By Kieran Kirwan, CAIA

Key Observations

- Mid-cap stocks may be well-positioned during the current period of tariff-induced turbulence, as most of their revenue is typically sourced from within the United States.

- A potential antidote for the uncertainty around tariffs and their global economic impact may be the strong fundamentals that define companies like the Dividend Aristocrats, which consistently grow their dividends over time.

- The ProShares S&P MidCap 400 Dividend Aristocrats ETF (REGL) recently celebrated its 10-year anniversary and has historically delivered all-weather performance that could be well-suited in the current environment.

Why Mid-Caps for Fighting Tariff-Induced Turbulence

As this year began, it was our view that mid-cap stocks could become a compelling opportunity. Historically it’s been a mistake to ignore the so called “sweet spot” of domestic stocks. Since its inception in 1991, the S&P MidCap 400 Index has outperformed both large- and small-caps.[1] Mid-caps this year have also generally offered a better fundamental outlook than large caps, based on more favorable valuations coupled with attractive levels of expected earnings growth.

The fluid situation around tariffs has created enormous uncertainty in the markets. Investors are understandably wary of the implications of a trade war resulting in some combination of higher consumer prices, slowing growth, and lower corporate profits.

Considering the significant uncertainty and market stress evident today, the case for high-quality mid-caps only seems to have grown stronger.

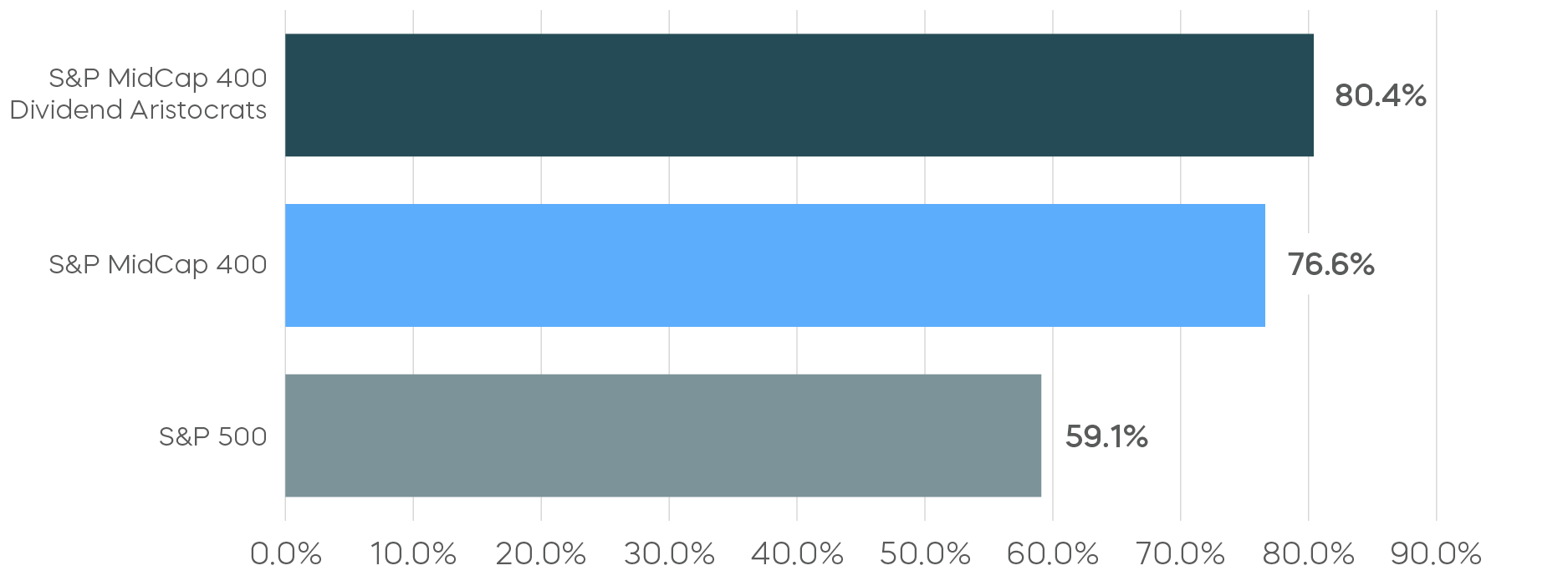

Mid-cap stocks, particularly the high-quality companies of the S&P MidCap 400 Dividend Aristocrats, are largely shielded from the noise around tariffs; most of their revenues are generated domestically. In contrast, roughly 40% of large-cap S&P 500 revenues come from offshore, potentially magnifying the exposure of those companies to tariff-based headwinds.

Percentage of Revenues Sourced From Within the U.S.

Sources: S&P Dow Jones Indices and Factset. Data as of 3/31/2025. Index returns are for illustrative purposes only and do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest directly in an index. Past performance does not guarantee future results.

Why Quality Mid-Cap Dividend Aristocrats Are a Timeless Approach

The S&P MidCap 400 Dividend Aristocrats Index® represents a distinguished group of companies that have consistently grown their dividends, year after year, for at least 15 consecutive years. Over half of them have grown their dividends for more than 25 consecutive years. With such an impressive track record, mid-cap Dividend Aristocrats have not only survived past periods of market turbulence, but thrived regardless of conditions.

When companies can raise their dividends in difficult economic periods, they are signaling their belief in the underlying strength of their businesses and management’s confidence in their ability to continue to grow revenues, profits and cash flows.

The signal this should send is one of long-term quality. Companies with long track records of dividend growth generally have attributes including durable competitive advantages, solid fundamentals, and management teams committed to returning capital to shareholders.

Mid-Cap Dividend Aristocrats Have Had All Weather Performance

The ProShares S&P MidCap 400 Dividend Aristocrats ETF (REGL) recently celebrated its 10-year anniversary. REGL tracks the S&P MidCap 400® Dividend Aristocrats® Index, which, since its inception in 2015, has outperformed the broader S&P MidCap 400 with lower levels of volatility.[2]

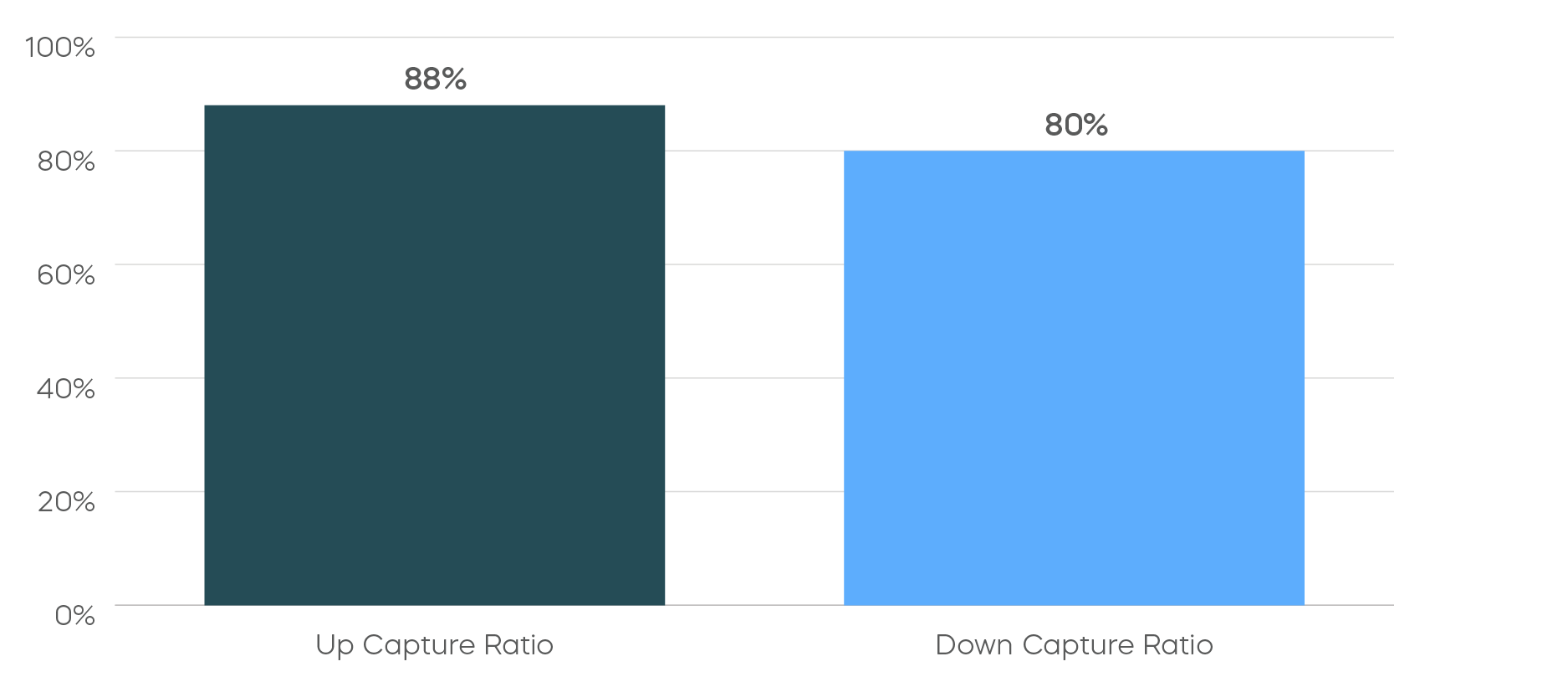

The mid-cap Dividend Aristocrats have also demonstrated a history of not just weathering but recovering well from market turbulence over time. They have delivered more of the market’s upside in rising markets, with less of the downside in falling ones—a valuable feature in times of uncertainty.

Upside/Downside Capture of the S&P MidCap 400 Dividend Aristocrats Index vs. S&P MidCap 400

Source: Morningstar. Data from 1/5/15 -3/31/2025. Index returns are for illustrative purposes only and do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest directly in an index. Past performance does not guarantee future results. “Up capture ratio” measures the performance of a fund or index relative to a benchmark when that benchmark has risen. “Down capture ratio” measures performance during periods when the benchmark has declined. Ratios are calculated by dividing monthly returns for the fund’s index by the monthly returns of the primary index during the stated time period and multiplying that factor by 100.

The Takeaway

Despite heightened levels of uncertainty and ongoing market turbulence related to U.S. tariff policy, high-quality mid-caps appear to be a compelling opportunity in 2025. U.S. mid-cap stocks typically generate most of their revenues from domestic sources, helping to insulate them from the effects of tariffs. And during periods of uncertainty, the S&P MidCap 400 Dividend Aristocrats offer the opportunity of investing in high-quality companies that have grown their dividends for a minimum of 15 consecutive years, regardless of market conditions.

ProShares S&P MidCap 400 Dividend Aristocrats ETF (REGL), which recently celebrated its 10-year anniversary, tracks the S&P MidCap 400 Dividend Aristocrats Index. The S&P MidCap 400 Dividend Aristocrats Index has not only outperformed the S&P MidCap 400 Index since its inception, but has generally delivered attractive all-weather performance over time.

[1] Source: Bloomberg, data from 7/1/1991-3/31/2025. Large-caps represented by S&P 500 Index, and small-caps represented by Russell 2000 Index

[2] Source: Morningstar, data from 1/5/2015 - 3/31/2025