Silver has rallied sharply over the past six months, outperforming many major asset classes and even gold. While geopolitical risk, easing monetary conditions, and inflation-related demand have supported precious metals broadly, silver’s move has been especially pronounced—bringing both its drivers and potential constraints into focus.

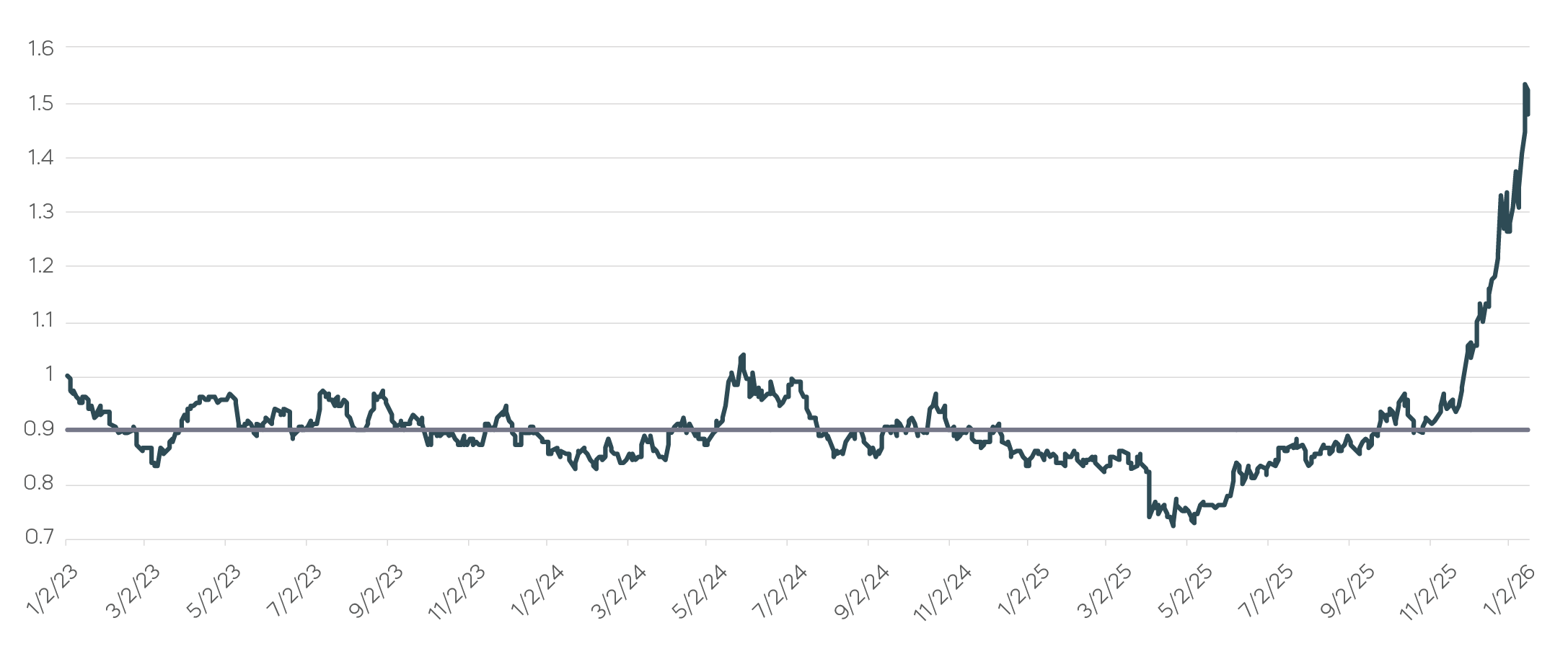

The price of silver is up over 140% since late July, compared to gold’s approximately 40% gain during the same period.[1] And from a valuation perspective, silver now sits well above recent norms. The silver-to-gold price ratio—which has averaged 0.9 since 2023 and had trended lower for more than a decade—recently reached a multi-year high. Such extreme performance could encourage bearish positioning by some speculators anticipating a moderation in prices.

At the same time, however, silver differs from traditional safe havens. Unlike gold, its demand is also meaningfully influenced by industrial uses, including electronics, solar energy, and broader electrification trends. This dual role has the potential to support silver even if geopolitical concerns ebb, provided global growth expectations and industrial demand remain firm.

Overall, silver continues to be driven by both macro sentiment and real-economy demand, but its price behavior often proves sensitive to changes in either, so investors should keep a close eye on any developments.

Silver’s Price Has Rallied, but Its Relative Value May Be Stretched (Silver-to-Gold Price Ratio)  Source: Bloomberg, based on comparison of cumulative spot price returns of silver and gold from 1/2/23 through 1/16/26. Past performance does not guarantee future results.

Source: Bloomberg, based on comparison of cumulative spot price returns of silver and gold from 1/2/23 through 1/16/26. Past performance does not guarantee future results.

[1] Source: Bloomberg, spot price returns of silver and gold, 7/31/25 – 1/16/26.