-

The S&P MidCap 400® Dividend Aristocrats® Index is a group of quality companies that have grown their dividends for at least 15 consecutive years.

-

Carlisle Companies Incorporated (NYSE: CSL) is a member of the S&P MidCap 400® Dividend Aristocrats® that has grown its dividend for more than 45 years.

Get to Know Carlisle

-

Year-over-year revenue growth was 57% (including 42% organic), and adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) growth was 146%.

-

Adjusted earnings grew 185% year over year, and operating margins increased to over 22%, despite high inflation.

-

CSL’s most recent quarterly distribution marked 46 years of consecutive dividend growth. Its 39% increase was the company’s largest dividend increase in 25 years, indicating management’s high confidence in the future growth of the business.

-

The company’s dividend growth rate over the most recent 10-year period was 11.8%.

Sustainable Growth Prospects

-

It is estimated that greater than 30% of annual greenhouse gas emissions come from residential and commercial use.2

-

To meet many countries’ ambitious climate targets, there is increasing demand for more energy-efficient products, which is one of Carlisle’s areas of expertise.

-

The company’s Polyiso wall and roofing insulation products avoid 34 tons of CO2 over the life of the product.

-

CSL’s spray-foam insulation reduces energy usage in buildings by as much as 40%.

In short, the type of energy-efficient building product solutions provided by Carlisle Companies may be in demand for decades to come.

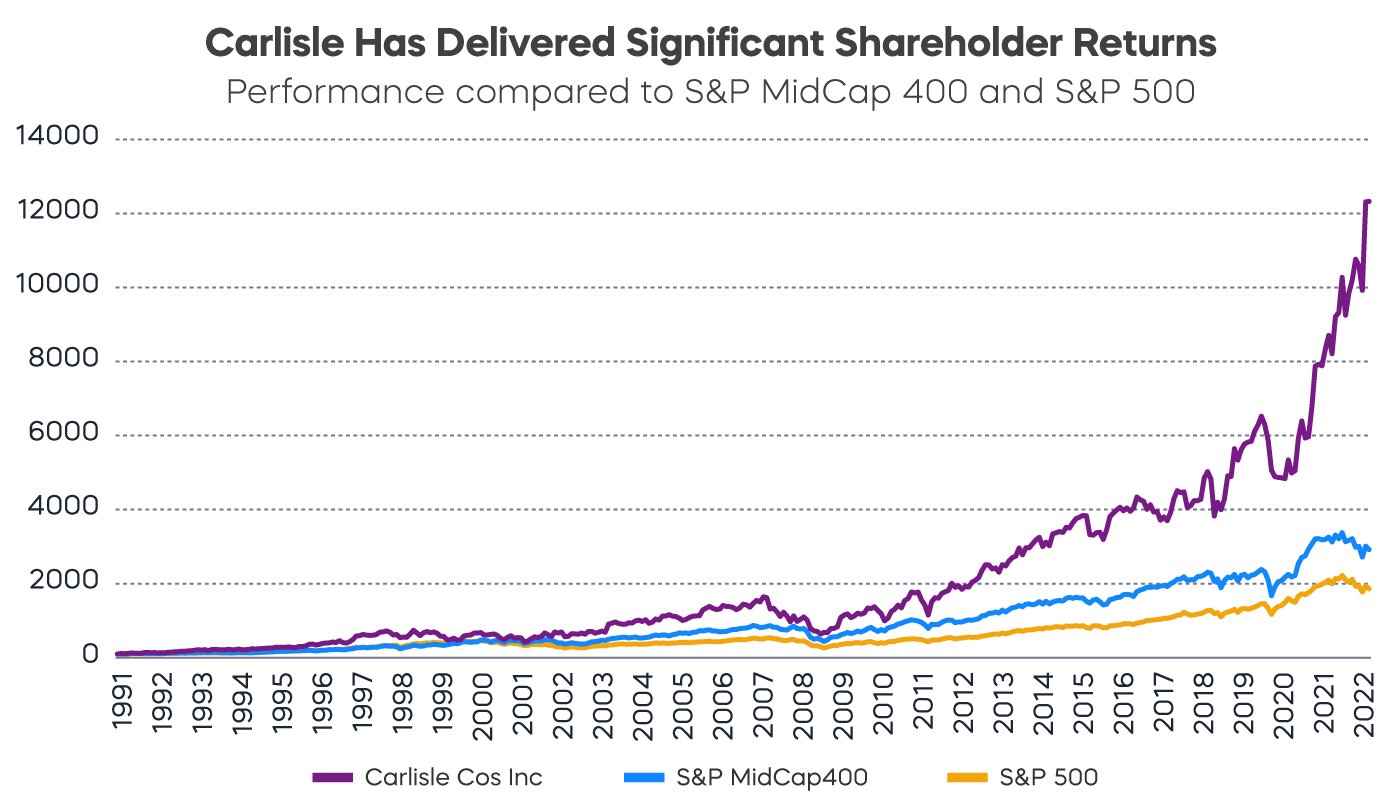

A History of Strong Performance

Source: Bloomberg. Data from 8/30/91‒8/31/22.

The Takeaway

Investors value Dividend Aristocrats for characteristics like stable earnings, solid fundamentals and strong histories of profit and growth. But they shouldn't limit themselves to investing in large-cap stocks to find companies with enviable dividend growth records, durable business models and competitive advantages. Carlisle Companies Incorporated is a great example of a high-quality company with sustainable growth prospects—and what it means to be a S&P MidCap 400 Dividend Aristocrat.

Explore more of the elite companies of the Dividend Aristocrats with the ProShares S&P MidCap 400 Dividend Aristocrats ETF (REGL).