Dover Corporation (NYSE: DOV) stands as a global manufacturing powerhouse with a broad spectrum of industrial products. The company’s presence is integrated into everyday life, from the fuel pumps at your local gas stations to the refrigerators in your favorite supermarkets. However, the reach of Dover’s influence extends significantly deeper, offering a comprehensive range of equipment, services, as well as parts and components to other industries.

Organized into five distinct segments—Engineered Products, Clean Energy & Fueling, Imaging & Identification, Pumps & Process Solutions, and Climate & Sustainability Technologies—Dover’s portfolio is expansive and highly diversified. The company is focused on innovation in each field and, in 2018, launched a digital lab to ensure that each business segment remains at the forefront of digital transformation.

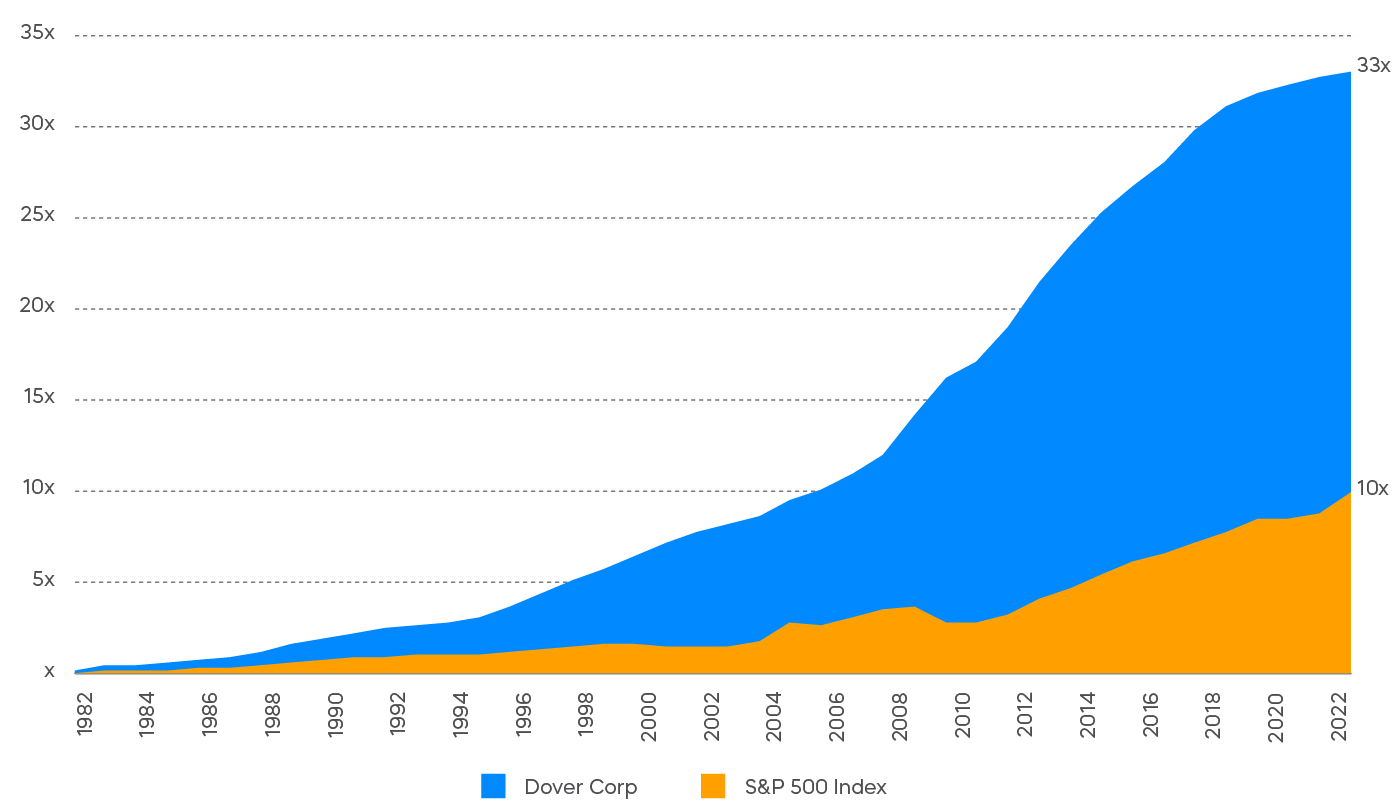

Dover’s broad global portfolio is not merely about boasting product variety. The diversified sources of revenue provide a strategic ability to maintain robust cash flow generation throughout various business cycles. For over a decade, Dover has consistently achieved a return on capital that not only exceeded the average in the industrial sector but also nearly doubled the broader S&P 500[1].

Dover's earnings resilience can be evident without the need to dig through quarterly financial statements. As a member of the S&P 500 Dividend Aristocrats[2], Dover has established an exceptional record of increasing dividends for 60 consecutive years, underscoring its stability and commitment to shareholder returns.

Cumulative Growth of Dividends since 1980

Source: Bloomberg. Available data from 1980 to 2022.

Dover Corporation is a great example of what it means to be a Dividend Aristocrat. Explore all the S&P 500 Dividend Aristocrats Index companies with the ProShares S&P 500 Dividend Aristocrats ETF (NOBL).

[1] Source: Bloomberg. Calendar year 2012 to 2022. Trailing 12-months return on capital indicates how effective a company is turning capital into profits.

[2] Source: https://www.spglobal.com/spdji/en/indices/dividends-factors/sp-500-dividend-aristocrats/#overview

Learn More

NOBL

S&P 500 Dividend Aristocrats ETF

Seeks investment results, before fees and expenses, that track the performance of the S&P 500® Dividend Aristocrats® Index.