The long-term opportunity presented by e-commerce may have a near-term catalyst. It could very well be that this year’s bricks-and-mortar rebound has run its course. The most bearish of potential outcomes of Chinese regulation—whether focused on antitrust issues, or other government interventions—is that Chinese e-commerce companies may have been generously priced in. If that proves to be the case, it could afford investors an opportune moment to initiate, increase or continue with investments in online retail.

Points to Consider

1

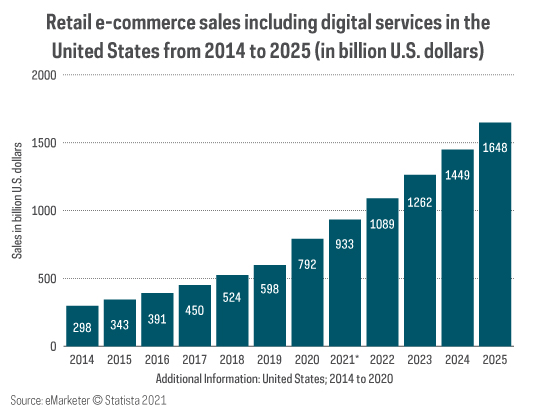

The pandemic accelerated an already impressive growth trajectory for online retail sales—one that may not be materially slowed by the reopening of the physical economy. E-commerce sales are projected to nearly double by 2025.

2

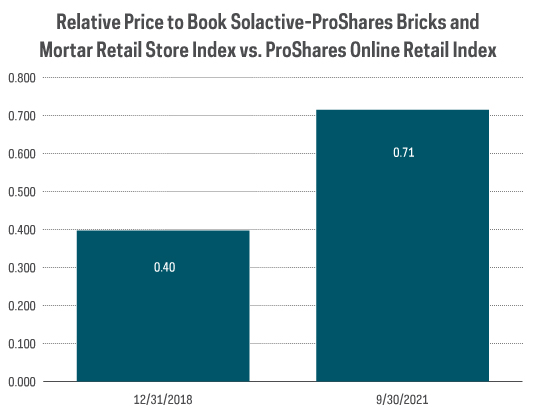

ProShares Bricks and Mortar Retail Store Index has returned 32.95% year to date through 9/30/2021, which is about double the return of the S&P 500. That performance reflects a deserved rebound initiated by the reopening of the physical economy—partial re-opening perhaps. However, the valuation advantage may now shift to e-commerce. The Solactive-ProShares Bricks and Mortar Retail Store Index is trading at more than double the pre-pandemic relative price-to-book of the ProShares Online Retail Index, as of September 30, 2021.

Source: Bloomberg. Price-to-book ratio measures market value of a fund or index relative to the collective book values of its component stocks.

3

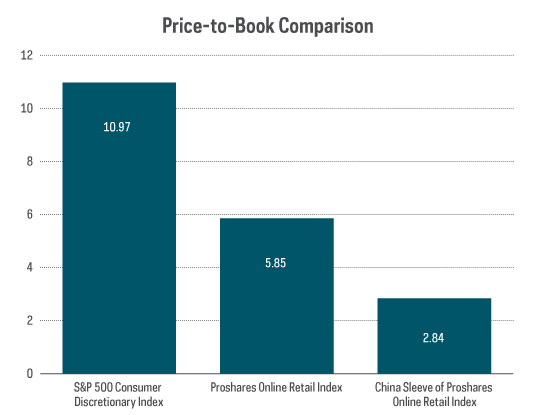

Chinese regulatory pressure has taken its toll on Chinese e-commerce stocks. As of September 30, 2021, Alibaba has fallen more than 50% from its peak last fall. It is tough to predict the Chinese government’s behavior and actions, but current valuations may be compelling. The ProShares Online Retail Index is trading at a 47% discount to the S&P 500 consumer discretionary sector, and the Chinese companies within the index are trading at roughly a 75% discount. That could be low enough, relatively, to be seen as a buying opportunity.

Source: Bloomberg, as of 9/30/2021

ProShares Online Retail Index Holdings as of 9/30/2021 - China as Country of Domicile

Retail Disruption: Settle in for the Long Haul

The growth of e-commerce and struggle of some legacy bricks-and-mortar retailers is a trend that was in place long before the pandemic, and may be poised to continue long after. Moreover, the potential impacts of e-commerce regulation in China could serve to magnify those trends. Now may be an opportune time to take advantage of this ongoing retail transformation, which could result in long-term investable opportunities.

Invest in Retail Disruption

ProShares offers multiple ETFs for investors looking to tap into long-term trends in e-commerce and retail disruption.

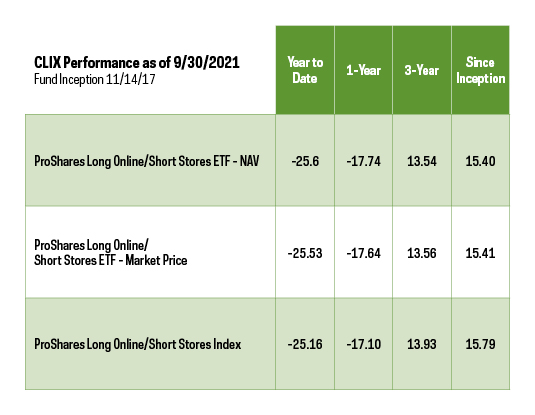

CLIX

PROSHARES LONG ONLINE/SHORT STORES ETF (CLIX)

CLIX offers investors the opportunity to benefit from both the potential growth of online companies and the decline of bricks-and-mortar retailers through a long/short construction.

Source: Bloomberg, 9/30/2021. This fund charges an expense ratio of 0.65%. The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 866.776.5125 or by visiting ProShares.com.

Shares are bought and sold at market price (not NAV) and are not individually redeemed from the fund. Brokerage commissions will reduce returns. Index performance is since inception of ProShares Long Online/Short Stores ETF on 11/14/17. Index returns are for illustrative purposes only and do not represent fund performance. Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest in an index.

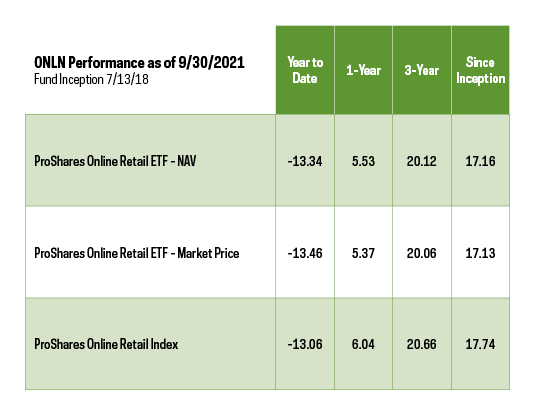

ONLN

PROSHARES ONLINE RETAIL ETF (ONLN)

ONLN is designed to track the performance of retailers that principally sell online or through other non-store channels.

Source: Bloomberg, 9/30/2021. This fund charges an expense ratio of 0.58%. The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 866.776.5125 or by visiting ProShares.com.

Shares are bought and sold at market price (not NAV) and are not individually redeemed from the fund. Brokerage commissions will reduce returns. Index performance is since inception of ProShares Online Retail ETF on 7/13/18. Index returns are for illustrative purposes only and do not represent fund performance. Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest in an index.

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Shares are bought and sold at market price (not NAV) and are not individually redeemed from the fund. Market price returns are based upon the midpoint of the bid/ask spread at 4:00 p.m. ET (when NAV is normally determined for most funds) and do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. Current performance may be lower or higher than the performance quoted. For standardized returns and performance data current to the most recent month end, see Performance.

There is no guarantee any ProShares ETF will achieve its investment objective.

Investing involves risk, including the possible loss of principal. These ProShares ETFs are subject to certain risks, including the risk that the funds may not track the performance of their index and that the funds’ market prices may fluctuate, which may decrease performance. These ProShares ETFs are non-diversified and concentrate their investments in certain sectors. Non-diversified and narrowly focused investments typically exhibit higher volatility. CLIX’s short positions are not intended to hedge the portfolio in market downturns, but rather to allow stocks with unfavorable outlooks to contribute to performance. Short positions lose value as security prices increase. Investments in the consumer discretionary and retailing industries are subject to risks such as changes in domestic and international economies, interest rates, competition and consumer confidence; disposable household income; consumer tastes and preferences; intense competition; changing demographics; marketing and public perception; and dependence on third- party suppliers and distribution systems. Investments in smaller companies typically exhibit higher volatility. Smaller company stocks also may trade at greater spreads or lower trading volumes, and may be less liquid than stocks of larger companies. ONLN and CLIX invest in international investments, which may involve risks from: geographic concentration, differences in valuation and valuation times, unfavorable fluctuations in currency, differences in generally accepted accounting principles, and from economic or political instability. In emerging markets, many risks are heightened, and lower trading volumes may occur. Please see their summary and full prospectuses for a more complete description of risks.

Carefully consider the investment objectives, risks, charges and expenses of ProShares before investing. This and other information can be found in their summary and full prospectuses. Read them carefully before investing.

“Solactive AG,” a registered trademark of Solactive AG, and the Solactive-ProShares Bricks and Mortar Retail Store Index have been licensed for use by ProShare Advisors LLC. Solactive AG serves as index calculation agent for the ProShares Long Online/Short Stores Index, ProShares Online Retail Index and Solactive-ProShares Bricks and Mortar Retail Store Index, and performs routine daily calculations and maintenance (e.g., reconstitution, rebalancing, and corporate actions). Solactive AG uses its best efforts to ensure that these indexes are calculated correctly. Solactive AG has no obligation to point out errors in the indexes to third parties, including but not limited to investors and/or financial intermediaries. Neither the ProShares Decline of the Retail Store ETF (“EMTY”) nor the ProShares Long Online/Short Stores ETF (CLIX) are sponsored, endorsed, sold or promoted by Solactive AG and they make no representation regarding the legality or suitability of the funds, or the advisability of investing in the funds. SOLACTIVE AG AND ITS AFFILIATES MAKE NO WARRANTIES, EXPRESS OR IMPLIED, AND BEAR NO LIABILITY WITH RESPECT TO THE INDEXES, PROSHARES OR THE FUNDS.

Learn More

CLIX

Long Online/Short Stores ETF

Seeks investment results, before fees and expenses, that correspond to the performance of the ProShares Long Online/Short Stores Index.

ONLN

Online Retail ETF

Seeks investment results, before fees and expenses, that track the performance of the ProShares Online Retail Index.