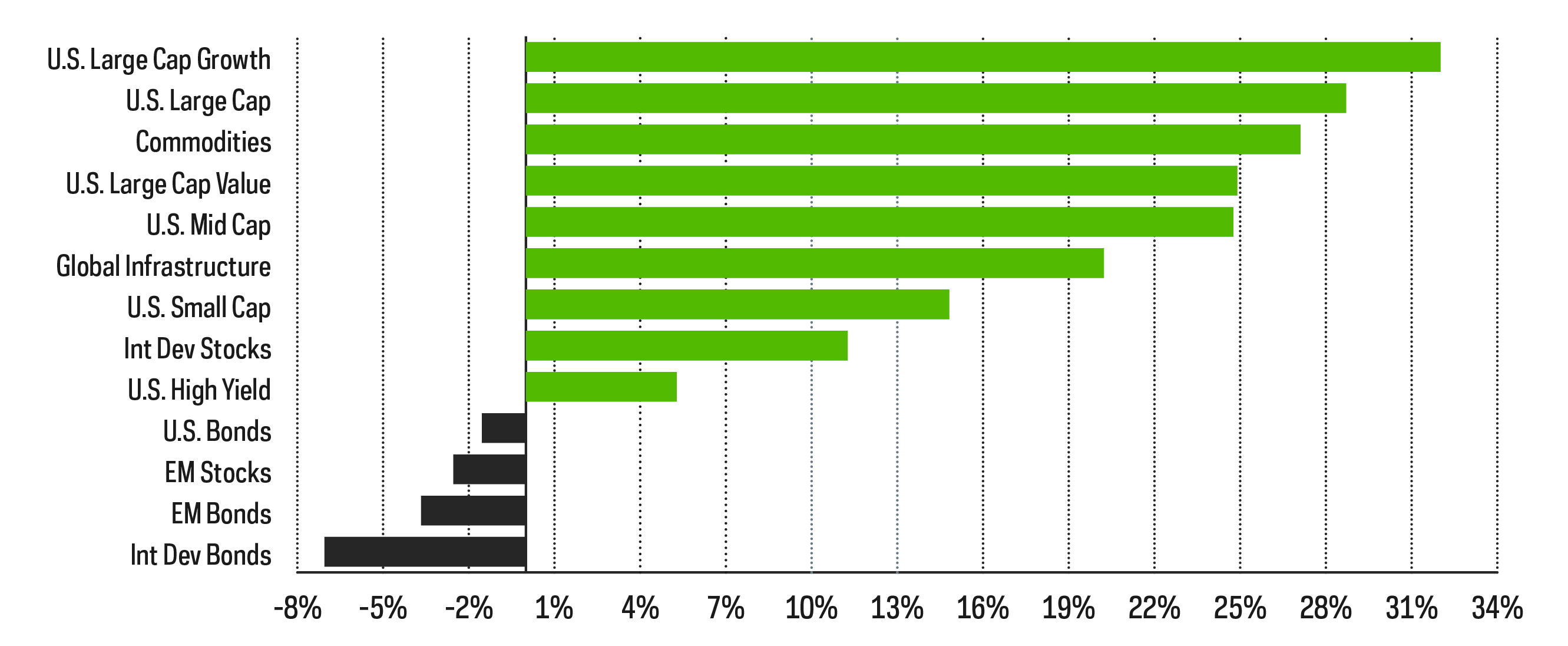

Performance Recap

A Santa Claus rally—fueled in part by tentative evidence that the omicron variant may be more transmissible but less virulent, pushed nearly all market segments into the green for the month of December. The year-to-date chart looks quite similar, with just bonds and emerging market stocks in the red for the year.

Returns of Various Common Market Segments

Market Segment Returns—Year to Date

Market Segment Returns—December 2021

Source: Bloomberg. December returns 12/1/21‒12/31/21, year-to-date returns 1/1/21‒12/31/21. Performance quoted represents past performance and does not guarantee future results.

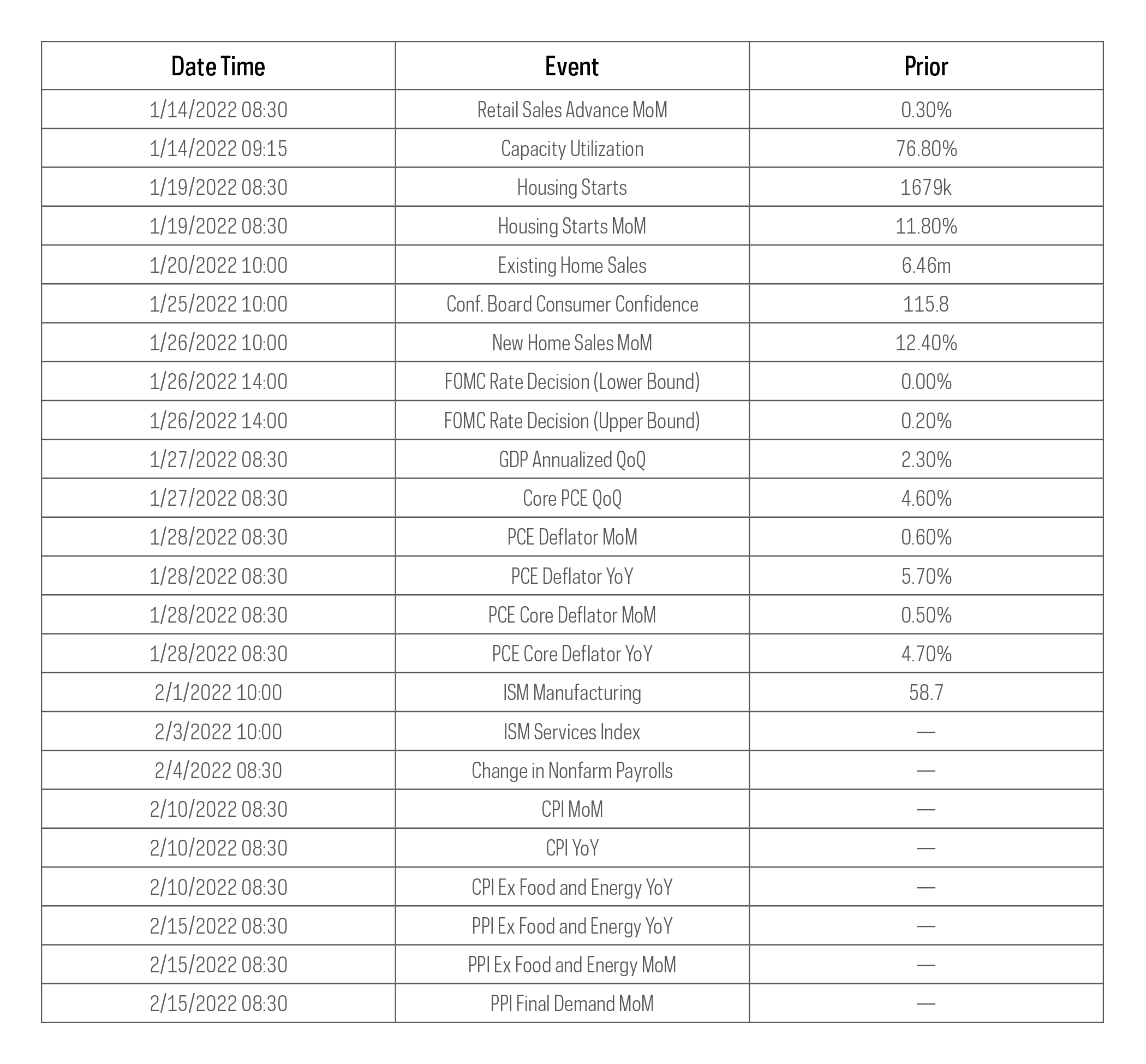

Economic Calendar

Here’s a list of upcoming key economic releases, which can serve as a guide to potential market indicators.

Equity Perspectives

Optimism for Stocks, but Choose Wisely

After three consecutive calendar years in which stocks—as measured by the S&P 500 index—have returned more than 18%, the contrarian may find it easy to forecast tougher sledding for 2022. Returns of that magnitude are historically rare. It’s happened only one other time since 1929. Perhaps more relevant, many of the dynamics that supported strong equity performance of late, namely accommodative central banks, low inflation, and strong corporate earnings bolstered by a resilient economy, may be changing as we enter the new year. Inflation is running at the highest levels we’ve seen in years, the Fed is tapering and is set to raise rates, and corporate earnings seem unlikely to continue their recent blistering pace.

However, as we noted in the first section of this outlook, a market backdrop in which inflation moderates to some degree and corporate America delivers smaller but still positive earnings growth may just be good enough to support reasonable equity returns. Of course, the near 50% growth in earnings that are expected when the dust settles on 2021 is not sustainable, but consensus estimates for near 9% appear reasonable and are only slightly ahead of historical averages. Even if 2022 earnings don’t quite get to forecasted levels, they remain well ahead of pre-pandemic levels, which have continued to bring elevated valuations down to more reasonable levels.

S&P 500 Calendar Year Earnings per Share

Source: FactSet. 2021 and 2022 amounts are estimates.

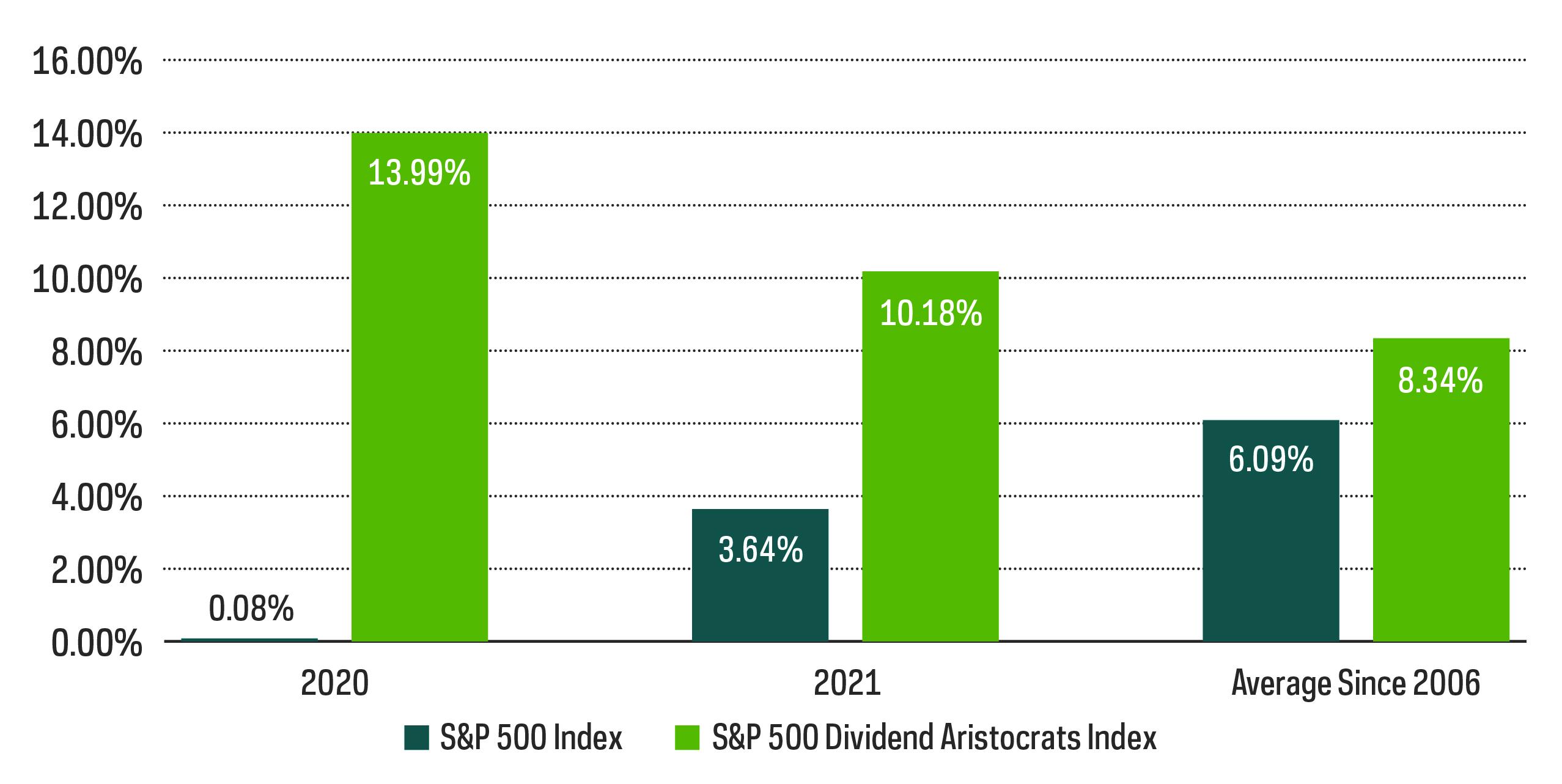

As always, there are many risks to consider and, therefore, some nuance to our optimism. Income remains scarce, even with rates seemingly headed higher. With inflation seemingly likely to hang around, a growing income stream can be especially useful. Valuations, while trending lower, remain elevated, and pockets of excess remain. Against this backdrop, high-quality dividend growth stocks with strong fundamentals like consistent growth of earnings and dividends may take on added importance this year.

Where to Find Sustainable and Growing Income Streams

After a challenging year in 2020 during which the S&P’s rate of income growth was essentially flat, many were hopeful for a brighter 2021. While the market’s total returns were fantastic and many companies resumed paying dividends, income investors were nevertheless left wanting. Amidst rising costs, a growing dividend stream takes on added significance for income investors. Growing a dividend is perhaps the most obvious signal that management can send when it’s confident in a company’s ability to deliver consistent and growing cash flows and earnings, which ultimately are the lifeblood of dividends. All else being equal, more growth equals more confidence. Similar to 2020, the place to find inflation-beating income growth was the S&P 500® Dividend Aristocrats®. The Aristocrats, all of which have produced at least 25 consecutive years of dividend increases, delivered robust rates of dividend growth and remain well positioned for 2022.

Dividend Aristocrats Have Delivered Robust Dividend Growth

Source: Standard & Poor’s.

International Dividend Resurgence

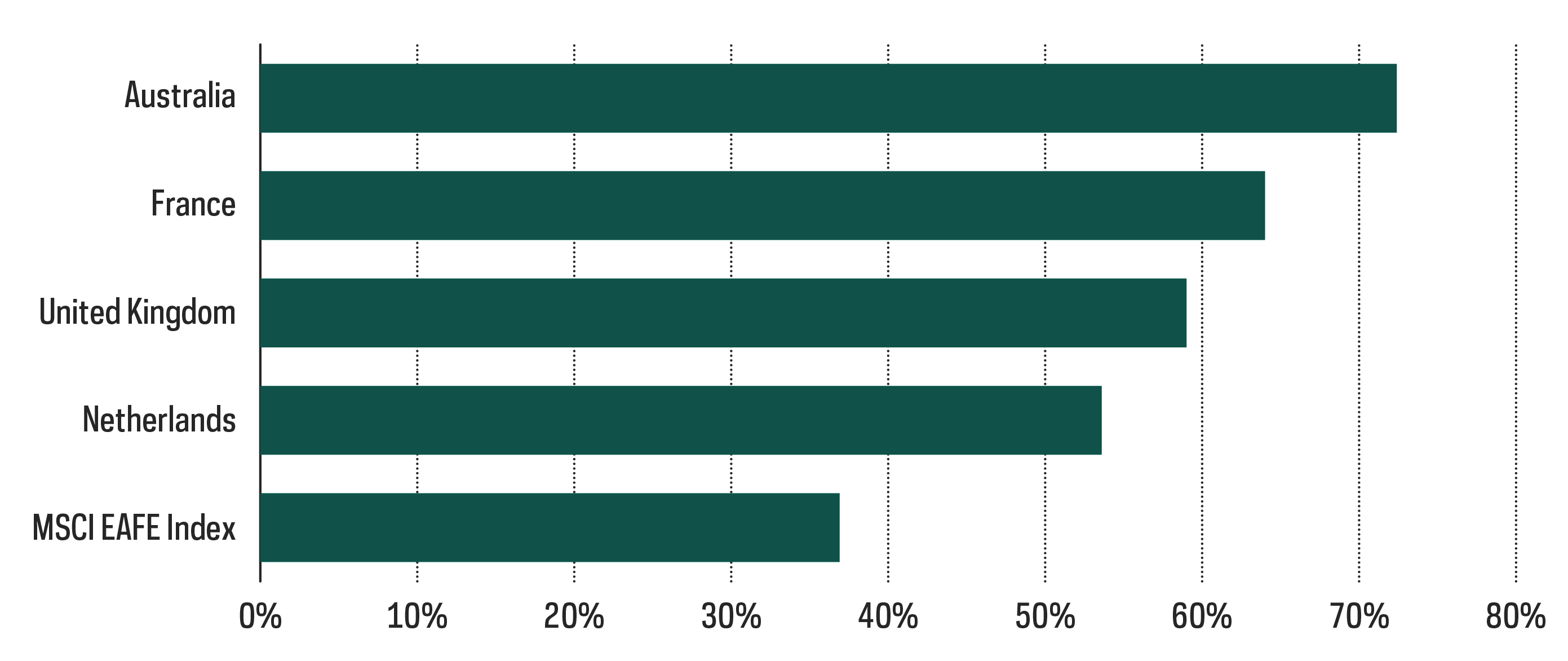

While it’s easy to lose sight amid exceptionally strong domestic returns, it’s important to remind ourselves that dividend strategies are a global opportunity. While the United States is the largest source of dividends, it only represents about half of the global dividend pool, according to MSCI. Developed markets in Europe and Asia contributed over 40% of global dividends in 2020 and represent a potentially untapped opportunity. Going abroad has long been a time-tested strategy for additional yield. Now international markets may represent an underappreciated source of dividend growth.

Compared with domestic stocks that held 2020 dividends essentially flat, international dividends fell by approximately 30%. At the onset of the pandemic, many companies chose a conservative route by suspending dividend payments. However, this dynamic has potentially set up international stocks for strong rebounds and faster dividend growth rates than domestic payers.

The MSCI EAFE Index is providing early evidence of this trend, with dividends for the first three quarters of 2021 up almost 37% versus 2020.

2021 Dividend Increases from International Developed Markets Have Been Robust

Source: MSCI. Data compares dividend payments through the first three quarters of 2021 versus the same period in 2020

Fixed Income Perspectives

Interest Rates and Inflation Pose Substantial Risk

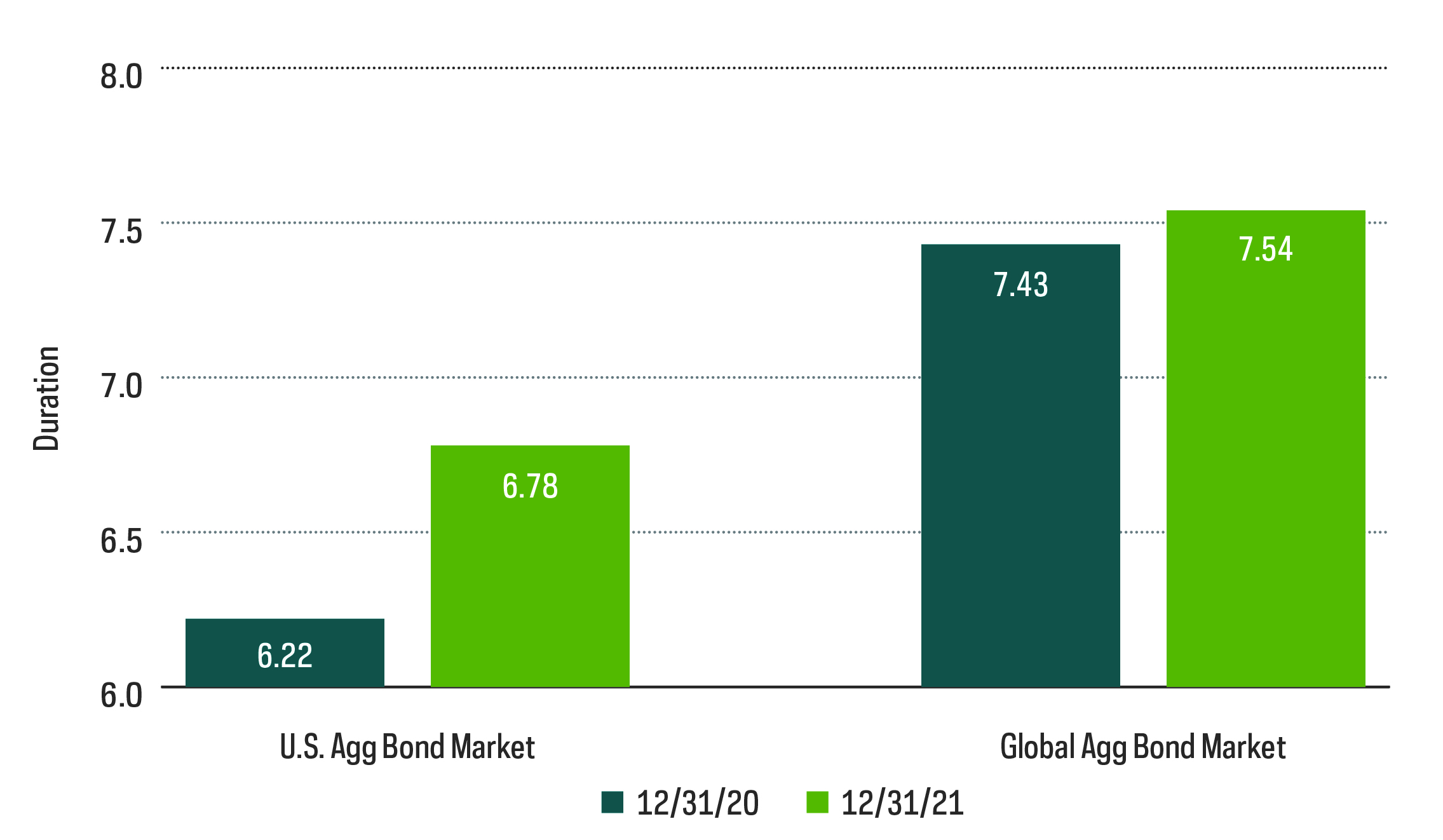

With central banks across the globe prepping to unwind accommodative monetary policy, traditional fixed income investments may continue to post negative returns in 2022. Last year, the aggregate U.S. bond market fell 1.5%, while the global aggregate bond market fell even further, down 4.7%.[1] Interest rate risk within the bond market ticked higher throughout 2021, indicating that 2022 may be an even tougher environment for fixed income investors.

Interest Rate Risk Crept Higher in 2021

Source: Bloomberg.

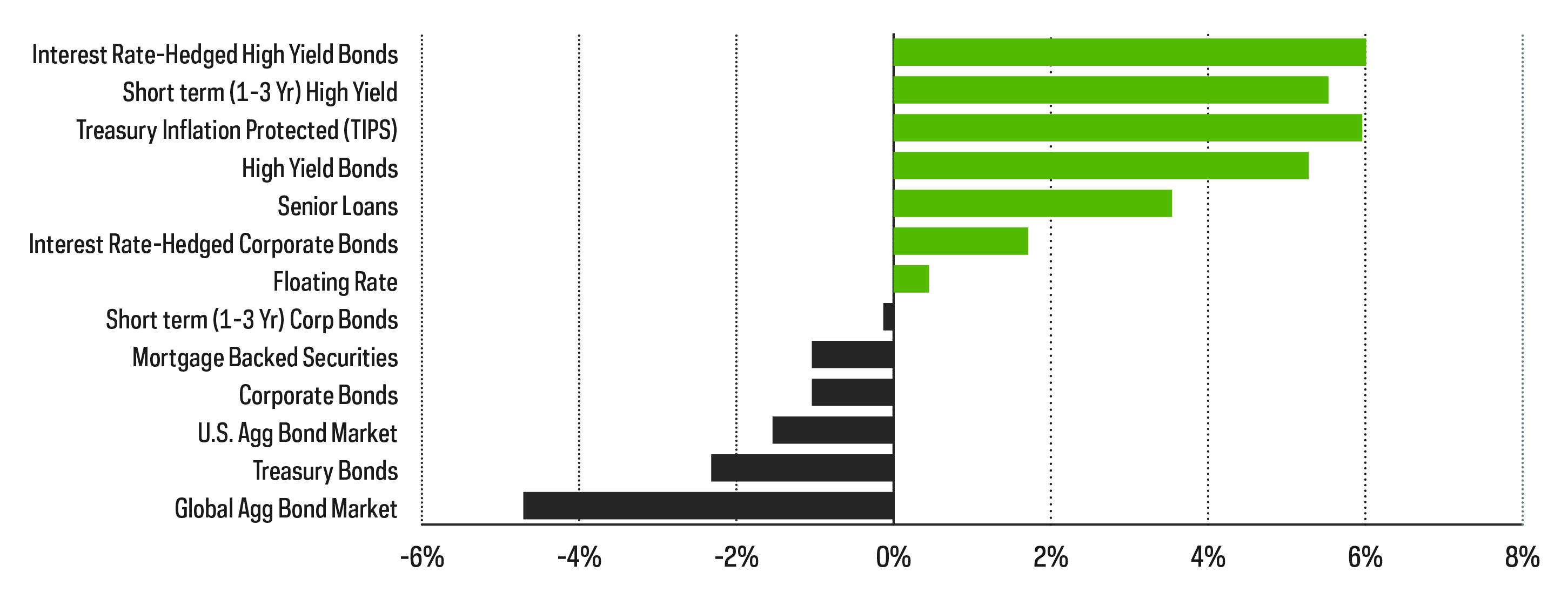

In 2022, we expect rising interest rates to be the primary detractor from traditional fixed income performance, while inflation presents another likely challenge. Looking back to 2021, short-duration, high-yield, and inflation-protected securities came out on top as shown in the graph that follows.

Moving forward, while inflation remains a potential headwind for bonds, investments in Treasury Inflation-Protected Securities (TIPS) may not perform as some investors hope due to the amount of interest rate risk they entail. As of December 31, the Bloomberg Treasury Inflation Notes Index had a duration of 7.6, indicating that it could fall 7.6% if interest rates rise by 1% (all else being equal). TIPS can help protect investors from rising inflation expectations rather than inflation itself, not specifically from rising interest rates. With fears of inflation already heightened, a potential rise in consumer prices may already be baked in to the price of TIPS.

Investors favoring strategies that tilt toward credit risk may be poised for outperformance as the global economy recovers from the pandemic-induced recession, with credit spreads potentially tightening on a rosier outlook. Interest rate–hedged strategies that target a duration of zero and pinpoint credit risk as a source of return outperformed their unhedged counterparts last year and may continue to do so this year. For example, the FTSE Corporate Investment Grade (Treasury Rate-Hedged) Index was up 1.7% in 2021, while the FTSE High Yield (Treasury Rate-Hedged) Index was up 6%.

Fixed Income Returns – 2021

Source: Bloomberg.

Is Fixed Income Still an Important Part of a Diversified Portfolio?

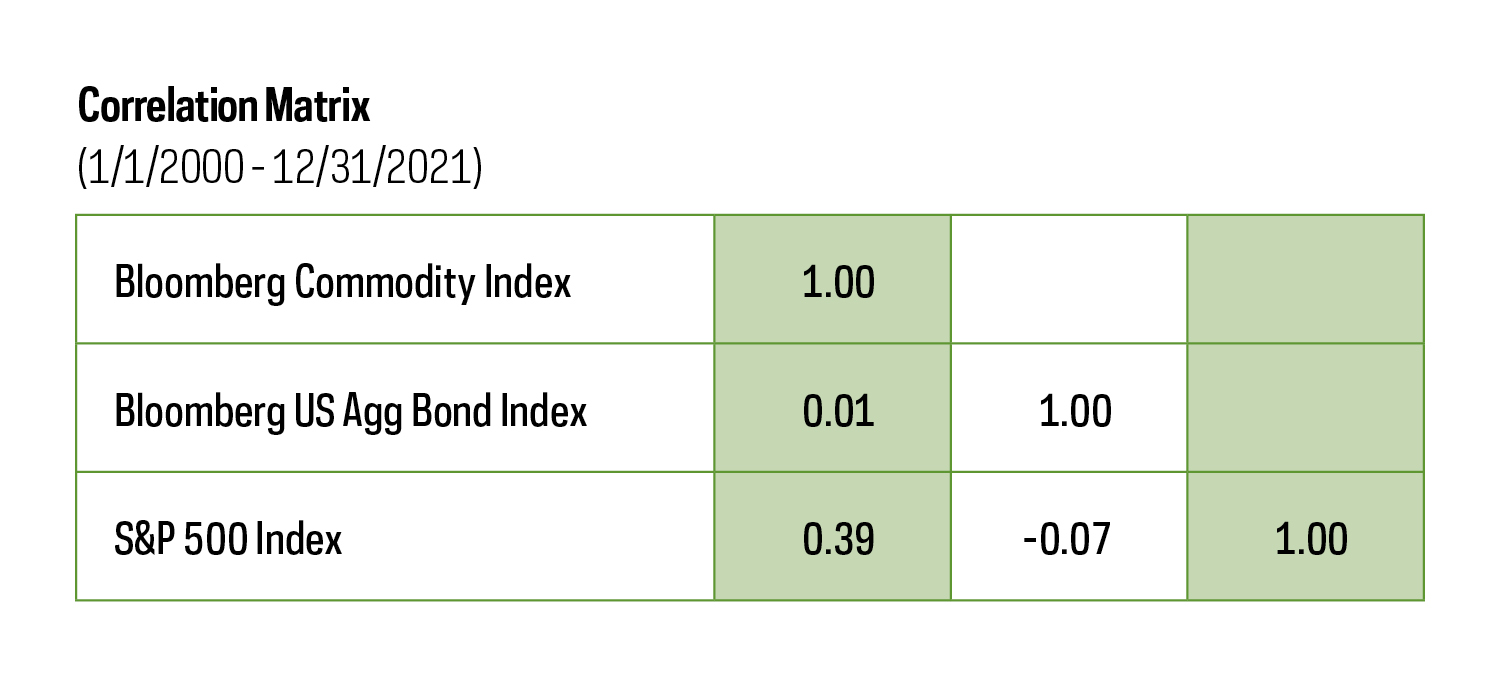

While we’ve identified some nontraditional fixed income strategies that may be poised to post positive performance in 2022, the general outlook for the asset class is challenging. In recent years, headlines calling for “the end of the 60/40 portfolio” have become more frequent. Could fixed income be past its prime following decades of falling interest rates? What about the importance of diversification? Treasury bonds are known for their ability to hedge against equity risk, with many investors flocking to the asset class during periods of market turmoil, as we referenced earlier on in our outlook. But if the preponderance of scenarios points to poor Treasury bond performance, perhaps it’s time to look outside of fixed income for diversification.

Enter Commodities

While commodities posted an impressive return of 27% in 2021, the category remains down a cumulative 25% over the past 10 years, having generated an annualized return of negative 2.9%.[1] If we look back 20 years, the category managed to eke out positive returns of 1.8% (annualized). Despite poor commodity performance so far in the 21st century, the asset class has relatively low correlation with equities and is known for being one of the investments most positively correlated with inflation. The Consumer Price Index (CPI) inherently reflects the change in the price of commodities, such as oil and natural gas as well as gold, sugar, and coffee. With inflation likely to remain elevated in 2022, perhaps it’s worth taking a closer look at the category.

Correlation of Commodities, Stocks, and Bonds

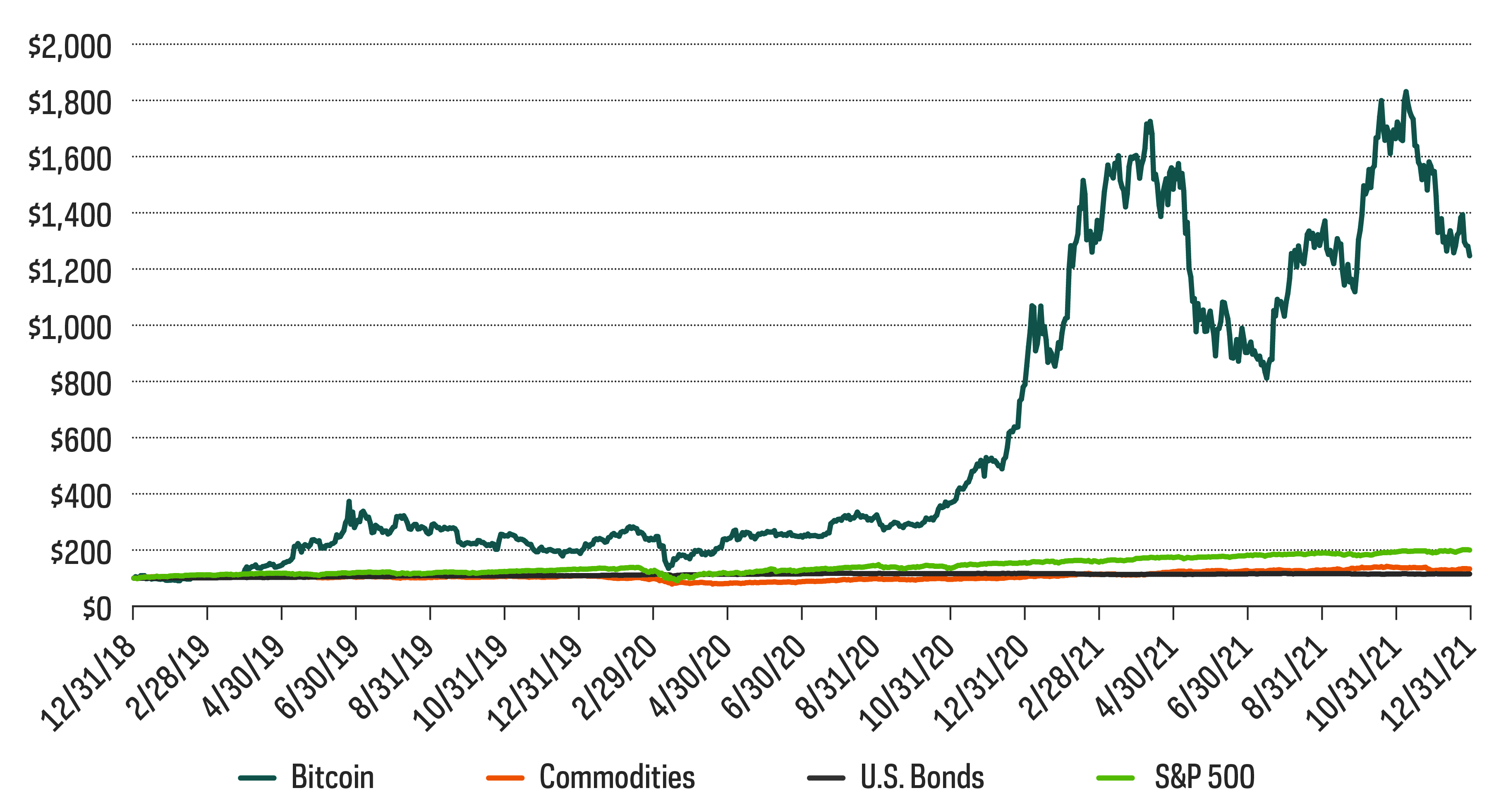

A Look at Digital Assets

We’d be remiss if we didn’t mention a strategy that’s been garnering more and more attention lately: digital assets, with a primary focus on bitcoin—which some have referred to as “digital gold.” Like commodities, used as a complementary investment to a portfolio of stocks and bonds. Particularly because of its fixed supply, bitcoin is also often viewed as a hedge against inflationary pressures. Barriers to invest in the asset class have previously been high and included the use of unregulated exchanges or wallets. However, recent innovations—including bitcoin-linked ETFs—have made exposure to bitcoin more attainable for the average investor. Bitcoin is volatile and relatively uncorrelated with traditional asset classes, so a modest allocation may go a long way.

Comparing Bitcoin, Stocks, Bonds, and Commodities

Source: Bloomberg.

[1] Bloomberg. U.S. aggregate bond market represented by the Bloomberg US Aggregate Bond Index. Global aggregate bond market represented by the Bloomberg Global Aggregate Bond Index.

[2] Commodities tracked by the Bloomberg Commodity Index.

Sources for data and statistics: Bloomberg, Morningstar, and ProShares.

The different market segments represented in the performance recap charts use the following indexes: U.S. Large Cap: S&P 500 TR; U.S. Large Cap Growth: S&P 500 Growth TR; U.S. Large Cap Value: S&P 500 Value TR; U.S. Mid Cap: S&P Mid Cap TR; U.S. Small Cap: Russell 2000 TR; International Developed Stocks: MSCI Daily TR NET EAFE; Emerging Markets Stocks: MSCI Daily TR Net Emerging Markets; Global Infrastructure: Dow Jones Brookfield Global Infrastructure Composite; Commodities: Bloomberg Commodity TR; U.S. Bonds: Bloomberg U.S. Aggregate; U.S. High Yield: Bloomberg Corporate High Yield; International Developed Bonds: Bloomberg Global Agg ex-USD; Emerging Market Bonds: DBIQ Emerging Markets USD Liquid Balanced.

THESE ENTITIES AND THEIR AFFILIATES MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO PROSHARES.

This is not intended to be investment advice. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Any forward-looking statements herein are based on expectations of ProShare Advisors LLC at this time. Whether or not actual results and developments will conform to ProShare Advisors LLC's expectations and predictions, however, is subject to a number of risks and uncertainties, including general economic, market and business conditions; changes in laws or regulations or other actions made by governmental authorities or regulatory bodies; and other world economic and political developments. ProShare Advisors LLC undertakes no duty to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Investing is currently subject to additional risks and uncertainties related to COVID-19, including general economic, market and business conditions; changes in laws or regulations or other actions made by governmental authorities or regulatory bodies; and world economic and political developments.

Investing involves risk, including the possible loss of principal. This information is not meant to be investment advice.

Bonds will decrease in value as interest rates rise. International investments may also involve risks from geographic concentration, differences in valuation and valuation times, unfavorable fluctuations in currency, differences in generally accepted accounting principles, and economic or political instability. In emerging markets, many risks are heightened, and lower trading volumes may occur. Small- and mid-cap companies may lack the financial and personnel resources to handle economic or industry-wide setbacks and, as a result, such setbacks could have a greater effect on small- and mid-cap security prices.

The “S&P 500® Dividend Aristocrats® Index” is a product of S&P Dow Jones Indices LLC and its affiliates and have been licensed for use by ProShares. “S&P®” is a registered trademark of Standard & Poor's Financial Services LLC (“S&P”) and “Dow Jones®” is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and they have been licensed for use by S&P Dow Jones Indices LLC and its affiliates. "MSCI," "MSCI Inc.," "MSCI Index" and "EAFE" are service marks of MSCI and have been licensed for use by ProShares. ProShares have not been passed on by MSCI or its affiliates as to their legality or suitability. ProShares based on S&P and MSCI indexes are not sponsored, endorsed, sold or promoted by S&P or MSCI or their affiliates, and they make no representation regarding the advisability of investing in ProShares. THIS ENTITY AND ITS AFFILIATES MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO PROSHARES.

Your use of this site signifies that you accept our Privacy Policy and Terms and Conditions of Use.