In the search for both income and growth, covered call strategies have become a popular part of investors’ toolkits. While covered call strategies can generate attractive levels of income, traditional covered call strategies—those using monthly call options—typically require investors to make a costly trade-off between the potential for high income and long-term total returns.

Recent innovations in the options market offer a potential solution. Using daily options, investors can participate more fully in upward price movements, capturing returns that monthly strategies may miss. A daily covered call strategy provides investors the opportunity to seek high income, target equity market performance over the long term, and potentially capture returns traditional strategies may sacrifice.

Traditional Covered Call Strategies: A Costly Trade-off

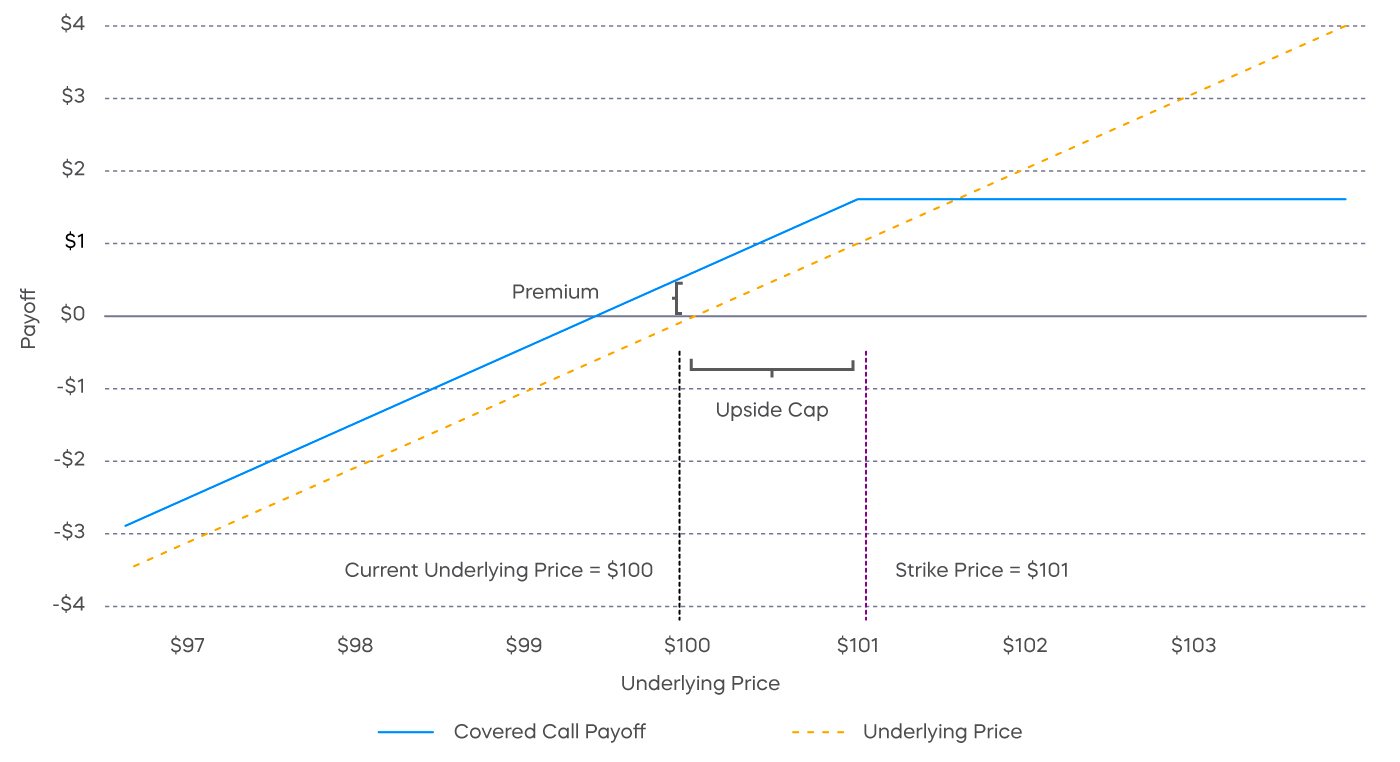

In the classic covered call strategy, an investor accepts a ceiling or cap on the appreciation of an investment—for example, a stock market index—in return for income from the sale of a call option. If the market price of the stock index rises above the strike price of the call option, the option is “in the money," meaning the seller of the call option owes a payment to the buyer. This payment or "payout" is equal to the difference between the price of the index and the option's strike price. The option payout is “covered” by the gains on the stock index. The covered call strategy does not lose money if the price of the index rises above the option’s strike price; the strategy simply places a cap on performance.

Covered Call Payoff at Expiration

Chart is for illustrative purposes only.

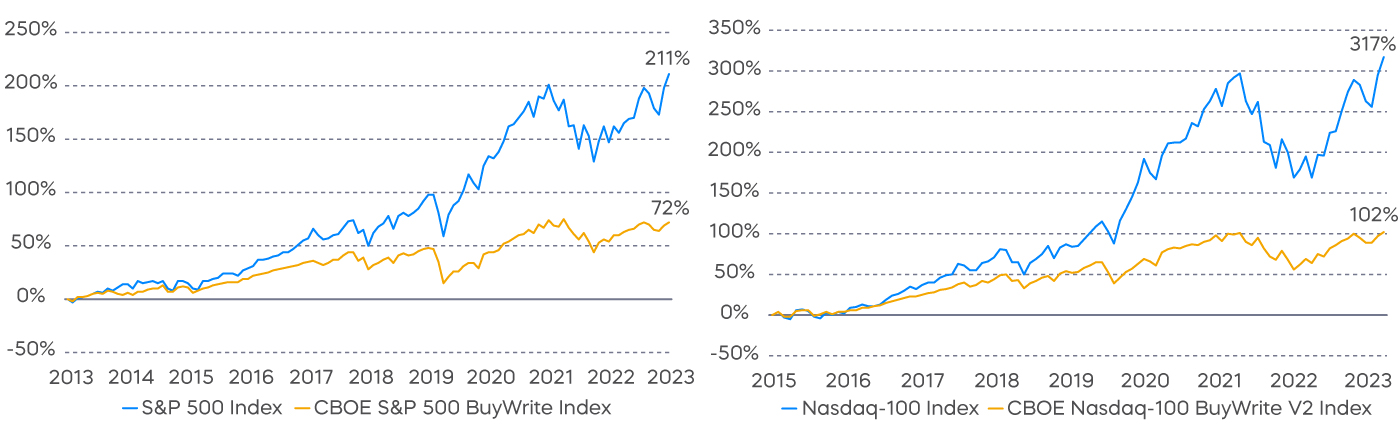

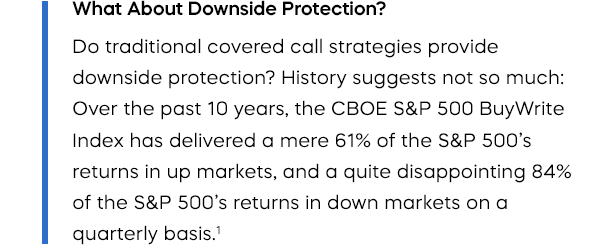

By capping the potential gains of an investment, covered call strategies create an inherent trade-off: The investor receives income from selling calls, but sacrifices total return potential by capping the upside. In the case of traditional covered call strategies, this trade-off can be particularly costly. Below are performance comparisons of the S&P 500 Index and the CBOE S&P 500 BuyWrite Index, and the Nasdaq-100 Index and the CBOE Nasdaq-100 BuyWrite V2 Index. The CBOE BuyWrite indices measure the performances of traditional, monthly covered call strategies on the S&P 500 and the Nasdaq-100, respectively. As you can see, S&P 500 and Nasdaq-100 covered call strategies have typically resulted in total returns that are less than half and less than one-third, respectively, of their indices. A costly trade-off indeed.

Income at a Significant Performance Cost

S&P 500 and Nasdaq-100 Covered Call Strategies

Daily Call Options: Potential to Improve the Trade-off Between Income and Total Return

Recalling the mechanics of a monthly covered call strategy, if the price of the stock index goes above, and stays above, the strike price early in the month, the strategy could potentially be unable to participate in a stock market rally for days, or weeks, until the call option expires. This can be a significant drawback for achieving long-term total returns.

This can be a significant drawback for achieving long-term total returns.

A daily covered call strategy seeks to overcome this by selling daily call options—a move that resets the cap daily. This allows the strategy the opportunity to participate in asset appreciation, up to the strike price, each day that it occurs. Additionally, selling call options each day acts as a rebalancing mechanism for maintaining the desired balance between premiums and payouts.

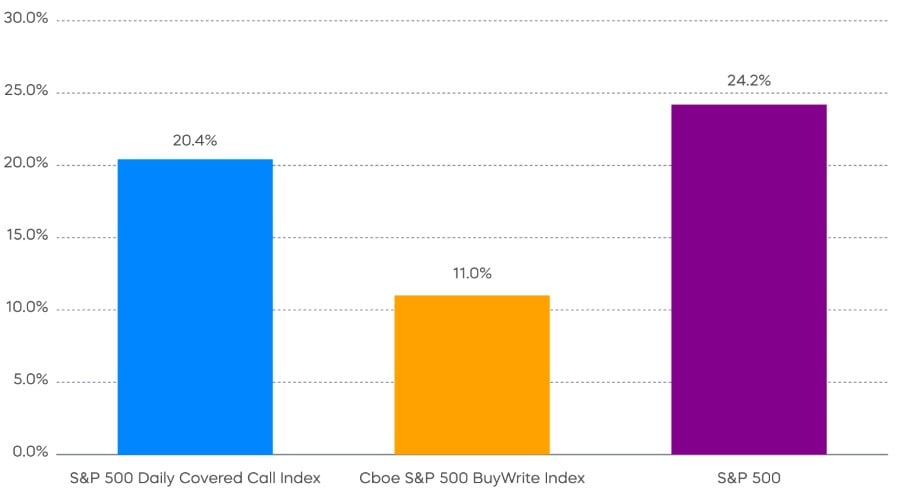

Taken together, daily appreciation potential and a better balance between premiums and payouts allow a daily covered call strategy to seek high income, target equity market performance over the long term, and potentially capture returns traditional strategies may sacrifice. While the daily covered call strategy is relatively new—the S&P 500 Daily Covered Call Index started only in October 2023—the early results are compelling in demonstrating the ability of this strategy to capture upside more effectively than its monthly option counterpart:

Daily Covered Call Index Shows Promise Since Its Inception

ISPY Total Return Since Inception—12/18/23[2]

As of 3/31/24: 8.97% (NAV) | 9.09% (Market Price)

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Shares are bought and sold at market price (not NAV) and are not individually redeemed from the fund. Market price returns are based upon the midpoint of the bid/ask spread at 4:00 p.m. ET (when NAV is normally determined for most funds). Your brokerage commissions will reduce returns. Current performance may be lower or higher than the performance quoted. For standardized returns and performance data current to the most recent month end, see the Performance page.

In addition to total return, the income potential of a covered call strategy is a key consideration for investors. For reference, the S&P 500 Daily Covered Call Index’s annualized index yield for the short period from inception on 10/5/2023 through 3/31/2024 was 10.82% (though it’s important to note that a daily covered call strategy’s option premium income will vary over time based on expectations of stock market volatility and other factors). The index’s yield and total return results are early indications that a daily covered call strategy can provide investors the opportunity to seek high income, target equity market performance over the long term, and potentially capture returns traditional strategies may sacrifice.[3]

For reference, the S&P 500 Daily Covered Call Index’s annualized index yield for the short period from inception on 10/5/2023 through 3/31/2024 was 10.82% (though it’s important to note that a daily covered call strategy’s option premium income will vary over time based on expectations of stock market volatility and other factors). The index’s yield and total return results are early indications that a daily covered call strategy can provide investors the opportunity to seek high income, target equity market performance over the long term, and potentially capture returns traditional strategies may sacrifice.[3]

Next-Generation ETFs Powered by a Daily Covered Call Strategy

ProShares recently introduced two daily covered call strategies, tracking the S&P 500 (ticker: ISPY) and Nasdaq-100 (ticker: IQQQ), respectively, that are designed to help investors overcome the trade-offs described above. The ProShares High Income ETFs, powered by a daily call options strategy, aim for both high income and equity market performance over time, potentially capturing returns that traditional covered call strategies may sacrifice. Learn about ProShares High Income ETFs: S&P 500 High Income ETF (ISPY) and Nasdaq-100 High Income ETF (IQQQ).

[1] Source: Morningstar. Quarterly up- and down-capture ratios from 12/31/2013 to 12/31/2023.

[2] The fund has very limited performance history, which should not be taken as an indication of future performance.

[3] Source: ProShares. The annualized index yield reflects the dividend and call premium income earned by the index for the period from 10/5/2023 through 3/31/2024, on an annualized basis, as measured by the S&P 500 Daily Covered Call Index - Income Only, a sub-index that measures the cash received by the index from dividends and call option premiums. The annualized index yield assumes that the income received from 10/5/2023 – 3/31/2024 would remain the same, but future income may differ significantly and is not guaranteed. The annualized index yield reflects dividend and call premium income from a short period of time only and does not reflect total returns. The index has a very limited performance history, which should not be taken as an indication of future performance. Indexes are unmanaged and do not include the effect of fees. One cannot invest directly in an index. Past performance does not guarantee future results. The annualized index yield is for illustrative purposes only and does not represent actual performance received by any investor.

Learn More

ISPY

S&P 500 High Income ETF

ProShares S&P 500 High Income ETF seeks investment results, before fees and expenses, that track the performance of the S&P 500 Daily Covered Call Index.

IQQQ

Nasdaq-100 High Income ETF

ProShares Nasdaq-100 High Income ETF seeks investment results, before fees and expenses, that track the performance of the Nasdaq-100 Daily Covered Call Index.