In Part I: The Significance of Portfolio Hedging, we talked about the inevitability of market downturns, and we introduced the concept of portfolio hedging as a way to help mitigate their effects. But how exactly do you build a hedge?

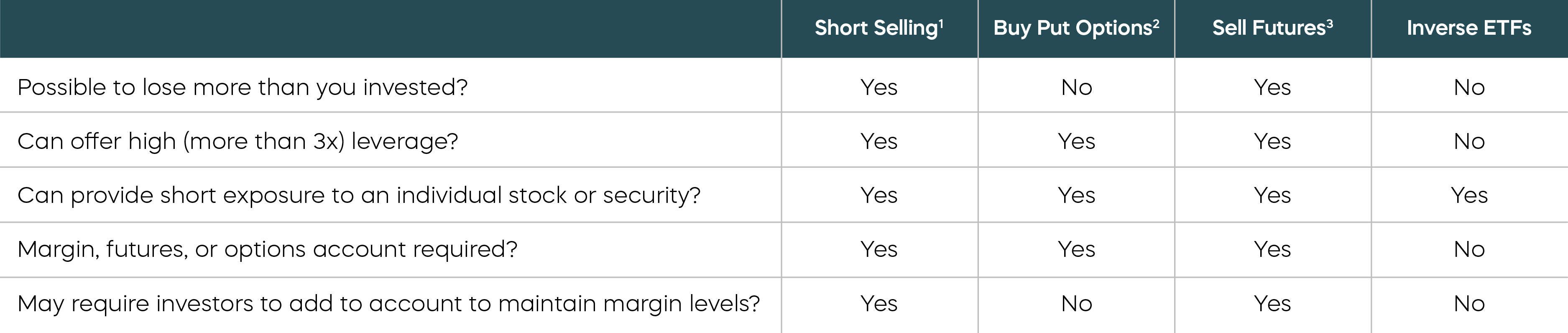

The most direct hedge you could implement would be to buy an investment that offsets 100% of losses in an investment during a specific time period. In reality, few, if any, investments have such ability. There are, however, several common hedging strategies investors use to help mitigate portfolio risk: short selling, buying put options, selling futures contracts and using inverse ETFs.

Hedging with Inverse Exposure—Pros and Cons of Different Hedging Strategies

While short selling, buying put options and selling futures contracts are widely used hedging techniques, they are quite sophisticated and have drawbacks that may place them beyond the reach of many investors. Inverse ETFs may be a preferable hedging alternative, as they may not have certain drawbacks that can be present with short selling, buying put options and selling futures contracts. There are, of course, disadvantages and risks with inverse ETFs too, and you should carefully read the prospectus for any fund you are considering for a more complete description.

1“Short selling” or “shorting” is the process of borrowing securities from a lender, typically for a small fee, with the intent to sell them at market value and then buy them back at a lower cost to return to the lender (known as covering the short).

2A contract between two parties in which the buyer of the put has the right (but not the obligation) to sell a security at an agreed-upon price to the seller of the put, regardless of its market price.

3Selling an agreement, facilitated through a futures exchange, to buy or sell an asset at a predetermined price on a predetermined date in the future (the expiration date).

4Designed to move in the opposite direction of a benchmark or index, by the inverse (-1x) or by multiples of the inverse (-2x or -3x).

A Closer Look at Inverse ETFs

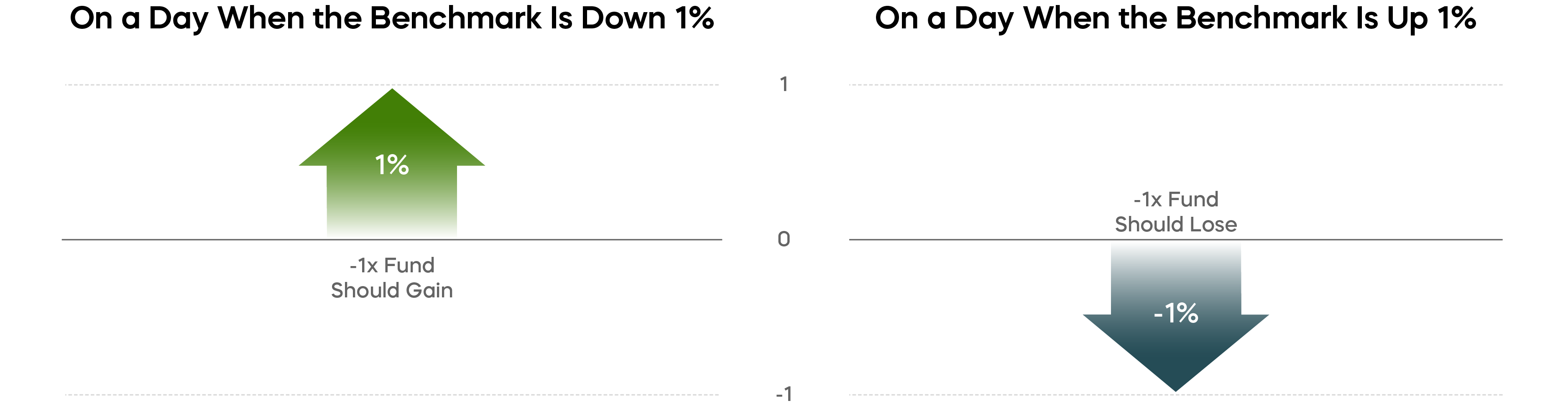

The concept behind inverse ETFs is not difficult to understand, so let’s see how they work in general. Take, for example, an inverse S&P 500 ETF designed to move directly opposite the market (-1x to the S&P 500) on a daily basis. If the S&P 500 declines 1% on a given day, a -1x inverse S&P 500 ETF is designed to rise by 1% that day (before fees and expenses). Of course, one of the risks is that the opposite can be true. If the S&P 500 should gain 1%, a -1x S&P 500 ETF should lose 1%. If you have a greater risk tolerance, or if you’re interested in using less capital when hedging an investment, you can magnify these effects, up and down, by using an inverse ETF with a multiple (-2x or -3x) of the exposure.

One-Day Investment Objectives

Conventional index funds are designed to match the performance of an underlying index over any time period. Most inverse ETFs, however, are designed to meet an investment objective, or multiple, for a single day only. This is to ensure that no matter when you invest, an inverse fund can be expected to deliver its stated multiple for that day. Without this one-day objective, gains and losses might result in compounded returns, which could cause the fund’s exposure to its benchmark to float unpredictably. To maintain their investment objectives, inverse funds rebalance their exposure to their underlying benchmarks each day by trimming or adding to their positions.

Holding Inverse Funds Longer Than for One Day

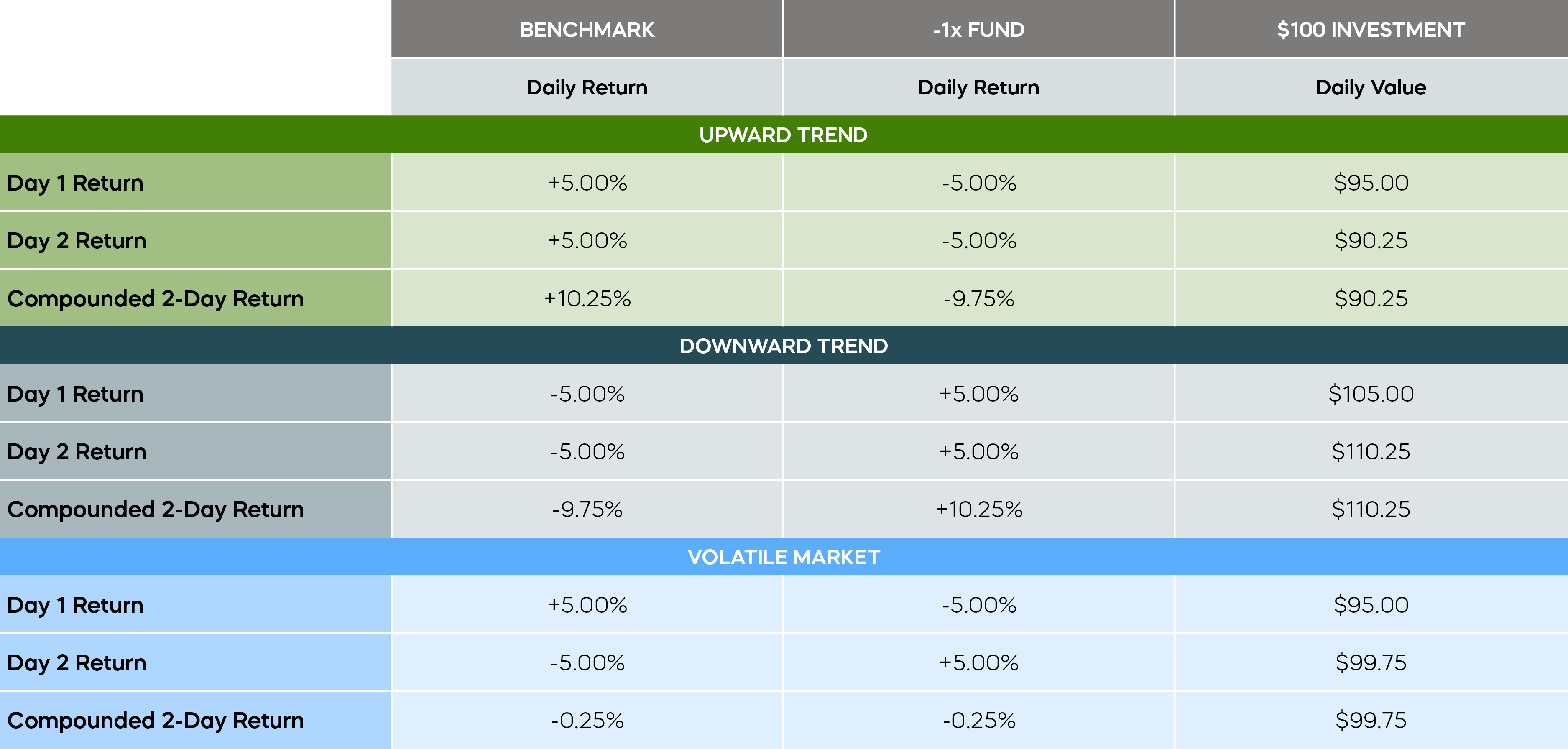

As a result of daily fund rebalancing, if you hold an inverse fund for longer than a day, to maintain a hedge position for example, it’s unlikely you will continue to receive the fund’s inverse multiple times the benchmark's returns. As long as you hold the fund, compounding can cause your exposure to the underlying benchmark to continue to deviate from the fund’s stated objective. In trending periods, compounding can enhance returns, but in volatile periods, compounding may hurt returns. The greater the multiple or more volatile a fund’s benchmark, and the longer your holding period while these factors apply, the more pronounced the effects may be.

The table below illustrates hypothetical returns for a -1x ETF in upward-trending, downward-trending and volatile markets. As you can see, two days of -5% returns for a -1x fund in an upward trending market result in a -9.75% return over the two-day period. Two days of 5% returns in a downward trending market result in a 10.25% return over the two-day period. In a volatile market, a 5% loss followed by a 5% gain does not result in a 0% return, but -0.25%. Investors using inverse funds over periods longer than one day are encouraged to actively monitor their investments, as frequently as daily, and to consider a rebalancing strategy for their holdings.

For illustrative purposes only. The example does not take into account any fees or costs associated with an investment in the funds. Actual investment returns may vary in amount and direction from the stated objective.

For illustrative purposes only. The example does not take into account any fees or costs associated with an investment in the funds. Actual investment returns may vary in amount and direction from the stated objective.

How Does Rebalancing Work?

As we mentioned earlier, rebalancing involves periodically increasing or decreasing an investment in a fund (in this case an inverse fund) to realign its value to the position originally intended. This process may involve fees and tax consequences. Prudent portfolio managers do much the same thing to manage portfolio weights. They will sell positions when weights get too high and buy positions when weights get too low in order to maintain their weighting targets.

There are two common rebalancing strategies: trigger-based and calendar-based. In a trigger-based approach, you would rebalance any time the difference between the desired hedge exposure and the ETF’s current value reaches a predetermined amount or percentage. How often you need to rebalance a trigger-based hedge can depend on several factors:

-

Fund Multiple: The greater the fund multiple, the more frequently you will need to rebalance. A -1x hedge will generally require less rebalancing than a -3x hedge.

-

Volatility: An inverse ETF with a more volatile underlying index may require more frequent rebalancing.

-

Percentage Trigger: In general, a larger percentage trigger will require less rebalancing than a smaller one (though the trades themselves may be larger).

If you are hedging over a significantly longer term, you might prefer a calendar-based technique. In that case, you would rebalance at set time intervals—weekly, monthly, quarterly, etc.—regardless of the difference in exposure between the investment being shielded and the hedge.

No matter which rebalancing approach you choose, there are several best practices to consider:

-

Evaluate the potential benefits of rebalancing against likely transaction costs and tax consequences.

-

Make sure you have the available cash on hand for the required transactions.

-

Monitor the position, as frequently as daily, no matter how often you intend to rebalance.

Pros and Cons of Rebalancing

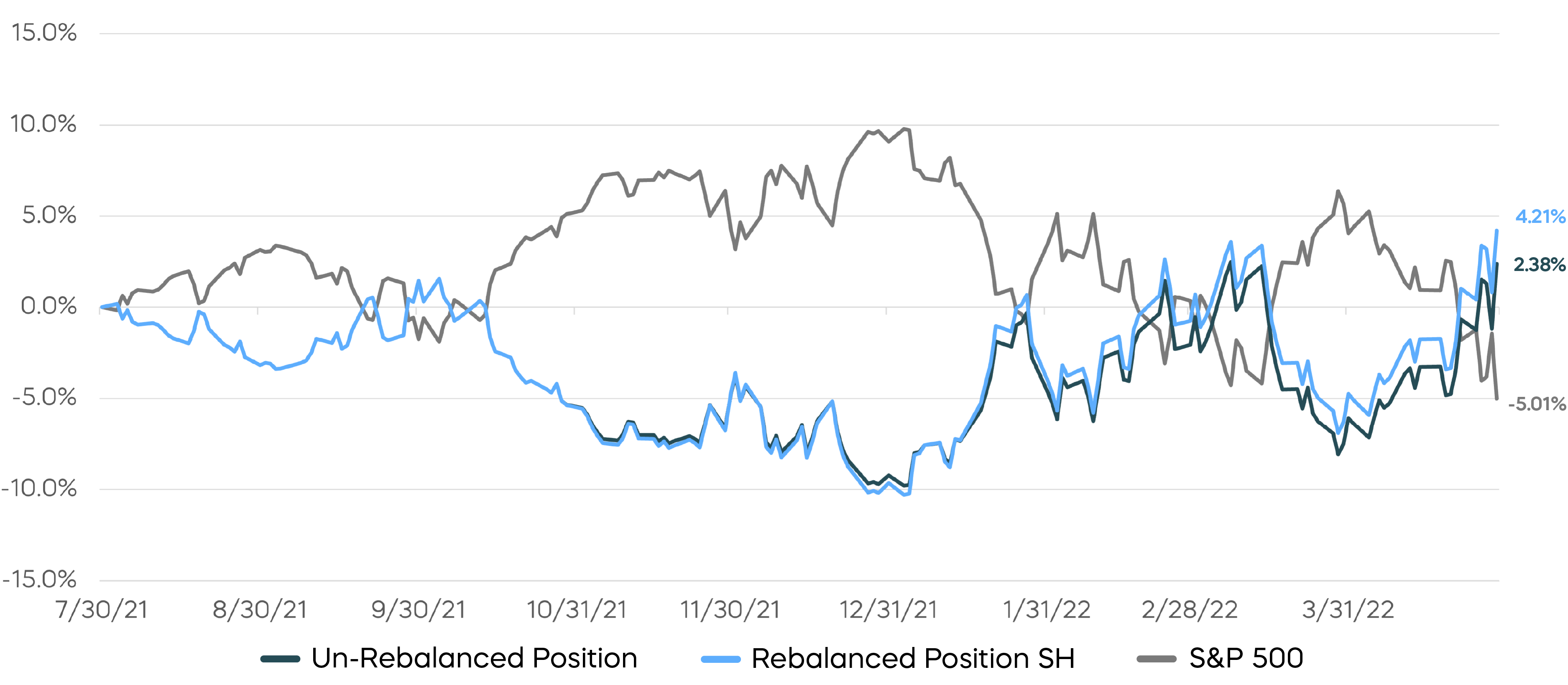

The chart below compares both rebalanced and un-rebalanced positions in the ProShares Short S&P500 ETF (ticker: SH) versus the S&P 500 over time to illustrate these effects. SH offers -1x daily inverse exposure to the S&P 500, and the rebalancing strategy used a 10% trigger-based approach. As you might expect, the rebalanced position in SH largely mirrored the S&P 500 throughout the period ending at 4.21%, compared to the S&P 500’s -5.01%. The rebalanced position in SH also outperformed the un-rebalanced position for the whole period. However, in the final months of 2021, while the S&P 500 was trending up, the un-rebalanced position was temporarily the better performer.

Rebalanced and Un-Rebalanced -1x S&P 500 ETF (SH) vs. S&P 500

For more information and to view current standardized performance for SH, click here.

Source: Bloomberg, 7/30/2021 – 4/29/2022. The illustration, using a 10% trigger on a hypothetical 20% hedge, would have required six rebalances. Illustration shows NAV returns. Market Price returns, which more closely reflect the experience of an investor, may yield different results. The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Shares are bought and sold at market price (not NAV) and are not individually redeemed from the fund. Market price returns are based upon the midpoint of the bid/ask spread at 4:00 p.m. ET (when NAV is normally determined for most funds) and do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. For both standardized performance and return data current to the most recent month end, see Performance. Index returns are for illustrative purposes only and do not represent fund performance. Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest in an index.

Read More

In Part III: The Efficacy of Hedging with Inverse ETFs, we will provide concrete examples across asset classes to show you how effectively inverse ETFs can mitigate the effects of market downturns.

|

INDEX/BENCHMARK |

DAILY OBJECTIVE |

|||

|

UltraPro Short |

UltraShort |

Short |

||

|

-3x |

-2x |

-1x |

||

|

BROAD MARKET |

||||

|

S&P 500 |

||||

|

NASDAQ-100 |

||||

|

NASDAQ-100 Mega |

-- | -- | ||

|

Dow Jones Industrial Average |

||||

|

S&P MidCap 400 |

||||

|

S&P SmallCap 600 |

-- |

|||

|

Russell 2000 |

||||

|

SECTOR |

||||

|

Dow Jones U.S. Basic Materials |

-- |

-- |

||

|

NASDAQ Biotechnology |

-- |

-- |

||

|

S&P Communication Services Select Sector |

-- |

-- |

||

|

Dow Jones U.S. Consumer Goods |

-- |

-- |

||

|

Dow Jones U.S. Consumer Services |

-- |

-- |

||

|

Dow Jones U.S. Financials |

-- |

|||

|

Dow Jones U.S. Health Care |

-- |

-- |

||

|

Dow Jones U.S. Industrials |

-- |

-- |

||

|

Dow Jones U.S. Oil & Gas |

-- |

-- |

||

|

Dow Jones U.S. Real Estate |

-- |

|||

|

Solactive-ProShares Bricks and Mortar Retail Store |

-- |

-- |

||

|

Dow Jones U.S. Semiconductors |

-- |

-- |

||

|

Dow Jones U.S. Technology |

-- |

-- |

||

|

Dow Jones U.S. Select Telecommunications |

-- |

-- |

-- |

|

|

Dow Jones U.S. Utilities |

-- |

-- |

||

|

INTERNATIONAL |

||||

|

MSCI EAFE |

-- |

|||

|

MSCI Emerging Markets |

-- |

|||

|

FTSE Developed Europe All Cap |

-- |

-- |

||

|

MSCI Brazil 25/50 Capped |

-- |

-- |

||

|

FTSE China 50 |

-- |

|||

|

MSCI Japan |

-- |

-- |

||

|

FIXED INCOME |

||||

|

ICE U.S. Treasury 20+ Year Bond |

||||

|

ICE U.S. Treasury 7-10 Year Bond |

-- |

|||

|

Markit iBoxx $ Liquid High Yield |

-- |

-- |

||

|

COMMODITY |

||||

|

Bloomberg WTI Crude Oil Subindex |

-- |

-- |

||

|

Bloomberg Natural Gas Subindex |

-- |

-- |

||

|

Bloomberg Gold Subindex |

-- |

-- |

||

|

Bloomberg Silver Subindex |

-- |

-- |

||

|

CURRENCY |

||||

|

EUR/USD 4:00 p.m. ET exchange rate |

-- |

-- |

||

|

JPY/USD 4:00 p.m. ET exchange rate |

-- |

-- |

||

|

CRYPTO-LINKED |

||||

|

Bloomberg Bitcoin Index |

-- |

|||

|

Bloomberg Ethereum Index |

-- |

|||

|

THEMATIC |

||||

|

Nasdaq-100 Mega Index |

-- |

-- | ||