The Two Sides of Technology Investing

Technology stocks have long been viewed as an exciting sector to invest in for growth, and, more specifically, innovation and invention. And while there will always be companies in the sector that are in high-growth mode, the sector as a whole has grown up from the long-ago days of the dot-com bubble. Growth and technology will always be synonymous for some investors, but the sector has evolved into having essentially two types of companies in it: early stage and well established.

Early-stage technology companies tend to be characterized by high growth rates, little-to-no profitability, and higher-than than-average volatility. This can be contrasted with well-established technology names with demonstrated staying power, healthy margins and plenty of free cash flows. Importantly, focusing on more mature tech companies doesn't mean sacrificing growth—these names still have long runways of attractive growth rates ahead of them. The upshot for income investors is that many of these well-established technology businesses are delivering yield to shareholders via dividends.

Technology Stocks Today—An Unexpected Source for Dividends

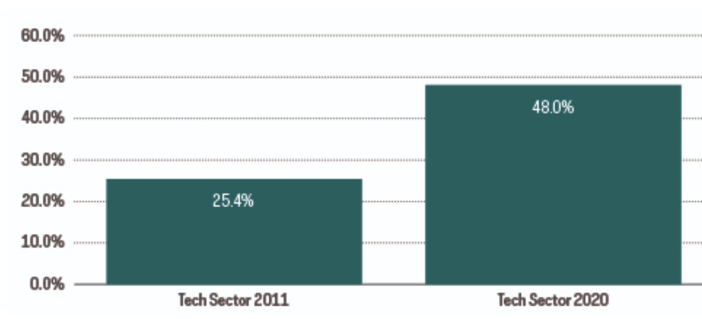

Investors may not immediately associate dividends with technology stocks. As recently as 10 years ago, relatively few technology companies even paid dividends, much less grew them. In fact, only one in four tech stocks paid a dividend in 2011.

The times have changed. According to S&P Dow Jones sector data, by 2020, approximately one-half of all technology stocks now pay a dividend and almost one-third are growing those dividends. The trend toward paying and growing dividends is also meaningful when compared with one of the sector’s consistent storylines—share buybacks. Paying and increasing dividends often indicate management’s confidence in the future trajectory of the business, while share buybacks may be driven by more transitory factors. If tech’s trend toward dividends is any indication, it seems likely that more technology companies will continue to initiate dividends over the coming years. Dividend investors who are not paying attention to the technology landscape may be missing a potential opportunity.

Nearly Half of Technology Companies Now Pay Dividends

Source: S&P Dow Jones Indices, S&P Composite 1500 technology sector data, December 2011 through December 2020.

Introducing the S&P Technology Dividend Aristocrats

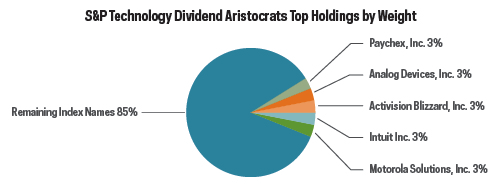

Recognizing the emergence of technology stocks as a prominent source for dividend growth, Standard and Poor’s introduced the S&P® Technology Dividend Aristocrats® Index in 2019. The index tracks the performance of technology and technology-related companies with a history of increasing dividends for at least seven consecutive years. The S&P Technology Dividend Aristocrats Index uses an equal-weighting methodology, which prevents concentration risk that can be caused by larger names in market-cap weighted indexes. We’ll talk more about this important distinction later.

Technology stocks are now fertile hunting ground for dividends, and, more specifically, for dividend growth, for three primary reasons:

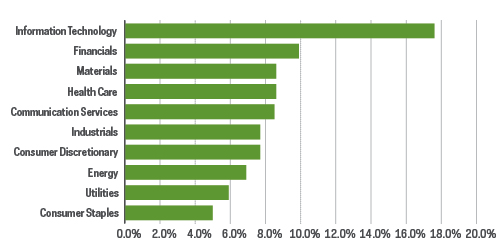

- The technology sector has become a critical source for the market’s dividends.

- As of June 2021, tech stocks contributed approximately 16% of the S&P 1500’s dividends—the second largest contribution of any sector.

- According to S&P Dow Jones Indices data, through the end of 2020, the technology sector has been growing its dividends at the fastest rate of any sector.

- Since 2011, the tech sector has quadrupled its dividend payout, and has grown dividends at a compound annual growth rate of over 16%, far exceeding other S&P 1500 sectors and the broad market in general.

Technology stocks are now fertile hunting ground for dividends—and dividend growth.

Information Technology Has the Highest Dividend Growth Rate in the S&P 1500

Source: S&P Dow Jones Indices, 1/1/11 through 12/31/20.

- Many well established tech and tech-related companies, like those in the S&P Technology Dividend Aristocrats Index, have grown their dividends for a minimum of seven years and have had hallmarks of quality such as stable earnings, solid fundamentals, and often strong histories of profit and growth

- According to FactSet, as of the beginning of 2021, the companies of the the S&P Technology Dividend Aristocrats Index have produced higher returns on equity and had lower debt than the S&P 500.

In addition to now helping capture dividend and income focused opportunities, the S&P Technology Dividend Aristocrats Index may also help address key challenges for investing in the sector in today’s market environment.

Challenge #1: Concentration Risk

Since 2007, the technology sector in the S&P 500 has drastically outperformed the market—and every other sector for that matter—by a wide margin. This has made the tech sector the market’s largest weight by market capitalization. Technology shares now represent over 26% of the S&P 500, the highest levels since the height of the dot-com bubble. The sector’s representation is so dominant that it is now larger than the six smallest sectors combined. Because the sector is a real driver of economic growth, it would be a huge bet to completely avoid tech stocks—kind of like avoiding U.S. stocks in one’s equity portfolio. The question for most investors should not be whether to invest in technology stocks, but how.

The Technology Sector's Weight Is Approaching All-Time Highs

Source: Morningstar, 1/1/90 through 5/21/21.

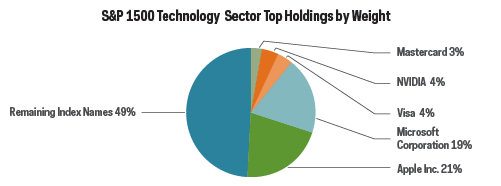

Answering that question itself can be a challenge. A majority of the technology sector’s outperformance over the last several years has come from a relatively small number of its largest stocks, as measured by market cap. For example, from June 1, 2016 through May 31, 2021—a period during which the S&P 500 technology sector delivered cumulative returns of almost 239%—the five largest stocks contributed half of the returns. Just ten stocks delivered approximately 70% of the sector’s returns.

The point here is that performance within the best performing sector over the last several years—technology—has been very narrow and primarily driven by the sector’s largest names. After such a long and sustained run, a market capitalization-weighted approach to the tech sector may not be optimal. An equal-weighted approach that enables a more balanced exposure to the sector may be wiser to minimize concentration risk.

Source: FactSet, S&P Composite 1500 technology sector weighting as of 5/31/21.

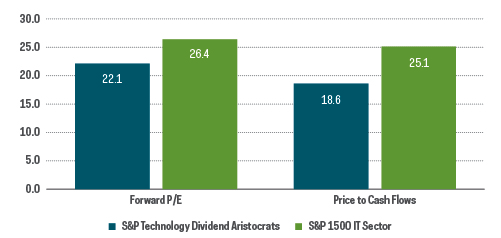

Challenge #2: Many Tech Stocks Are Expensive

After the multi-year run-up in the technology sector, valuations are unsurprisingly at premium levels. Tech stocks may arguably deserve a premium valuation, based not only on the strength of their fundamentals but on their growth prospects. Just how much of a premium is difficult to answer, however.

According to FactSet, going back to 2015, the sector’s price-to-earnings ratio has seen a sustained increase, and by the end of 2020, traded at a nearly 50% premium to its long-term median level. Price-to-earnings is a ratio valuing a company that measures its current share price relative to its per-share earnings. At some point, today’s valuations will come under increased market scrutiny. But not all technology stocks trade at premium prices. As a group, the companies within the S&P Technology Dividend Aristocrats Index trade at a relative bargain compared with the overall sector, potentially offering investors the upside of tech at the “right price.”

S&P Technology Dividend Aristocrats Trade at Lower Prices Versus the Tech Sector

Source: FactSet, as of 5/31/21

The rising interest rates that peaked in mid-February were a reminder of the perils of excessive valuation. As the 10-year Treasury yield moved from 92 basis points to 174 basis points during the first quarter of 2021, S&P 1500 technology sector stocks underperformed the S&P 1500 broad-market benchmark. Generally speaking, the most expensive technology stocks—as measured by price-to-earnings ratios—underperformed the most. In contrast, it was the least expensive decile of tech stocks that performed the best, up over 22% on average for the quarter.

The Takeaway

The technology sector has become a critically important component of today’s market. The sector has matured over time, and now represents some of the largest and most successful companies. That success has translated into increasingly large amounts of cash being returned to shareholders, and tech stocks have become the second-largest source of the market’s dividends. Technology stocks have also been growing their dividends at a faster rate than any other sector in the market. That all makes the equally weighted S&P Technology Dividend Aristocrats—quality companies that have grown their dividends for at least seven consecutive years—a potentially compelling opportunity for dividend- and income-focused investors. The S&P Technology Dividend Aristocrats may also be uniquely positioned to address today's challenges for investing in the technology sector.

Important Information

This is not intended to be investment advice. Any forward-looking statements herein are based on expectations of ProShare Advisors LLC at this time. ProShare Advisors LLC undertakes no duty to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Past performance does not guarantee future results.

Investing is currently subject to additional risks and uncertainties related to COVID-19, including general economic, market and business conditions; changes in laws or regulations or other actions made by governmental authorities or regulatory bodies; and world economic and political developments.

The "S&P® Technology Dividend Aristocrats® Index" is a product of S&P Dow Jones Indices LLC and its affiliates. All have been licensed for use by ProShares. "S&P®" is a registered trademark of Standard & Poor's Financial Services LLC ("S&P") and "Dow Jones®" is a registered trademark of Dow Jones Trademark Holdings LLC ("Dow Jones") and have been licensed for use by S&P Dow Jones Indices LLC and its affiliates. ProShares have not been passed on by these entities and their affiliates as to their legality or suitability. ProShares based on this index are not sponsored, endorsed, sold or promoted by these entities and their affiliates, and they make no representation regarding the advisability of investing in ProShares. THESE ENTITIES AND THEIR AFFILIATES MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO PROSHARES.

Learn More

TDV

S&P Technology Dividend Aristocrats ETF

ProShares S&P Technology Dividend Aristocrats ETF seeks investment results, before fees and expenses, that track the performance of the S&P® Technology Dividend Aristocrats® Index.