The first quarter’s uptick in interest rates has raised concerns with investors about the potential for headwinds in the stock market if rates continue to increase. As opposed to bonds—and perhaps to the surprise of some—stocks often rise in value when interest rates rise. Dividend growth strategies focused on companies with the longest track records of consistent dividend growth tend to be all-weather strategies that have performed well during a variety of interest rate environments. They may contribute positively to performance through both price appreciation and growing income streams, even when interest rates are rising.

First Quarter 2021 Dividend Scorecard

In the previous installment of Dividend Viewpoint , we noted that dividends stabilized entering 2021 and expectations had shifted toward a belief that companies would reinstate dividends and buybacks. The new year has indeed brought far more dividend raises than cuts through late March 2021. The performance differential between growers and cutters has also remained wide.

Figure 1: Dividend Cutters versus Raisers

| Cutters | Raisers | |

| Total S&P 500 | 3 | 124 |

| % Breakdown |

1% | 30% |

| Average Performance YTD | -3.26 | 10.24 |

| Cutters | Raisers | |

| Total S&P MidCap 400 | 1 | 73 |

| % Breakdown |

0% | 27% |

| Average Performance YTD | -19.64 | 18.42 |

| Cutters | Raisers | |

| Total Russell 2000 | 13 | 250 |

| % Breakdown |

1% | 29% |

| Average Performance YTD | 2.30 | 19.90 |

Sources: Bloomberg, ProShares. Based on dividend per share announcements from 1/1/21-3/31/21 broken down as a percentage of dividend payers in each index. Past performance is no guarantee of future results.

Interest Rates Are Rising and Stocks Are Performing Well

Interest rates have been increasing since the summer of 2020, but the stock market has continued to rise. Some investors have seen this as gravity-defying and perhaps a sign of growing risk. After all, rising interest rates increase the discount rate on future cash flows of a stock, which in turn lowers the present value. Stocks are not bonds, though. A bond paying fixed coupons is defenseless in the face of rising rates—when rates rise, bond prices typically fall. Stocks, however, are different. Earnings grow. So too can dividends. It is the battle between growth and higher discount rates that can muddle the relationship between stocks and rising interest rates.

The history of stock market performance in various interest rate environments is mixed. Standard & Poor’s has found that, prior to 1998 and including the period when interest rates peaked in the early 1980s, stocks performed best when rates fell the most. Over the past two decades, however, rising rates have not necessarily caused the same results. Stocks have performed strongly during several sustained periods when rates increased.

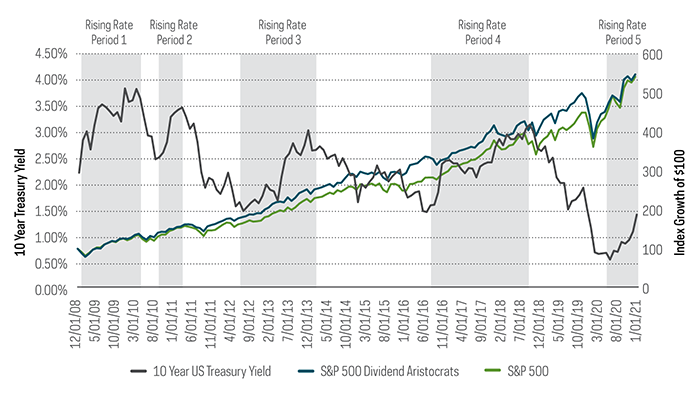

Stocks Have Performed Well in Prior Rising Rate Periods

Source: Morningstar, data from 12/31/2008-2/26/2021. Periods of rising rates indicated by shaded bars. Past performance is no guarantee of future results.

One plausible explanation for positive stock performance during periods of rising rates is this: Historically, when rates have risen from already high levels—such as the stagflation of the 1970s—stocks performed poorly. When rates rose from low levels, however, the economy was showing signs of improving and the growth potential of stocks overwhelmed the negative impact of rising rates. In such an environment, stocks may perform well. That appears to be the environment we are in today. As such, it’s rational to be somewhat optimistic regarding the overall stock market.

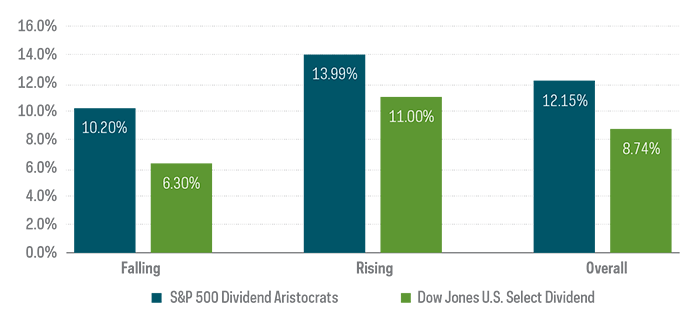

Your Dividends Need to Be Growing

Not all dividend strategies are created equal. Income-oriented investors have often gravitated to high dividend yield strategies, while investors focused on total return have looked to dividend growth strategies. One would expect high dividend yielders to be more exposed to the negative impact of rising rates because their yields can be high, but they also may not offer much growth potential. Dividend growth strategies (as represented by the S&P 500 Dividend Aristocrats Index), on the other hand, notably outperformed high dividend yielders (as represented by the Dow Jones U.S. Select Dividend Index) during periods of rising rates. Interestingly, dividend growers have outperformed high dividend yielders during both rising and falling interest rate periods, which can make them an all-weather strategy capable of performing well under a variety of interest rate regimes.

Dividend Growth Outperformed High Dividend Yield in Both Rising and Falling Rate Periods

Source: Bloomberg, 5/2/05—12/31/20. Results show average performance of dividend strategies based on monthly interest rate changes. S&P 500 Dividend Aristocrats measures the performance of S&P 500 companies that have increased dividends every year for the last 25 consecutive years. Dow Jones U.S. Select Dividend Index represents the United States’ leading stocks by dividend yield; this index is shown here because it is tracked by the largest high dividend yield ETF by assets. Past performance is no guarantee of future results. There is no guarantee dividends will be paid. Companies may reduce or eliminate dividends at any time, and those that do will be dropped from the indexes at reconstitution.

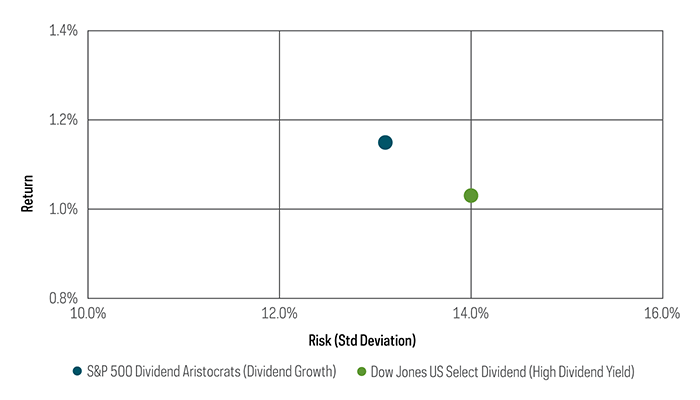

Dividend growth strategies have also performed well from a risk and return perspective when Treasury yields moved higher. During months when the 10-year Treasury yield increased, dividend growth companies produced better returns per unit of risk (measured by standard deviation) than those that merely had high levels of dividend yield.

Dividend Growers Showed Strong Risk/Return Performance When the 10-Year Treasury Advanced

Source: Bloomberg, data from 5/2/2005-3/31/2021. Chart reflects the average monthly return and standard deviation for the indexes during months when the 10-Year Treasury yield increased during the data period. Past performance is no guarantee of future results.

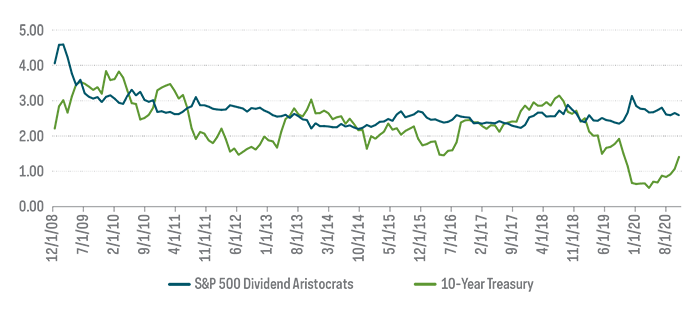

Dividend Growth Can Add Up Over Time

Dividend strategies have drawn increased interest from investors, especially since Treasury bond yields have been in secular decline for more than two decades and remain below 2%. But even with the yield increases we have seen since the summer of 2020, bond yields have a long way to rise before they are equal to dividend equity yields. To demonstrate, the figure that follows shows the historical relationship between 10-year Treasury yields and dividend yields for the S&P 500 Dividend Aristocrats Index since December 2018. While the 10-year Treasury has been more volatile, the S&P 500 Dividend Aristocrats Index’s yield has held relatively steady between 2.5%-3.0% for the last decade. The 10-year Treasury bond’s yield would have to increase another 100 basis points to reach the level of the S&P 500 Dividend Aristocrats Index. Changing equity prices could impact that, of course.

Dividend Growth Strategies Have Provided Higher Yields

Source: Bloomberg, data from 12/31/2008-2/28/2021. Past performance is no guarantee of future results.

Moreover, a dividend growth strategy can deliver something that fixed income yields cannot: the potential for income growth. Granted, bonds and equities—even high-quality equities—have very different risk profiles and cannot be viewed as substitutes for one another in an income strategy. But dividend growth companies, like the S&P 500 Dividend Aristocrats, can be powerful components in a strategy designed to build a growing income stream over time, one that can even potentially exceed the rate of inflation.

In the figure below, we show the hypothetical annual yield that the S&P 500 Dividend Aristocrats Index produced on a $1 million portfolio compared to the income produced from a 10-year Treasury bond purchased at the same time and reinvested upon maturity. Treasurys are generally considered to be of high credit quality, and they are backed by the full faith and credit of the U.S. government. As such, they may potentially offer a suitable and more conservative core element of an income strategy. However, despite being lower initially, the S&P 500 Dividend Aristocrats Index’s yield eventually met and exceeded the 10-year Treasury yield. By 2020, the S&P 500 Dividend Aristocrats Index’s yield on the original cost basis was well over 8%, which far exceeded the Treasury yield that faced reinvestment risk and subsequently lower yields over time.

Dividend Growth Strategies Can Provide Income Growth Over Time

Sources: Bloomberg and ProShares calculations, data from 1/1/2006-12/31/20. Past performance is no guarantee of future results.

The Takeaway

While the relationship between stock performance and rising interest rates isn’t as cut and dried as some believe it to be, what does seem clear is that rising rates don’t always coincide with poor equity performance. Stocks have performed well in prior periods of rate increases. In fact, an equity strategy focused on dividend growth like the S&P 500 Dividend Aristocrats Index may provide an evergreen approach for almost any interest rate environment. Dividend growth strategies have even outperformed high dividend yield strategies from a return and risk perspective when Treasury yields moved higher.

Dividend growth strategies have also rightly drawn increased interest from income focused investors while bond yields have been in secular decline. Despite recent yield increases, bond yields still have a long way to rise before they are equal to dividend equity yields. And perhaps even more importantly, dividend growth strategies delivered income growth over time, something that fixed income yields did not do.

This is not intended to be investment advice. Any forward-looking statements herein are based on expectations of ProShare Advisors LLC at this time. ProShare Advisors LLC undertakes no duty to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Investing is currently subject to additional risks and uncertainties related to COVID-19, including general economic, market and business conditions; changes in laws or regulations or other actions made by governmental authorities or regulatory bodies; and world economic and political developments.

The "S&P 500® Dividend Aristocrats® Index" and "S&P MidCap 400® Dividend Aristocrats® Index" are products of S&P Dow Jones Indices LLC and its affiliates. All have been licensed for use by ProShares. "S&P®" is a registered trademark of Standard & Poor's Financial Services LLC ("S&P") and "Dow Jones®" is a registered trademark of Dow Jones Trademark Holdings LLC ("Dow Jones") and have been licensed for use by S&P Dow Jones Indices LLC and its affiliates. ProShares have not been passed on by these entities and their affiliates as to their legality or suitability. ProShares based on these indexes are not sponsored, endorsed, sold or promoted by these entities and their affiliates, and they make no representation regarding the advisability of investing in ProShares. THESE ENTITIES AND THEIR AFFILIATES MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO PROSHARES.

Learn More

TDV

S&P Technology Dividend Aristocrats ETF

ProShares S&P Technology Dividend Aristocrats ETF seeks investment results, before fees and expenses, that track the performance of the S&P® Technology Dividend Aristocrats® Index.