Markets change, but quality endures. The companies of the S&P 500® Dividend Aristocrats® Index have demonstrated history of weathering every disruption the market has thrown at them.

In fact, the S&P 500 Dividend Aristocrats have not just paid dividends, but grown them for at least 25 consecutive years, and investing in them may contribute to a more resilient portfolio. While the S&P 500 Dividend Aristocrats Index retains the same 69 large-cap constituents as last year, there are new Aristocrats to celebrate in the mid-caps.

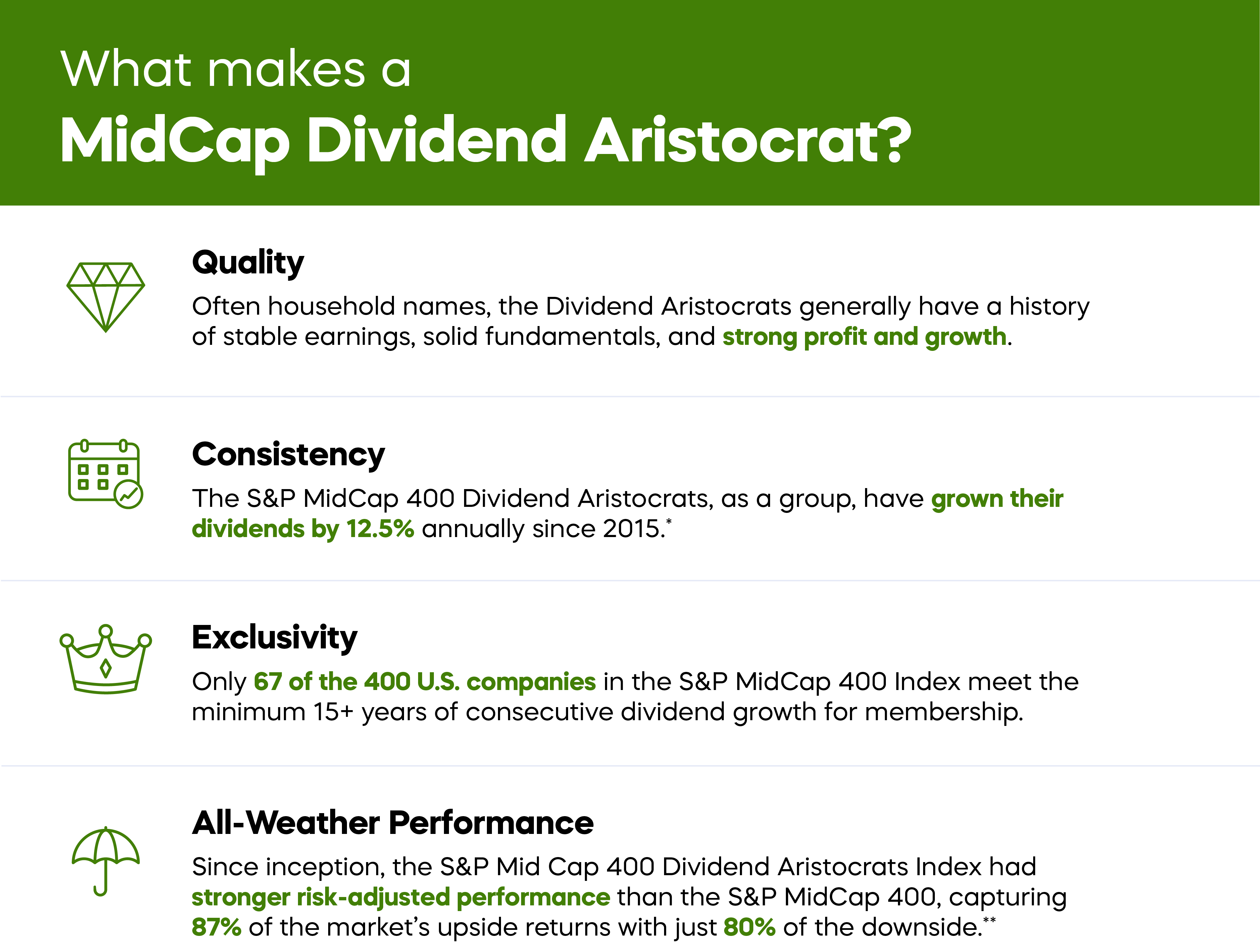

The S&P MidCap 400® Dividend Aristocrats® Index represents a distinguished group of companies that have consistently grown their dividends, year after year, for at least 15 consecutive years.

In 2026, the MidCap Dividend Aristocrats welcomes 17 new members. We highlight three of the new additions below:

GATX Corporation (Ticker: GATX)

- Founded in 1898, GATX leases transportation assets, including tank and freight railcars, and provides critical services to customers worldwide.

- 2025 marked the 107th consecutive year of paying a dividend; 5-year dividend growth has been 27.1%.[1]

- In the most recent 15 years of consecutive dividend increases, GATX has outperformed the S&P MidCap 400 with an annualized return of 13.8%.[2]

Littelfuse Incorporated (Ticker: LFUS)

- Founded in 1927, LFUS manufactures and sells fuses and other circuit protection devices for use in the automotive, electronic and general industrial markets.

- LFUS, an information technology company, will provide a new sector allocation among the S&P MidCap 400 Dividend Aristocrats, further diversifying the strategy.

- In the most recent 15 years of consecutive dividend increases, LFUS has outperformed the S&P MidCap 400 with an annualized return of 13%.[3]

EastGroup Properties (Ticker: EGP)

- Founded in 1969, EGP is an equity real estate investment trust which acquires and develops industrial properties in major U.S. sunbelt markets.

- In the most recent 15 years of consecutive dividend increases, EGP has outperformed the S&P MidCap 400 with an annualized return of 13.7%.[4]

Why REGL? See all current REGL holdings, and learn more about the Dividend Aristocrats.

** Source: Bloomberg as of 12/31/25

** Source: Morningstar, data as of 12/31/25. S&P MidCap 400 Dividend Aristocrats Index inception is 1/5/15.

Only REGL Focuses on the S&P MidCap 400 Dividend Aristocrats

The ProShares S&P MidCap 400 Dividend Aristocrats ETF (REGL) is the only ETF focused exclusively on the S&P MidCap 400 Dividend Aristocrats. REGL’s proven strategy has allowed investors to capture most of the gains of rising markets, and less of the loss in falling markets.

[1] Source: Bloomberg, 12/31/20 - 12/31/25.

[2] Source: Bloomberg, 12/31/10 - 12/31/25.

[3] Source: Bloomberg, 12/31/10 - 12/31/25.

[4] Source: Bloomberg, 12/31/10 - 12/31/25.

Learn More

REGL

S&P MidCap 400 Dividend Aristocrats ETF

Seeks investment results, before fees and expenses, that track the performance of the S&P MidCap 400® Dividend Aristocrats® Index.