Key Observations

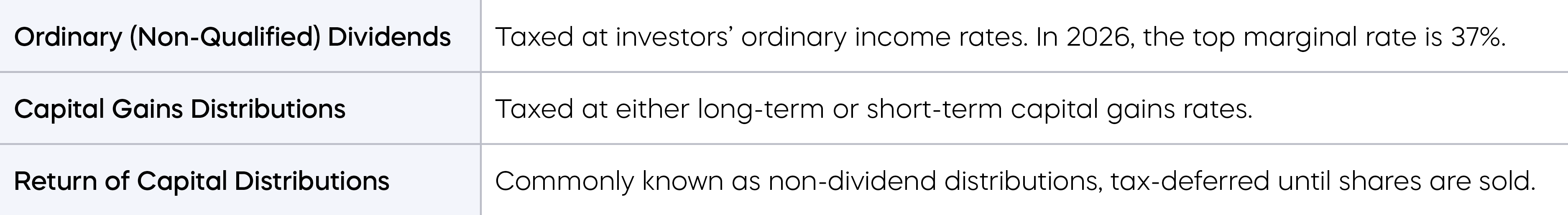

- Distributions from covered call strategies can generally be characterized in three ways for tax purposes—ordinary dividends, capital gains, and tax return of capital—each with a unique tax treatment.

- Distributions characterized as tax return of capital (or non-dividend distributions) can have potential advantages.

- Investors should consult with a tax professional and reference Form 1099-DIV to determine the tax characteristics of their distributions.

Covered call strategies, which generate income by selling call options on held stocks, can be a powerful tool for investors who are looking for more income than their fixed income holdings might typically generate. Investors evaluating covered call strategies for their portfolio should focus on how well a particular covered strategy delivers both income and total return. (For example, covered call strategies driven by daily options strategies target both high income and equity market returns over time.)

Taxation, however, is another critical factor for investors to consider. How a covered call strategy’s distributions are taxed can have a significant impact on an investor’s long-term results.

Not All Distributions Are Created Equal

Covered call ETF distributions are generally reported to shareholders in three primary ways: as dividends, as capital gain distributions, or as non-dividend distributions. The mix of these distributions can vary by fund and change in any given year.

It is important to understand that these strategies can be subject to some or all of the tax treatments outlined above. Some covered call strategies make distributions characterized only as ordinary dividends. Other strategies make distributions that may include all three types. And since investors’ individual tax rates vary significantly, there can be a large difference between what investors receive in fund distributions on a pre-tax basis, and what they keep after paying taxes.

Simply put, some strategies produce income distributions that are more tax efficient than others.

What to Know About Return of Capital Distributions

Tax treatment of return of capital (ROC) distributions are often misunderstood. For the purpose of our discussion here, let’s clarify that we will refer to ROC as a tax concept, not an economic one.

Return of capital (ROC), reported as non-dividend distributions, is generally not taxable when received. Instead, it typically reduces an investor’s cost basis. When shares are sold, the reduced basis may result in a capital gain (or a smaller loss). Then, as with most investments, if shares are held more than one year, any gain may be eligible for long-term capital gains treatment. ROC can also improve current after-tax cash flow, because it defers—not eliminates—tax liability.

If an investor sells an ETF with ROC for a gain after a holding period of at least 12 months, they could receive the benefit of long-term capital gain tax treatment.

Look to Form 1099-DIV

Investors should consult their tax professional and IRS form 1099-DIV for information regarding the final tax characterization of any ETF distributions.

Covered call ETFs generally issue a notification known as a 19a-1 notice. This is a notification required by the Investment Company Act of 1940 that requires funds to provide the sources of distributions when they are not paid solely from net investment income. 19a-1 notices are accounting-source disclosures and are not intended to be relied upon to estimate future tax liability, and they should not be used for income tax planning purposes. Final shareholder tax reporting is provided by Form 1099-DIV.