2022 has been a challenging year for many equity inventors. A combination of rising inflation, tightening monetary conditions and geopolitical crises have driven increased volatility. Growth stocks—in particular unprofitable technology names—have been among the market's weakest performers. As rates and monetary policy normalize, however, technology names with reputations for profitability, quality and attractive growth potential could be compelling.

-

Against a backdrop of a less accommodative Federal Reserve, technology investors seeking profitable growth at reasonable valuations may be attracted to the S&P Technology Dividend Aristocrats.

-

With its attractive growth runway and general reputation for quality, a Technology Dividend Aristocrat like Broadcom (Nasdaq: AVGO) may be a more compelling opportunity than the “growth at any price” technology names.

Attractive Growth with Strong Fundamentals

Broadcom is a global technology leader with a long heritage of innovation designing and developing semiconductors and infrastructure software solutions. Broadcom sells products into several large and still growing end markets, including mobile phones and Bluetooth-capable devices, high-growth industrial applications like factory automation, renewable energy, and automotive sensors. In its current form, the company is also the result of several acquisitions over the years, including the 2019 acquisition of enterprise security company Symantec.

Broadcom’s recent financial results have been notable.

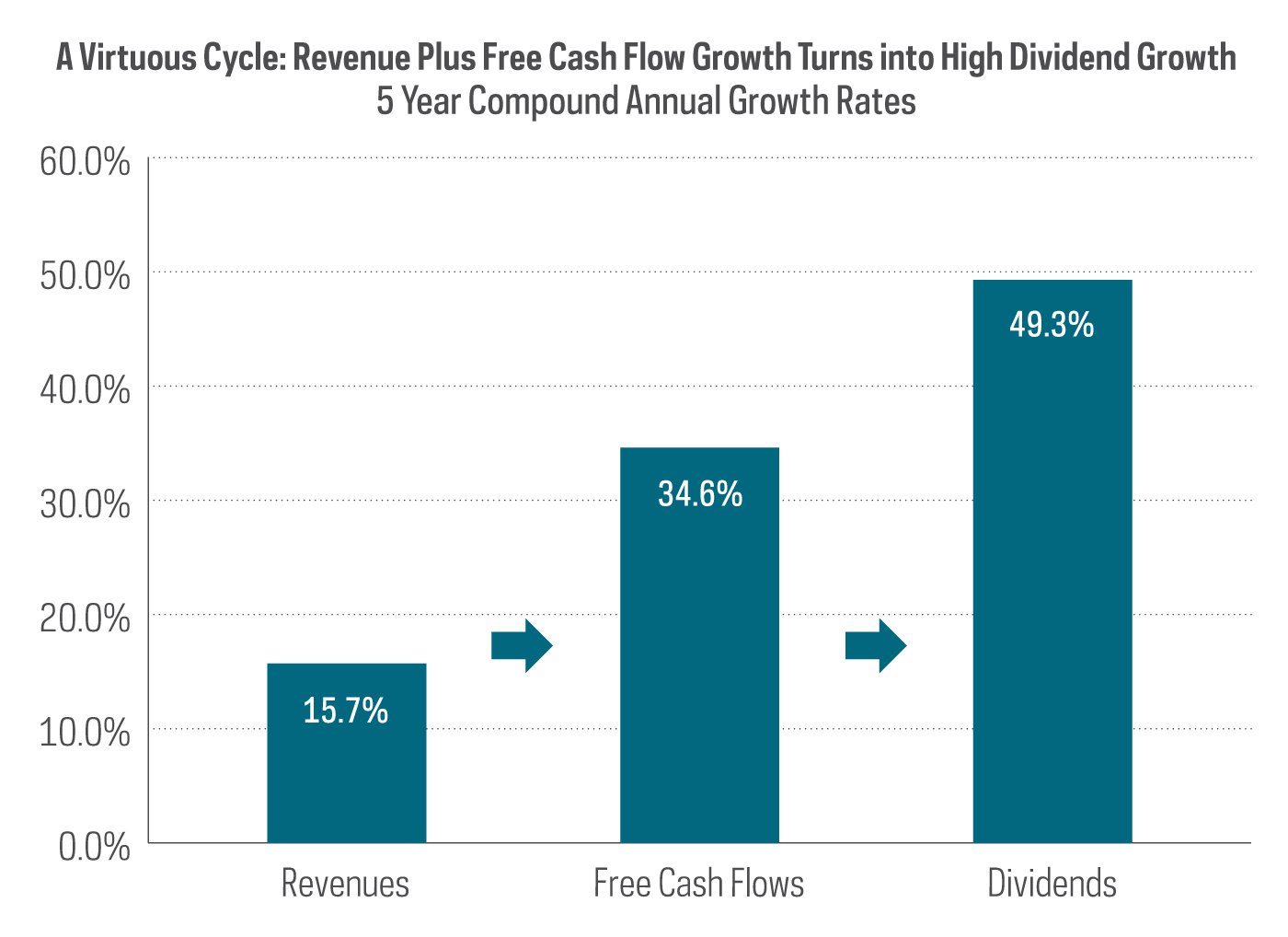

- Net revenue has grown from $13 billion in 2016 to over $27 billion in 2021, a compound annual growth rate of nearly 16%.

- With margins currently over 54%, recent revenue growth has translated into high levels of profitability and cash flow—EBITDA1 has approximately quadrupled to nearly $15 billion since 2016.

Dividend investors may take particular interest in the company’s free cash flow growth, up from approximately $2.7 billion in 2016 to over $13 billion in 2021. That’s a compound annual growth rate of almost 38%. This prodigious free cash flow growth has translated to surprising levels of dividend growth.

- Broadcom has raised its dividend every year since it first started paying one ($0.35 per share in 2011).

- Broadcom’s per-share distribution in 2021 was $14.40, which represents a compound growth rate of 45%.

- With a free cash flow payout ratio of approximately 45%, we believe plenty of headroom remains to continue growing the dividend while reinvesting for growth.

Broadcom by the Numbers

Source: FactSet. Data from 10/31/2016 to 10/31/2021.

Currently, Broadcom trades for approximately 16 times the next 12 months’ earnings, which compares favorably to the S&P 500 Information Technology sector’s forward multiple of 24.6 times, as of 5/5/22.2

The Takeaway

The S&P Technology Dividend Aristocrats are well-established technology companies that have grown their dividends for at least seven consecutive years. They generally have a history of profitability, with attractive growth trajectories, and reasonable price valuations. Broadcom is one such company. Historically, strong profits and cash flows coupled with a favorable growth runway and valuation make Broadcom a compelling example of what it means to be an S&P

® Technology Dividend Aristocrat

®.

Explore more of the elite companies of the Dividend Aristocrats with the

ProShares Technology Dividend Aristocrats ETF (Cboe: TDV).

1EBITDA – earnings before interest, taxes, depreciation and amortization.

2P/E is the current price of Broadcom to 12-month projected earnings. This is not a forecast of the fund’s future.