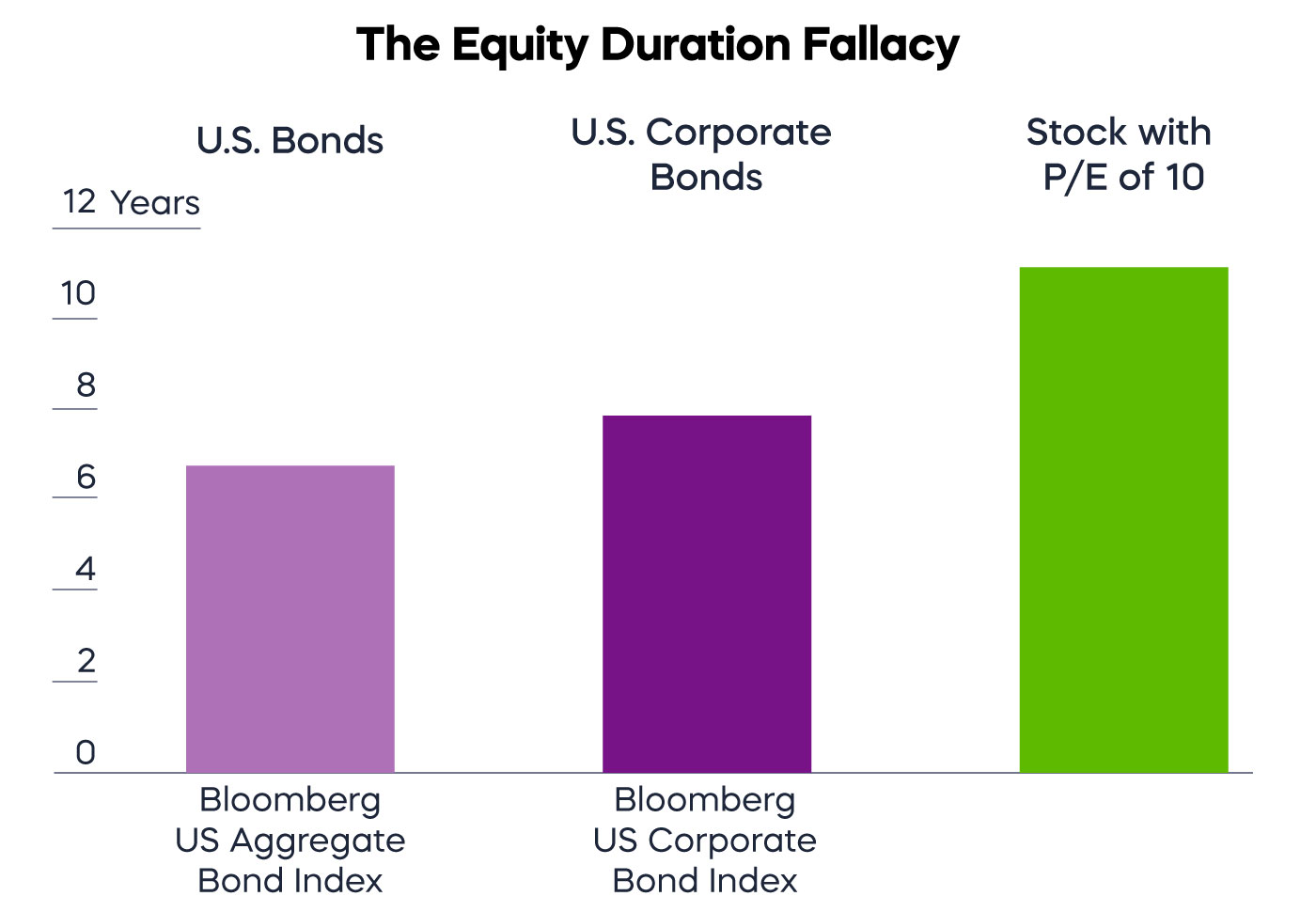

When rates rise, many investors seek to extend the logic of bonds to equities. If the appropriate response is to reduce (or eliminate) duration risk in one’s bond portfolio1, why not seek to reduce duration risk in one’s equity portfolio? Reducing duration risk in an equity portfolio means owning cheaper and higher yielding stocks, where more of the return is concentrated in shorter periods of time. This approach is misguided.

Source: Bloomberg, as of 6/30/22. P/E is the price-earnings ratio, also known as P/E ratio, or P/E, which is the ratio of a company's share (stock) price to the company's earnings per share. Chart is for illustrative purposes only and not indicative of any particular investment.

A stock with a P/E of 10 – roughly half of the P/E of the current P/E levels of the S&P 500 – still has a duration considerably longer than the bond market. Salvation from rising rates for equities comes not from low price and high dividend yields – but from growth. Stocks that consistently grow their dividends can be particularly effective solutions.

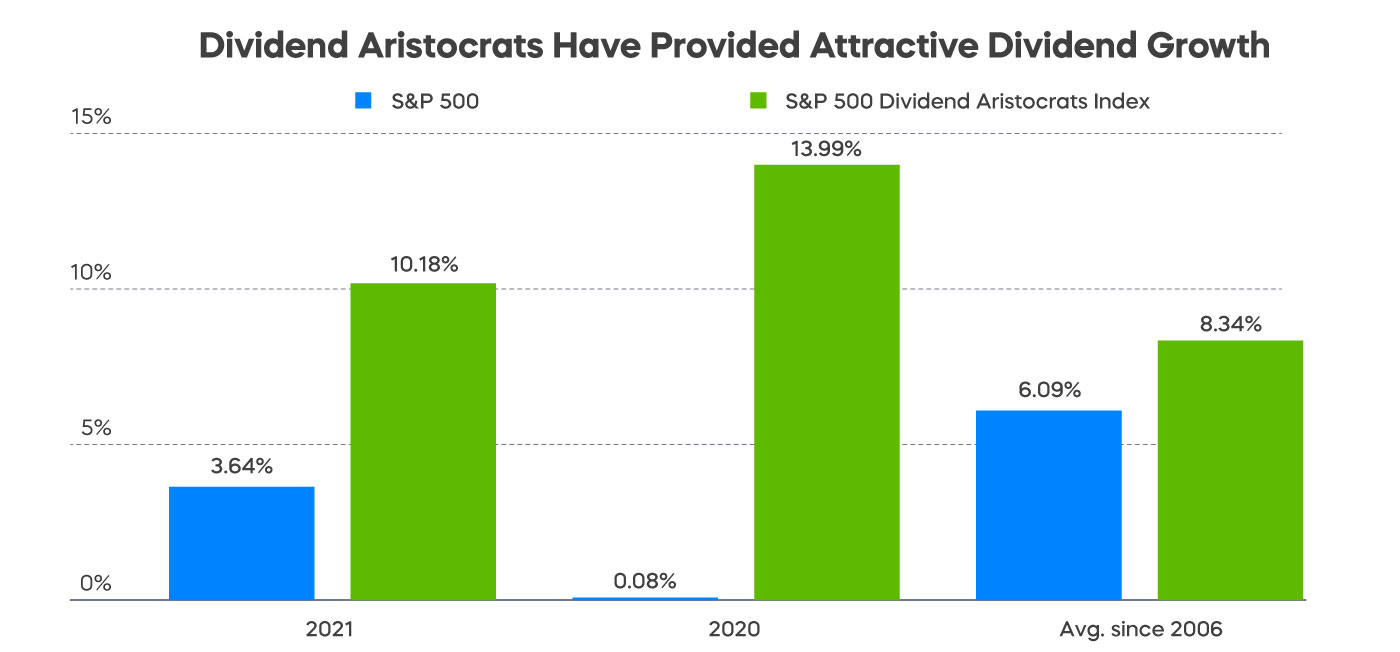

The S&P 500 Dividend Aristocrats consists of companies that have increased their dividends for at least 25 consecutive years. Here is the dividend growth delivered by the strategy over the past 15 years.

Source: Standard & Poor’s. As of 12/31/21.

These companies are delivering an income stream whose growth is outstripping the impact of rising rates and the inflation that often accompanies those rising rates. And because growing dividends can only be generated from growing earnings and cash flow, they are a key marker of high quality.

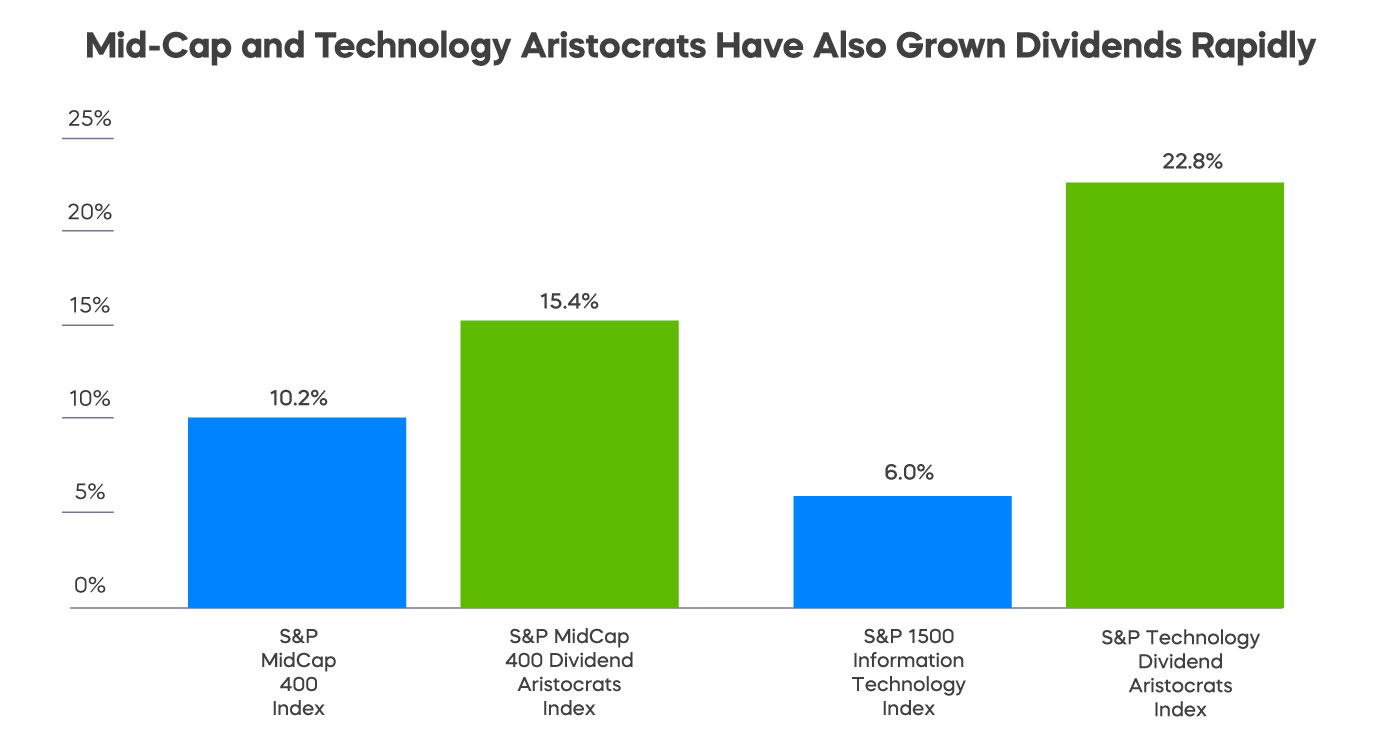

The approach extends beyond just the large cap portion of a core equity portfolio. The S&P MidCap Dividend Aristocrats – consisting of mid cap companies that have delivered at least 15 years of consecutive dividend growth – have delivered attractive levels of dividend growth that exceed the levels of the broad mid-cap market. And for those thinking about the ever-growing technology component of the core – there’s the S&P Technology Aristocrats with a minimum of 7 consecutive years of dividend growth.

Source: Standard & Poor’s. As of 12/31/21.

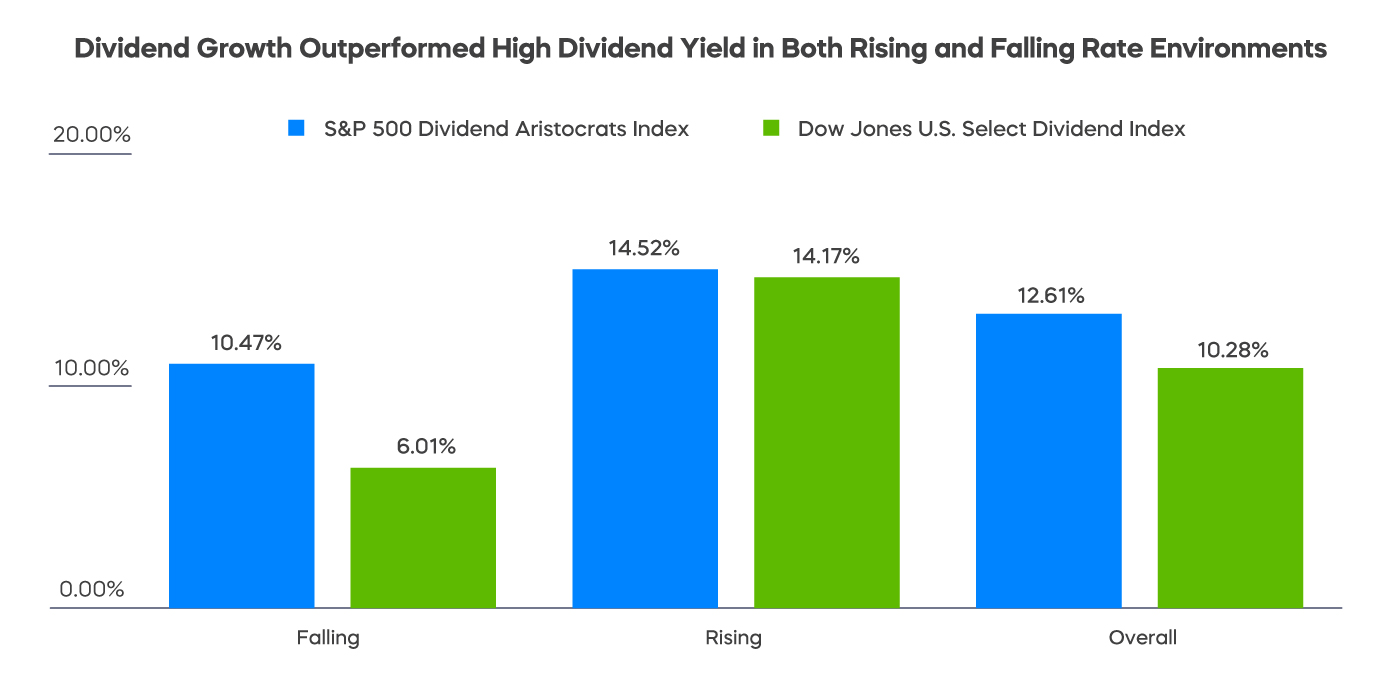

An important proof-point for the efficacy of dividend growth compared to low price/high yield alternatives is the outperformance of the S&P 500 Dividend Aristocrats compared to the Dow Jones US Select Dividend Index – an index of high-yielding US stocks.

Reinforcing the core, however, is not just about positioning for a specific environment. A core equity allocation should perform across the widest range of conditions. After all, there is a chance that interest rates don’t rise. The outperformance of consistent dividend growers in both rising and falling interest rate environments makes the S&P 500 Dividend Aristocrats potentially suitable for an evergreen, high-quality core equity strategy. And one that is particularly well fortified against rising rates.

Source: Bloomberg, 5/2/05 - 3/31/22. Results show average performance of both dividend growth - as represented by the S&P 500 Dividend Aristocrats Index - and high dividend yield - as represented by the Dow Jones U.S. Select Dividend Index - during different interest rate regimes. Monthly returns for each strategy were separated into rising rate periods and falling rate periods based on movements in the 10-year Treasury yield. Rising rate periods were defined as periods in which the change in the 10-year Treasury yield was > 0, and falling rate periods were those in which the change in the 10-year Treasury yield was < 0. Average monthly returns were then annualized. Index returns are for illustrative purposes only and do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

1A bond’s duration is the measure of price sensitivity to interest rate changes.

Learn More

Learn More

NOBL

S&P 500 Dividend Aristocrats ETF

Seeks investment results, before fees and expenses, that track the performance of the S&P 500® Dividend Aristocrats® Index.

REGL

S&P MidCap 400 Dividend Aristocrats ETF

Seeks investment results, before fees and expenses, that track the performance of the S&P MidCap 400® Dividend Aristocrats® Index.

SMDV

Russell 2000 Dividend Growers ETF

Seeks investment results, before fees and expenses, that track the performance of the Russell 2000® Dividend Growth Index.

TDV

S&P Technology Dividend Aristocrats ETF

ProShares S&P Technology Dividend Aristocrats ETF seeks investment results, before fees and expenses, that track the performance of the S&P® Technology Dividend Aristocrats® Index.