Key Observations

- Infrastructure owners and operators provide real asset exposure in inflationary environments

- Opportunities for yield on infrastructure continue to be relatively strong

- Infrastructure companies have delivered consistent operating margins over time

How can investors power through rising inflation, low real yields and sluggish profits that are quickly becoming hallmarks of today’s volatile markets? The answer may lie with pure-play infrastructure companies. By owning critical products and services, these and other types of infrastructure companies can raise prices to offset inflation, pay reasonable dividends, and maintain consistent operating margins. That is a powerful trifecta amid current market conditions.

Fight Inflation Fears with Infrastructure

Inflation, as measured by the consumer price index (CPI), is at the highest level in the past 40 years,1 and New York Fed consumer survey data on one-year inflation expectations suggests that price increases could persist for some time. Inflation can have an adverse impact on growth and profitability simultaneously in many sectors. Owners of real assets, which provide essential services like energy and water, may buck the trend – and justify price increases in inflationary times.

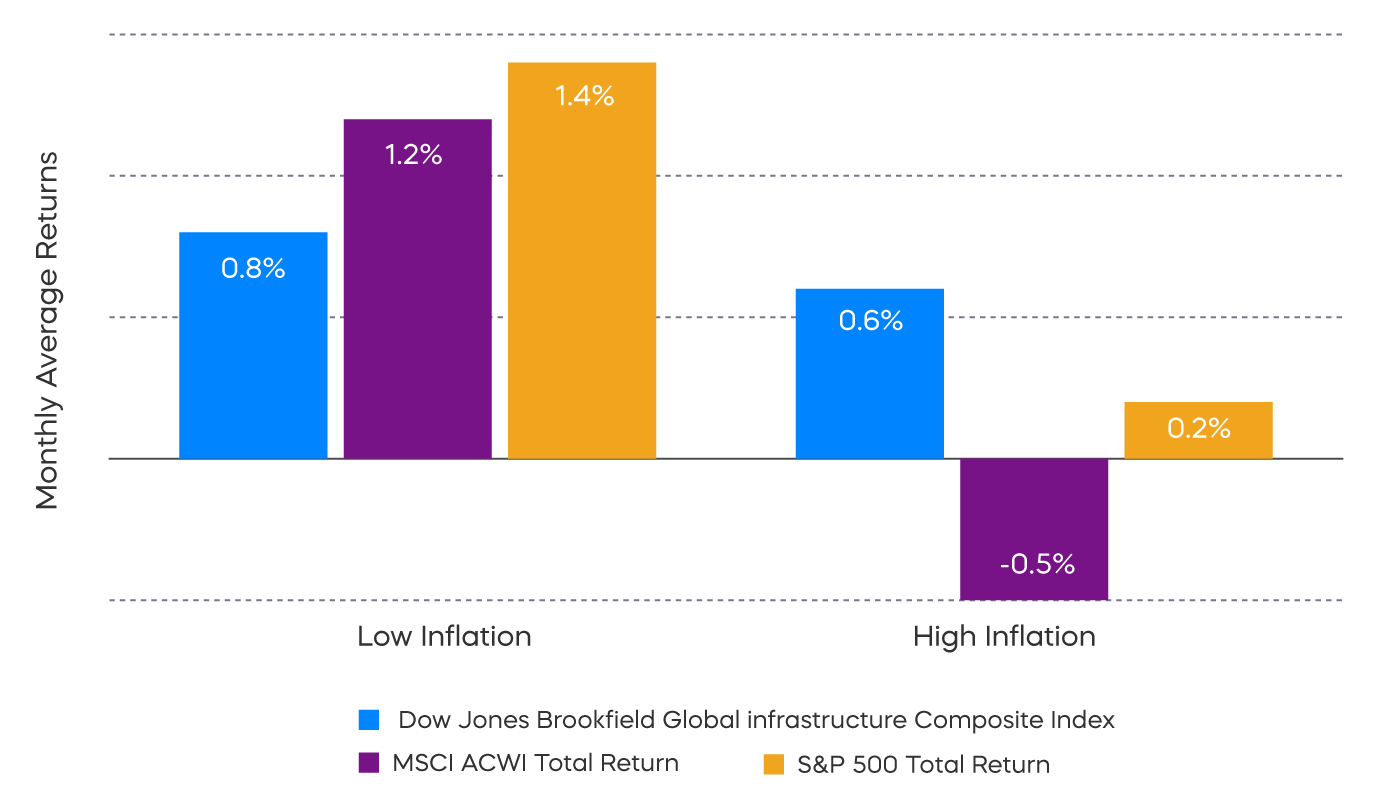

Over the course of two economic cycles, going back to 2008, infrastructure owners and operators have outperformed the S&P 500 in inflationary periods. When year-over-year inflation exceeded the average of 2.25%, 25 bps above the Fed target rate, the Dow Jones Brookfield Global Infrastructure Composite Index outperformed the MSCI ACWI Index

by 1.1% and the S&P 500 by 0.4% monthly on average. That translates to annual outperformance of more than 13%.

Pure-Play Infrastructure Companies Outperformed in Periods of High Inflation

Source: Bloomberg, 7/31/08-3/31/22. MSCI ACWI Index is a global equity index designed to represent performance of the full opportunity set of large- and mid-cap stocks across developed and emerging markets. Index information does not reflect any management fees, transaction costs, or expenses. Indexes are unmanaged, and one cannot directly invest in an index. Past performance does not guarantee future results.

Hungry for Yield

The hunt for yield has been challenging in the low interest rate environment that followed the 2008 global financial crisis. Now, the addition of rapidly rising inflation in a still relatively low interest rate environment makes this even more acute. Investors looking for yield may be skeptical of fixed income as the Fed starts a prolonged rate hiking cycle, since loss of principal could easily offset any gains from interest. Further, high inflation erodes real rates of return. While fixed income is principal protected, there is no participation in economic growth.

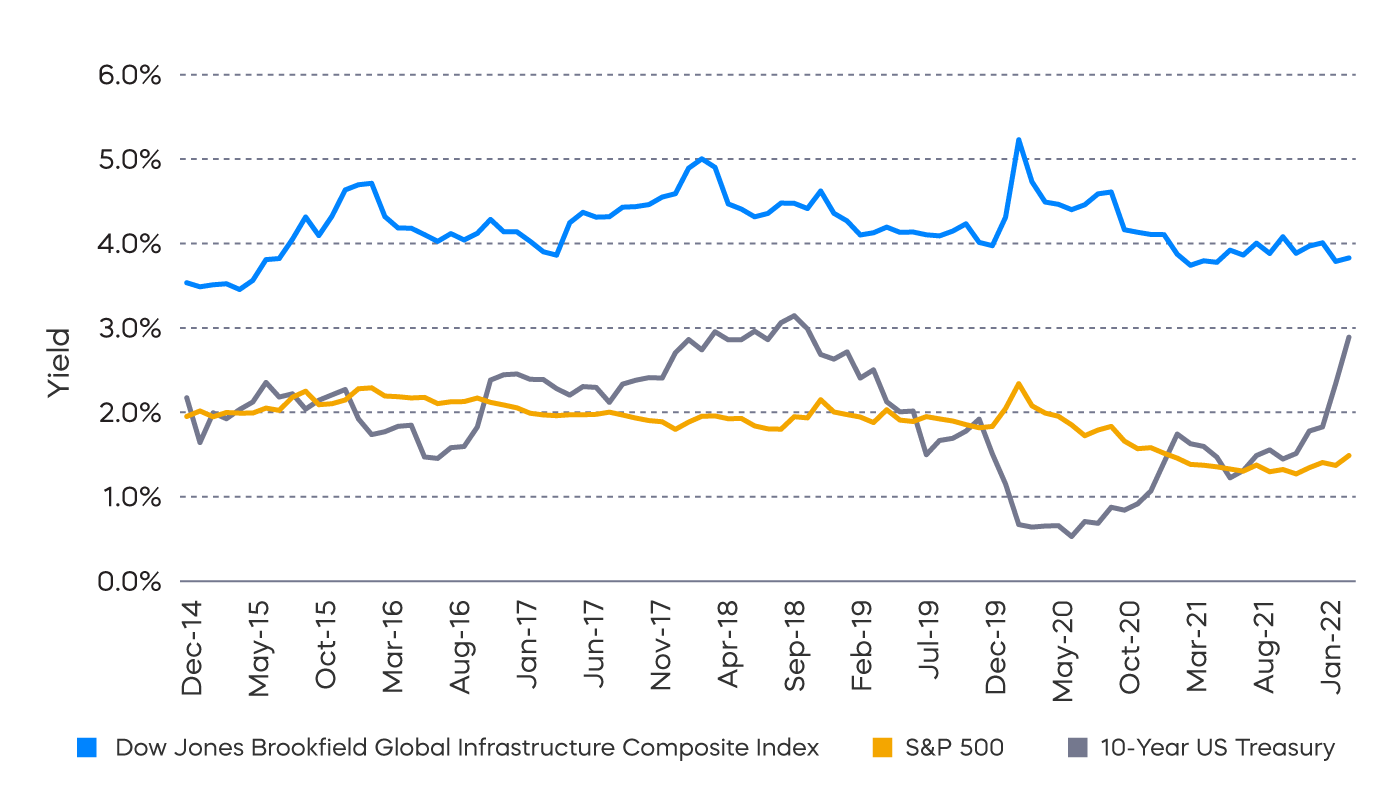

Infrastructure companies often offer attractive yield, while also providing potential for capital appreciation. Since 2014, infrastructure owners and operators have provided yield meaningfully higher than that of the S&P 500 or the 10-year US treasury, potentially helping satisfy investor yield appetite.

Pure-Play Infrastructure Companies Have Delivered Attractive Yield

Source: Bloomberg, 12/31/14-4/29/22. Index information does not reflect any management fees, transaction costs, or expenses. Indexes are unmanaged, and one cannot directly invest in an index. Past performance does not guarantee future results.

Consistent Performance Amidst Uncertainty

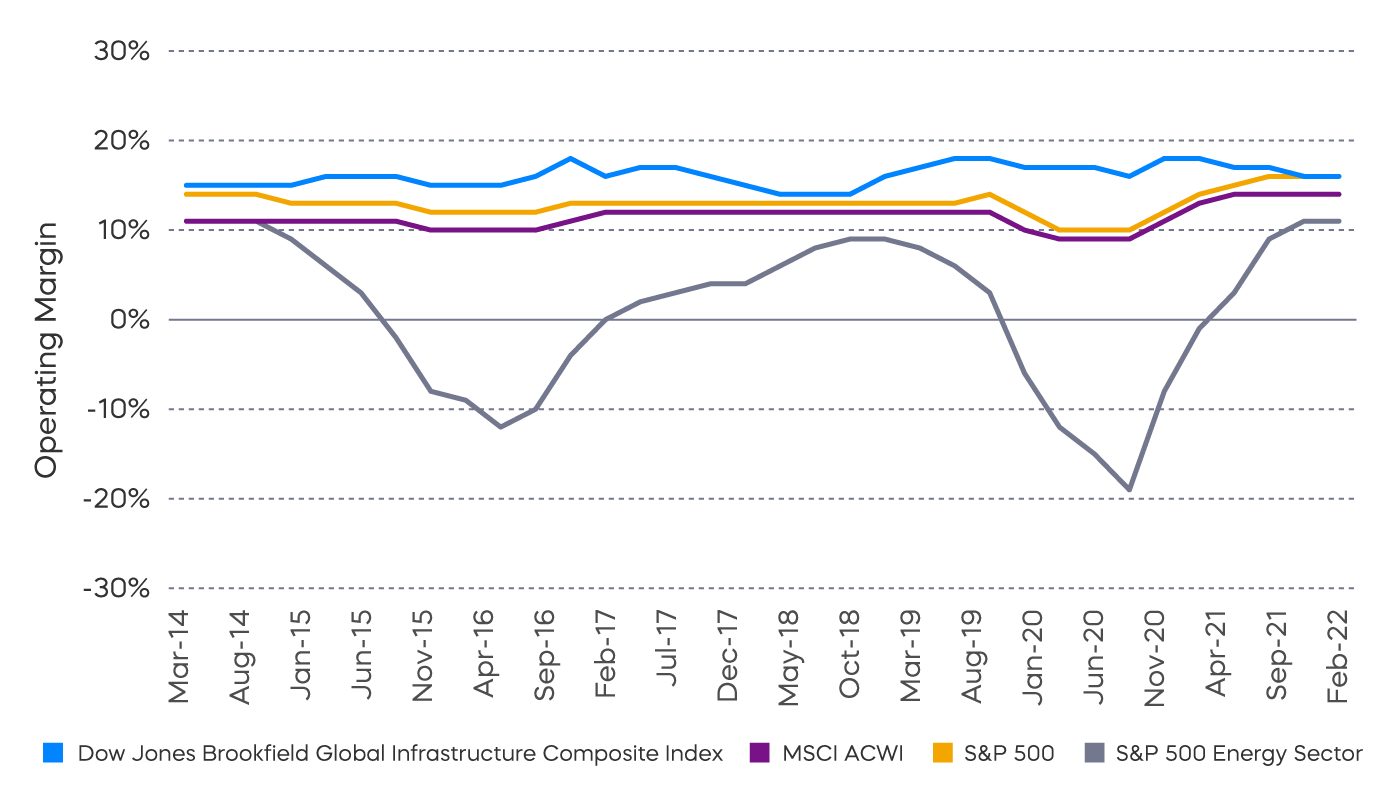

Uncertainty is rising as markets grapple with implications of the Russia-Ukraine crisis, China’s renewed Covid-19 lockdown strategy, higher commodity prices, supply chain bottlenecks and slowing demand. Many companies are facing margin compression as producer prices continue to rise faster than consumer prices. Recent earnings results showed sales growing faster than earnings, reflecting pressure on operations.

Against this backdrop, investors may put a premium on consistency and stability. Infrastructure owners and operators typically have long-term agreements that help deliver consistent fundamental results. Operating margins for infrastructure owners and operators are historically less volatile than the MSCI ACWI Index, S&P 500, and the S&P 500 Energy Index, providing a degree of stability in uncertain times.

Historically Consistent and Strong Operating Margins

Source: Bloomberg, 3/31/14-3/31/22. Index information does not reflect any management fees, transaction costs, or expenses. Indexes are unmanaged, and one cannot directly invest in an index. Past performance does not guarantee future results.

TOLZ: The Only Pure-Play Infrastructure ETF

ProShares DJ Brookfield Global Infrastructure ETF (TOLZ) is the only ETF to invest exclusively in pure-play infrastructure, giving investors access to the asset class’s stable, attractive cash flows, high yield and potential to benefit from global growth.

TOLZ follows the Dow Jones Brookfield Global Infrastructure Composite Index. This index consists of developed and emerging markets companies that qualify as “pure-play” infrastructure companies whose primary business is the ownership and operation of infrastructure assets and derive more than 70% of their cash flows from infrastructure lines of business.

Click

here for fund performance.

1 Source: U.S. Bureau of Labor and Statistics, "Consumer Price Index," April 2022.