Key Observations:

- E-commerce growth remains strong, and there is ample room to gather market share

- With inflation on the rise, dynamic e-commerce companies may have the advantage

- E-commerce and bricks-and-mortar index levels equalized, but the growth expectations are widely divergent

The E-Commerce Growth Trend Remains on Track

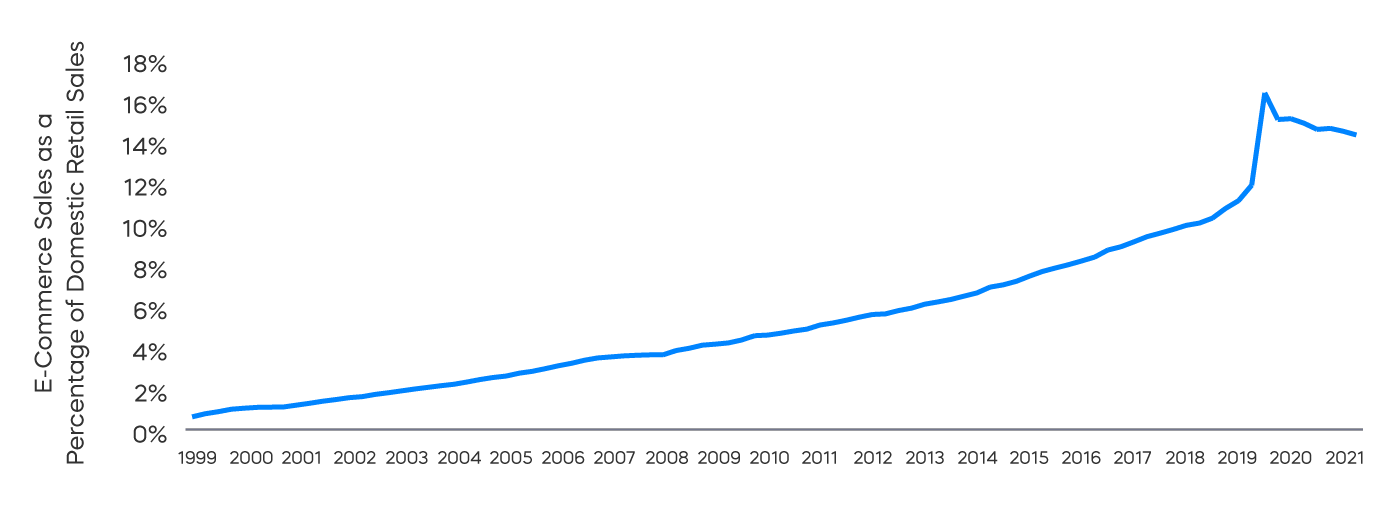

Think online shopping accounts for a majority of US retail sales? Think again. Total retail sales in Q1 2022 were over $1.7 trillion in the US alone and e-commerce represented just over 14% of total sales.1 Online retailers may have the opportunity to capture more revenue by taking market share from traditional bricks-and-mortar companies over time. Shoppers turned to e-commerce firms during the height of the pandemic, with online purchasing hitting a high of 16% in Q2 2020.2 Customers used the internet to buy things they had traditionally purchased in stores, like food and clothes, and those new shopping patterns may persist. While online sales dipped from the pandemic-induced peak, e-commerce as a percent of total sales remains on a robust trend line.

E-Commerce Penetration Has Room to Grow

Amid Inflation, It Is E-Commerce’s Time to Shine

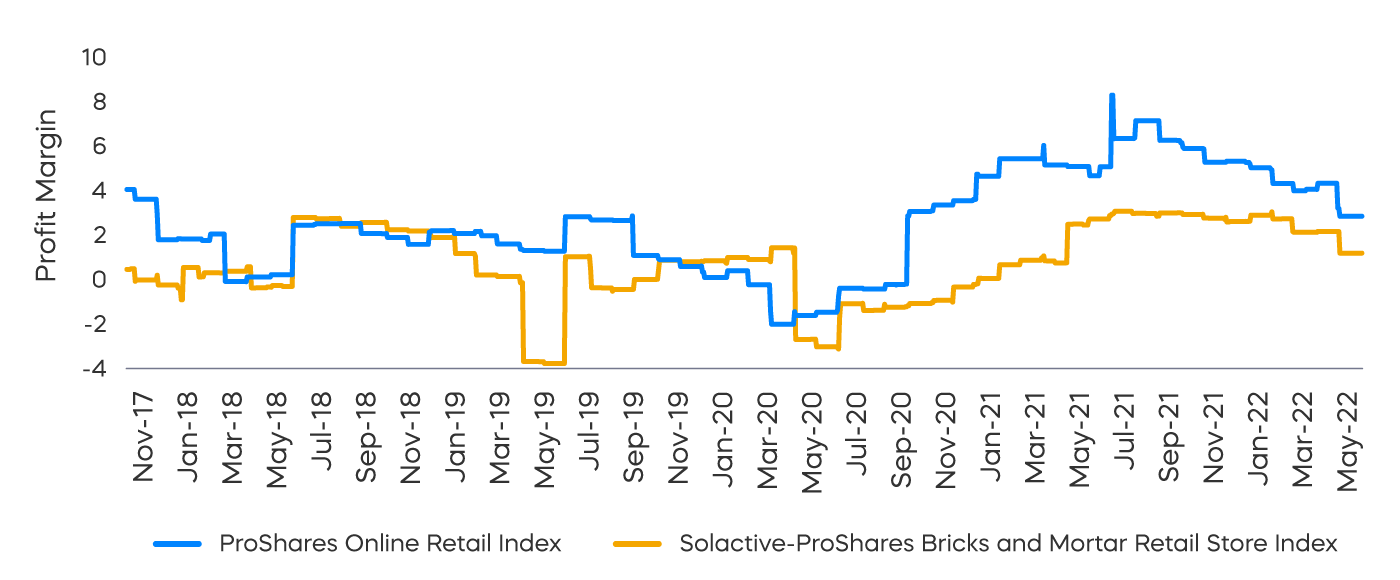

With inflation hitting a 40-year high in May 2022, maintaining margins has become essential and businesses cannot necessarily shift cost structure to stabilize profits as cost of inputs increase.3 E-commerce firms may have an edge over bricks-and-mortar retail that typically has high fixed costs for storefronts and employees. By contrast, e-commerce companies with a digital-first retail model may operate with less overhead and can adjust prices in real time. E-commerce profit margins compared with those of bricks-and-mortar over the past five years have been higher over 75% of the time.4

E-Commerce Profit Margins Outpaced Bricks-and-Mortar Profit Margins

Unique Moment to Invest in the Future

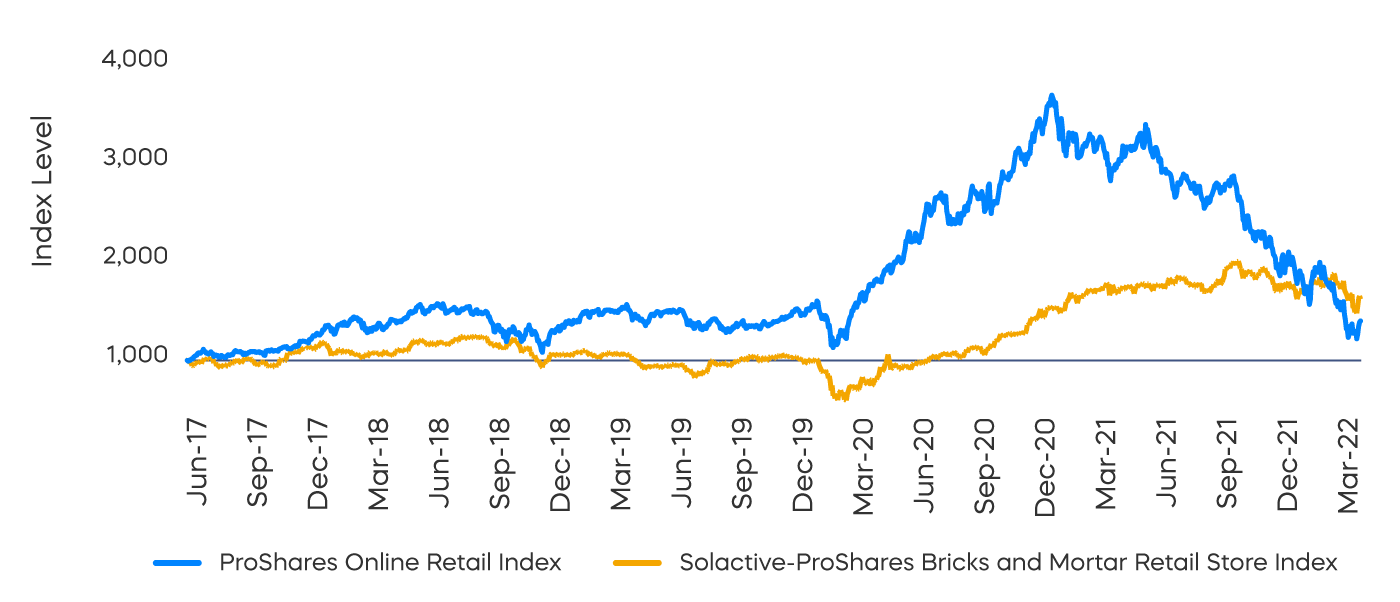

Sales and earnings growth usually have proven important in the long run. After years of online retail outperforming bricks-and-mortar retail, the Covid-19 lockdown and subsequent reopening have provided investors with a unique opportunity. The ProShares Online Retail Index and the Solactive-ProShares Bricks-and-Mortar Retail Store Index are priced at similar levels for the first time in about five years; however, online retail may outpace their traditional counterparts going forward.5 Online retail has an estimated projected 14% growth in earnings by 2023, versus only 2% growth for bricks-and-mortar retail.6 There is an opportunity to invest in a fast-growing segment at an access point similar to traditional retail.

Index Levels Offer a Possible Unique E-Commerce Buying Opportunity

Click here for fund performance.

1, 2United States Census Bureau, “Latest Quarterly E-Commerce Report,” May 2022

3U.S. Bureau of Labor Statistics, “Consumer Price Index (CPI),” 5/31/22

4Source: ProShares, Bloomberg. Profit margins measured daily from 11/21/17-5/31/22.

5Bloomberg, as of 6/23/22

6Bloomberg, as of 4/28/22

Learn More

Learn More

ONLN

Online Retail ETF

Seeks investment results, before fees and expenses, that track the performance of the ProShares Online Retail Index.