Key Observations:

-

Global battery demand is expected to grow at a 25% annual rate through the end of the decade, driven primarily by the rapid growth of electric vehicles.1

-

The race is on to secure raw materials to enable battery production—core battery metals lithium, nickel and cobalt are critical to meeting the growing demand.

-

Companies that mine these three core metals are expected to be key beneficiaries of electrification.

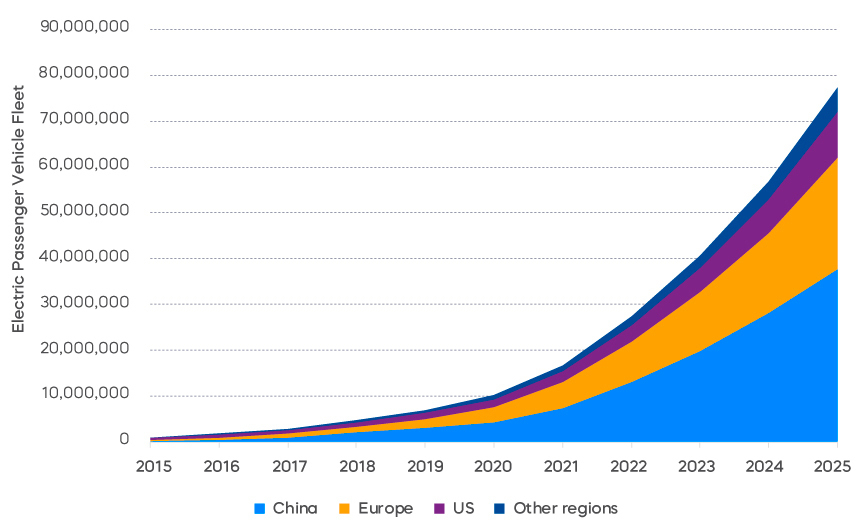

Electric Vehicle Growth to Trigger Huge Demand for Batteries

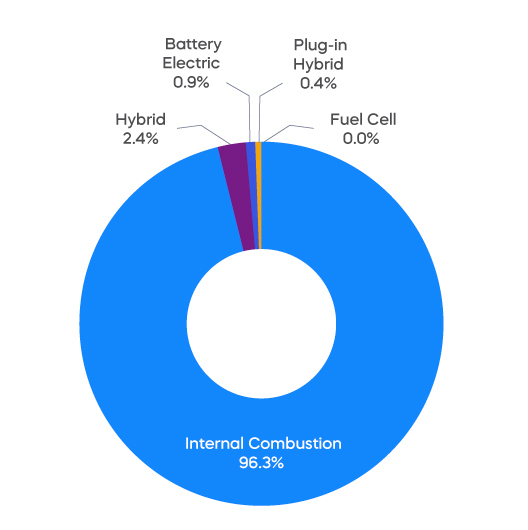

An energy revolution is underway. As part of global initiatives to reduce emissions, electricity is the fastest-growing consumer energy2 and will play a key role in decarbonizing the building, industrial, and transportation sectors. While there has been a rapid adoption of electric vehicles (EVs), we are still in the very early stages of the transformation. Approximately 20 million passenger electric vehicles are on global roads today, but that represents less than 2% of total number of cars.3

Global Passenger EV Sales Are Increasing

Source: BloombergNEF, "Electric Vehicle Outlook 2022,” 2022.

… But Still Represent a Tiny Fraction of Total Passenger Vehicles on

the Road Today

Source: BloombergNEF, "Electric Vehicle Outlook 2022,” 2022.

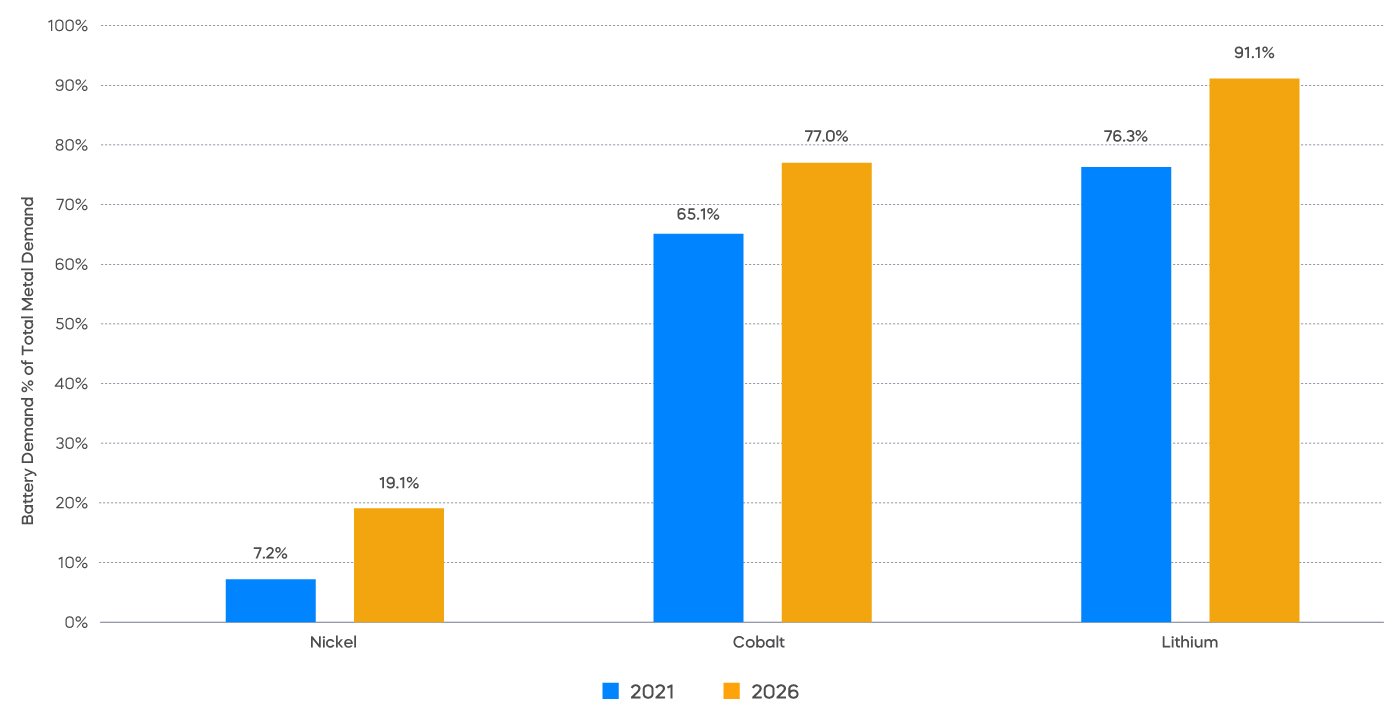

Battery Demand Requires a Plentiful Supply of Critical Metals

Among the key dependencies to meeting global EV demand will be sourcing the materials required to manufacture batteries and related components. Batteries to power EVs require a range of metals and other elements like silicon and graphite. But three metals in particular—lithium, cobalt and nickel—are core battery metals for two important economic reasons.

First, battery demand represents a large and growing percentage of the overall market demand for lithium, nickel and cobalt. For example, battery production is projected to account for 90% of all lithium demand by 2026.1 Nickel’s primary use today is stainless steel, but use in batteries is expected to double in the coming years as nickel-intensive battery chemistries have improved driving range over other battery formulations.1, 4 In contrast, demand for metals like aluminum and copper comes more heavily from uses other than batteries.5

Lithium, Nickel and Cobalt Demand is Rising Rapidly Because of Their Use in Batteries

Source: S&P Global Market Intelligence; China Automotive Battery Alliance, as of 10/24/22.

Second, lithium, nickel and cobalt are all expected to face significant supply crunches in the coming years. Lithium’s supply gap is expected to be severe by 2035, perhaps as much as 24% of the total demand.6 Core battery metals are often concentrated in a relatively small number of geographically remote locations. The vast supply of cobalt, for example, is concentrated in the Democratic Republic of Congo. Significantly ramping up production of the core battery metals is challenging and could take many years.1

We Believe Companies That Mine May Be Key Beneficiaries

Like other transformative trends, the explosion in EV demand will undoubtedly produce a series of winners and losers. One segment expected to be a key beneficiary from the coming electrification are the companies that mine core battery metals. The coming supply crunch will likely keep core battery metals demand high, allowing miners to extract at favorable prices. We believe incumbent miners of core battery metals appear to be well positioned and already control much of the market. The top 10 global lithium producers control 83% of the market.1 Newer entrants will be challenged to find and produce new reserves in a timely and economic manner. In short, we believe the existing miners will likely see their revenues and profits continue to expand for many years.

Capturing the Growth Opportunity with a Single Investment

To access the continuing growth potential of EV batteries, consider ProShares S&P Global Core Battery Metals ETF (ION). ION is the first ETF to invest only in companies mining battery metals.

Click here for fund performance.

1S&P Global Market Intelligence, 9/21/22.

2The Oxford Institute for Energy Studies, “Energy Networks in the Energy Transition Era,” May 2022.

3BloombergNEF, "Electric Vehicle Outlook 2022," 2022.

4Geology.com, “Facts About Nickel,” 2022.

5SkyQuest Technology Consulting PVT. Ltd., “Global Aluminum Market to Hit Sales of $238.2 Billion by 2028: Over Production and Declined Demand Have Reduced Profit Margin of Producer by $120 per Ton,” 11/16/22. USGS, Copper Statistics and Information, 2022.

6BCG, “The Lithium Supply Crunch Doesn’t Have to Stall Electric Cars,” 8/31/22.

Learn More

ION

S&P Global Core Battery Metals ETF

The first ETF to invest only in companies mining battery metals.

A green energy revolution is underway, fueling demand for lithium-ion batteries and metals needed to make them—lithium, nickel and cobalt.