According to the International Energy Agency (IEA), the energy sector is the source of approximately three-quarters of greenhouse gas emissions globally. Reducing carbon emissions is seen as one key to averting the worst effects of climate change. In a recently released report, the IEA states that nothing short of a total transformation of the world’s energy systems is required if the world is to successfully limit the rise in global temperature.

Simultaneously, various governments around the world are introducing legislation to help reach ambitious emissions reduction targets, most with the long-term goal of eventually becoming carbon neutral. Here in the United States, President Biden has introduced the largest investment in our infrastructure to date, a portion of which will provide for creating thousands of miles of new power lines and expanding renewable energy.

The recent focus on infrastructure and cleaner energy has ignited questions about the future role of the world’s current energy infrastructure system. After all, our current network of pipelines stores and transports mostly energy created from carbon-based sources like oil and natural gas, and much of our electricity is still generated from carbon-based sources. If the world is indeed moving toward cleaner energy, will our current energy infrastructure system become obsolete? Will it be needed at all? Is renewable energy like wind and solar the only way to invest in the future of energy?

In this commentary, we highlight four important reasons we believe infrastructure will continue to play an important role in energy transformation, helping to build a cleaner and more sustainable future and providing attractive investment opportunities.

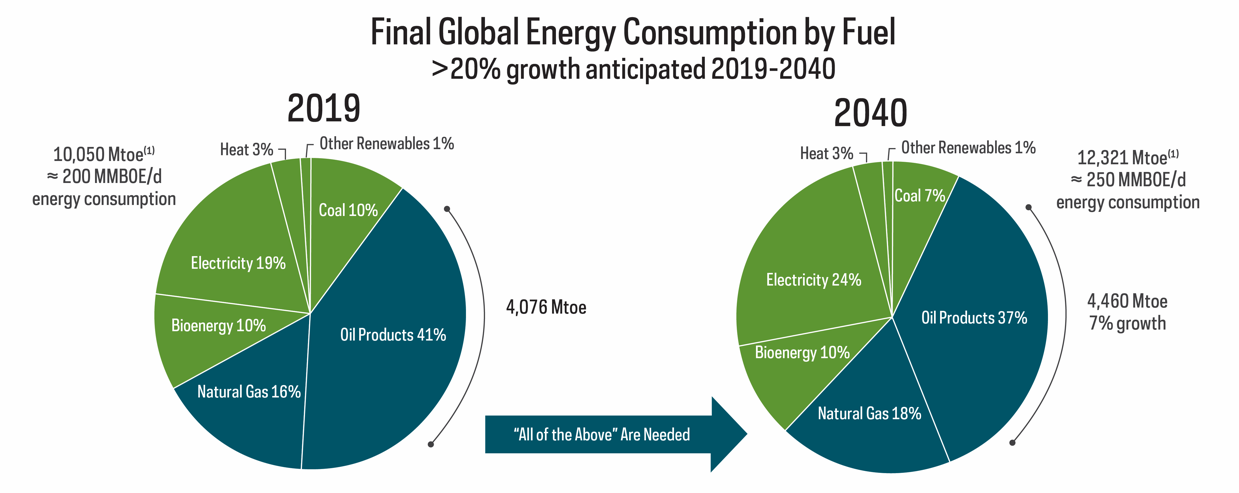

1. All Forms of Energy Will Be Needed to Meet Future Global Demand

The world’s population is expected to grow to almost 10 billion people by 2050, and the global economy is expected to be almost twice as large as today’s. With continued economic progress, more of the world’s population will enjoy better living standards.

More people with higher living standards will require more energy. While it would be ideal if all the world’s energy needs were met with clean energy sources, there simply won’t be enough of it, at least for several decades. In the meantime, carbon-based fuels will remain a key component of the world’s energy sources. This continued use of carbon-based fuels means that ongoing investment in energy infrastructure will be just as critical as ever in supporting growing, developing populations.

Source: IEA 2020 World Energy Outlook, via Enterprise Products Partners presentation. TOLZ has holdings in Enterprise Products Partners (2.31%) as of 07/30/2021. Holdings are subject to change.

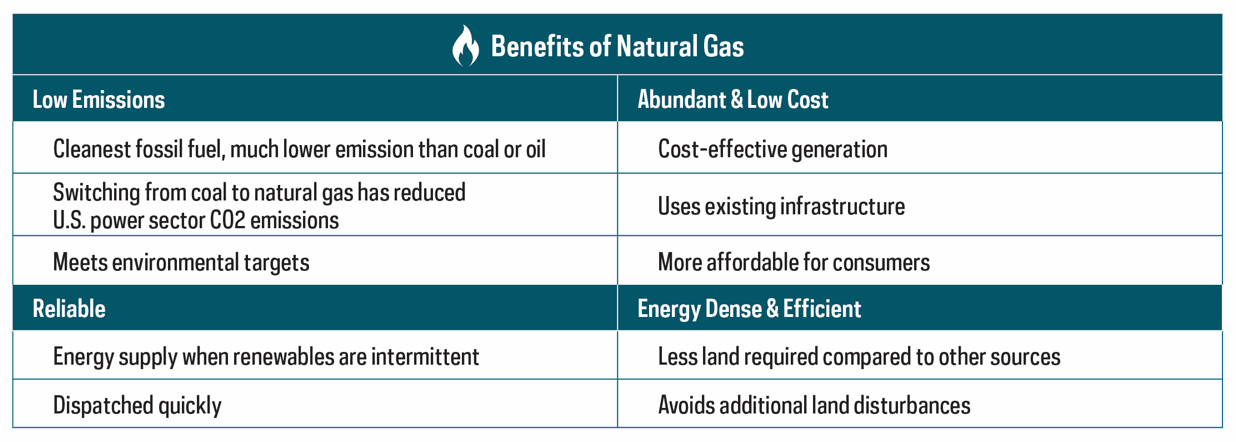

2. The Energy Transition Will Take Time

Recently, the U.S. government strengthened its pledge to reduce greenhouse gas emissions, targeting net zero. Net zero pledges now cover approximately 70% of global GDP and CO2 emissions. However, getting to net zero will take several decades. Some countries, such as Finland, are seeking to reach net neutral as soon as 2035, but most countries will take much longer to get there. And China isn’t targeting carbon neutrality until 2060.

In the meantime, low-emission, carbon-based fuels like natural gas will play a significant role in the global energy mix for decades to come. Natural gas, including liquefied natural gas (LNG), is a key enabler of a lower carbon future and will gradually replace much dirtier sources, like coal, as a reliable and cost-effective energy source. Natural gas enables economic growth without sacrificing environmental objectives.

The infrastructure that extracts, stores and transports natural gas will therefore continue to present compelling investment opportunities for the foreseeable future.

Source: Becher, Meike. “All hydrogen roads lead to renewables (and through Rome?)” Sanford C. Bernstein & Co., LLC. September 3, 2020. Kinder Morgan, Inc. Report. TOLZ has holdings in Kinder Morgan, Inc. (2.37%) and Cheniere Energy (1.36%) as of 07/30/2021.

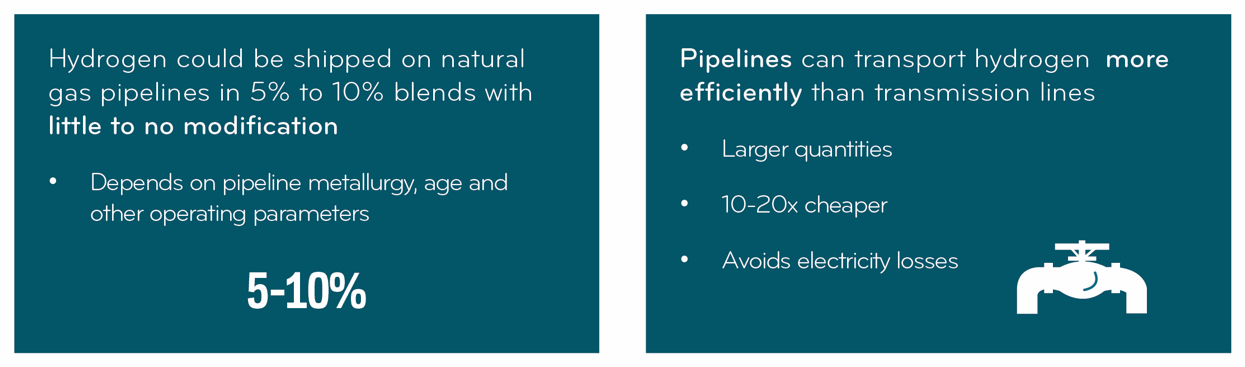

“Existing gas infrastructure is a valuable asset with significant storage capacity that can be repurposed over time to deliver large columns of biomethane or with modifications, low-carbon hydrogen.” – IEA

3. Existing Pipelines Will Transport Fuels of the Future

Many of today’s leading pipeline operators—like Williams and Kinder Morgan—are already pursuing and investing in cleaner alternative fuels of the future. Low-emission fuel sources like hydrogen, and renewable fuels like biodiesel and renewable natural gas, can be transported, stored and used in the same pipelines as natural gas with little to no modification. This positions many of today’s leading operators to maintain and expand their capacity in the future.

Source: KMI presentation: Becker, Meike. “All hydrogen roads lead to renewables (and through Rome?)” Sanford C. Bernstein & Co., LLC. September 3, 2020. TOLZ has holdings in Kinder Morgan, Inc. (2.37%) as of 07/30/2021. Holdings are subject to change.

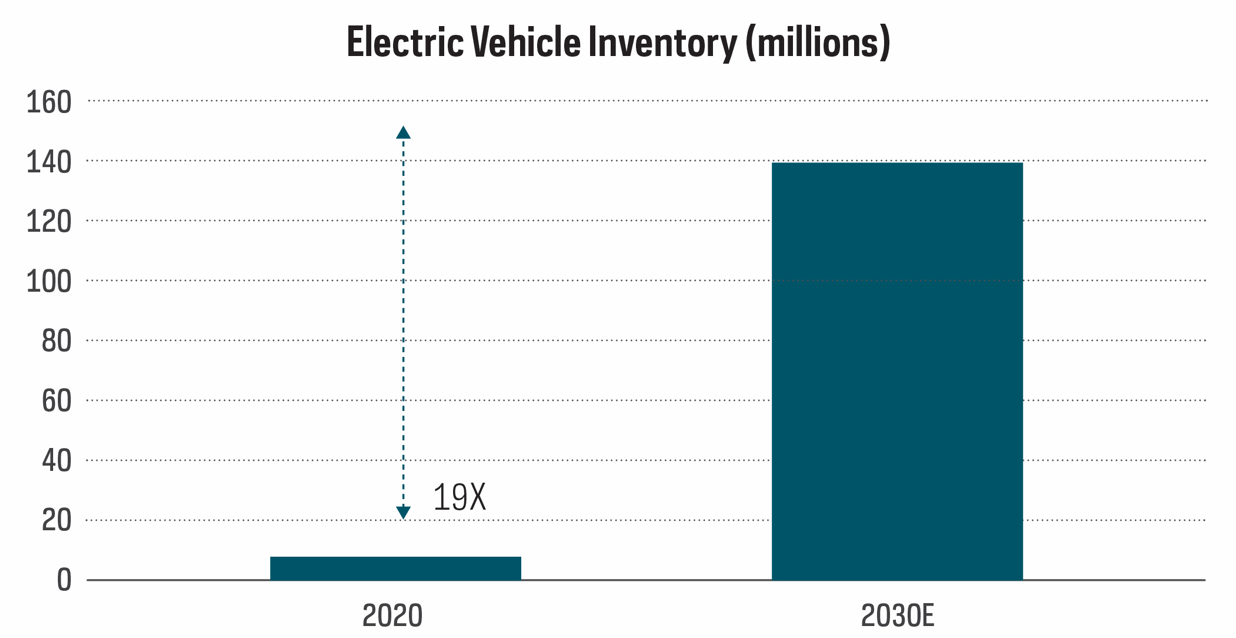

4. Electrification Is Coming

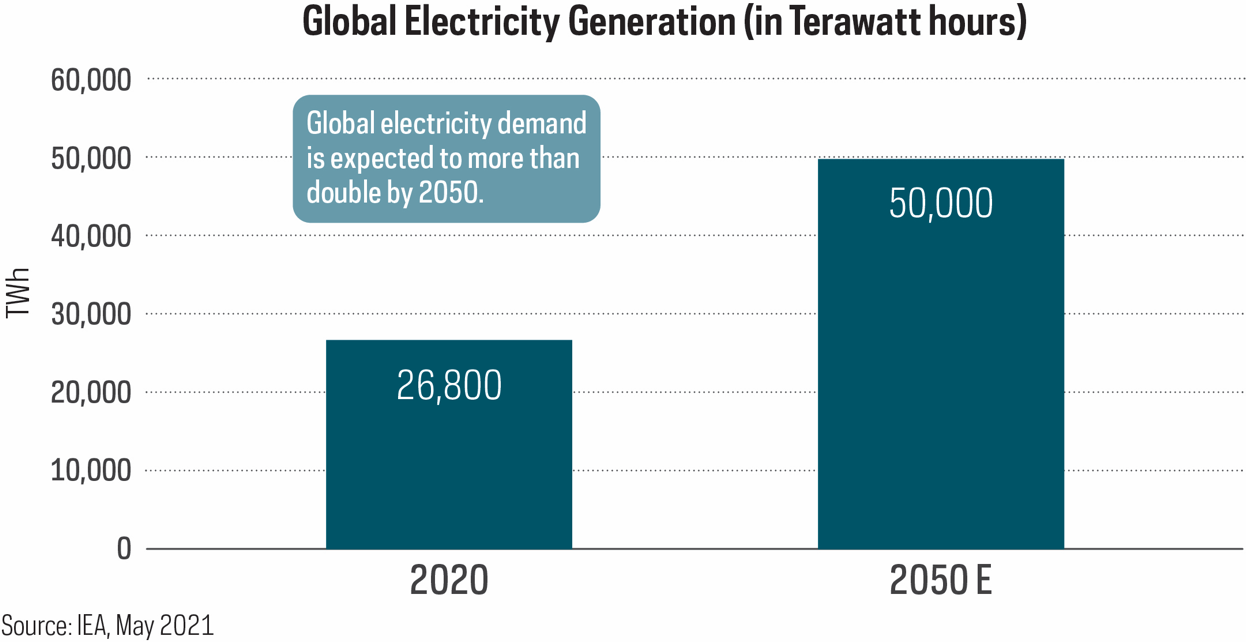

The adoption of low-emissions electricity in place of fossil fuels is one of the most important drivers of reducing our carbon footprint. Global electricity demand is expected to more than double by 2050, according to the IEA. Perhaps the most apparent of these initiatives will be the rapid increase in electric car sales. According to the IEA, electric vehicle inventory is expected to increase by 18x by 2030 to 140 million vehicles. More electricity needs will require investments not only in low-carbon electricity generation, but also in developing and maintaining a more robust transmission and distribution network. Electricity transmission and distribution companies such as National Grid and Eversource will be at the center of these efforts.

Source: IEA

The Infrastructure Investment Opportunity

For investors, these tides of change represent investment opportunities in infrastructure.

With long-term commitments to energy transformation around the world, maintaining and enhancing current energy infrastructure and developing new infrastructure will be critical for decades to come. As a result, the owners and operators of those pipelines, energy grids and other energy infrastructure may be poised for investment opportunity.

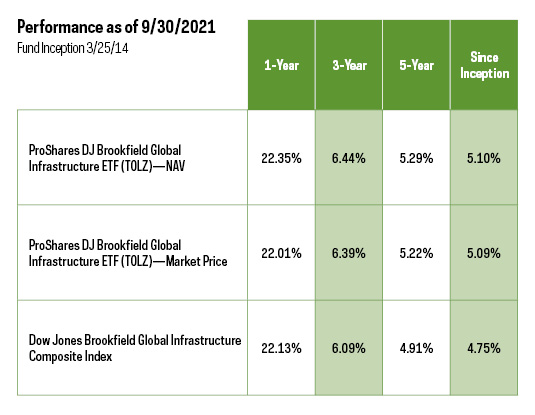

To take advantage of this investment opportunity, we invite you to explore the ProShares DJ Brookfield Global Infrastructure ETF (TOLZ). TOLZ invests in the “pure-play” owners and operators of transportation, communication, water, and energy infrastructure. Pure-play refers to companies that derive 70% or more of their cash flows from infrastructure lines of business, as tracked by the DJ Brookfield Global Infrastructure Composite Index. The TOLZ portfolio’s energy infrastructure exposure includes midstream-energy pipelines and electricity transmission and distribution systems that are well positioned for the world’s transformation to a cleaner energy future.

As of September 30, 2021. TOLZ’s total operating expenses are 0.46%.

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. Standardized returns and performance data current to the most recent month end may be obtained by visiting ProShares.com.

Index performance is for illustrative purposes only and does not represent fund performance. Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest in an index.

This information is not meant to be investment advice. There is no guarantee forecasts will be met.

Shares are bought and sold at market price (not NAV) and are not individually redeemed from the fund. Market price returns are based upon the midpoint of the bid/ask spread at 4:00 p.m. ET (when NAV is normally determined for most funds) and do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns.

Investing is currently subject to additional risks and uncertainties related to COVID-19, including general economic, market and business conditions; changes in laws or regulations or other actions made by governmental authorities or regulatory bodies; and world economic and political developments.

Investing involves risk, including the possible loss of principal. This ProShares ETF is diversified and entails certain risks, including imperfect benchmark correlation and market price variance, that may decrease performance. Please see summary and full prospectuses for a more complete description of risks. There is no guarantee any ProShares ETF will achieve its investment objective.

This ETF is subject to risks faced by companies in the infrastructure, energy and utilities industries to the same extent as the Dow Jones Brookfield Global Infrastructure Composite Index is so concentrated. This ETF invests in master limited partnerships (MLPs). Investments in MLPs expose the ETF to certain tax risks associated with investing in partnerships. Changes in U.S. tax laws could revoke the pass-through attributes that provide the tax efficiencies that make MLPs attractive investment structures. MLPs may also have limited financial resources, may be relatively illiquid, and may be subject to more erratic price movements because of the underlying assets they hold. In addition, a portion of the ETF's distributions may be a return of capital, which constitutes the return of a portion of a shareholder's original investment. Under tax rules, returns of capital are generally not currently taxable, but lower a shareholder's tax basis in their shares. Such a reduction in tax basis will result in larger taxable gains and/or lower tax losses on a subsequent sale of shares.

International investments may involve risks from geographic concentration, differences in valuation and valuation times, unfavorable fluctuations in currency, differences in generally accepted accounting principles, and economic or political instability.

Emerging markets are riskier than more developed markets because they may develop unevenly or may never fully develop. Investments in emerging markets are considered speculative.

Carefully consider the investment objectives, risks, charges and expenses of ProShares before investing. This and other information can be found in their summary and full prospectuses. Read them carefully before investing.

The “Dow Jones Brookfield Global Infrastructure Composite” Index is a product of S&P Dow Jones Indices LLC and its affiliates and has been licensed for use by ProShares. “S&P®” is a registered trademark of Standard & Poor’s Financial Services LLC (“S&P”) and “Dow Jones®” is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and they have been licensed for use by S&P Dow Jones Indices LLC and its affiliates. ProShares have not been passed on by S&P Dow Jones Indices LLC and its affiliates as to their legality or suitability. ProShares based on the Dow Jones Brookfield Global Infrastructure Composite Index are not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P or their respective affiliates, and they make no representation regarding the advisability of investing in ProShares. THESE ENTITIES AND THEIR AFFILIATES MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO PROSHARES.

Learn More

TOLZ

DJ Brookfield Global Infrastructure ETF

TOLZ focuses exclusively on pure-play companies—the owners and operators of infrastructure assets such as toll roads, airports and cell towers.