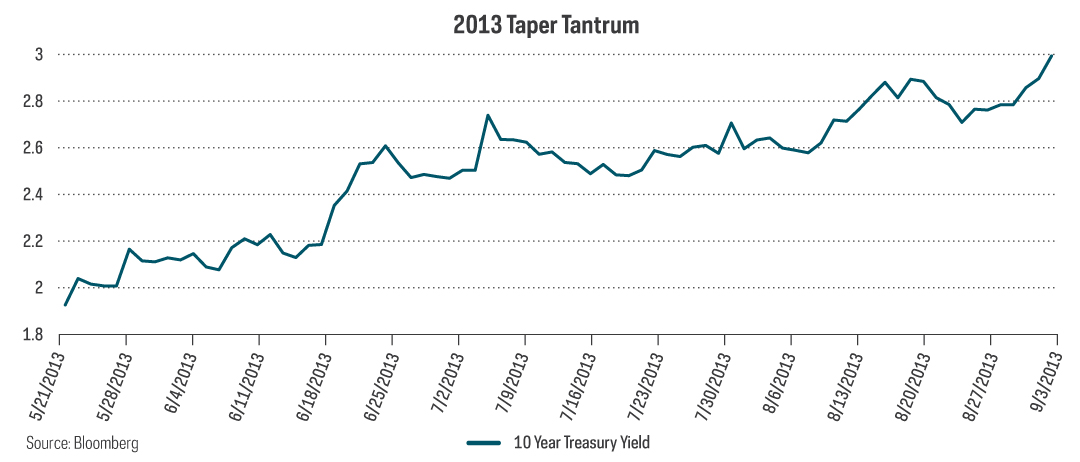

What’s driving interest rates higher? For that matter, are interest rates really even headed higher? Several forces are putting upward pressure on rates, although the threat of the delta variant’s impact to the economy may affect the speed at which they move. Interest rates are largely impacted by two factors: policy decisions made by the Federal Reserve (the Fed), and investor expectations of those decisions over the long term. More recently, the Fed seems to have honed in on the latter, carefully crafting the language used at Federal Open Market Committee (FOMC) meetings in order to temper expectations of dramatic monetary policy shifts. Policy officials are likely trying to avoid a taper tantrum, like the one seen in 2013. For historical context, on May 21, 2013, then-Chairman Bernanke announced plans to begin tapering the Fed’s asset purchase program following the global financial crisis. Following the announcement, the 10-year Treasury yield rapidly rose more than 100 basis points (bps).

Source: Bloomberg

As a result, U.S. bond market returns suffered, as bond prices and interest rates have an inverse relationship. This time around, it appears the Fed is trying to provide sufficient notice as to when quantitative easing might end. Nonetheless, the Fed has indicated that it will likely reduce the size of its asset purchases sometime this year, so long as the economy stays on track. It is the intent of quantitative easing to suppress treasury yields, and the intent of tapering to allow them to rise. The Fed would like to moderate the speed at which 10-year Treasury rates rise; however, we are still likely to see them increase from the suppressed levels that have existed since the onset of the pandemic.

Once tapering begins, the next likely catalyst for an uptick in rates across the yield curve would be an uptick in the Fed Funds rate. Keeping in mind the Fed’s dual mandate of price stability and maximum employment, let’s take a look at two potential reasons why the Fed may become more hawkish, which could lead to the next rate hike coming sooner than anticipated.

1. Rising Inflation

The uptick in inflation seen in 2021 is causing many businesses and consumers to become concerned with rising prices. The Fed typically looks to prevent such uneasiness and has reiterated its belief that the current spike in inflation is likely transitory, even though supply bottlenecks may continue to push prices higher. Uneven vaccination rates across the globe may lead to a continued squeeze of supply chains, with the delta variant potentially leading to further mismatches in supply and demand here in the United States.

2. An Improving Labor Market

The number of job openings has reached all-time highs domestically, now surpassing the number unemployed (when looking at data for July 2021). The Department of Labor reported that the number of job openings climbed to 10.9 million, while the number of unemployed people fell to 8.4 million. The unemployment rate has also declined steadily from its peak in April of 2020, standing at 5.2% as of August 2021.

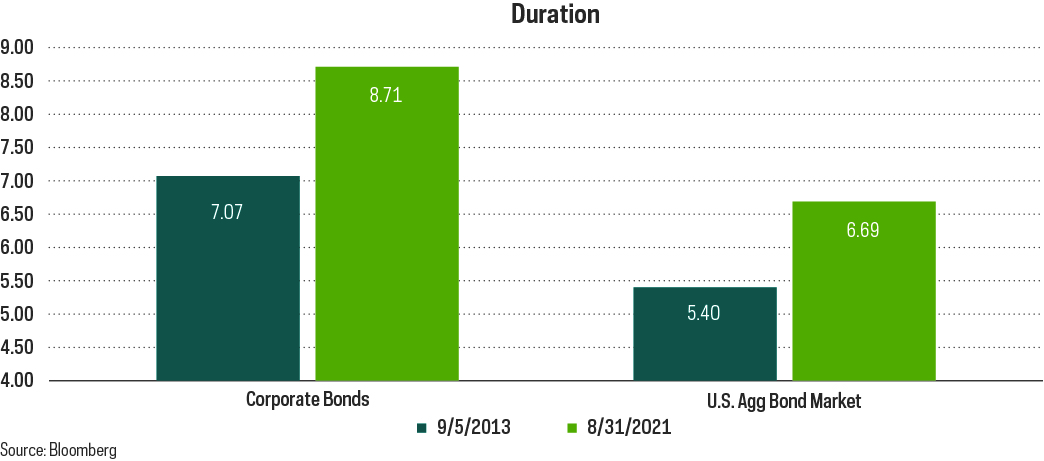

Potential surprises to either consumer prices or labor market conditions may change the pace at which rates rise, but current historically low levels are likely unsustainable. For investors seeking protection from rising rates, an interest rate hedged solution may be a prudent investment. The interest rate risk embedded in the corporate bond market has risen significantly since 2013. And U.S. corporate bonds, in particular, are most likely to be negatively impacted by rising rates because of their extended duration.

Interest rate hedged strategies, like that of the FTSE Corporate Investment Grade (Treasury Rate-Hedged) Index, can help shield portfolios from interest rate risk. The index outperformed the corporate bond market by 5.7% during the 2013 taper tantrum. While significant differences exist between today’s environment and that of 2013, it may be wise for investors to carefully evaluate the duration of their fixed income portfolios.

Interest Rate Hedged Bond Strategies

In our previous piece, “Bond Strategies for Rising Rates—Shorten, Float or Hedge?” we compared several strategies to help prepare for rising rates. Interest rate hedged bond strategies typically invest in portfolios of investment-grade or high-yield bonds and include built-in hedges to alleviate the impact of rising Treasury rates. The hedges are specifically designed to reduce exposure to interest rate risk, so the strategies retain full exposure to credit risk as a primary source of return.

Two Interest Rate Hedged Corporate Bond ETFs to Consider:

For investors focused on higher grade fixed income, ProShares Investment Grade—Interest Rate Hedged ETF (IGHG) is an investment grade bond ETF with a built-in hedge that targets a duration of zero to virtually eliminate interest rate risk.

For investors interested in the return potential of non-investment-grade bonds, ProShares High Yield—Interest Rate Hedged ETF (HYHG) is a high-yield bond ETF, also with a built-in hedge targeting a duration of zero to virtually eliminate interest rate risk.

Disclosures

Investment comparisons are for illustrative purposes only and not meant to be all-inclusive.

Investing involves risk, including the possible loss of principal. These ProShares ETFs entail certain risks, which include the use of derivatives (futures contracts), imperfect benchmark correlation, leverage and market price variance, all of which can increase volatility and decrease performance. Bonds will generally decrease in value as interest rates rise. High yield bonds may involve greater levels of credit, liquidity and valuation risk than higher-rated instruments. High yield bonds are more volatile than investment grade securities, and they involve a greater risk of loss (including loss of principal) from missed payments, defaults or downgrades because of their speculative nature. Narrowly focused investments typically exhibit higher volatility. Please see summary and full prospectuses for a more complete description of risks. There is no guarantee any ProShares ETF will achieve its investment objective.

Carefully consider the investment objectives, risks, charges and expenses of ProShares before investing. This and other information can be found in their summary and full prospectuses. Read them carefully before investing.

“FTSE” is a trademark and service mark of FTSE Inc. or its affiliates, is used and registered throughout the world, and has been licensed for use by ProShares. ProShares ETFs based on the "FTSE High Yield (Treasury Rate-Hedged) Index” and the "FTSE Investment Grade (Treasury Rate-Hedged) Index” are not sponsored, endorsed, sold, or promoted by FTSE Index LLC (“FTSE Index”) or its affiliates (collectively, “FTSE”), and they make no representation regarding the advisability of investing in ProShares ETFs. FTSE INDEX MAKES NO EXPRESS OR IMPLIED WARRANTIES OF ANY KIND, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. In no event shall FTSE be liable for any direct, indirect, special or consequential damages in connection with any use of the “FTSE High Yield (Treasury Rate-Hedged) Index” and "FTSE Investment Grade (Treasury Rate-Hedged) Index.”

HYHG and IGHG do not attempt to mitigate factors other than rising Treasury interest rates that impact the price and yield of corporate bonds, such as changes to the market's perceived underlying credit risk of the corporate entity. HYHG and IGHG seek to hedge high yield bonds and investment grade bonds, respectively, against the negative impact of rising rates by taking short positions in Treasury futures. The short positions are not intended to mitigate credit risk or other factors influencing the price of the bonds, which may have a greater impact than rising or falling interest rates. These positions lose value as Treasury prices increase. Investors may be better off in a long-only high yield or investment grade investment than investing in HYHG or IGHG when interest rates remain unchanged or fall, as hedging may limit potential gains or increase losses. No hedge is perfect. Because the duration hedge is reset on a monthly basis, interest rate risk can develop intra-month, and there is no guarantee the short positions will completely eliminate interest rate risk. Furthermore, while HYHG and IGHG seek to achieve an effective duration of zero, the hedges cannot fully account for changes in the shape of the Treasury interest rate (yield) curve. HYHG and IGHG may be more volatile than a long-only investment in high yield or investment grade bonds. Performance of HYHG and IGHG could be particularly poor if high yield or investment grade credit deteriorates at the same time that Treasury interest rates fall. High yield bonds are more volatile than investment grade securities, and they involve a greater risk of loss (including loss of principal) from missed payments, defaults or downgrades because of their speculative nature. There is no guarantee the funds will have positive returns.

Learn More

IGHG

Investment Grade - Interest Rate Hedged ETF

Seeks investment results, before fees and expenses, that track the performance of the FTSE Corporate Investment Grade (Treasury Rate-Hedged) Index.

HYHG

High Yield - Interest Rate Hedged ETF

Seeks investment results, before fees and expenses, that track the performance of the FTSE High Yield (Treasury Rate-Hedged) Index.