Moody’s Friday downgrade of the U.S. credit rating may not seem particularly earthshaking, given that Fitch and Standard & Poor’s had gotten there quite a while ago. Still, it’s an important reminder that the quintessential “risk-free” rate may not be quite so risk free. Just a smidge of perceived risk in U.S. Treasuries can put upward pressure on interest rates—particularly longer-maturity Treasuries. While there are a host of arguments as to why this may be so, perhaps the most obvious has been somewhat overlooked—the credit term premium. Time exacerbates credit risk. Today, for example, AAA U.S. industrials have nearly a zero spread to U.S. Treasuries for six-month maturities, but about 50bps spread for 10-year maturities, according to Bloomberg. What might this mean for the Treasuries themselves? A whiff of credit risk may steepen the U.S. Treasury curve—with a larger spread between the 10-year Treasury and the Fed Funds Rate.

Treasury Risk Could Drive a Steepening Yield Curve and Wider Rate Spreads

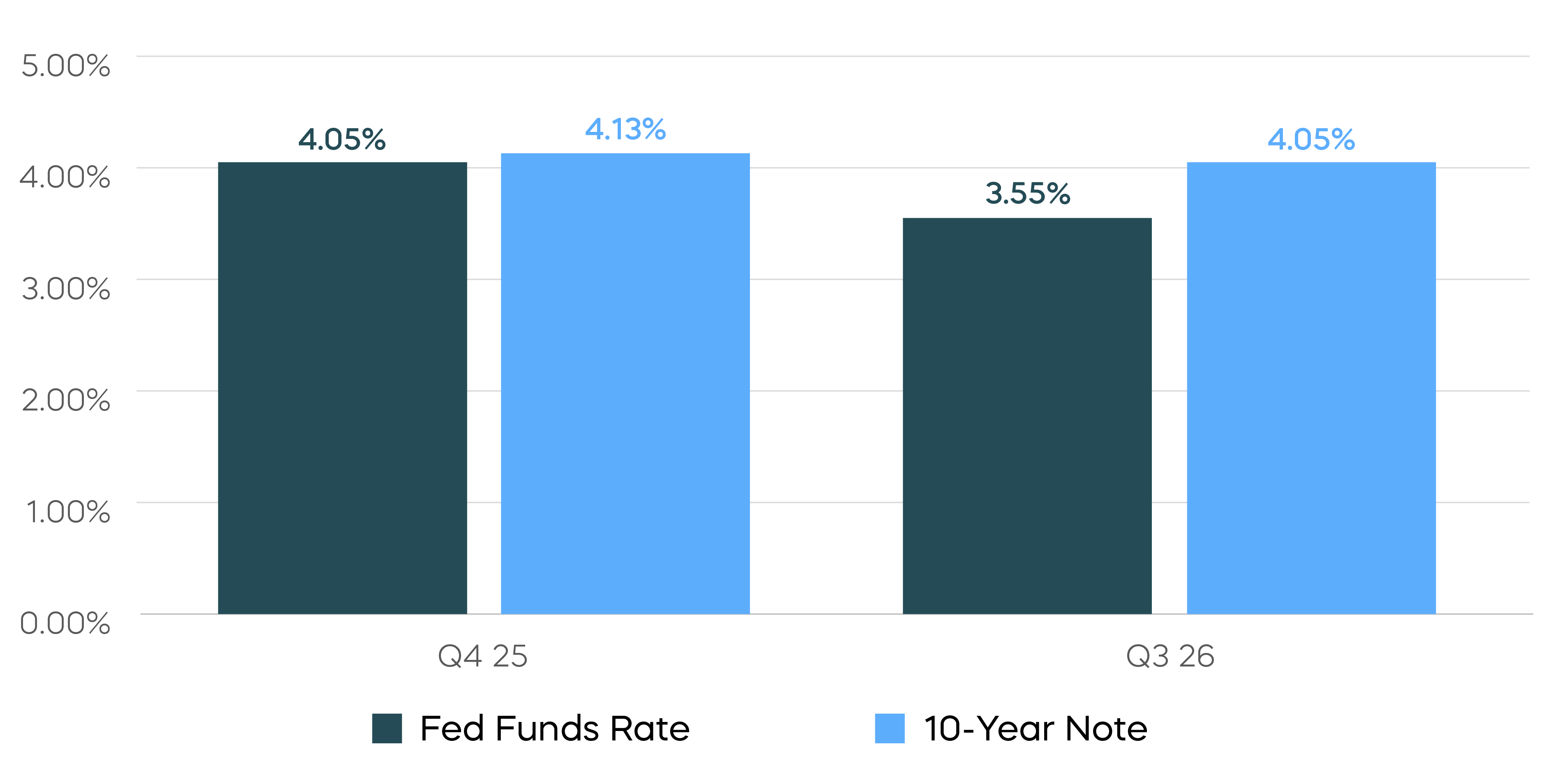

Figure 1: Bloomberg Consensus Interest Rate Forecasts as of 5/18/25

Even before the Moody’s downgrade, consensus forecasts indicated perhaps too flat of a yield curve. While 50bps of cuts both this year and next may be reasonable forecasts for the Fed Funds Rate, the historical average real yield on the 10-year Treasury of around 2.5% suggests a nominal yield more in the 4.5% range—and that’s if inflation gets down to 2%. Add that smidge of credit risk into the mix (oh, and maybe a little tariff-driven inflation) and a 4% 10-Year Treasury yield sounds a bit light.

Could 10-Year Treasury yields fall to 4% or even lower? Yes, but the likely driver would be a recession. And a meaningful recession just might force the Fed towards more cuts than currently forecast.

This is not intended to be investment advice. Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results.

Any forward-looking statements herein are based on expectations of ProShare Advisors LLC at this time. Whether or not actual results and developments will conform to ProShare Advisors LLC’s expectations and predictions, however, is subject to a number of risks and uncertainties, including general economic, market and business conditions; changes in laws or regulations or other actions made by governmental authorities or regulatory bodies; and other world economic and political developments. ProShare Advisors LLC undertakes no duty to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.