Key Observations:

-

E-commerce growth has kept up with its pre-pandemic pace.

-

Bricks-and-mortar retailers’ outperformance may have gone too far.

-

E-commerce gross margins expanded during the COVID-19 pandemic.

E-Commerce Growth Is Right on Schedule

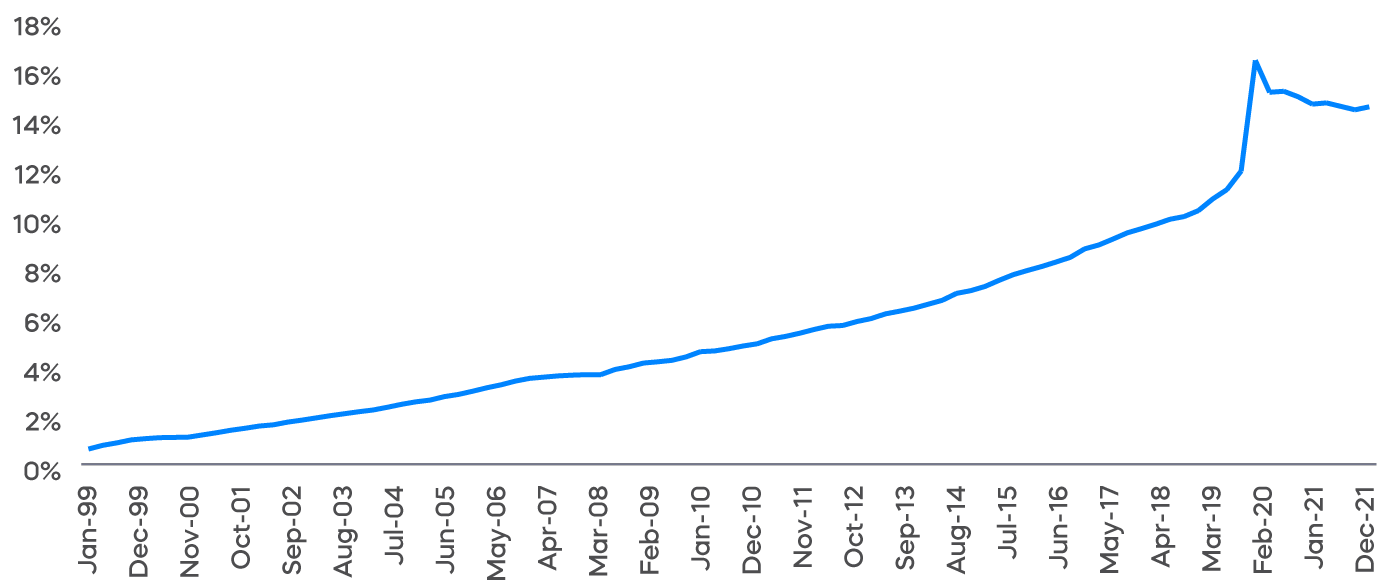

In March of 2020, the United States went into lockdown, and much of bricks-and-mortar retail was shuttered. E-commerce penetration increased nearly 40%, jumping from roughly 12% in the first quarter of 2020, to nearly 17% in the second quarter. Two years later, with the country predominantly reopened, e-commerce penetration has receded to 14.5%.

In the five years prior to the pandemic, e-commerce penetration rose from 7% to 12%—roughly 1% per year. What’s the takeaway? E-commerce penetration is over 2% higher than it was prior to the pandemic. That's still right on the long-term trend of roughly 1% increase per year. The steady growth of e-commerce is on schedule.

E-Commerce as a Percentage of Total Domestic Sales

Has the Bricks-and-Mortar Rebound Gone Too Far?

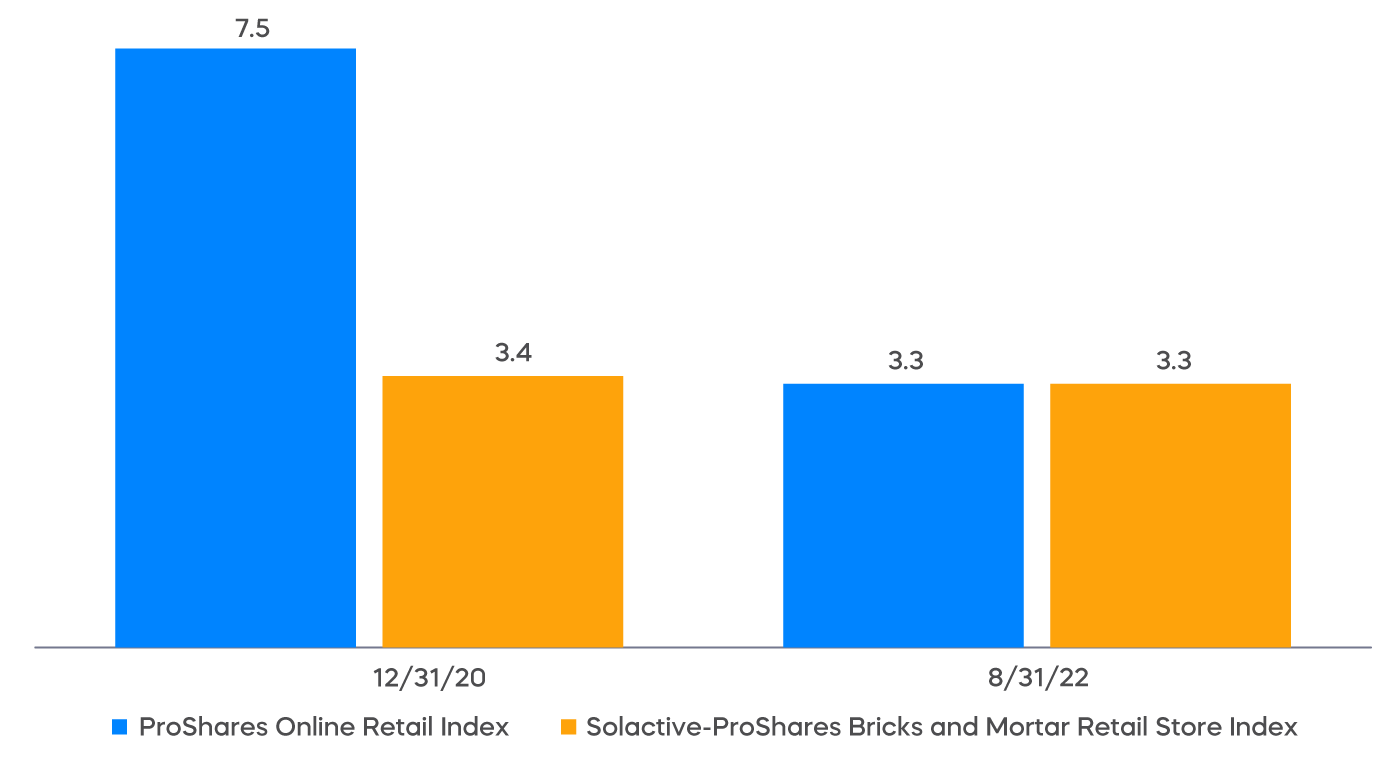

In perhaps a misguided market reaction to e-commerce’s retreat from its lockdown-driven levels, bricks-and-mortar retailers have outperformed online retailers since the end of 2020. As a group, bricks-and-mortar retailers are now trading at price-to-book parity to online retailers, compared to less-than-half prior to the pandemic. Perhaps the pendulum has swung too far? With just a 1% per year penetration growth trend, online retail penetration may grow 30-35% over five years without any increase in overall retail sales, and by 50% in seven years. That’s a lot of tailwind for e-commerce, and it’s coming at the expense of bricks and mortar.1

Bricks-and-Mortar Retailers Trading at Parity to Online Retailers

Price-to-Book Ratio

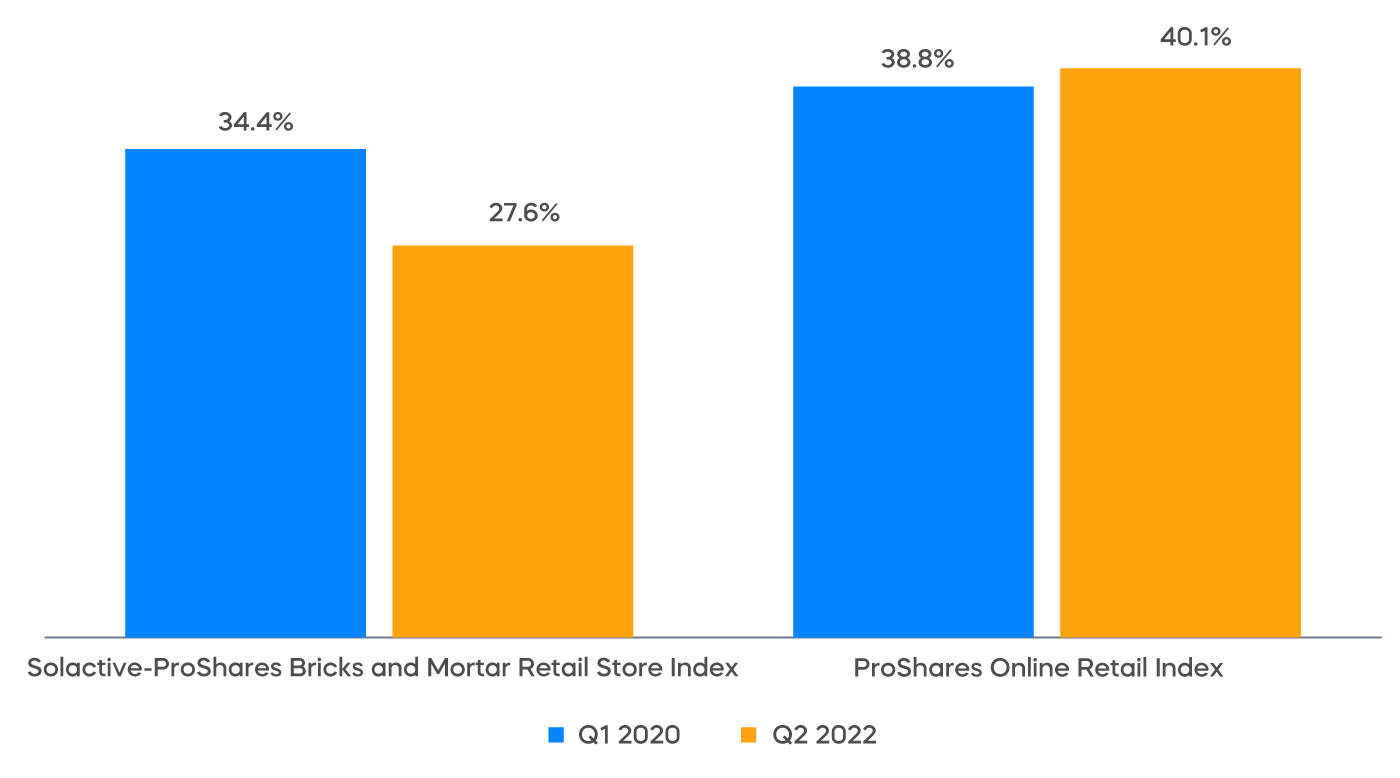

The Margin Advantage Goes to… Online Retail

At its core, retail is simple: Sell things for more than you pay for them. Inflation poses a challenge to all companies, retailers included. Can the price to consumers be increased fast enough to keep up with your rising costs? The answer, of late, is “yes” for online retailers and “no” for bricks-and-mortar retailers. Gross margins have fallen substantially from pre-pandemic levels for bricks-and-mortar retailers but have expanded for online retailers. What’s the source of this advantage? It’s hard to pinpoint, but among the likely answers are better and more dynamic control of inventory and more sophisticated customer targeting. Bricks-and-mortar retailers are, to some extent, fighting yesterday’s battle.

Margins Have Fallen for In-Store Retail and Expanded for Online

Capturing the E-Commerce Growth Opportunity with a Single Investment

To access the continuing potential growth of online retail, consider ProShares Online Retail ETF (ONLN). ONLN’s strategy pinpoints retailers that principally sell online or through other non-store channels, and then zeros in on the companies reshaping the retail space, like Amazon and Alibaba.

ONLN is an ETF that brings together the growth opportunity of online retail in a single ETF—enabling you to invest in how you shop.

Click here for fund performance. Indexes are unmanaged, and one cannot directly invest in an index. Past performance does not guarantee future results.

1Sources: Bloomberg, as of 8/31/22 (price to book); United States Census Bureau, 12/31/99-6/30/22 (growth); ProShares (calculations).

Learn More

Learn More

ONLN

Online Retail ETF

Seeks investment results, before fees and expenses, that track the performance of the ProShares Online Retail Index.