What Makes an S&P 500 Dividend Aristocrat?

-

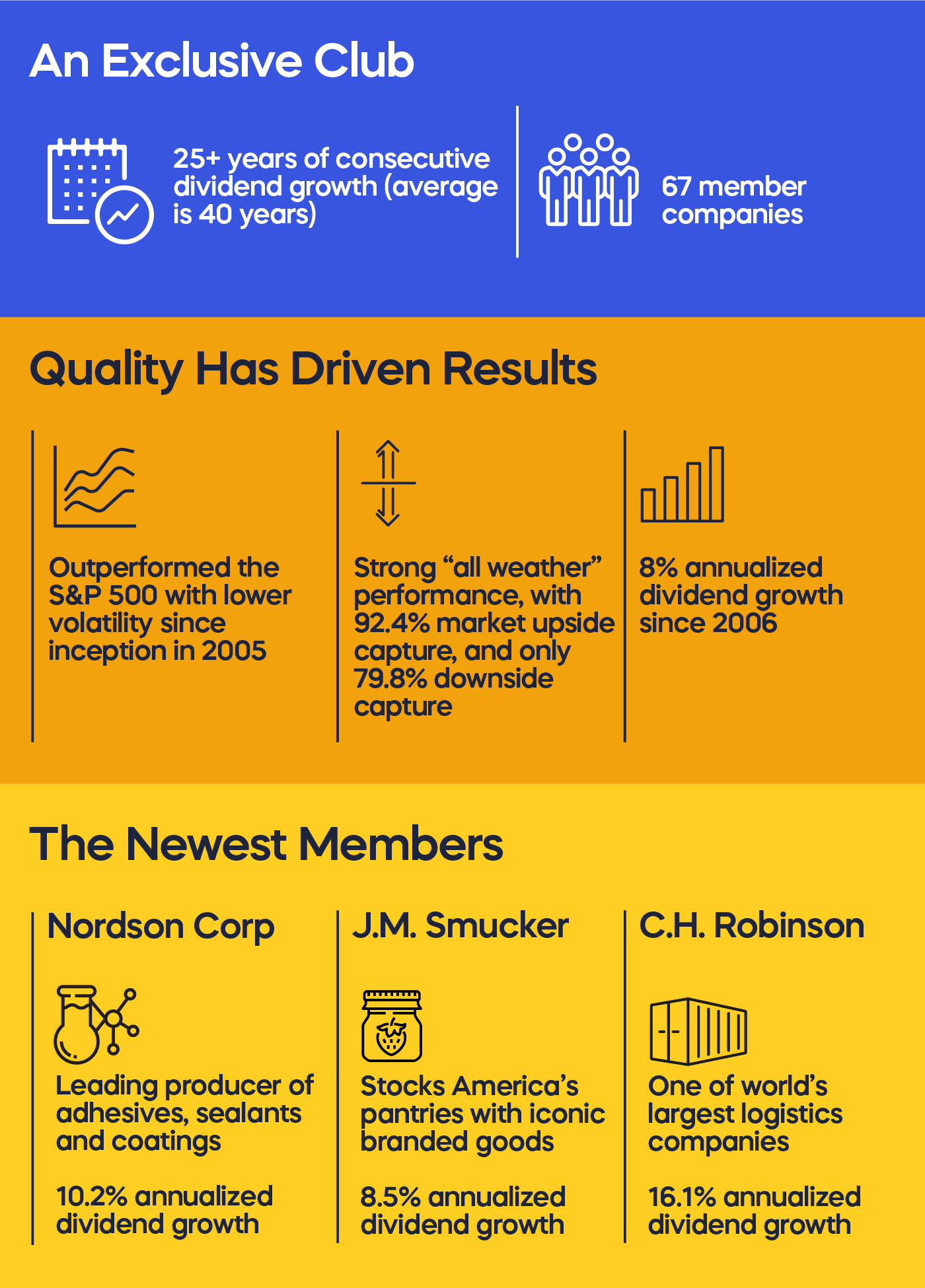

Robust Earnings: Often household names, they are an elite group of quality companies that have had stable earnings, solid fundamentals and strong histories of profit and growth.

-

Lower Volatility: The index has had strong performance with lower volatility than the S&P 500 since its inception in 2005.1

-

Consistent Dividend Growth: As a group, the S&P 500 Dividend Aristocrats have grown their dividends by 8% annually since 2006.2

What Companies Have Been Added in 2023?

-

C.H. Robinson (Ticker: CHRW)C.H. Robinson solves logistics challenges for global companies across industries. Headquartered in Eden Prairie, Minnesota, the company has grown its dividend by an average of 16.1% annually for the past 24 years.3

-

Nordson Corporation (Ticker: NDSN)Nordson is a leading engineer and manufacturer of systems that dispense, apply and control fluids, such as adhesives, sealants and coatings to a range of consumer and industrial industries. Headquartered in Westlake, Ohio, the company has averaged 10.2% annualized dividend growth over the last 25 years.4

-

J.M. Smucker (Ticker: SJM)J.M. Smucker is a manufacturer of food and beverage products, with many well-known brands such as Smucker’s® fruit spreads, Jif® peanut butter, Folgers® coffee and Milk-Bone® dog treats. Headquartered in Orrville, Ohio, the company has grown its dividend 8.5% per year on average over the last 25 years.5

S&P 500 Dividend Aristocrats

How Can You Invest in the S&P 500 Dividend Aristocrats?

Learn More

NOBL

S&P 500 Dividend Aristocrats ETF

Seeks investment results, before fees and expenses, that track the performance of the S&P 500® Dividend Aristocrats® Index.

REGL

S&P MidCap 400 Dividend Aristocrats ETF

Seeks investment results, before fees and expenses, that track the performance of the S&P MidCap 400® Dividend Aristocrats® Index.

SMDV

Russell 2000 Dividend Growers ETF

Seeks investment results, before fees and expenses, that track the performance of the Russell 2000® Dividend Growth Index.

TMDV

Russell U.S. Dividend Growers ETF

Seeks investment results, before fees and expenses, that track the performance of the Russell 3000® Dividend Elite Index.

TDV

S&P Technology Dividend Aristocrats ETF

ProShares S&P Technology Dividend Aristocrats ETF seeks investment results, before fees and expenses, that track the performance of the S&P® Technology Dividend Aristocrats® Index.

EFAD

MSCI EAFE Dividend Growers ETF

Seeks investment results, before fees and expenses, that track the performance of the MSCI EAFE Dividend Masters Index.

EUDV

MSCI Europe Dividend Growers ETF

Seeks investment results, before fees and expenses, that track the performance of the MSCI Europe Dividend Masters Index.

EMDV

MSCI Emerging Markets Dividend Growers ETF

Seeks investment results, before fees and expenses, that track the performance of the MSCI Emerging Markets Dividend Masters Index.