Two ETFs to Prepare for a Rising Rate Environment

The recent run of good economic data and the promise of a COVID-19 vaccine suggest a period of rising interest rates could be on the way. Even a minor rate increase could be a significant drag on returns in corporate bond portfolios.

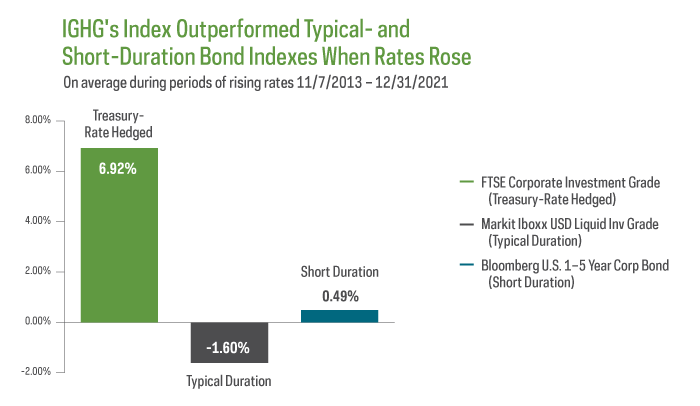

Source: Bloomberg. Average performance based on quarterly changes in the 10-Year Treasury yield. Rising rate periods are any calendar quarters in which the 10-Year Treasury yield increased. As of 12/31/2021, the duration of the FTSE Corporate Investment Grade (Treasury-Rate Hedged) Index was -0.06 years. Duration is a measure of a fund’s sensitivity to interest rate changes, reflecting the likely change in bond prices given a small change in yields. Higher duration generally means greater sensitivity. The Markit iBoxx USD Liquid Investment Grade Index is designed to provide a balanced representation of the USD investment grade corporate market and to meet the investor's demand for a USD denominated, highly liquid and representative investment grade corporate index. The index represents typical duration for the broad investment grade bond market. The Bloomberg Barclays U.S. 1–5 Year Corporate Bond Index measures the investment return of U.S. dollar denominated, investment grade, fixed rate, taxable securities issued by industrial, utility, and financial companies with maturities between one and five years. Index returns are for illustrative purposes only and do not represent fund performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest directly in an index. For IGHG's standardized returns and performance data current to the most recent month end, see Performance.

If, for example, 10-year U.S. Treasury yields rose just a half of a percent (still a low rate for 10-year yields), a typical investment-grade bond portfolio with a duration of 10 could see a five percent reduction in total return. And while short-term bond funds are an option to help reduce rate risk, they cannot eliminate it.

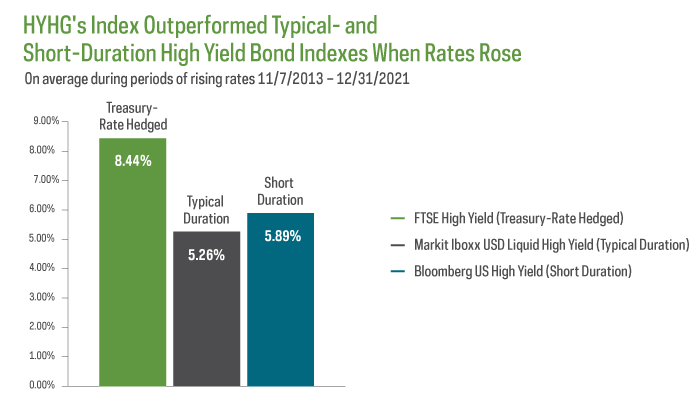

ProShares interest rate hedged bond ETFs, on the other hand, target zero interest rate risk. They combine portfolios of diversified corporate bonds, either investment grade or high yield, with built-in hedges against rising rates.

ProShares Investment Grade—Interest Rate Hedged (IGHG) and ProShares High Yield—Interest Rate Hedged (HYHG) follow indexes that have a history of performing well during periods of rising rates.

Source: Bloomberg. Average performance based on quarterly changes in the 5-Year Treasury yield. Rising rate periods are any calendar quarters in which the 5-Year Treasury yield increased. As of 12/31/2021, the duration of the FTSE High Yield (Treasury-Rate Hedged) Index was -0.27 years. Duration is a measure of a fund’s sensitivity to interest rate changes, reflecting the likely change in bond prices given a small change in yields. Higher duration generally means greater sensitivity. The Markit iBoxx USD Liquid High Yield Index consists of liquid USD high yield bonds, selected to provide a balanced representation of the broad USD high yield corporate bond universe. The index represents typical duration for the broad high yield bond market. Bloomberg Barclays Short Term High Yield Bond (Short Duration) Index is designed to measure the performance of short-term publicly issued U.S. dollar-denominated high yield corporate bonds. Index returns are for illustrative purposes only and do not represent fund performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest directly in an index. For HYHG's standardized returns and performance data current to the most recent month end, see Performance.

For more information and current IGHG and HYHG performance, click here.

Performance quoted represents past performance and does not guarantee future results. Investment return and principal value will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. For standardized returns and performance data current to the most recent month end, see Performance.

Investing involves risk, including the possible loss of principal. These ProShares ETFs are diversified and entail certain risks, including risks associated with the use of derivatives (swap agreements, futures contracts and similar instruments), imperfect benchmark correlation, leverage and market price variance, all of which can increase volatility and decrease performance. Please see summary and full prospectuses for a more complete description of risks. There is no guarantee any ProShares ETF will achieve its investment objective.

IGHG and HYHG do not attempt to mitigate factors other than rising Treasury interest rates that impact the price and yield of corporate bonds, such as changes to the market's perceived underlying credit risk of the corporate entity. IGHG and HYHG seek to hedge investment grade bonds and high yield bonds, respectively, against the negative impact of rising rates by taking short positions in Treasury futures. The short positions are not intended to mitigate credit risk or other factors influencing the price of the bonds, which may have a greater impact than rising or falling interest rates. These positions lose value as Treasury prices increase. Investors may be better off in a long-only investment grade or high yield investment than investing in IGHG or HYHG when interest rates remain unchanged or fall, as hedging may limit potential gains or increase losses. No hedge is perfect. Because the duration hedge is reset on a monthly basis, interest rate risk can develop intra-month, and there is no guarantee the short positions will completely eliminate interest rate risk. Furthermore, while IGHG and HYHG seek to achieve an effective duration of zero, the hedges cannot fully account for changes in the shape of the Treasury interest rate (yield) curve. IGHG and HYHG may be more volatile than a long-only investment in investment grade or high yield bonds. Performance of IGHG and HYHG could be particularly poor if investment grade or high yield credit deteriorates at the same time that Treasury interest rates fall. There is no guarantee the fund will have positive returns.

Bonds will decrease in value as interest rates rise.

High yield bonds may involve greater levels of credit, liquidity and valuation risk than higher-rated instruments. High yield bonds are more volatile than investment grade securities, and they involve a greater risks of loss (including loss of principal) from missed payments, defaults or downgrades because of their speculative nature.

Short positions in a security lose value as that security's price increases.

Narrowly focused investments typically exhibit higher volatility.

"FTSE,®" "FTSE Corporate Investment Grade (Treasury Rate-Hedged)" and "FTSE High Yield (Treasury Rate-Hedged)" have been licensed for use by ProShares. FTSE is a trademark of the London Stock Exchange Plc and The Financial Times Limited and is used by the FTSE International Limited ("FTSE") under license. ProShares have not been passed on by FTSE or its affiliates as to their legality or suitability. ProShares based on the FTSE Corporate Investment Grade (Treasury Rate-Hedged) or FTSE High Yield (Treasury Rate-Hedged) Index are not sponsored, endorsed, sold or promoted by FTSE or its affiliates, and they make no representation regarding the advisability of investing in ProShares. THIS ENTITY AND ITS AFFILIATES MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO PROSHARES.

Carefully consider the investment objectives, risks, charges and expenses of ProShares before investing. This and other information can be found in their summary and full prospectuses. Read them carefully before investing.

Learn More

IGHG

Investment Grade - Interest Rate Hedged ETF

Seeks investment results, before fees and expenses, that track the performance of the FTSE Corporate Investment Grade (Treasury Rate-Hedged) Index.

HYHG

High Yield - Interest Rate Hedged ETF

Seeks investment results, before fees and expenses, that track the performance of the FTSE High Yield (Treasury Rate-Hedged) Index.