Investing involves risk, including the possible loss of principal. There is no guarantee any ProShares ETF will achieve its investment objective.

BITI and SETH seek daily investment results that correspond, before fees and expenses, to -1x the daily performance of its underlying benchmark (the “Daily Target”). SBIT seeks daily investment results that correspond, before fees and expenses, to -2x the daily performance of its underlying benchmark- the Bloomberg Bitcoin Index (the “Daily Target”). While the funds have a daily investment objective, you may hold the funds’ shares for longer than one day if you believe it is consistent with your goals and risk tolerance. For any holding period other than a day, your return may be higher or lower than the Daily Target. These differences may be significant. Smaller index gains/losses and higher index volatility contribute to returns worse than the Daily Target. Larger index gains/losses and lower index volatility contribute to returns better than the Daily Target. The more extreme these factors are, the more they occur together, and the longer your holding period while these factors apply, the more your return will tend to deviate. Investors should consider periodically monitoring their geared fund investments in light of their goals and risk tolerance.

These ETFs invest in derivatives (swap agreements, futures contracts and similar instruments) that provide indirect exposure to bitcoin or ether and do not invest directly in bitcoin or ether. Bitcoin and bitcoin derivatives, and ether and ether derivatives, are each a relatively new asset class, and the market for bitcoin and ether is subject to rapid changes and uncertainty. Bitcoin and bitcoin futures, and ether and ether futures, are subject to unique and substantial risks, such as rapid price swings and lack of liquidity, including as a result of changes in the supply of and demand for bitcoin and bitcoin futures contracts, and ether and ether futures contracts. Bitcoin and ether are largely unregulated and may be more susceptible to fraud and manipulation than more regulated investments. The value of an investment in these funds could decline significantly and without warning, including to zero. The ETFs may not be suitable for all investors.

The costs associated with rolling (buying and selling) futures and the impact of margin requirements, collateral requirements and other limits may have a negative impact on performance and prevent each Fund from achieving its objective. The price and performance of bitcoin futures and ether futures should be expected to differ from the current ‘‘spot’’ prices of bitcoin and ether (the prices of bitcoin and ether that can be purchased immediately). These differences could be significant.

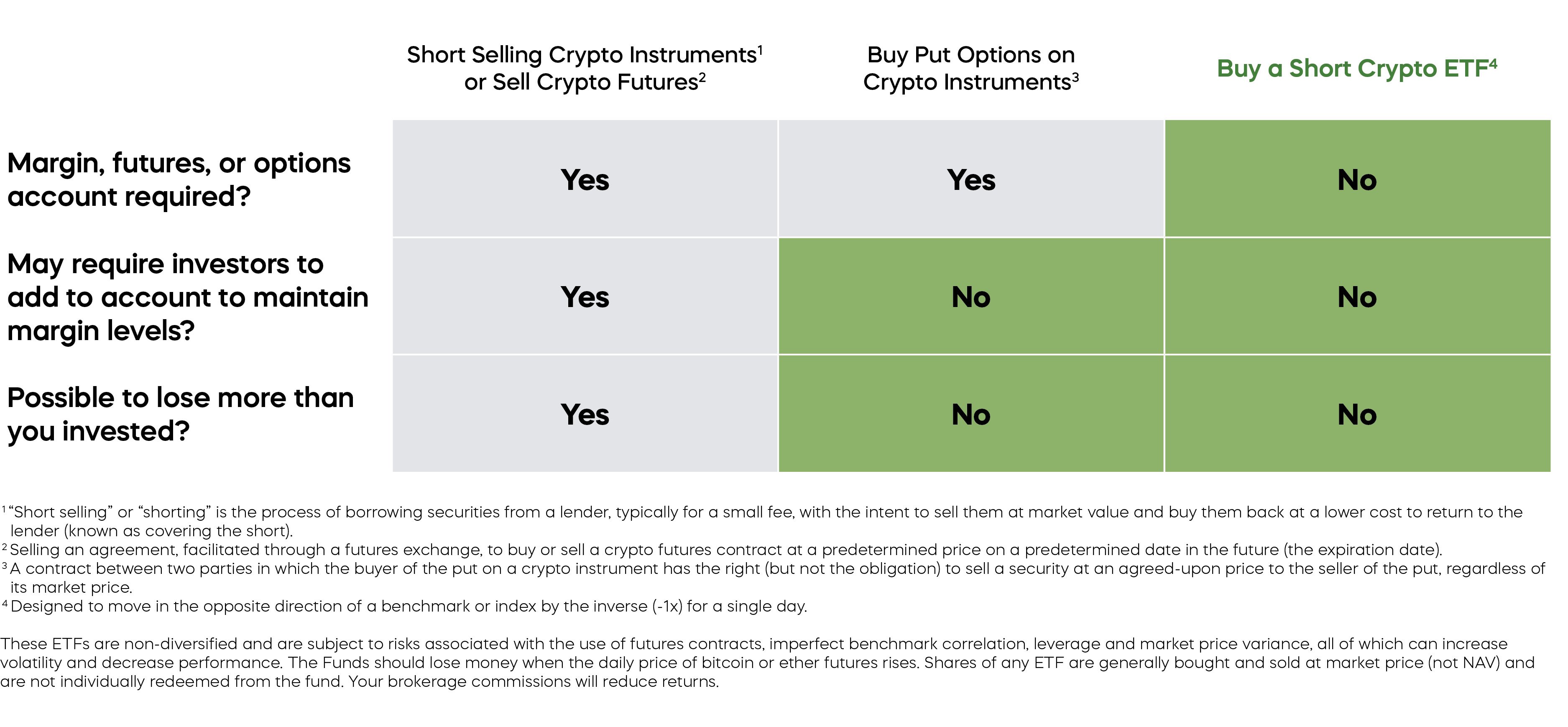

These ETFs are non-diversified and are subject to risks associated with the use of futures contracts, imperfect benchmark correlation, leverage and market price variance, all of which can increase volatility and decrease performance. The Funds should lose money when the daily price of bitcoin or ether futures rises. Shares of any ETF are generally bought and sold at market price (not NAV) and are not individually redeemed from the fund. Your brokerage commissions will reduce returns.

Carefully consider the investment objectives, risks, charges, and expenses of ProShares before investing. This and other information can be found in their summary and full prospectuses. Read them carefully before investing. Obtain them from your financial professional or visit ProShares.com.

ProShares are distributed by SEI Investments Distribution Co. ("SIDCO"), which is not affiliated with the funds' advisor or sponsor. SIDCO is located at 1 Freedom Valley Drive, Oaks, PA 19456.

©2024

If you are having issues loading a document, you may need to adjust your web browser settings, clear your browser's cache and/or cookies, or try a different web browser.

Settings on your internet browser may impact how documents and pages from ProShares.com appear on your device. To ensure the most up-to-date view of ProShares.com, it is recommended you clear your cache or select a different web browser.

Quote data provided by Interactive Data - Real Time Services, Inc. and subject to terms of use.

ProShares are distributed by SEI Investments Distribution Co., which is not affiliated with the funds’ advisor or sponsor.

Your use of this site signifies that you accept our Terms and Conditions of Use.