Key Observations

-

Dividends have accounted for roughly one-third of the market’s total return since 1960.1

-

Many investors turned to dividend strategies as a source of potential income during the ultra-low interest rates of the past decade.

-

Not all dividend investing strategies are equal, and there are important differences between strategies targeting high dividend yield versus dividend growth.

With near-zero interest rate policies behind us, investors may want to re-evaluate their use of dividend strategies. Here, we outline three potential advantages of dividend growth strategies like the S&P 500 Dividend Aristocrats, which many consider an all-weather approach for investing in dividends.

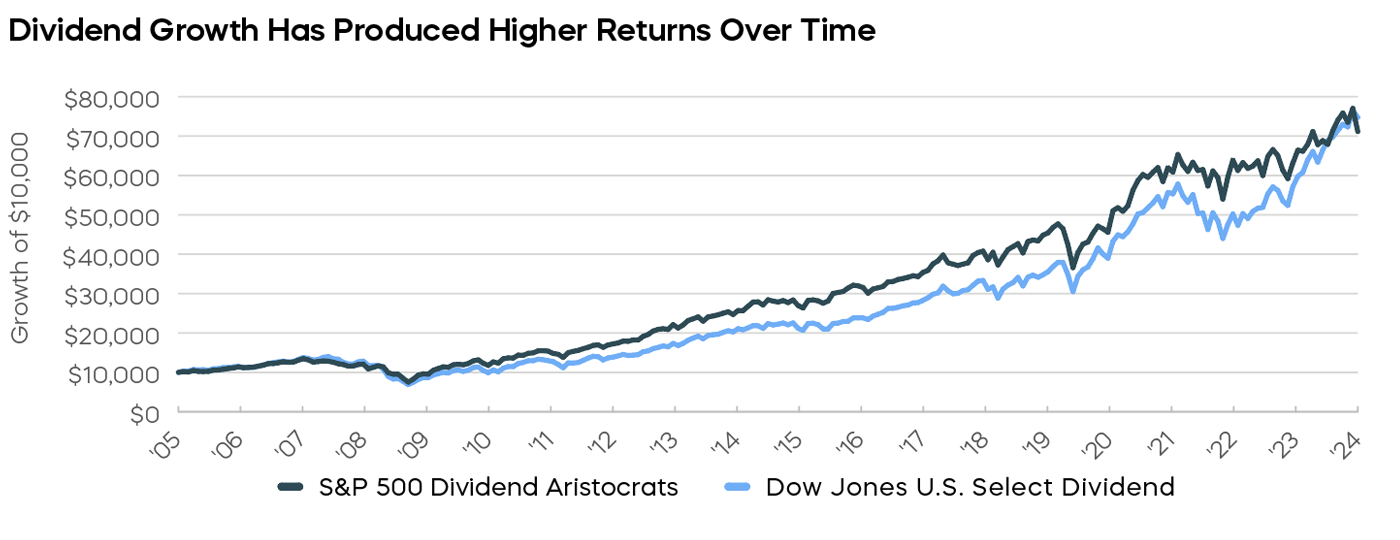

Dividend Growth Can Provide a More Balanced Approach to Returns

-

To attract investors, companies with high dividend yield often pay dividends at levels that make it difficult to reinvest into the business, sacrificing potential growth as a result.

-

A dividend growth strategy, on the other hand, invests in companies that consistently grow their dividend. The S&P 500 Dividend Aristocrats Index, for example, tracks high-quality companies that have grown their dividends for at least 25 consecutive years.

While their yields may be lower, companies like those in the S&P 500 Dividend Aristocrats Index generally have a better balance of growth and income. As a result, they have provided greater total returns over time.

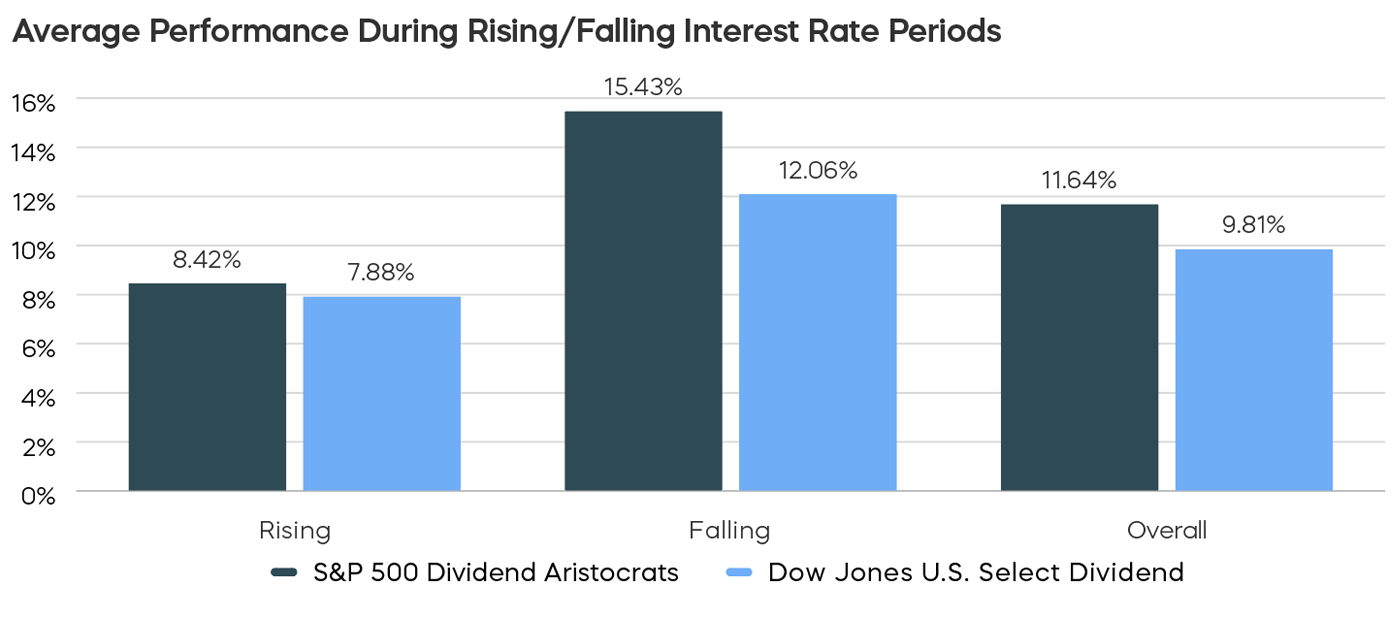

Dividend Growth Has Outperformed Regardless of Interest Rate Direction

The normalization of Federal Reserve monetary policy has opened a huge divide in expectations

around the future direction of interest rates. While the Fed maintains a higher-for-longer stance, market participants have been pushing yields lower in anticipation of economic uncertainty and future rate cuts. Such a volatile rate environment has been a challenge for many dividend investors.

The all-weather approach of the S&P 500 Dividend Aristocrats, however, has performed well under a variety of rate environments, making it a potentially sound strategy no matter where rates go.

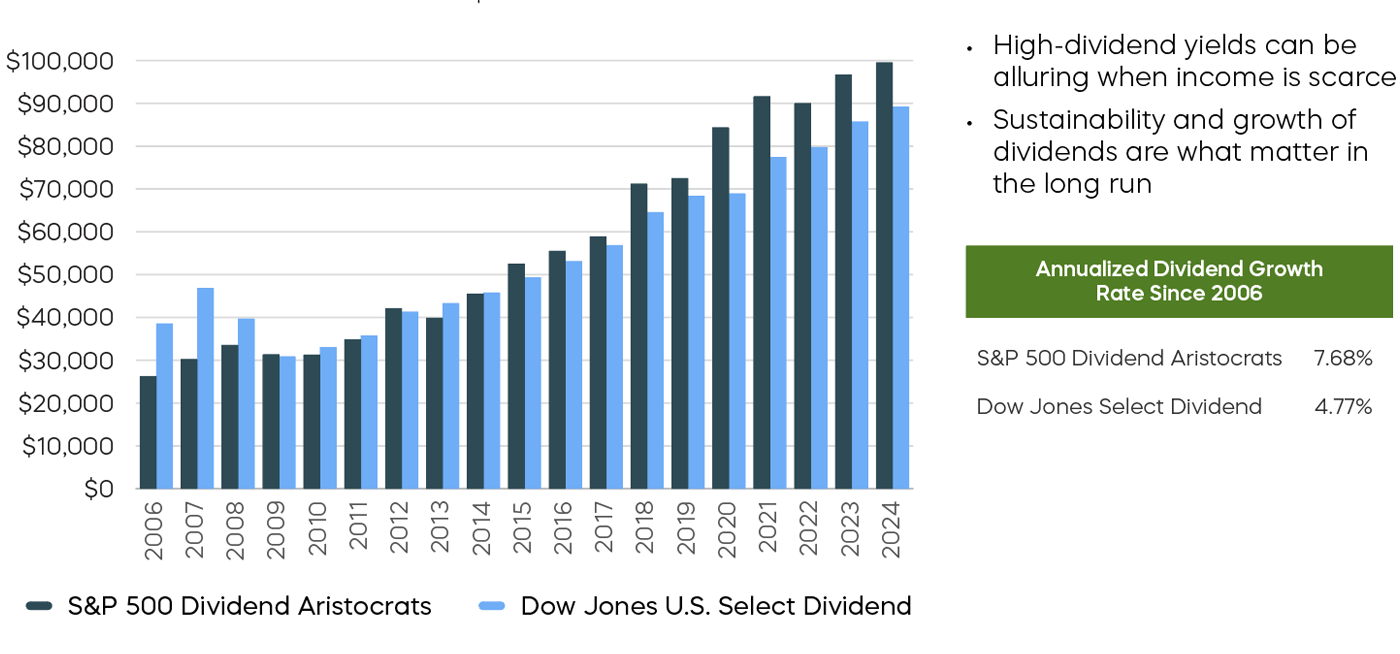

Initial Yield Can Be Deceiving

-

High dividend yielding companies have been known to reduce dividends during difficult periods, for example, during the Great Financial Crisis.

-

The S&P 500 Dividend Aristocrats have consistently grown their dividends through numerous difficult environments, resulting in higher levels of yield-on-cost compared to high dividend yielding companies, and despite lower levels of initial yield.

The Takeaway

Against the backdrop of a rapidly changing interest rate environment and significant economic uncertainty, advisors may want to consider their dividend strategies carefully. A strategy focused on longterm dividend growth may outweigh the immediate benefits of a high dividend yield strategy. ProShares offers the only ETF tracking the S&P 500 Dividend Aristocrats Index, plus seven more dividend growth ETFs covering a variety of U.S. market caps, technology strategies and international markets.

1,2Source: Morningstar, as of 9/30/23.

Learn More

Learn More

NOBL

S&P 500 Dividend Aristocrats ETF

Seeks investment results, before fees and expenses, that track the performance of the S&P 500® Dividend Aristocrats® Index.

REGL

S&P MidCap 400 Dividend Aristocrats ETF

Seeks investment results, before fees and expenses, that track the performance of the S&P MidCap 400® Dividend Aristocrats® Index.

SMDV

Russell 2000 Dividend Growers ETF

Seeks investment results, before fees and expenses, that track the performance of the Russell 2000® Dividend Growth Index.

TMDV

Russell U.S. Dividend Growers ETF

Seeks investment results, before fees and expenses, that track the performance of the Russell 3000® Dividend Elite Index.

TDV

S&P Technology Dividend Aristocrats ETF

ProShares S&P Technology Dividend Aristocrats ETF seeks investment results, before fees and expenses, that track the performance of the S&P® Technology Dividend Aristocrats® Index.

EFAD

MSCI EAFE Dividend Growers ETF

Seeks investment results, before fees and expenses, that track the performance of the MSCI EAFE Dividend Masters Index.

EUDV

MSCI Europe Dividend Growers ETF

Seeks investment results, before fees and expenses, that track the performance of the MSCI Europe Dividend Masters Index.

EMDV

MSCI Emerging Markets Dividend Growers ETF

Seeks investment results, before fees and expenses, that track the performance of the MSCI Emerging Markets Dividend Masters Index.