Omicron’s Economic Impact, the Potential of International Dividend Growers, and the Fed’s Sudden Pivot

Key Observations

Omicron Crashes Thanksgiving

Things were going so well. All we were worried about was a little bit—or maybe more than a little bit—of inflation. Economic data came in strong: A strong jobs report, an all-time high for the ISM Services, very strong retail sales, and perhaps most tangibly, strong corporate profits.

Things were going so well. All we were worried about was a little bit—or maybe more than a little bit—of inflation. Economic data came in strong: A strong jobs report, an all-time high for the ISM Services, very strong retail sales, and perhaps most tangibly, strong corporate profits. Q3 earnings season wrapped up with the S&P 500 delivering 41% earnings growth. The strength of that performance goes well beyond low pandemic-driven 2020 comparisons. Bloomberg S&P 500 2021 consensus earnings are indeed indicating a 70% increase over 2020 earnings, but also reflect a 38% percent over 2019 pre-pandemic levels. And remember, those Q3 earnings results already reflected inflation challenges, supply-chain challenges, and wage pressure challenges. Perhaps surprising to some, that trend holds outside the United States as well, with Bloomberg MSCI EAFE 2021 consensus earnings indicating a 40% increase over 2019.

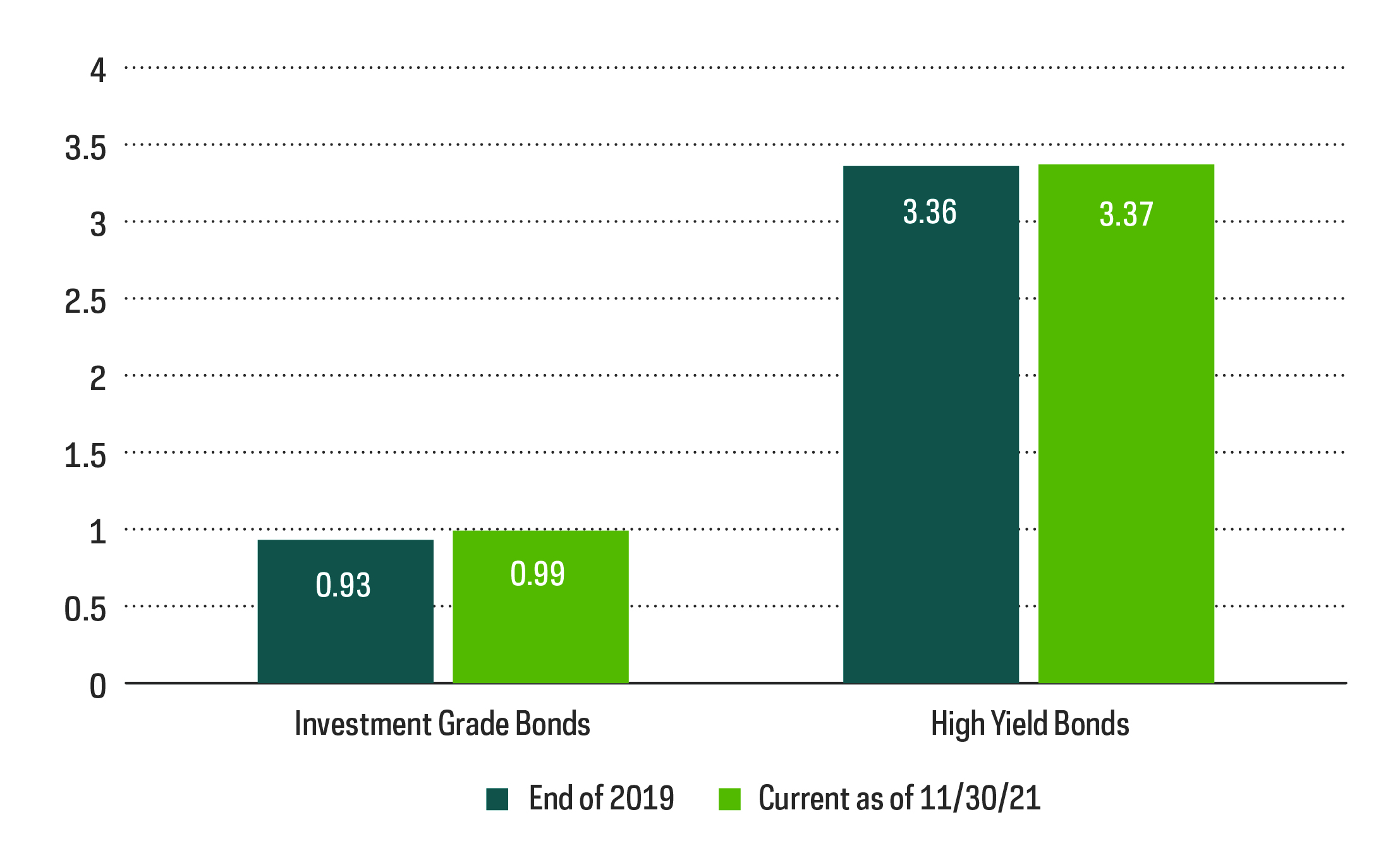

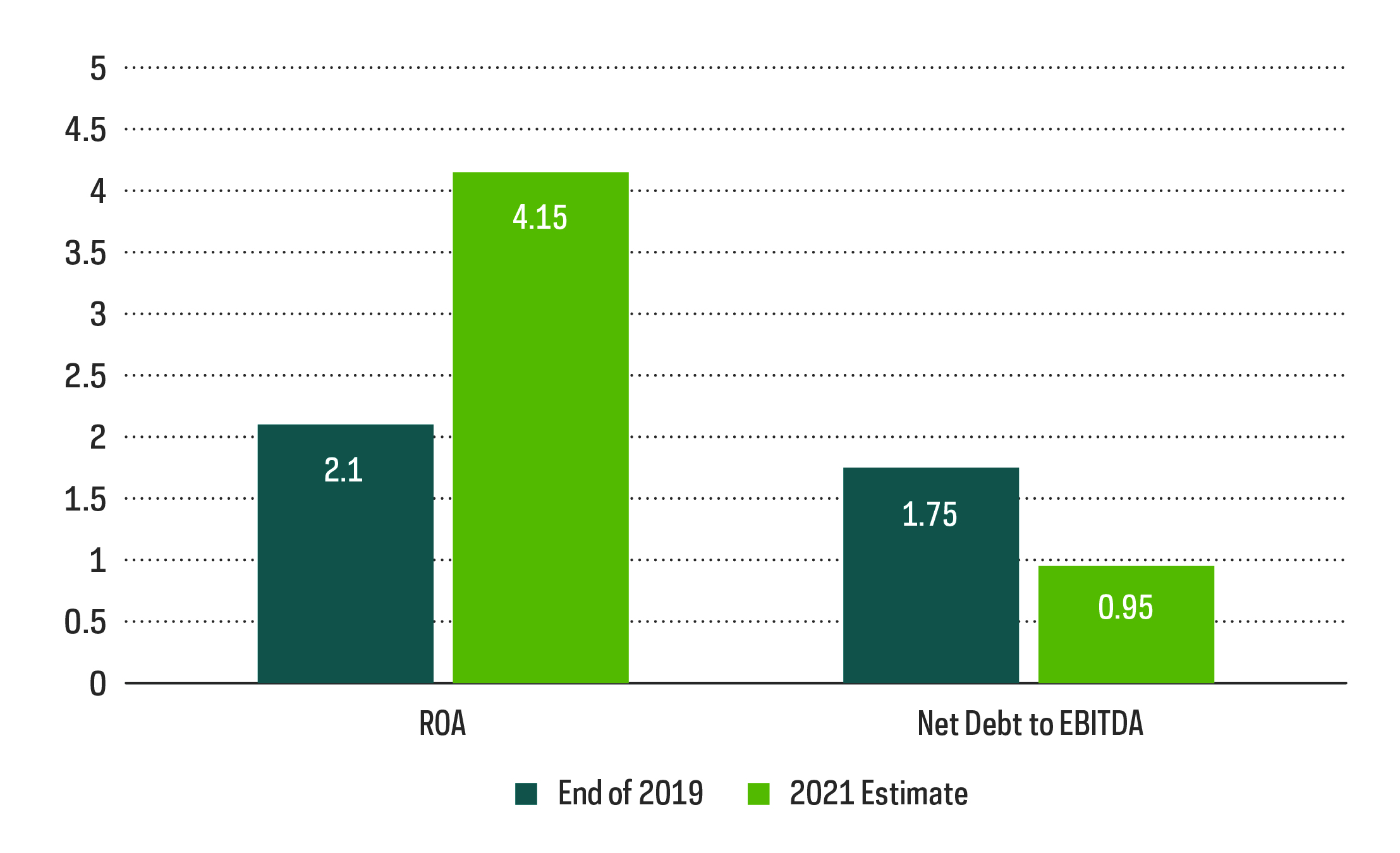

The corporate bond market also tells an interesting story. Omicron concerns have widened both investment grade and corporate bond spreads to levels seen at the end of 2019. Corporate fundamentals are however much stronger now than immediately prior to the pandemic. 2021 Bloomberg consensus estimates net debt/EBITDA at roughly half the level at the end of 2019— and return on assets are projected to be 60% higher in 2021 compared to 2019.

Chart of the Month

Corporate Bond Signals: Widening Spreads with Strengthening Fundamentals

S&P 500 Fundamentals

Source: Bloomberg. Return on Assets, as of 11/30/2021. Investment grade bonds represented by the Bloomberg US Corporate Bond Index. High yield bonds represented by the Bloomberg US Corp High Yield Bond Index. Net debt to EBITDA, 2021 year-end estimate. Return on Assets is an indicator of a company’s profitability relative to its total assets, calculated by dividing a company’s net income by total assets.

As we write this, the global health impacts of the Omicron variant are still uncertain. The economic impacts are still uncertain as well—including the endless matrices of “what ifs.” What might happen to monetary policy, fiscal policy, and inflation? It would be wise not to underestimate the powerful trajectory of the economy and corporate performance. Omicron’s impact would have to be quite substantial to knock them off their course. Fed Chair Powell’s hawkish congressional testimony on the last day of the month suggests that the Fed is giving the benefit of the doubt to continued economic strength—for now.

Performance Recap

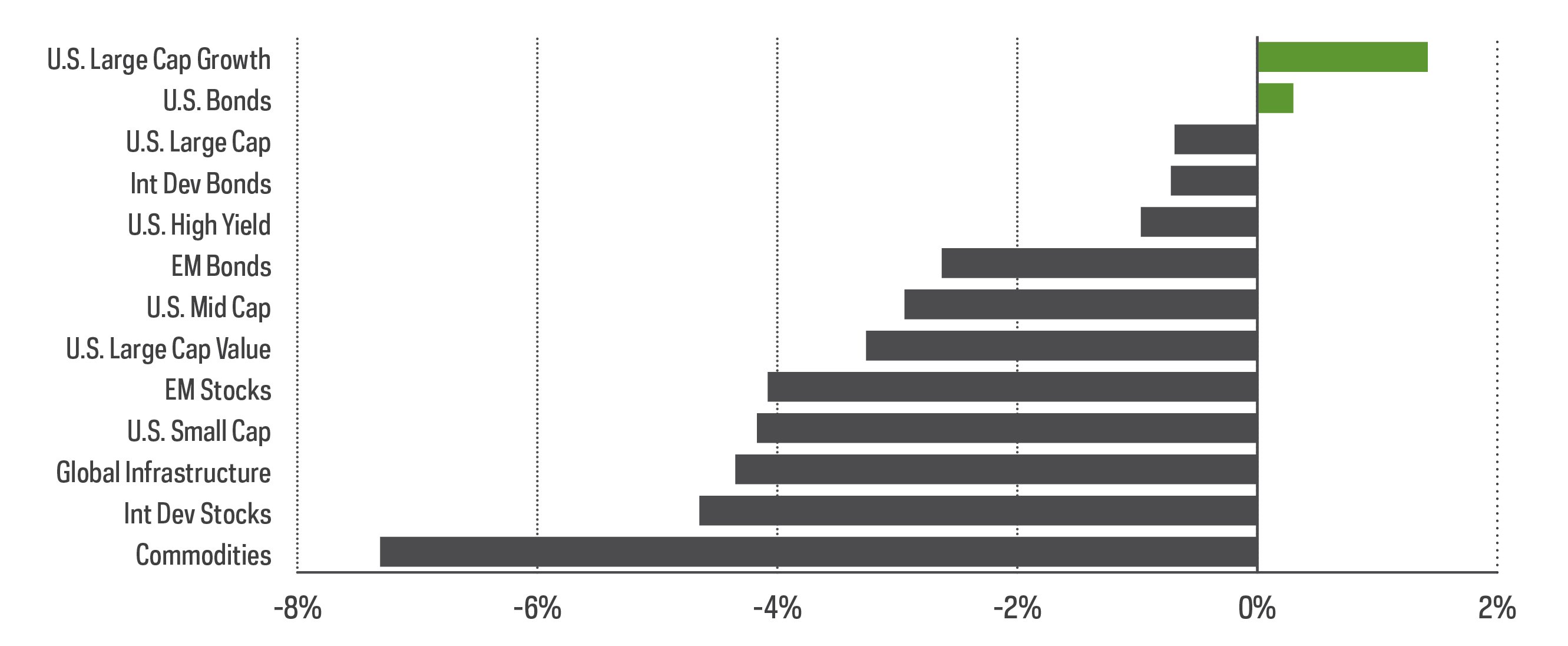

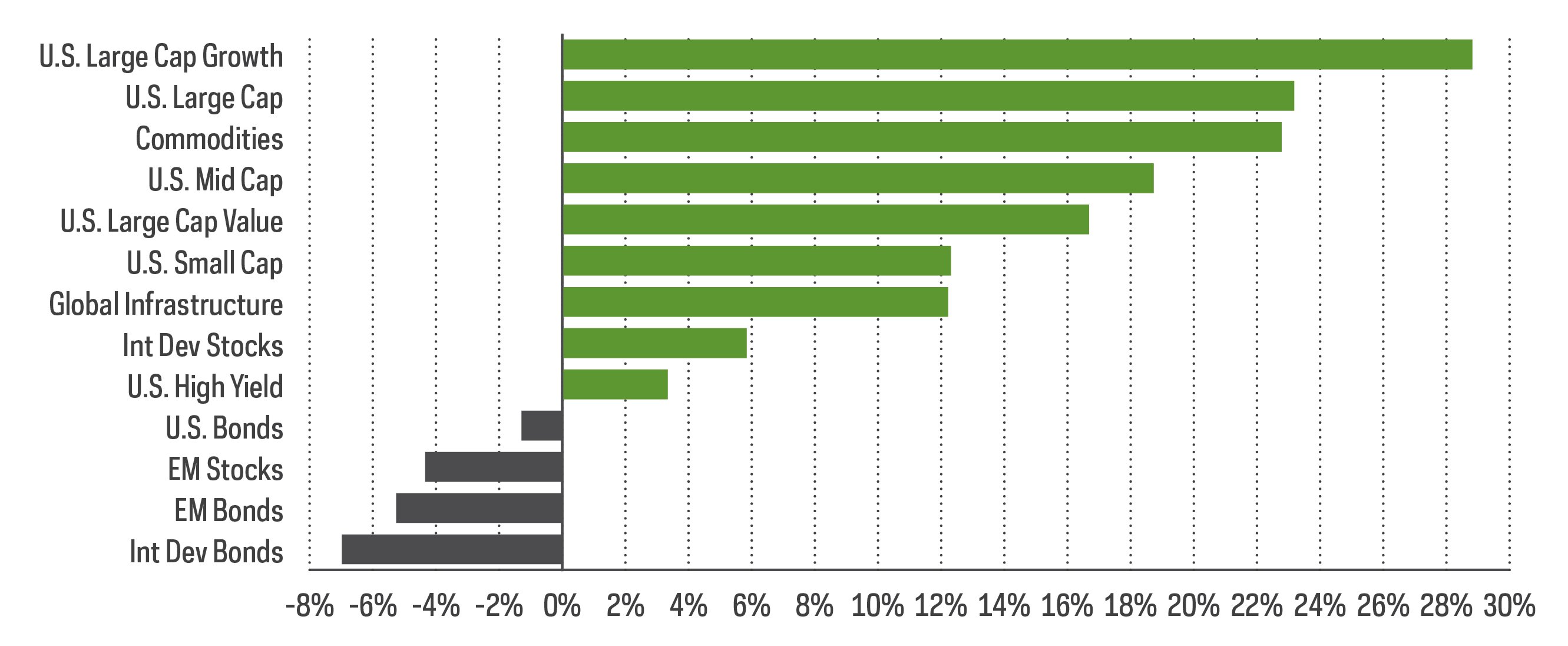

The Thanksgiving arrival of the Omicron variant as well as hawkish congressional testimony from Fed Chair Powell on November 30 pushed most equity segments into the red for the month. Omicron took an even bigger bite out of commodities. A flattening yield curve left U.S. bonds just barely in the green.

Returns of Various Common Market Segments

Market Segment Returns—November 2021

Market Segment Returns—November 2021

Source: Bloomberg. November returns 11/1/21-11/30/21, year-to-date returns 1/1/21-11/30/21. Performance quoted represents past performance and does not guarantee future results.

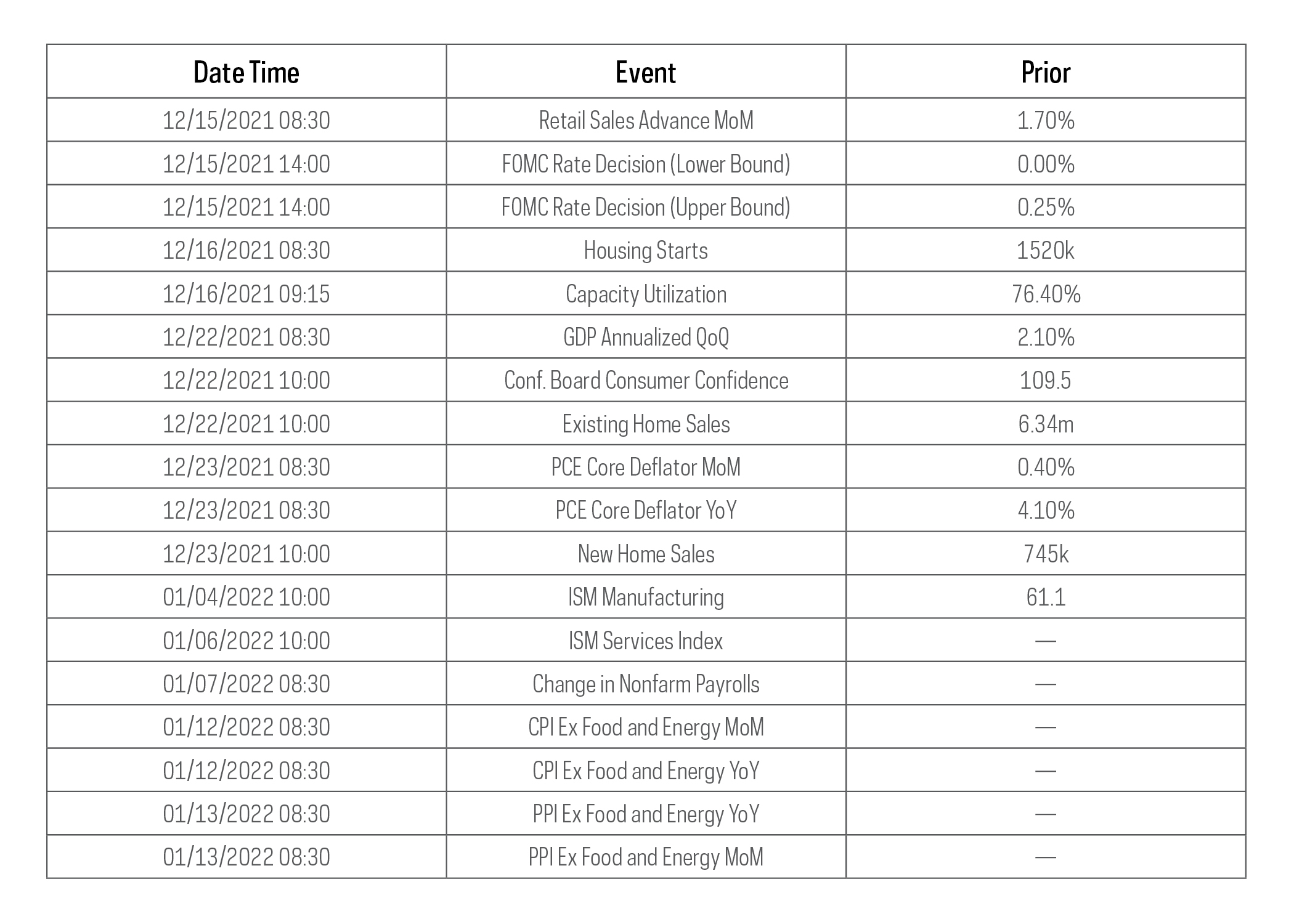

Economic Calendar

Here's a list of upcoming key economic releases, which can serve as a guide to potential market indicators.

Equity Perspectives

The Case for International Dividend Growth

The closing months of the year inevitably provide an opportunity for investors to shine a light on their portfolio allocations. After an extended run of strong performance from domestic stocks, many U.S. portfolios undoubtedly display a home court bias. The merits of adding international dividend growth stocks are quite compelling against today’s market backdrop and rest on three pillars: higher yields, a post-COVID dividend resurgence, and more attractive valuations.

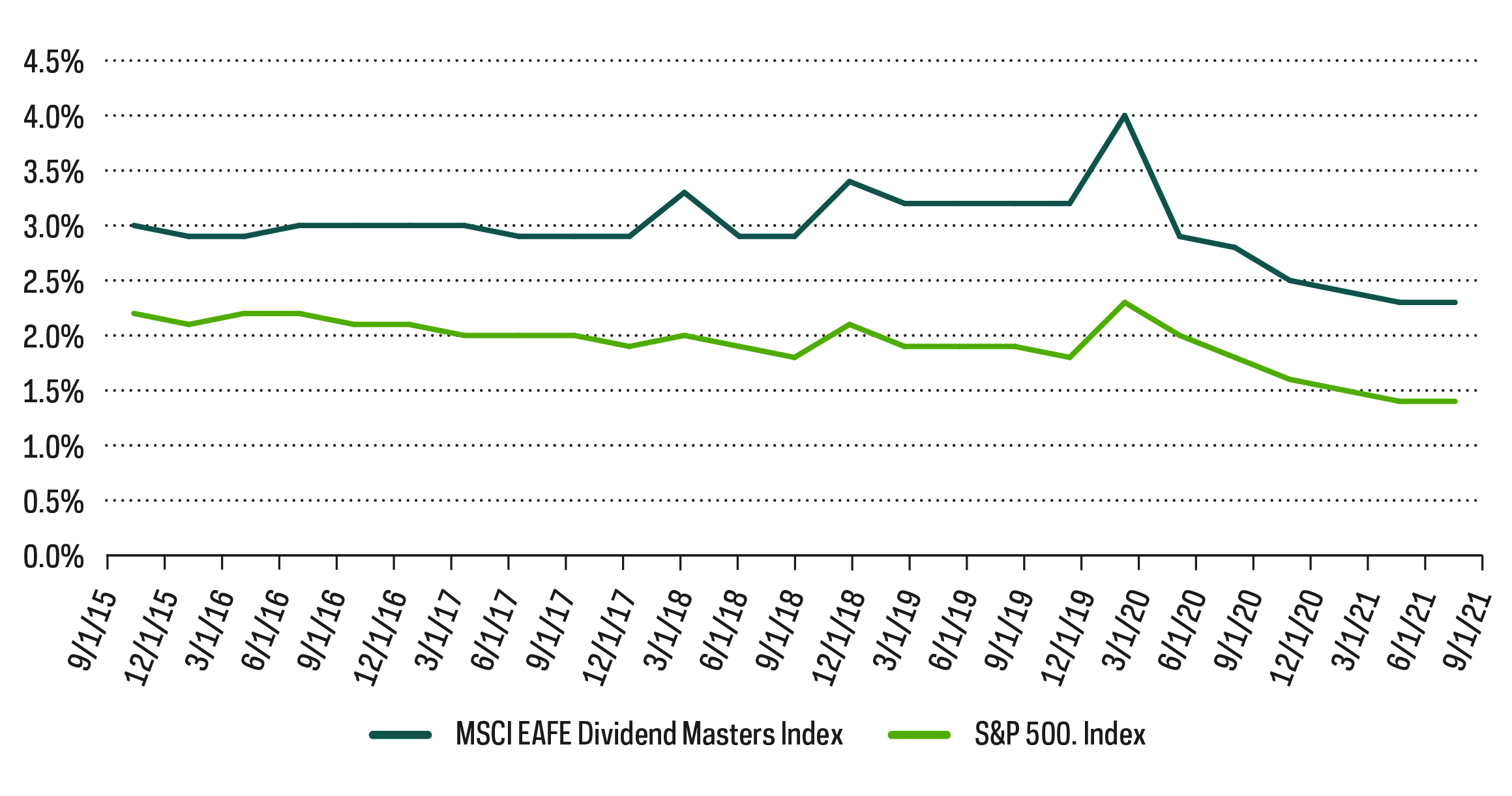

Go Abroad to Get Paid

The first and perhaps most obvious reason to look abroad is the universal need for income in a low-rate environment. Despite recent developments which may lead to a sooner-than-anticipated taper timeline and rising rates, yield remains scarce—especially among equity securities. Too often, U.S.-based dividend investors narrowly focus only on domestic stocks, but make no mistake, dividends represent a global opportunity. Even though the United States is the single largest source of dividend payments, a domestic-only approach would omit slightly less than half of global dividend pool. Developed markets in Europe and Asia contribute just over 40% of global dividends and represent a large opportunity. International developed stocks have traditionally yielded more than domestic stocks for years. This dynamic still holds true today, albeit with lower absolute yield levels.

The International Dividend Growth Yield Advantage

Source: Bloomberg. Data from September 1, 2015 through September 30, 2021.

International Dividend Resurgence

Yields on international stocks have been trending lower since the onset of the COVID-19 pandemic, which hit many international dividend stocks especially hard. Compared to domestic stocks, which proved more resilient and in aggregate held 2020 payments essentially flat, international stock dividends fared much worse. Note however, that there was much variation on a region-by-region basis. Countries like Japan, which saw a decrease of just 2%, proved far more resilient than selected European markets like the UK, which saw dividends fall over 35%. Many companies with long dividend growth histories were also able to better withstand the turmoil, highlighting the importance of a strict dividend growth discipline.

The silver lining to this dynamic is that international stocks are poised for a strong rebound and are likely to deliver faster levels of dividend growth than domestic payers. European markets are providing early evidence of this trend and saw first half 2021 payments jump significantly from the prior year.

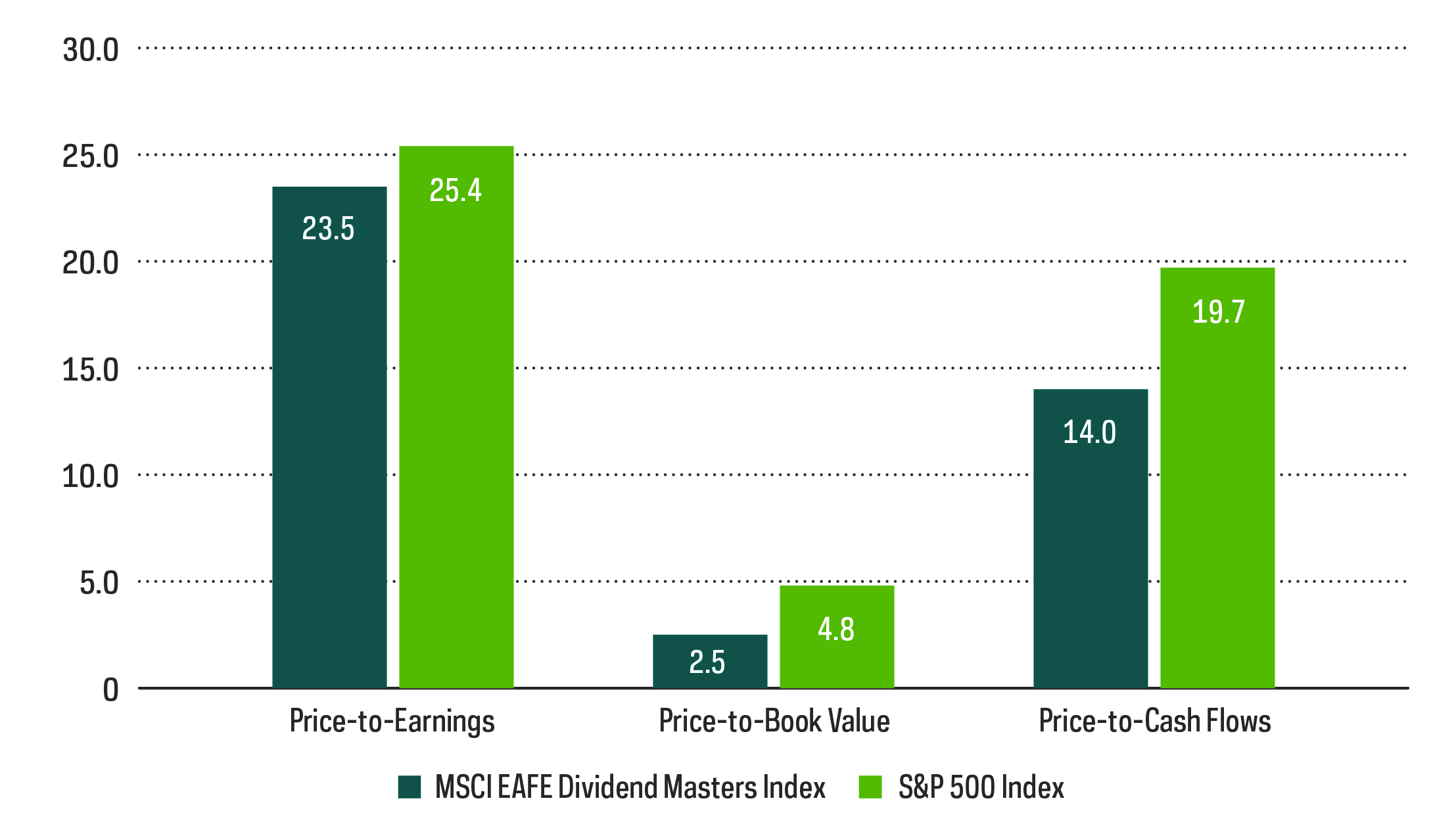

Attractive Valuations

Several years of U.S. stock outperformance relative to international markets has likely led many to question the need to hold them at all. However, performance between regions of the globe tends to be cyclical, as we show in the graphic below. Perhaps the catalyst to turn the tables on relative performance will be the continued recovery of international economies, which have lagged those in the United States.

The upside to recent underperformance is that international stocks are cheap at a time when domestic stocks are not. Stated simply, the cheaper the starting valuation, the more attractive future returns tend to be. While valuation is a powerful predictor of future long-term returns, it has essentially zero utility in the short term. Indeed, this approach requires patience, but the potential upside could be significant. Currently trading at significant discounts of 8%, 29%, and 47% respectively on a price-to-earnings, price-to-cash flows, and price-to-book basis, the MSCI EAFE Dividend Masters Index offers compelling value relative to domestic stocks as represented by the S&P 500.

International Dividend Growth at a Reasonable Price

Source: Bloomberg

Fixed Income Perspectives

The Fed Pivots

In our September market commentary, we referenced how Fed Chair Powell seemed a bit too keen on tempering inflation expectations, highlighting how he managed to mention inflation 65 times during his roughly 20-minute speech at the Jackson Hole Economic Symposium. At the time he was reiterating his stance that the spike was transitory. As indicated earlier, Chairman Powell took a more hawkish stance in November and has now

retired the use of “transitory” when referencing the increasingly high levels of inflation we have been seeing. Powell also indicated that the Fed is likely to

expedite the tapering process, potentially wrapping up its bond purchase program a few months earlier than anticipated.

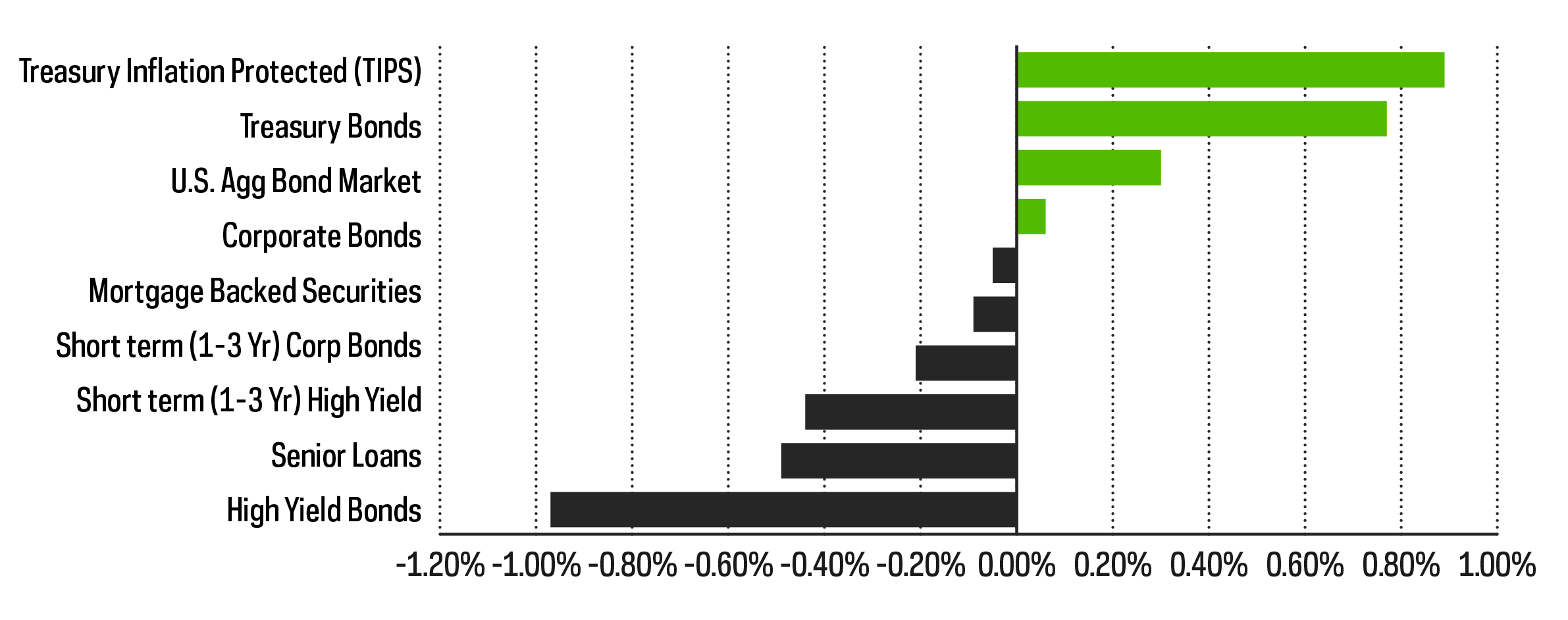

Fixed Income Segment Returns

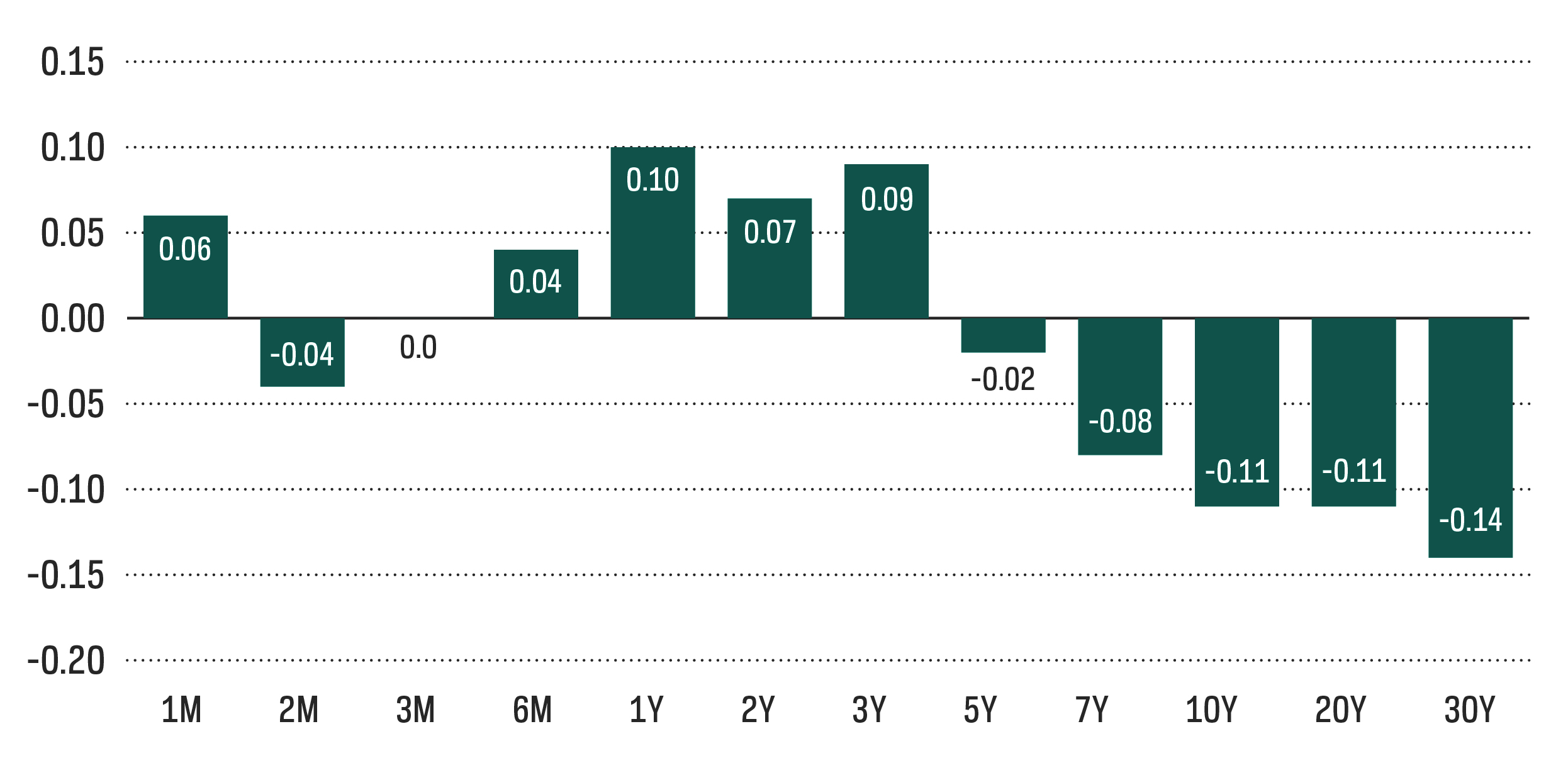

Interest rate sensitive bonds rallied during the month, with TIPS topping the charts. While the more hawkish stance taken by the Fed didn’t cause longer-term rates to rise, which in fact fell during the month, shorter-term yields jumped up a bit with the 2-year Treasury yield rising 11 basis points (bps) November.

Changes In Treasury Yields (MoM)

It’s true that historically Fed tightening has resulted in a flatter yield curve—higher shorter-term rates and flat or even lower longer-term rates. That history is primarily from the pre-quantitative easing (QE) era, where longer-term yields were set by the market, and tightening was defined by an increase in the federal funds rate that often brought down longer-term growth and inflation expectations. Tightening that begins with tapering may be a different animal. Longer-term yields today are suppressed by QE, and tapering will allow likely those yields—particularly those real yields—to rise. So even if inflation expectations fall somewhat, tapering will may drive-up longer-term yields. Recall that in 2013, our only previous experience with tapering, 10-year U.S. Treasury rates rose 100 bps in the following months. November’s one week of flattening may beshort‑lived.

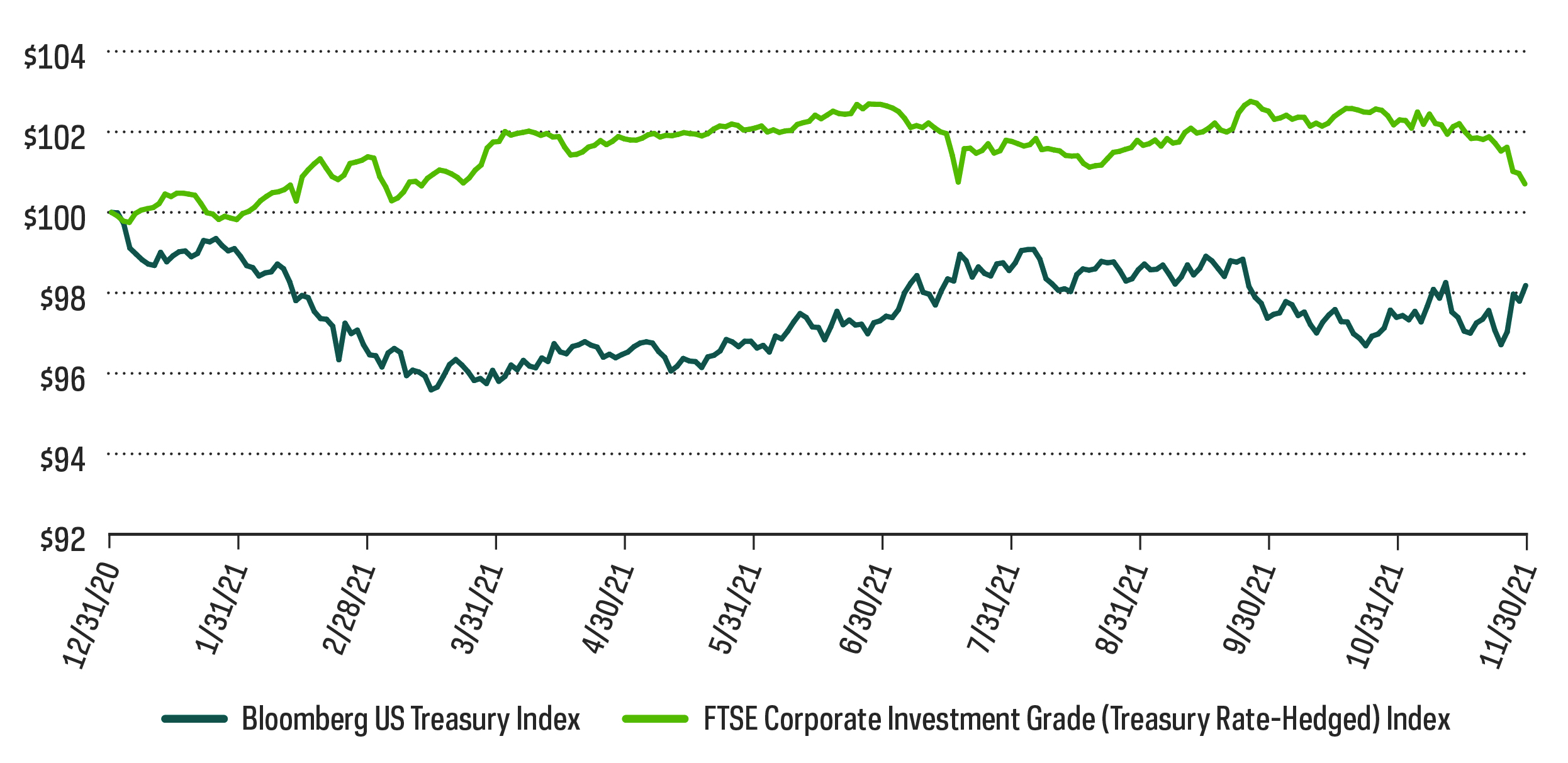

Uncertainty amid the movement of interest rates is cause for concern for many investors, as is the movement of credit spreads. Credit spreads for both investment grade and high yield bonds have widened to levels above those seen at the end of 2019, but fundamentals indicate a stronger market which could benefit those investors who tilt their strategies towards credit risk. Additionally, an analysis of a strategy that pinpoints credit risk, such as the FTSE Corporate Investment Grade (Treasury Rate-Hedged) Index, indicates that it has in fact been less volatile than the Treasury market on a year-to-date basis while also generating a higher return. While market turmoil could reverse this trend, its an interesting dynamic to see occur in 2021.

Growth of $100

Sources for data and statistics: Bloomberg, Morningstar, ProShares

The different market segments represented in the performance recap charts use the following indexes: U.S. Large Cap: S&P 500 TR; U.S. Large Cap Growth: S&P 500 Growth TR; U.S. Large Cap Value: S&P 500 Value TR; U.S. Mid Cap: S&P Mid Cap TR; U.S. Small Cap: Russell 2000 TR; International Developed Stocks: MSCI Daily TR NET EAFE; Emerging Markets Stocks: MSCI Daily TR Net Emerging Markets; Global Infrastructure: Dow Jones Brookfield Global Infrastructure Composite; Commodities: Bloomberg Commodity TR; U.S. Bonds: Bloomberg U.S. Aggregate; U.S. High Yield: Bloomberg Corporate High Yield; International Developed Bonds: Bloomberg Global Agg ex-USD; Emerging Market Bonds: DBIQ Emerging Markets USD Liquid Balanced.

THESE ENTITIES AND THEIR AFFILIATES MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO PROSHARES.

This is not intended to be investment advice. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Any forward-looking statements herein are based on expectations of ProShare Advisors LLC at this time. Whether or not actual results and developments will conform to ProShare Advisors LLC's expectations and predictions, however, is subject to a number of risks and uncertainties, including general economic, market and business conditions; changes in laws or regulations or other actions made by governmental authorities or regulatory bodies; and other world economic and political developments. ProShare Advisors LLC undertakes no duty to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Investing is currently subject to additional risks and uncertainties related to COVID-19, including general economic, market and business conditions; changes in laws or regulations or other actions made by governmental authorities or regulatory bodies; and world economic and political developments.

Investing involves risk, including the possible loss of principal. This information is not meant to be investment advice.

Bonds will decrease in value as interest rates rise. International investments may also involve risks from geographic concentration, differences in valuation and valuation times, unfavorable fluctuations in currency, differences in generally accepted accounting principles, and economic or political instability. In emerging markets, many risks are heightened, and lower trading volumes may occur. Small- and mid-cap companies may lack the financial and personnel resources to handle economic or industry-wide setbacks and, as a result, such setbacks could have a greater effect on small- and mid-cap security prices.

"MSCI," "MSCI Inc.," "MSCI Index" and "EAFE" are service marks of MSCI and have been licensed for use by ProShares. ProShares have not been passed on by MSCI or its affiliates as to their legality or suitability. ProShares based on MSCI indexes are not sponsored, endorsed, sold or promoted by MSCI or its affiliates, and they make no representation regarding the advisability of investing in ProShares. THIS ENTITY AND ITS AFFILIATES MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO PROSHARES.

Your use of this site signifies that you accept our Privacy Policy and Terms and Conditions of Use.

Information provided by ProShares and SEI Investments Distribution Co., which is not affiliated with ProShares.