ProShares Equities for Rising Rates ETF is built on a strategy specifically designed to potentially outperform traditional U.S. large-cap indexes during periods of rising rates. That’s because its underlying index is:

Built to Outperform as Rates Increase

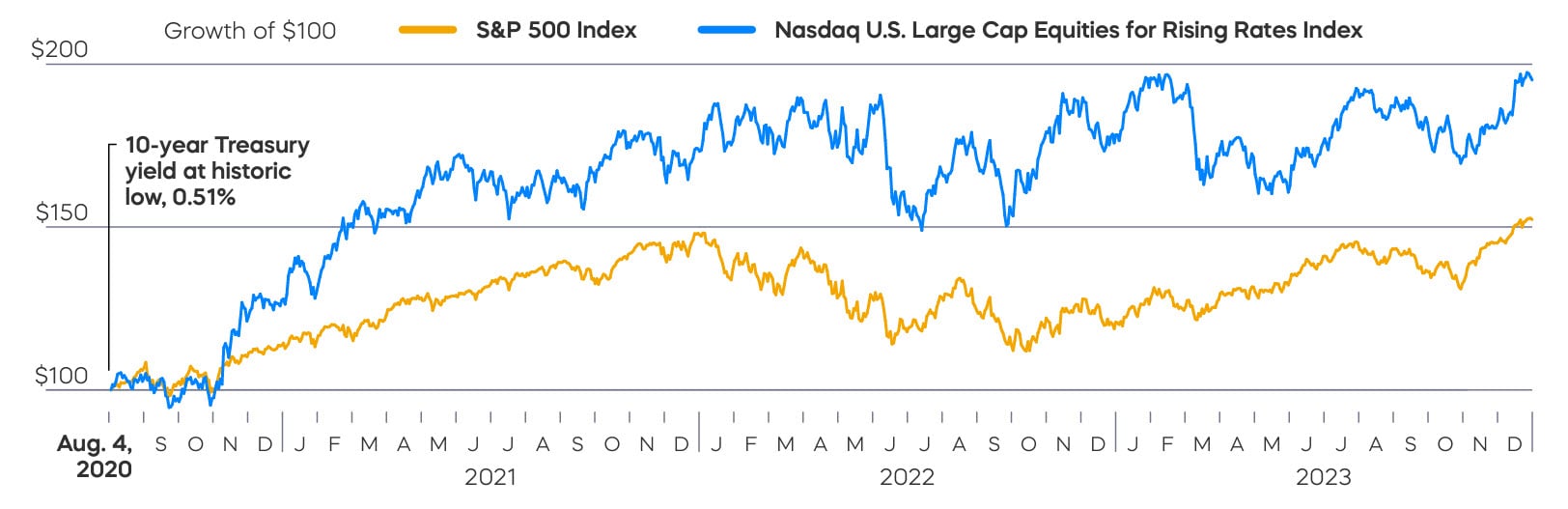

EQRR's underlying index, Nasdaq U.S. Large Cap Equities for Rising Rates Index, has significantly outperformed the S&P 500 after the yield on the 10-yr Treasury started rising during the summer of 2020.

Source: ProShares and Bloomberg, 8/4/20-12/31/23. Index information does not reflect any management fees, transaction costs, or expenses. Indexes are unmanaged, and one cannot directly invest in an index. Past performance does not guarantee future results.

A Rules-Based Approach

EQRR tracks the Nasdaq U.S. Large-Cap Equities for Rising Rates Index, which is built using a rules-based engine designed to target sectors that have outperformed as interest rates climb.

1. Focused On 5 Sectors with Outperformance Potential

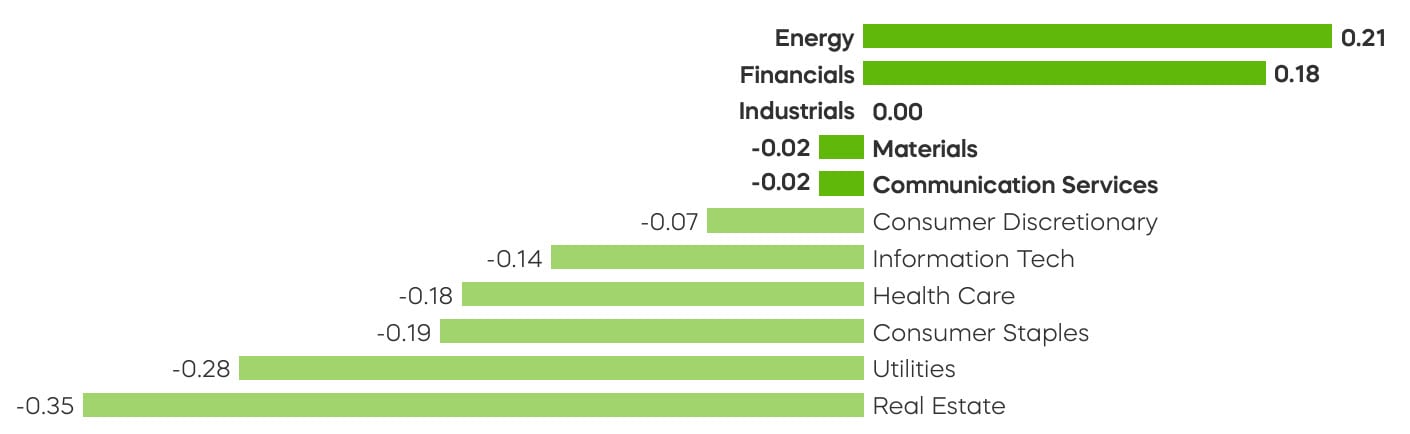

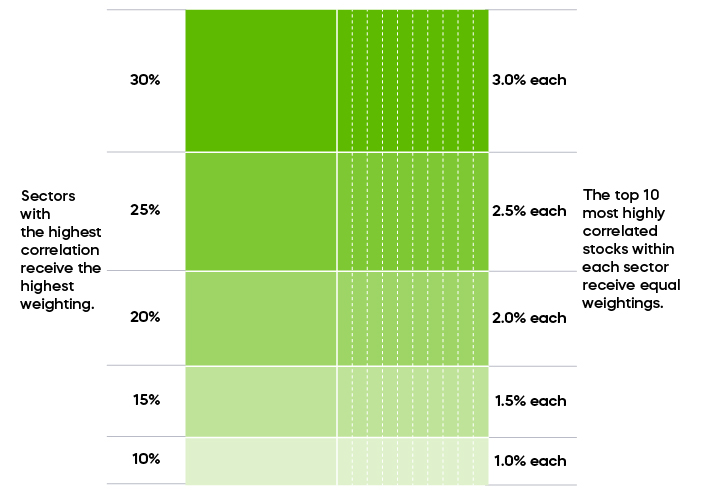

The index first targets the five sectors that have had a tendency to outperform when rates rise – those sectors that have demonstrated the highest correlation with the 10-year U.S. Treasury yield over the prior 36 months. The sectors with the highest correlations receive the highest weighting.

Three-year average correlation of S&P 500 sectors to rising 10-year Treasury rates

Source: Bloomberg, as of 12/31/23. Sectors based on GICS classification within the S&P. For illustrative purposes only. Past performance does not guarantee future results.

2. Focused on 50 Stocks with Outperformance Potential

The index next targets 10 stocks within each of those sectors that have demonstrated the highest correlation to the 10-year U.S. Treasury yield over the past 36 months. The 10 stocks in each sector are then equally weighted

3. Reconstituted Every 3 Months

The index is reconstituted using this rules-based approach on a quarterly basis, allowing both sectors and stocks to help keep pace with evolving market conditions.

Go On the Offensive when Rates Rise

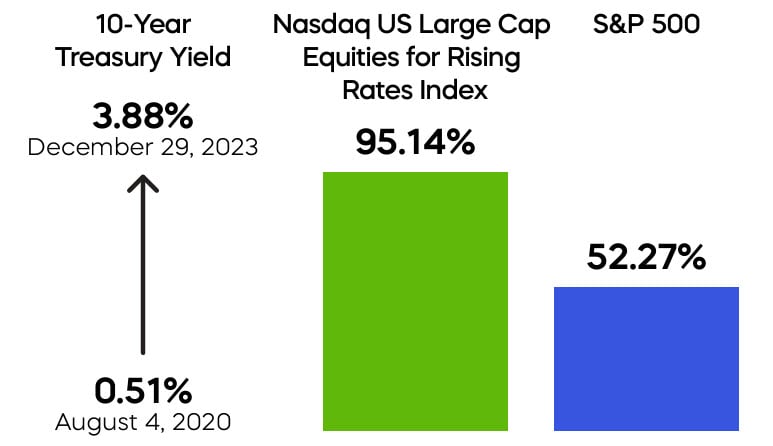

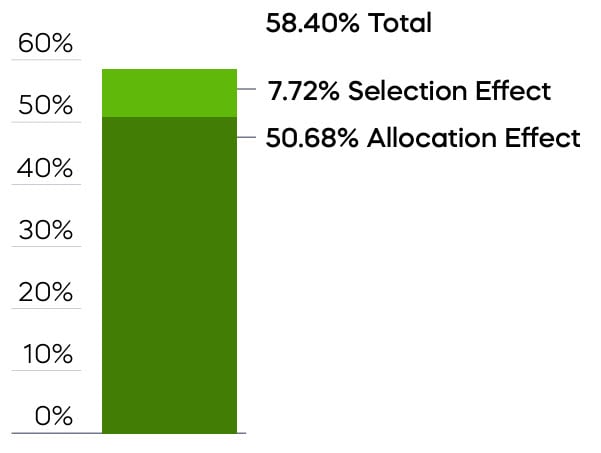

EQRR has outperformed the S&P 500 as the 10-year Treasury yield has risen, and sector allocation and stock selection components were both key contributors to the fund's performance.

Performance during period of rising 10-year Treasury rates |

Contribution to relative performance of EQRR vs S&P500 |

|

|

Source: FactSet, Bloomberg, 8/4/20-12/31/23. Performance is cumulative. Contribution is annualized.

A Compelling Strategy with the Convenience of an ETF

Equity strategists and portfolio managers have traditionally addressed rising rates environments with a variety of fragmented approaches. EQRR synthesizes these strategies with a rules-driven, sector and stock selection approach that delivers:

-

A focused strategy that includes only those U.S. large-cap sectors and stocks that have demonstrated a tendency to outperform when interest rates rise.

-

A complement to a core equity allocation for a rising rate environment.

-

The ease and convenience of an ETF.

Click here for fund performance.

Source: ProShares, Bloomberg. EQRR’s total operating expenses are 0.35%.

Periods greater than one year are annualized.

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling 866.776.5125 or visiting ProShares.com. Index performance does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in any index.

Learn More

EQRR

Equities for Rising Rates ETF

Seeks investment results, before fees and expenses, that track the performance of the Nasdaq U.S. Large Cap Equities for Rising Rates Index.