Baking soda is an essential ingredient with a myriad of uses, including in foods, pharmaceuticals, water treatment and environmental applications. Under its flagship Arm & Hammer brand, Church & Dwight Co., Inc. (NYSE: CHD) is the nation’s leading producer of sodium bicarbonate. Added to the elite group in January 2022, Church & Dwight is also a quintessential example of what it means to be a member of the S&P 500® Dividend Aristocrats® Index.

The S&P 500 Dividend Aristocrats are high-quality companies that have grown their dividends for at least 25 consecutive years. Investors value Dividend Aristocrats for characteristics like stable earnings, solid fundamentals and strong histories of profit and growth.

Who Is Church & Dwight?

Founded in 1846, CHD manufactures and markets household and personal care products under premium brands that include OxiClean, Kaboom, Waterpik, Nair, Orajel, and more. The company recently expanded its portfolio with the purchase of TheraBreath, the #2 brand in the alcohol-free mouthwash category in the United States.

CHD’s fourth quarter 2021 financial results demonstrate the company’s strength and its worthiness as a Dividend Aristocrat.

-

Sales growth was 5.7% for the most recently completed quarter (and 6% for the 2021 fiscal year, including organic growth of 4.3%).[1]

-

Adjusted earnings grew over 20%, with high returns on both assets (11.2%) and equity (27.6%).[1]

-

CHD has paid quarterly dividends for 121 years, grown its dividends for 26 consecutive years, and maintains a conservative payout ratio of approximately 30%.[2]

A Company with Pricing Power

In a challenging environment, CHD’s recent earnings release was also notable for another reason. Like many companies, it reported increases in labor and raw materials costs. However, backed by strong distribution and consumer demand for its everyday-use products, CHD has been able to raise its prices. In its recent earnings announcement, Church & Dwight announced that, to respond to rising costs, as of the end of Q1 2022, the company expects it will have taken pricing actions on 80% of its global portfolio of brands.[1] Not every company has that kind of pricing power, and it’s a characteristic that can separate good companies from great companies—like the Dividend Aristocrats.

And a History of Strong Performance

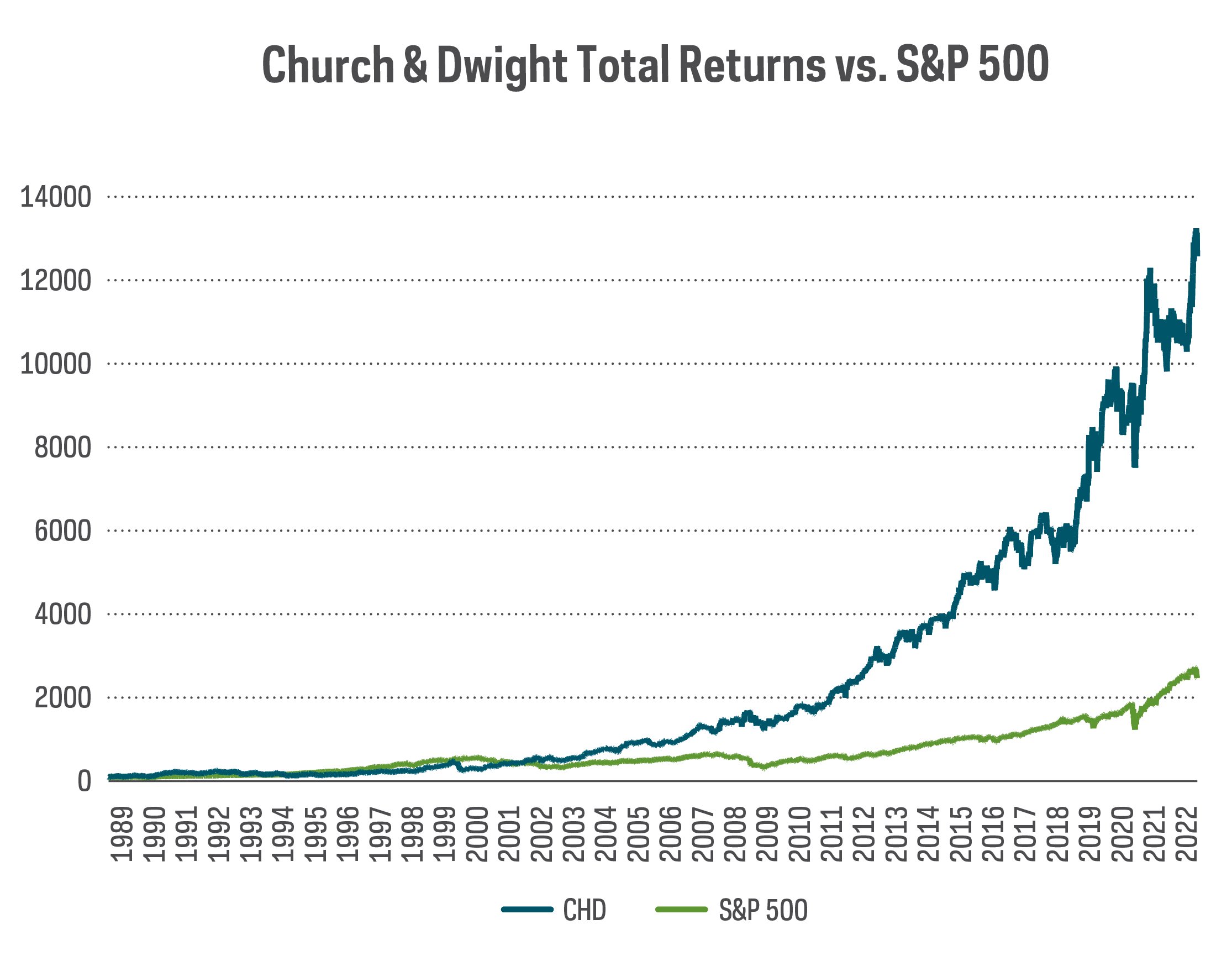

Taken together, CHD’s fundamentals and pricing power have helped the company to deliver noteworthy total shareholder returns over time.

-

Annualized returns of over 16% since 1989 have far surpassed the 11% returns for the S&P 500 consumer staples sector and 10% returns for the broad index.[3]

Source: Bloomberg. Data from 9/11/89 to 1/26/22.

The Takeaway

With its powerful everyday brands, strong financial results, and steady growth that have all fueled attractive returns over time, CHD is a compelling example of what it means to be a Dividend Aristocrat.

Explore more of the elite companies of the Dividend Aristocrats with the ProShares S&P 500 Dividend Aristocrats (NOBL).

1 Source: FactSet Fundamentals, Church & Dwight Fourth-Quarter and Full-Year 2021 Results

2 Source: Church & Dwight Fourth-Quarter and Full-Year 2021 Results, FactSet.

3 Source: Bloomberg. Data from 9/11/89 to 1/26/22.

Important Information

As of 2/1/22, NOBL included a 1.53% allocation to Church & Dwight. Holdings are subject to change.

Any forward-looking statements herein are based on expectations of ProShare Advisors LLC at this time.

The performance quoted represents past performance and does not guarantee future results. Index information does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest directly in an index.

There is no guarantee any ProShares ETF will achieve its investment objective.

Shares of any ETF are generally bought and sold at market price (not NAV) and are not individually redeemed from the fund. Your brokerage commissions will reduce returns.

Investing involves risk, including the possible loss of principal. This ProShares ETF is diversified and entails certain risks, including imperfect benchmark correlation and market price variance, that may decrease performance. Please see summary and full prospectuses for a more complete description of risks.

Carefully consider the investment objectives, risks, charges and expenses of ProShares before investing. This and other information can be found in their summary and full prospectuses. Read them carefully before investing.

The "S&P 500® Dividend Aristocrats®" Index is a product of S&P Dow Jones Indices LLC and its affiliates and has been licensed for use by ProShares. "S&P®" is a registered trademark of Standard & Poor's Financial Services LLC ("S&P") and "Dow Jones®" is a registered trademark of Dow Jones Trademark Holdings LLC ("Dow Jones") and have been licensed for use by S&P Dow Jones Indices LLC and its affiliates. ProShares have not been passed on by S&P Dow Jones Indices LLC and its affiliates as to their legality or suitability. ProShares based on the S&P 500 Dividend Aristocrats Index are not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P or their respective affiliates, and they make no representation regarding the advisability of investing in ProShares. THESE ENTITIES AND THEIR AFFILIATES MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO PROSHARES.

Learn More

NOBL

S&P 500 Dividend Aristocrats ETF

Seeks investment results, before fees and expenses, that track the performance of the S&P 500® Dividend Aristocrats® Index.