The Dividend Aristocrats Are on Sale: Potential Buy Signal?

Metrics like a company’s price-to-earnings (P/E) ratio[1], which may indicate whether a stock is over- or undervalued, can help investors determine the potential for future total returns, but with one big caveat: They must be patient. In the short term, stock prices tend to be driven by supply and demand, and sentiment. Fundamentals like earnings, cash flows and valuations tend to matter more in the longer term. What can today’s valuations tell us? That there is a potential opportunity to buy high-quality stocks at low prices.

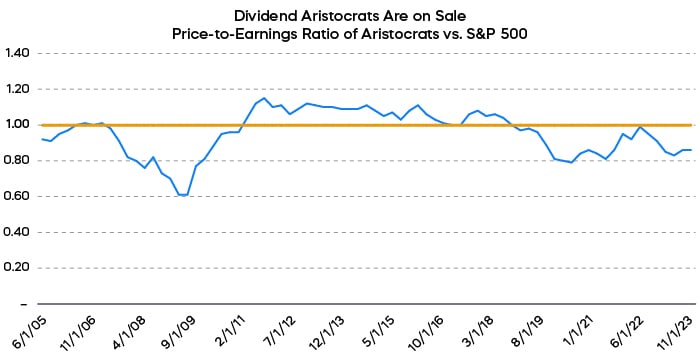

The S&P 500 advanced over 26% in 2023 with earnings that have been mostly flat, pushing the P/E ratios of S&P 500 stocks above long-term averages. Meanwhile, returns for the S&P 500 Dividend Aristocrats were more modest, despite delivering more stable earnings.[2] The result? The Aristocrats were trading at roughly 86% of the broader S&P 500’s P/E multiple as of 12/31/23.

That level of discount is not common and, prior to a few occurrences in 2020–2021, had not been seen in well over a decade. Higher-quality stocks like the S&P 500 Dividend Aristocrats have tended to trade at premium valuations to the market. When they have traded at discounted valuations to the S&P 500, it’s typically been a good time to invest.

The following chart shows the price-to-earnings ratio of the S&P 500 Dividend Aristocrats Index relative to the S&P 500. Anytime the blue line is below 1, the Aristocrats are relatively cheaper than the broad market.

Source: Bloomberg. Data from 6/30/05 to 12/31/23.

Prior periods when the Aristocrats have traded at similar relative valuations to today have often preceded strong periods of future outperformance, which could make today’s valuation levels a potential buy signal.

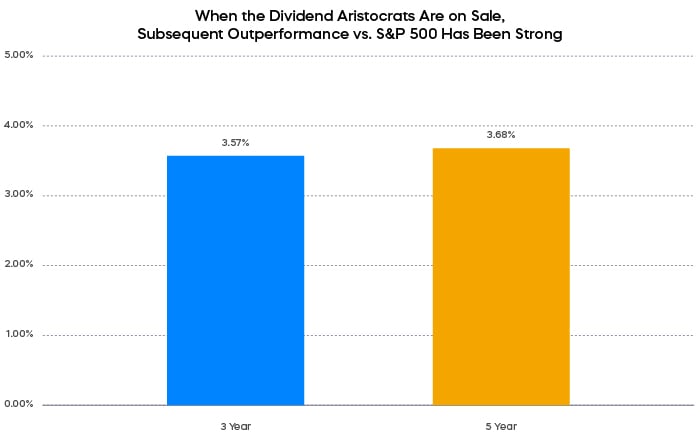

Anytime the Dividend Aristocrats have traded at less than 90% of S&P 500 valuations, average forward three- and five-year returns for the Aristocrats have outperformed and always been positive, as shown in the next chart.

Source: Bloomberg. Data from 6/30/05 to 12/31/23. Chart represents average of subsequent 3- and 5-year outperformance of S&P 500 Dividend Aristocrats vs. S&P 500 when the Aristocrats have been valued at less than 90% of the valuation of the S&P 500.

The S&P 500 Dividend Aristocrats often trade at premium valuations relative to the S&P 500. The Aristocrats are on sale, and they were trading at only 86% relative to the broad market as of 12/31/23. While there’s not generally a bad time to invest in quality stocks, now could be a great time to invest in the Dividend Aristocrats.

[1] Price/earnings (P/E) ratio is calculated by dividing the current share price of a company by its earnings per share (EPS). It shows how much investors are paying for a dollar of a company's earnings.

[2] Sources: Morningstar and FactSet.

Learn More

NOBL

S&P 500 Dividend Aristocrats ETF

Seeks investment results, before fees and expenses, that track the performance of the S&P 500® Dividend Aristocrats® Index.