Mid-caps stocks have been called the forgotten asset class. Stuck between typically more popular large-cap stocks and the potential upside of small caps, the appeal of mid-caps is often overlooked. Similarly, dividend investors can under-appreciate the “sweet spot” of high-quality mid-cap stocks that have consistently grown their dividends. But make no mistake, mid-cap Dividend Aristocrats® represent a potentially compelling investment opportunity, and may warrant consideration when constructing portfolios.

The Case for Mid-Cap Stocks

The mighty mid-caps…

The forgotten asset class…

The sweet spot…

-

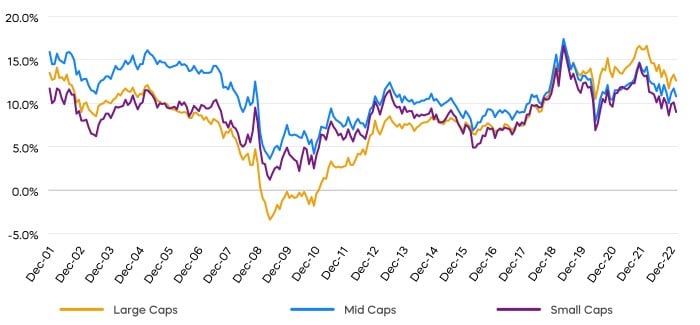

The S&P MidCap 400 has delivered greater nominal and risk-adjusted returns compared to the large-cap S&P 500 and small-cap Russell 2000 Index.

-

Mid-cap stocks also consistently outperformed over longer periods, delivering better returns than large and small caps in 83% of the rolling 10-year return periods since 1991.

As of 12/31/2022, mid-cap stocks represent 20% of total U.S. market capitalization, according to Morningstar. However, despite their long-term outperformance, they represent just 11% of domestic mutual fund and ETF assets.

Mid-Cap Stocks Have Had Consistently Higher Rolling 10-Year Returns

Source: Morningstar, data from 9/1/91‒12/31/22.

What Makes a Mid-Cap Aristocrat?

The Dividend Aristocrat brand is well known to investors who seek to invest in high-quality companies with the longest records of consistent dividend growth. Many investors intuitively associate dividends with large-cap stocks, particularly from companies with prominent brands that make products they consume regularly. Household large-cap names like Coca-Cola, Procter & Gamble, and Johnson & Johnson have been growing their dividends for over 50 consecutive years.

What’s often missed, however, is that similar dividend longevity also exists in mid-cap stocks. While their names may be less familiar, their dividend records are often no less impressive.

-

Durable competitive advantages, solid fundamentals, and management teams that are committed to returning capital to shareholders.

-

Higher gross and net profit margins than the broader index, with more consistent levels of earnings growth through the market’s ups and downs.

-

Lower levels of debt than the broader S&P MidCap 400.

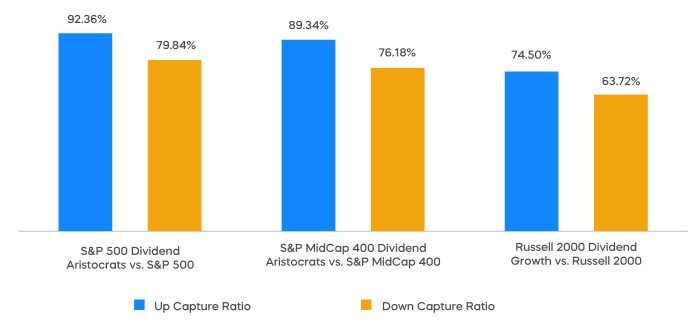

Since its inception in 2015, the S&P MidCap 400 Dividend Aristocrats Index has outperformed the broader S&P MidCap 400 by 177 basis points annualized, with lower levels of volatility. The mid-cap Dividend Aristocrats have also demonstrated a history of weathering market turbulence over time. They’ve done so by delivering most of the market’s upside in rising markets with considerably less of the downside in falling ones—a valuable feature in times of uncertainty.

Mid-Cap Dividend Aristocrats Have Shown Superior Up/Down Returns Capture

Source: Morningstar. S&P 500 Dividend Aristocrats - 5/2/05 - 12/31/2022 S&P MidCap 400 Dividend Aristocrats: 1/5/15 -12/31/2022. Russell 2000 Dividend Growth: 11/11/14 - 12/31/2022. Index returns are for illustrative purposes only and do not reflect any management fees, transaction costs, or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results. “Up capture ratio” measures the performance of a fund or index relative to a benchmark when that benchmark has risen. Likewise, “down capture ratio” measures performance during periods when the benchmark has declined. Ratios are calculated by dividing monthly returns for the fund’s index by the monthly returns of the primary index during the stated time period and multiplying that factor by 100.

Why Mid-Cap Dividend Aristocrats Now?

-

They are attractively priced, particularly relative to large caps. With a trailing 12-month price-to-earnings ratio of 15.58, they are trading below their recent averages, and at approximately 83% of S&P 500 levels. On a price-to-book basis, they are trading at approximately 60% the value of large caps.

-

Mid-cap Dividend Aristocrats have delivered faster levels of earnings growth. For calendar year 2022, MidCap Dividend Aristocrats delivered earnings growth of 11.1%, well above the 5.5% rate of the S&P 500 (as of 12/31/2022).

-

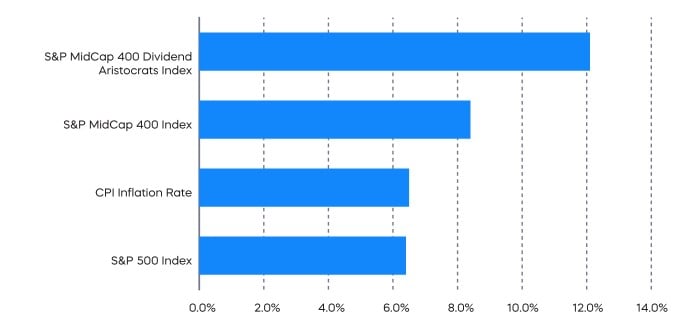

High inflation levels have put a premium on finding durable and growing income streams. The mid-cap Dividend Aristocrats grew distributions at an annualized rate of over 12% since 2015, a level above those of large caps and recent inflation levels.

Mid-Cap Dividend Aristocrats’ Dividend Growth Rates Can Help Combat Inflation

Source: S&P and Bureau of Labor Statistics, data from 1/5/2015 - 12/31/2022. The Consumer Price Index is the un-adjusted 12 months ended Dec 2022. It measures the change in prices paid by consumers for goods and services.

The Takeaway

Mid-cap stocks have delivered impressive and consistent levels of outperformance for decades. Although often overlooked, the S&P MidCap 400 Dividend Aristocrats—an elite group of mid-cap companies—have produced impressive levels and longevity of dividend growth. Since its inception the S&P MidCap 400 Dividend Aristocrats Index has outperformed the S&P MidCap Index and represents a potentially compelling investment opportunity. This opportunity is based on more favorable valuations as compared to large caps, robust earnings growth, and attractive levels of dividend growth.