Floating Rate Bond ETFs Reduce Interest Rate Risk but May Have Limited Return Potential

Bond prices fall when interest rates rise. As a result, many investors consider making a shift to floating rate bonds when rates increase. Their interest payments should increase (or “float”) to mitigate risk when interest rates rise.

The caveat here is that floating rate bond ETFs involve limited credit exposure because floating rate bonds are often short in maturity. Longer-dated bonds include not only additional interest rate risk, but also additional credit premium. Since credit exposure and interest rate risk are two of the key drivers for bond returns, switching to a floating rate strategy can limit an investor’s potential returns.

Interest Rate Hedged Bond ETFs Target Zero Interest Rate Risk and Keep Full Credit Exposure

Interest rate hedged bond ETFs, on the other hand, are designed to target a duration of zero while maintaining full credit exposure and return potential. Because credit spreads typically tighten as rates rise, interest rate hedged bond ETFs may produce higher returns in a rising rate environment. It is, however, important to consider that this potential excess return includes additional risks, with the strategy potentially underperforming if credit spreads widen.

Consider an Investment Grade Bond ETF for Rising Rates

ProShares Investment Grade—Interest Rate Hedged ETF (IGHG) tracks the FTSE Corporate Investment Grade (Treasury Rate-Hedged) Index. The ETF offers a diversified portfolio of investment grade long-term bonds, with a built-in interest rate hedge.* IGHG maintains full exposure to credit risk, which helps the fund maintain return potential even as rates rise.

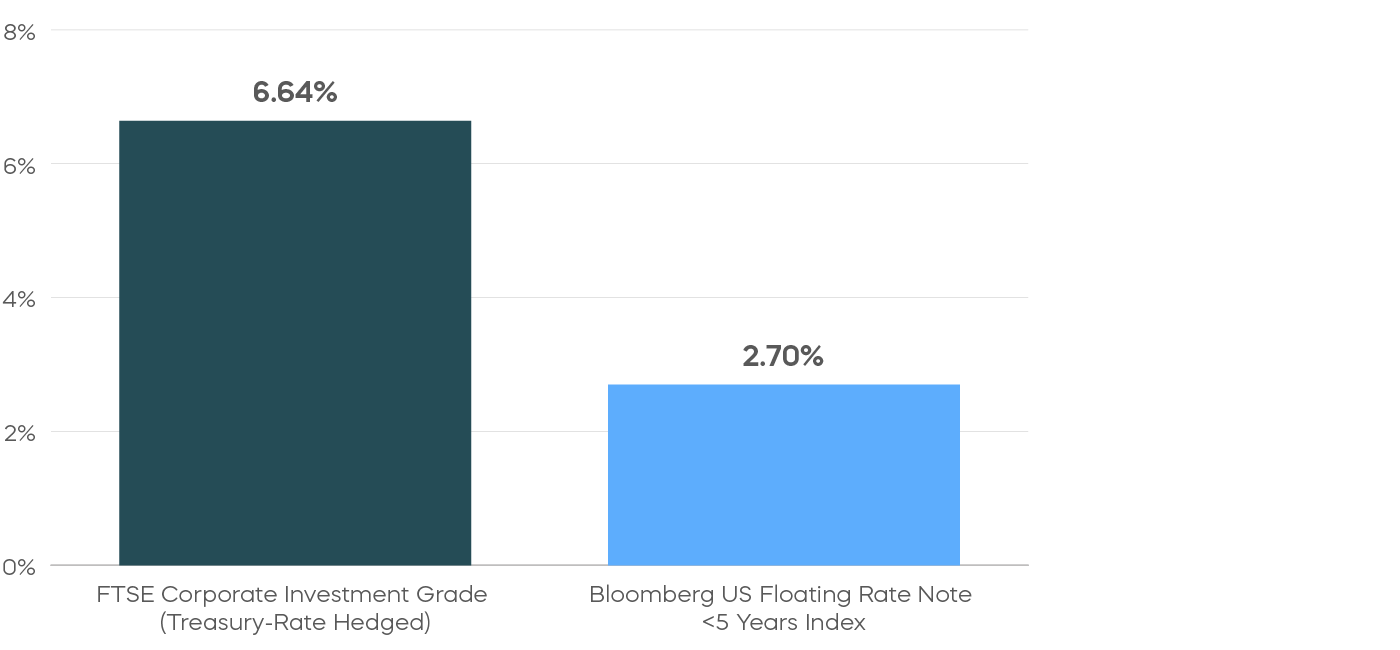

When Rates Rose, IGHG's Index Outperformed Floating Rate Note Index

On Average During Periods of Rising Rates

3/31/14 – 12/31/24

Source: Bloomberg, 3/31/14–12/31/24. Average performance based on quarterly changes in the 10-Year Treasury yield. Rising rate periods are any calendar quarter where the 10-Year Treasury yield increased, which are Q2 2015, Q4 2015, Q3 2016, Q4 2016, Q3 2017, Q4 2017, Q1 2018, Q2 2018, Q3 2018, Q4 2019, Q3 2020, Q4 2020, Q1 2021, Q3 2021, Q4 2021, Q1 2022, Q2 2022, Q3 2022, Q4 2022, Q2 2023, Q3 2023, Q1 2024, Q2 2024 and Q4 2024. Index returns are for illustrative purposes only and do not represent fund performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest in an index. Past performance does not guarantee future results.

Key Takeaways

Floating rate bond ETFs can help investors reduce their interest rate risk, but they have some potential drawbacks. If you are looking to maintain return potential and to take advantage of tightening credit spreads, consider an interest rate hedged bond ETF such as IGHG.

However, please note that since spreads often widen when rates fall, floating rates may outperform interest rate hedged bond ETFs in falling rate environments, but for investors anticipating falling rates, a simple regular duration approach may be appropriate.

Fund Performance and Index History

Fund inception (11/5/2013) through March 31, 2025

Performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Shares are bought and sold at market price (not NAV) and are not individually redeemed from the fund. Market price returns are based upon the midpoint of the bid/ask spread at 4:00 p.m. ET (when NAV is normally determined for most funds) and do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. Current performance may be lower or higher than the performance quoted. Standardized returns and performance data current to the most recent month end may be obtained by visiting ProShares.com.