Markets Can Be Messy

Investors attempting to manage volatility in their portfolio often employ defensive equity strategies to define their optimal market exposure and risk profile. Such strategies are designed to help limit losses on the downside, while also allowing investors to participate in the market’s gains.

Two things make these strategies appealing.

- First, equity markets suffer meaningful drawdowns on a regular basis.

- Second, investors often overreact during these volatile periods, sometimes withdrawing from markets entirely and foregoing the long-term returns that stocks have historically provided.

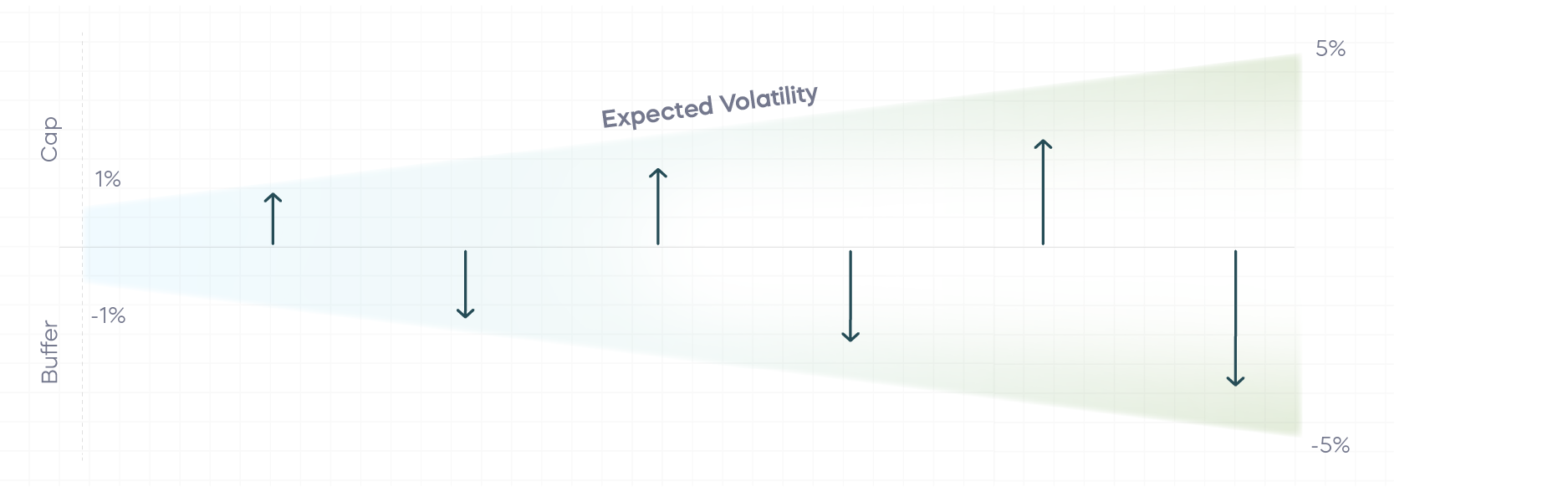

Now, ProShares Dynamic Buffer ETFs are redefining defensive equity with a strategy that adjusts to the markets each trading day. This groundbreaking strategy offers a daily buffer that adapts as expected volatility increases or decreases to potentially help shield investors from 1% to as much as 5% of daily losses in the funds’ underlying equity indexes, while also offering market upside up to a limit. The result is a risk/reward profile that may be well-matched to many investors’ investment objectives and tolerances.

The Human Factor

The stock market has generated tremendous wealth over time. Since 1957, the S&P 500 has delivered a cumulative return of 98,000%, turning $100 at inception into nearly $100,000 today.1 This type of example, based on long-term or average performance over time, is a foundational component of most investors’ education. Risk is evaluated similarly.

Behavioral finance teaches us, however, that people don’t experience risk and reward in such a simple or linear fashion. For example, loss aversion, the well-established cognitive bias where the emotional impact of a loss is felt more acutely than the joy of an equivalent gain, may often lead investors to sell when they might be better off holding and awaiting a recovery. Another core behavioral concept, the certainty effect, tells us that people often prefer a sure gain versus an uncertain outcome, even one with a potentially larger reward.

With the emotional human brain in charge, many investors sell their investments at low points in market cycles to staunch the bleeding, effectively locking in losses. Similarly, investors can become overly conservative during volatile markets and avoid stocks completely out of fear. Either way, investors can wind up sacrificing significant returns when the markets recover.

Even for investors who manage to avoid psychologically driven missteps, resultant anxiety about their investment strategy may not let them sleep well at night. Moreover, the market stress—and investor distress it causes—is more frequent than many realize.

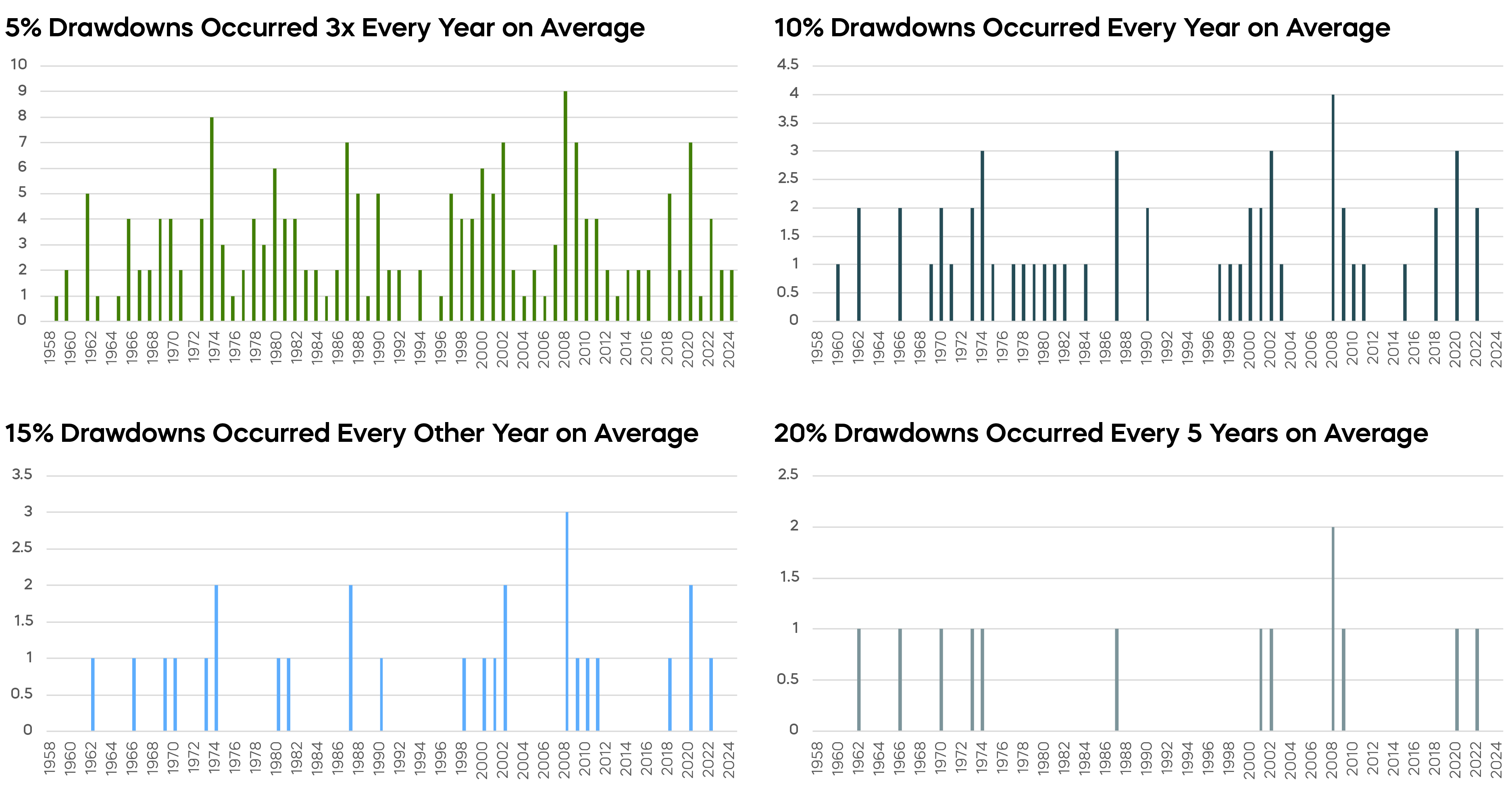

Frequency of 5%, 10%, 15% and 20% S&P 500 Pullbacks

Source: Bloomberg. Data from 1957-2025. Index returns are for illustrative purposes only and do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest directly in an index. Past performance does not guarantee future results.

The challenge is not just one of unease and capitulation. As retirement nears, the time required to weather market downturns becomes less viable, regardless of risk tolerance. Many investors simply don’t have the necessary timelines required for their investments to recover before that money is needed. Plus, sudden and sharp market recoveries, as happened after COVID, are actually relatively rare. More often, recoveries take time. For example, the S&P 500 has had at least two extended, 12+ year periods (1966–1982 and 2000–2012) where stock prices stagnated and produced weak returns.2

A Dynamic Defense

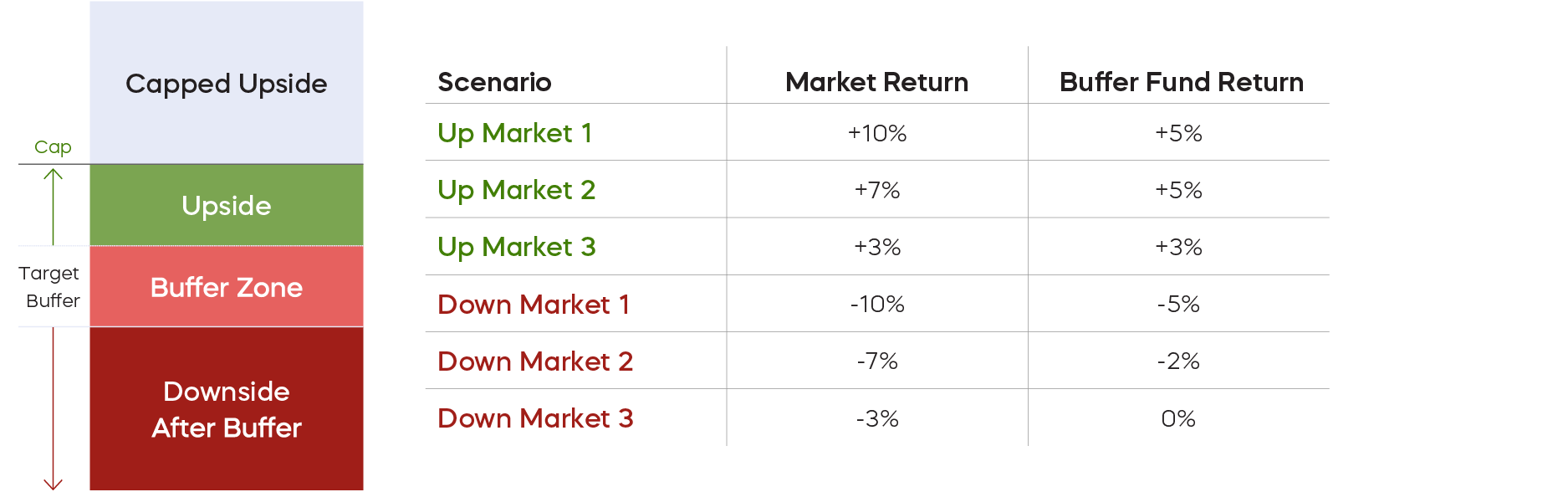

ProShares S&P 500 Dynamic Buffer ETF (FB), ProShares Nasdaq-100 Dynamic Buffer ETF (QB), and ProShares Russell 2000 Dynamic Buffer ETF (RB) feature a patent-pending, dynamic buffer that targets protection from the first 1% of daily losses with the ability to dynamically increase its protection target to as much as 5% as volatility expectations rise. Here’s what that looks like each day assuming a 5% buffer and a 5% cap:

Hypothetical Daily Market Scenarios with a 5% Cap and 5% Buffer

For illustrative purposes only. The chart above assumes the market’s expected volatility, as measured by the Cboe Volatility Index, resulted in the fund targeting a 5% buffer and cap for the day. The fund’s Cap and Target Buffer are each reset daily based on expectations of market volatility, and investors may experience losses to the extent market volatility exceeds such expectations. Even if the fund’s Dynamic Daily Buffer Strategy is successful, the fund will be exposed to index losses that exceed the Target Buffer. There can be no guarantee that the fund’s Dynamic Daily Buffer Strategy will provide a level of downside protection up to the Target Buffer, or that the fund will participate in upside returns up to the daily Cap.

With our dynamic daily strategies, the size of the buffer and market upside cap are adjusted proportionately to market volatility every day. This enables our ETFs to target greater overall downside protection along with increased market upside potential as the cap rises.

For illustrative purposes only.

Avoiding Unexpected Outcomes

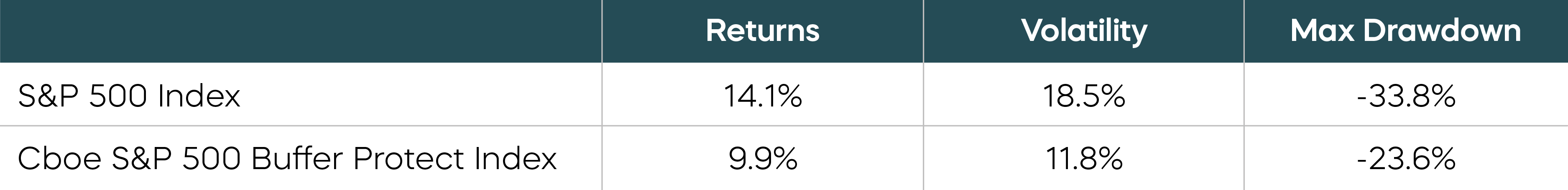

Conventional buffer strategies are popular and have provided a useful—if limited—solution to help equity investors stay invested and manage risk. Since their inception, buffer ETF strategies have gathered approximately $66 billion in assets.3 And they have worked reasonably well too. Since its launch in 2016, the Cboe S&P 500 Buffer Protect Index, a benchmark for conventional buffer strategies, has delivered solid risk-adjusted returns, lower volatility and better performance during drawdowns compared to the S&P 500, as the table below shows.

Performance of Cboe S&P 500 Buffer Protect Index

Source: Bloomberg. Data from 3/30/16 - 5/31/25. Index returns are for illustrative purposes only and do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest directly in an index. Past performance does not guarantee future results.

However, conventional buffer strategies are limited in two important ways.

- First, they are static. The caps and buffers are set and remain fixed regardless of what the markets do.

- Second, conventional buffer strategies are designed to provide outcomes only over a specific period of time—called the defined outcome period—that typically lasts one year. To achieve the defined outcome, investors must be invested for the entire period.

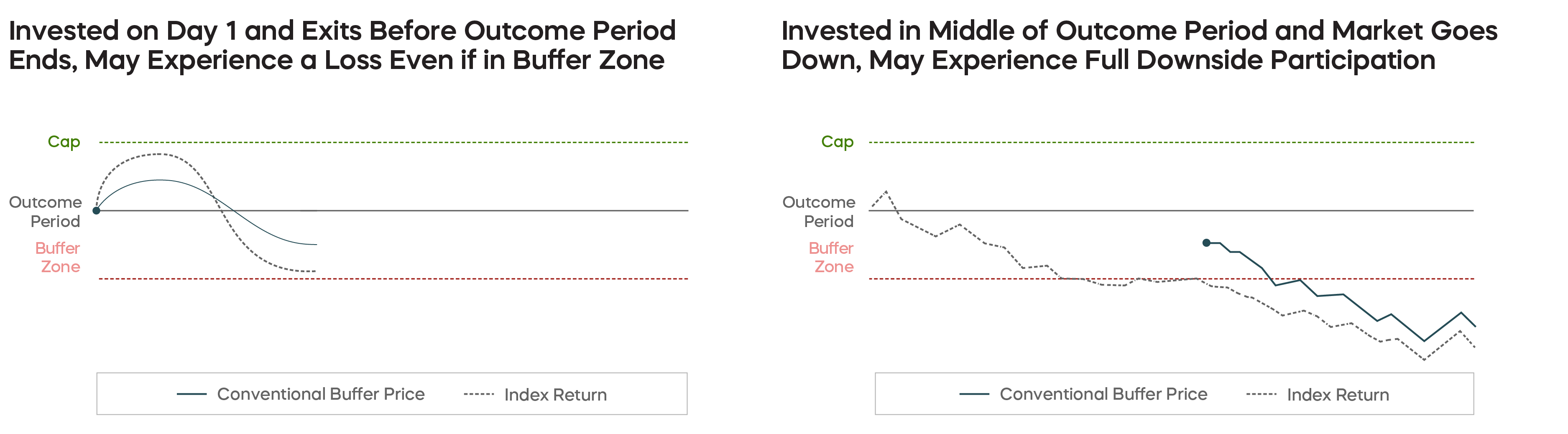

But investing doesn’t always go to plan. What happens when an investor’s timeline does not align with the defined period? Investors who purchase or redeem during the interim period—after the first or before the last day of the defined outcome period—will see their performance diverge from the planned outcome.

The Outcome Dilemma: When Static Buffers Fall Short

For illustrative purposes only. There can be no guarantee that any fund’s buffer strategy will provide a level of downside protection up to the Target Buffer, or that the fund will participate in upside returns up to the daily Cap. The above chart is intended to show the potential effect of selling buffer funds without holding for a full Outcome Period. Outcome Periods vary by fund. Carefully review a fund’s prospectus for more information on how long they are designed to be held.

Consider an investor who purchases a conventional buffer ETF at the outset of its defined outcome period but must sell before it ends. If the underlying investment had fallen, but within the buffer level, that investor would likely expect full protection. But as the illustration shows, they could still experience a decline, though less than the market overall.

Or consider an investor who wants to buy a buffer ETF in the middle of its outcome period. Determining the remaining buffer and cap range mid-cycle can be complex. If, for example, the underlying investment had already fallen close to or beyond its initial buffer level, there could be little to no further downside protection for someone purchasing at that point.

The Dynamic Advantage: Resetting Daily

ProShares Dynamic Buffer strategies redefine the category. Their targeted levels of protection and opportunity adjust based on expected volatility. And they do so each day, allowing you to invest at any point without needing to time the market or stick to a calendar.

1 Source: Bloomberg. S&P 500 cumulative returns 3/4/1957–5/31/2025.

2 Source: Bloomberg. Data from 2/9/1966–8/12/1982 and 9/1/2000–9/4/2012.

3 Source: Morningstar. Data as of 5/31/25.

Learn More

FB

S&P 500 Dynamic Buffer ETF

Seeks investment results, before fees and expenses, that track the performance of the S&P 500 Daily Dynamic Buffer Index.

QB

Nasdaq-100 Dynamic Buffer ETF

Seeks investment results, before fees and expenses, that track the performance of the Nasdaq-100 Dynamic Buffer Index.

RB

Russell 2000 Dynamic Buffer ETF

Seeks investment results, before fees and expenses, that track the performance of the Cboe Russell 2000 Daily Buffer Index.