The Paradox of Dividends in Today’s Markets

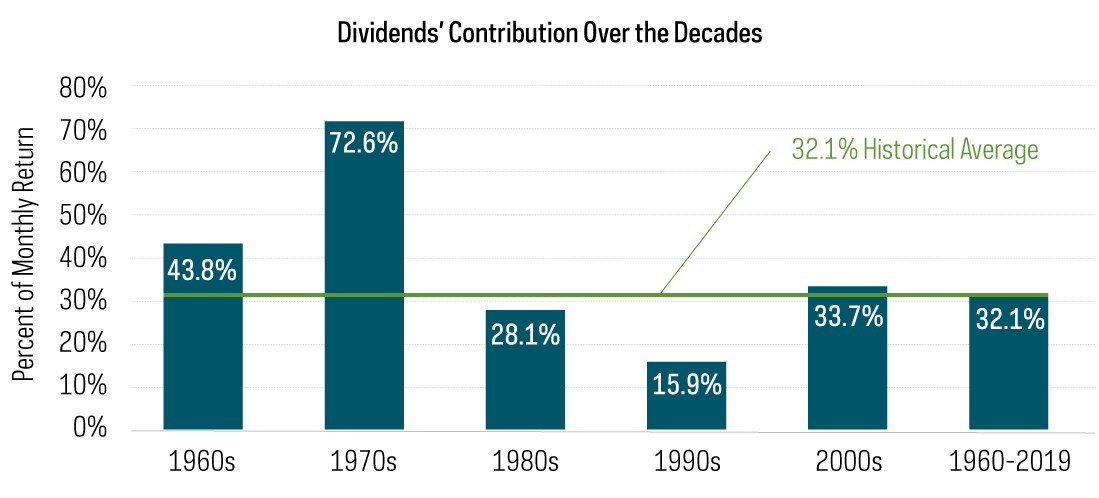

The pandemic-driven shutdown of much of the global economy—and the uncertain path to recovery—are weighing on nearly every aspect of the investment landscape. Of particular concern to many investors is the question of what will happen with dividends. It’s a fair question, when you consider that dividends have contributed approximately 32% of the S&P 500’s total return since 1960.

Source: Morningstar, 1/1/60-12/31/19. Past performance is no guarantee of future results. Chart is provided for illustrative purposes.

Paradoxically, if we are in for a period of muted equity returns—an environment where at least some companies’ dividends may be at risk—dividends may have increased importance. During the return-challenged 1970s, dividends accounted for nearly three-quarters of S&P 500 returns. It wasn’t an entirely lost decade. Investors earned a cumulative total return of 77% from the S&P 500 in that decade. The catch, however, was that 60% of that 77% was from dividends.

The Economic and Legislative Risk

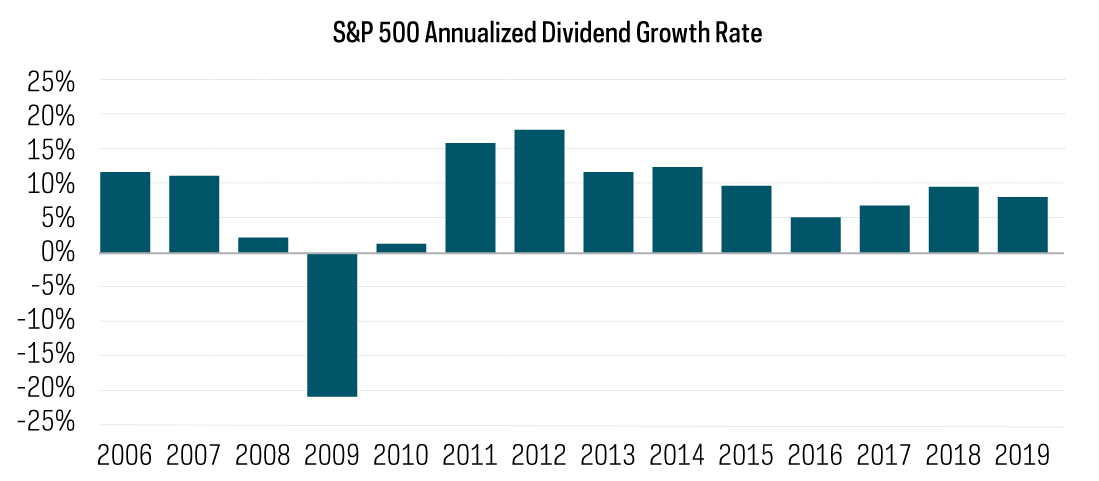

Dividends are what is left over after a company looks at its income and determines how much is needed to reinvest in the business and what should be saved for a rainy day. The remainder can be distributed to investors in the form of dividends. In times of economic risk, not only can that income shrink, but many companies increase their savings. Reductions in investment are often not enough to offset these challenges. Still, in most historical environments, dividends have increased for the S&P 500. The glaring exception is 2009, which saw a substantial decrease of over 20%. Given the significant impact of the current global shutdown and the implications for the potential path to recovery, it is a data point that should be considered relevant.

Source: ProShares and S&P Dow Jones Indices

In addition to the economic risk to dividends, investors have also become understandably concerned regarding the current legislative risks to dividends. In the United States, the CARES Act stimulus bill specifies that companies receiving federal assistance will, among other restrictions, be prohibited from paying a dividend for a period of time. The key to keeping this legislative risk in perspective is to remember that only companies that receive federal assistance will be subject to these restrictions. The legislative risk to dividends in the United States can be thought of as being encompassed by the broader economic risk, but not necessarily exacerbating it.

In contrast, European regulators have been discussing restrictions on paying dividends that are not contingent on receiving government assistance. The discussions have been limited to companies in the financial sector so far. There could, however, be a modest risk that some firms in Europe would be financially able to pay or raise their dividends, but could be legislatively prohibited from doing so.

The Current Dividend Scorecard

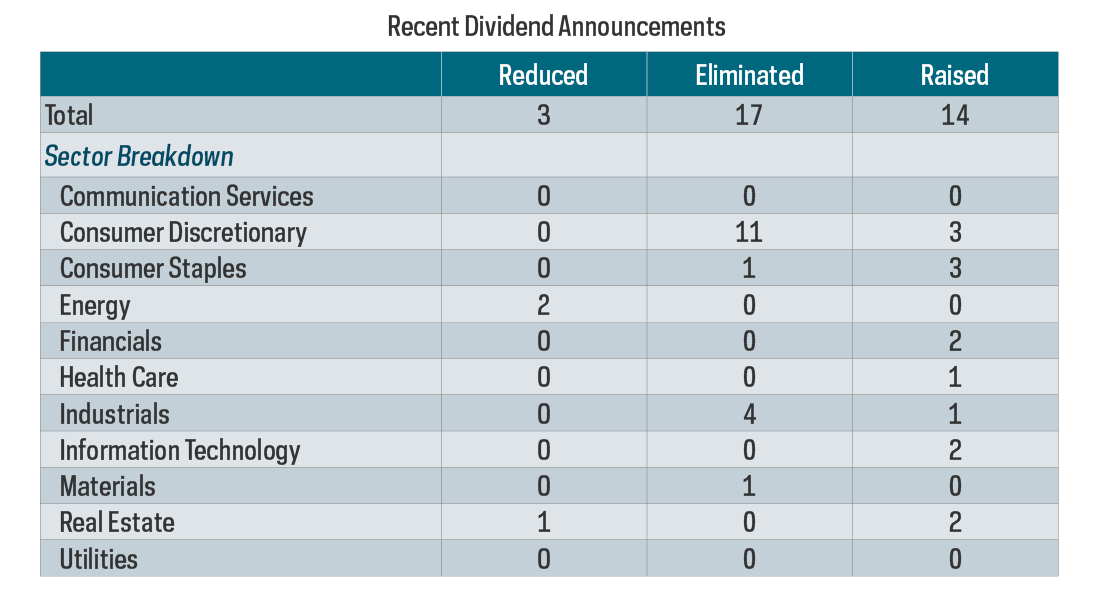

The announcements of dividend cuts and eliminations—and surprise, some increases—have already begun. Here is a rundown on dividends thus far:

Source: ProShares and Bloomberg. Based on DPS announcements from 3/1/20-4/16/20.

What’s Next in This Series

In the next installment, The Quality-Based Differences Developing in Dividends, we will look at the companies and sectors that may be most impacted by the pandemic, and those likely to show resilience as well.

This is not intended to be investment advice. Any forward-looking statements herein are based on expectations of ProShare Advisors LLC at this time. ProShare Advisors LLC undertakes no duty to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Investing is currently subject to additional risks and uncertainties related to COVID-19, including general economic, market and business conditions; changes in laws or regulations or other actions made by governmental authorities or regulatory bodies; and world economic and political developments.

Investing involves risk, including the possible loss of principal. There is no guarantee any ProShares ETF will achieve its investment objective.

Carefully consider the investment objectives, risks, charges and expenses of ProShares before investing. This and other information can be found in their summary and full prospectuses. Read them carefully before investing.

The "S&P 500® Dividend Aristocrats® Index," "S&P MidCap 400® Dividend Aristocrats Index" and "S&P® Technology Dividend Aristocrats Index®" are products of S&P Dow Jones Indices LLC and its affiliates. "Russell 2000® Dividend Growth Index," "Russell 3000® Dividend Elite Index" and "Russell®" are trademarks of Russell Investment Group. "MSCI," "MSCI Inc.," "MSCI Index" and "EAFE" are service marks of MSCI. All have been licensed for use by ProShares. "S&P®" is a registered trademark of Standard & Poor's Financial Services LLC ("S&P") and "Dow Jones®" is a registered trademark of Dow Jones Trademark Holdings LLC ("Dow Jones") and have been licensed for use by S&P Dow Jones Indices LLC and its affiliates. ProShares have not been passed on by these entities and their affiliates as to their legality or suitability. ProShares based on these indexes are not sponsored, endorsed, sold or promoted by these entities and their affiliates, and they make no representation regarding the advisability of investing in ProShares. THESE ENTITIES AND THEIR AFFILIATES MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO PROSHARES.

Learn More

NOBL

S&P 500 Dividend Aristocrats ETF

Seeks investment results, before fees and expenses, that track the performance of the S&P 500® Dividend Aristocrats® Index.