Market volatility is inevitable. While long‑term investing is the goal for many, sharp downturns can erode portfolio value and test discipline. Hedging—using strategies or financial instruments to help offset potential losses—can potentially cushion declines during these periods without forcing investors to exit positions or time the market perfectly. There are numerous hedging tools, each with its own benefits and drawbacks. One increasingly popular choice is the inverse exchange traded fund (ETF), a vehicle designed to move opposite its benchmark and offer a straightforward way to target downside protection in a portfolio.

1. What Is an Inverse ETF?

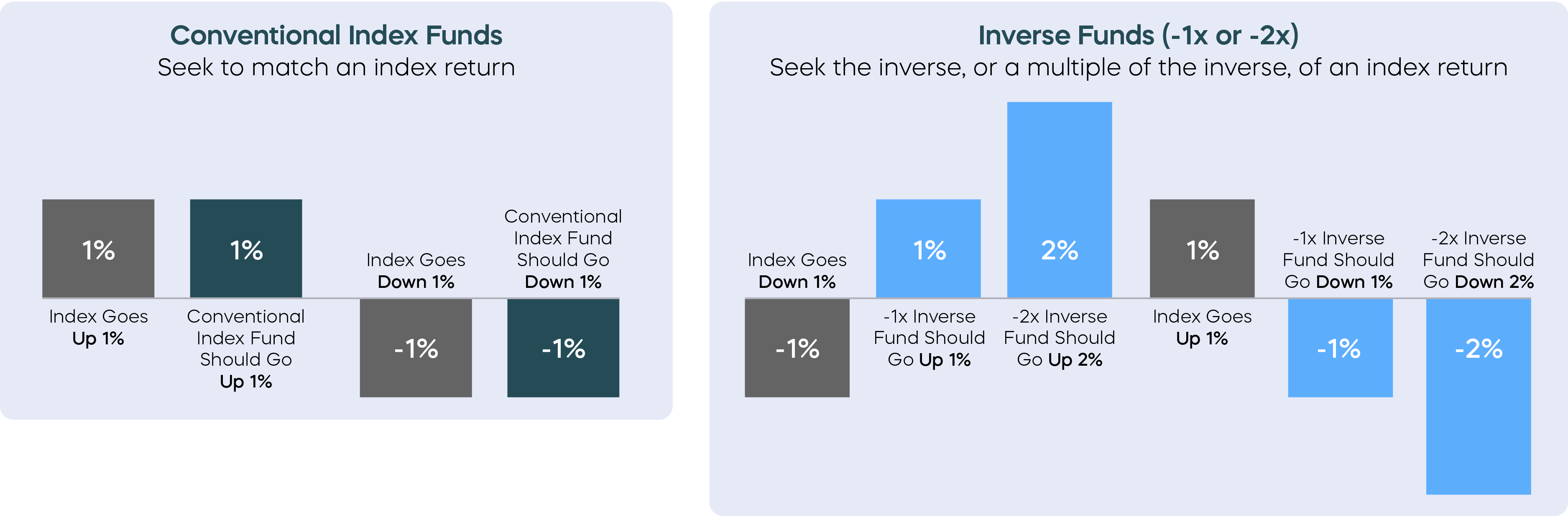

Inverse ETFs are designed to move in the opposite direction of their index—either directly (‑1x) or by a target multiple of ‑2x or ‑3x over a specific period, before fees and expenses. An inverse ETF with a ‑1x daily objective should rise by approximately 1% on a day when its index goes down by 1% and fall by approximately 1% on a day when the index goes up by 1%. Some inverse ETFs also magnify performance: an ETF with a ‑2x daily objective should rise about 2% when its index falls 1% and decline about 2% when the index rises 1%.

*For illustrative purposes only. Not representative of an actual investment.

An inverse ETF targets the one‑day opposite (‑1x) of its benchmark’s return; ‑2x and ‑3x versions further amplify that exposure, reducing the capital needed for equivalent notional exposure and magnifying both gains and losses compared with the benchmark’s daily change. By holding an inverse ETF, investors can potentially hedge long exposure in their portfolios. Because these ETFs reset daily, performance when held over longer periods can drift from the stated multiple—particularly in volatile markets—so positions should be monitored and rebalanced as needed.

2. Why Many Investors Choose Inverse ETFs

When evaluating hedging tools, many investors consider futures, options, or short selling. Although effective, these approaches can be costly, require margin accounts, and set high entry thresholds. Inverse ETFs help to overcome these obstacles—offering a straightforward, brokerage‑friendly way to hedge portfolios while limiting risk to the cash invested. Key advantages include:

- Convenience – No margin or options approval; trades like any stock.

- Daily Transparency – Holdings and net asset value are published every trading day.

- Capped Downside – Loss is limited to the amount invested; no margin calls.

- Broad Choice – Investors can choose from a wide menu of inverse exposures spanning equities, bonds, commodities, crypto, and currencies.

3. Implementing an Inverse ETF Hedge

Once you determine that an inverse‑ETF hedge may fit your goals, translate the decision into action:

-

Assess portfolio objectives. First, figure out which index your portfolio moves most like—usually an index with a beta close to 1.0. Beta is a measure of how sensitive your portfolio is to moves in that index. For example, if you have $100,000 with a beta of 0.8, your portfolio carries about $80,000 of “index risk.” Multiply your beta by your portfolio value to get this beta‑adjusted exposure, then decide how much of it you want to hedge based on your goals.

-

Select and implement an initial hedge. Once you've identified an index that best mirrors your investment (e.g., Nasdaq‑100 for tech‑heavy holdings), choose ‑1x, ‑2x, or ‑3x leverage based on capital and risk tolerance.

-

Monitor and rebalance. Decide how often to review the hedge and set triggers—such as a +/‑ 10% move—for adjusting the size or closing the position once the specific risk has passed.

Once you’ve determined that hedging is appropriate, size the hedge sensibly and periodically review and adjust it to ensure alignment with your risk tolerance and financial objectives. This allows you to mitigate downside risk without disrupting your core strategy.

Inverse ETFs can be a useful addition to an investor’s risk-management toolkit, offering a transparent, accessible way to seek downside protection without overhauling a long-term strategy. However, like any powerful tool, they require care: investors should understand their daily objectives, the impact of volatility over time, and the potential for magnified losses as well as gains. By pairing thoughtful hedge sizing with disciplined monitoring and rebalancing, investors can use inverse ETFs to help navigate periods of market stress while staying focused on their long-term goals.

Explore ProShares' Lineup of Inverse ETFs.