As the anticipated bitcoin halving in April 2024 draws near, investors are keenly observing the potential for significant market movement. The halving is expected to slash mining rewards from 6.25 to 3.125 bitcoins, marking a critical juncture that historically has been associated with notable price fluctuations and increased investor interest. Here is everything you need to know as we approach this key milestone.

| How often do halvings occur? | Halvings occur approximately once every four years, and they are expected to continue until the year 2140, when the amount of bitcoin in circulation is forecast to reach its maximum supply. |

| What is the maximum supply of bitcoin? | With a capped supply of 21 million bitcoin, halvings represent a step closer to bitcoin’s max supply limit. |

| What is the current award for mining bitcoin? | The current bitcoin award of 6.25 BTC is expected to be reduced to 3.125 BTC following the April 2024 halving event. |

What is Bitcoin “Halving”?

Bitcoin halving is designed to control the supply of new bitcoin entering circulation. Bitcoin operates on a decentralized network where transactions are verified and added to the blockchain ledger by miners. These miners are rewarded with bitcoin for their computational efforts, which in turn introduces new coins into circulation. The term “halving” refers to the scheduled reduction by half of these mining rewards. By reducing the rate at which new bitcoin are created, halving creates scarcity and limits the total supply of bitcoins that will ever exist. This controlled supply is a fundamental aspect of bitcoin’s design and contributes to its appeal for many investors.

Why does Halving Matter?

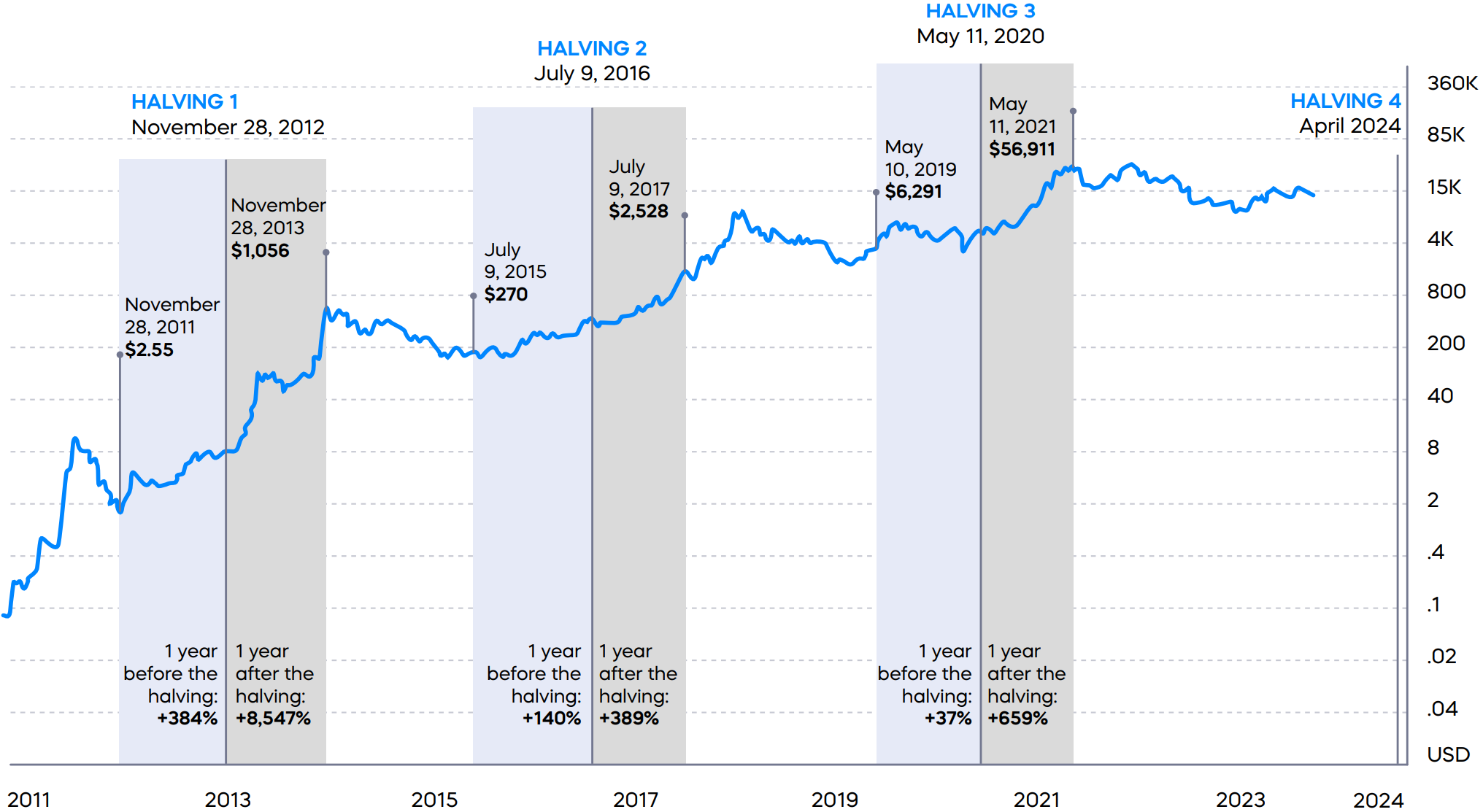

The previous bitcoin halvings occurred in November 2012, July 2016, and May 2020. Historically, the price of bitcoin has increased immediately prior to, as well as after, these halving events.

For example, in the 30 days preceding the July 9, 2016 halving event, bitcoin’s price rose from $574.63 to $650.96, a 13% increase. In the 30 days preceding the May 11, 2020 halving event, bitcoin’s price rose from $6,859.08 to $8,601.80, a 25% increase. The total calendar year returns for bitcoin in 2016 and 2020 were 124% and 303%, respectively.

Historically, Bitcoin Has Rallied Around Halving Events

Source: Bloomberg

Refer to the graph below for bitcoin rallies before and after halving events.

Bitcoin Halvings: History of BTC Prices

Source: Bloomberg, as of 12/31/23. Past performance does not guarantee future results.

What to expect.

The reduction in the supply of new bitcoin resulting from halving, coupled with potential increased demand, can create a supply-demand imbalance that may contribute to price appreciation. However, it’s important to note that the halving itself is not the sole factor influencing bitcoin’s price. Other market factors, investor sentiment, and macroeconomic conditions can also play significant roles in the price of bitcoin increasing or decreasing around halving events.

As we approach the April 2024 halving event, investors should prepare for increased volatility, possible consolidation within the mining industry, and potentially consequential shifts in the broader cryptocurrency market:

- Increased volatility. As evidenced by past data, bitcoin has experienced significant price moves during halving years. While, historically, those moves have been higher, the opposite could occur.

- Consolidation within the bitcoin mining industry. Lower block rewards may impact less-efficient miners’ profitability, possibly causing some to cease operations.

- Potential for higher prices in other cryptocurrencies. . While the halving is specific to bitcoin, other cryptocurrencies have made notable moves during halving years as well. Ether, which has historically maintained a strong correlation to bitcoin prices, rose from $129.63 to $737.80 during the 2020 halving, a 469% increase.

ProShares, a global leader in crypto-linked ETFs, offers a broad suite of products to help investors target the performance of the world’s largest cryptocurrencies, and prepare their portfolios for the April 2024 halving event.

These ETFs do not invest directly in bitcoin or ether.

Learn More

BITO

Bitcoin Strategy ETF

BITO aims to produce returns that correspond to bitcoin

EETH

Ether Strategy ETF

First ETF that targets the performance of ether

BETE

Bitcoin & Ether Equal Weight Strategy ETF

Targeting the equal weighted performance of bitcoin and ether in a single investment

BETH

Bitcoin & Ether Market Cap Weight Strategy ETF

Targeting the market cap weighted performance of bitcoin and ether in a single investment

BITI

Short Bitcoin Strategy ETF

BITI, the first short bitcoin strategy ETF, offers investors the potential to profit on days when bitcoin drops

SETH

Short Ether Strategy ETF

Provides an opportunity to profit when the daily price of ether declines

SBIT

UltraShort Bitcoin ETF

Provides an opportunity to profit when the daily price of bitcoin declines

BITU

Ultra Bitcoin ETF

Provides an opportunity to magnify gains when the daily price of bitcoin rises (will also magnify losses if the price declines)